Saietta price crash

Market Cap £19m, Net Assets (estimated) £29m, Discount to NAV 33% (estimated)

Saietta has secured a major global OEM (original equipment manufacturer) as its launch customer for a range of their vehicle lines and established leading manufacturing facilities and local supply chains in both Sunderland and Delhi.

SED believes that it has reached its inflection point for its core business based on its proven AFT eDrives. The orders in place provide a firm launch pad and the Board is confident that it is now able to convert a significant proportion of its rapidly growing sales pipeline into firm commercial orders.

Let’s look at SED via the 7 Ps of marketing:

Product

a. The Lightweight market

Renault is a great car maker isn’t it? Pappa? Nicole? Ah, oui! So isn’t Renault just a little bit gutted when a start up develops an engine that is 10% more efficient than Renault’s own engine. Dealing with the biggest single problem with Electric Vehicles…. RANGE ANXIETY. Saietta makes a Axial Flux Technology (AFT) and more recently an RFT (Radial Flux Technology). Does Saietta get involved with Renault and Twizzy’s? No this was just an illustration of its technology.

b. Marine Market

Not just with cars either. Boats. Marine engines too. Saietta developed an inboard and outboard motor which is a more robust design and technically superior in performance as this Aussenborder is about to show:

The market leader in this space was Torqeedo. Then Saietta came along with Propel to become “Der Beste”. This video (in German) basically is a head-to-head speed and power test. Look at the chart below as to how Propel performs. If you forward to 7 minutes 30 look at how the Propel outperforms when they “put their foot down” and the German chap’s whooping….. A “Gott in Himmel” a “Donner Und Blitzen!” or even an “Achtung!” would’ve been perfect, but life isn’t like a Commando Comic is it?

Or look at this chart. Seems the Torqeedo gets out torque’d in a major way.

More economical yet more powerful was the outcome of this “Testfahrt” (no giggling please)

c. Heavyweight Market

Partnership with Conmet.

Not just light vehicles, not just marine, but buses and trailers too. In fact along came Conmet who had started their eMobility division and formed a partnership with Saietta. Conmet have developed a hybrid technology for “trailers” (what the Americans call HGVs). It incorporates a battery and regenerative braking and accelerate assist but also to power the cold store of the vehicle too.

If you follow these links Conmet are actively marketing this to its customers. Saietta get a revenue share of 2.5% of any sales up to a limit of €20m Euros

Acquisition from Evergrande

Saietta began as a motor. An AFT. But in 2021 in the first round of Evergrande’s troubles, Saietta swooped and bought “e-traction” from Evergrande a competitor EV firm based in Holland for €2m. e-Traction were focused on the heavy vehicle market but had developed an invertor and software to deliver a more comprehensive solution, even to its other products. This included software control as well as an invertor. They also had a bus conversion business which has now been disposed of.

It also acquired the ability to make an RFT. These are less expensive but also less sophisticated than an AFT.

People

Saietta IPO’d with Vic as CEO and Tony as Chair. Vic’s background is engineering, at Cosworth and Spyder Cars. He was the inspirational start up leader at Saietta and really the “face of Saietta” in the early days. Reminiscent of Boris Johnson with an energy, charisma, and a blonde mop of hair Vic brought in Tony Gott whom he knew since many years.

Tony was CEO of Rolls Royce, then CEO of Bentley, then put in a long spell at Jacobs as VP Emea (nothing to do with Crackers, Jacobs is a 60,000 person business solving business engineering problems). For example a current project that Jacobs EMEA are currently working on is Hinckley Point Nuclear Power Station. I’d really encourage you to click and read about it, it’s a mind boggling story where they are drawing in 4,200 olympic swimming pools a day.

Vic stepped away earlier this year realising his passion lay in start ups and passed the torch to Tony who now has appointed David Woolley, another industry veteran with a track record of commercialising vehicle electrical components in India (so extremely relevant experience). Part of this changing of the guard is the exit of the CFO too.

The Saietta leadership are very credible, in my opinion. The vitriole directed towards the “rubbish management” on Bulletin Boards is simply ignorant. Management teams don’t control share prices - they control the business.

Here are their profiles and you can judge for yourself reader.

Process

Delhi

This is where the products diverge. For Lightweight the place is (mainly) India. Via a joint venture called Saietta VNA. The strategy is “East to West”. The Indian vehicle market is enormous. Indian light commmercial vehicle sales in 2023 are 3.79m units and growing 8-12% a year. Three wheelers are 4.9m units and two wheelers are 17.8m and forecast to be 48.1m units a year by 2028.

Sunderland

Saietta had budgeted £10m in its IPO to establish a factory. It acquired its Sunderland factory in April 2022 at just over a 1/10 of that (£1.1m) from ZF Automotive UK Limited ("ZF"). Its 86,000 square feet can produce 100,000 units per annum, and previously had a history of manufacturing over 20 million electric motors for a range of automotive applications.

As part of the purchase Saietta took over the 4 established motor production lines and an electronic circuit board (ECB) production line where a considerable amount of the in situ equipment was re-purposed to meet the needs of Saietta's customers going forward, potentially representing a meaningful cost saving.

Thirty-nine former ZF personnel with a range of critical skills including fabrication, engineering, IT, quality control, finance and process management will join Saietta. This team's ability to deliver efficient and timely fabrication and certification of electric motors for automotive applications is extremely valuable and scalable - as is the Sunderland Factory's established supply and logistics chain.

Other costs - rent is £0.615m per annum.

Buried away in the footnotes of the accounts, in May 2023, 2 of the 4 lines have been transferred to the JV (VNA). These lines are valued at £2.8m. So this means there’s about £1.5m of net cash coming to SED from VNA (because SED owns 49% of VNA so the other £1.5m nets off). 50,000 units a year of production can be produced in the UK and exported to India.

Place

The place is India, with the UK as a technology centre for product design (at Silverstone) and process design (at Sunderland)

Saietta have so far secured J.V. targetted volumes of 0.17m in India out of these 27.00m-60m annually to be produced vehicles. That’s 1 vehicle in 352 is motored by a Saietta engine system. Just in India. Fewer still when you consider wider SE Asia, or even Asia, or even world wide

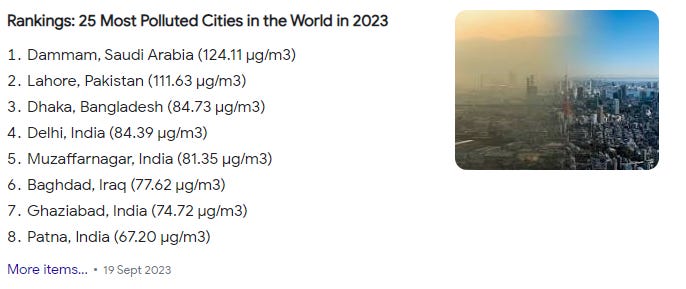

Why do I believe 1 in 352 Indian vehicles is too low? The problems of pollution in Indian cities is enormous. In large part due to vehicle emissions. Electric vehicles go a long way to solve this (albeit not by 100% as EVs still emit particles from their tyres for example).

Sunderland began work a month ago, on a 3,000 unit order for Aygo.

While partnership is the path for VNA/India, heavyweight and marine.

Currently Conmet being the only heavyweight partnership we know of.

VNA/India - the unknown “major vehicle mfrs” is probably includes TATA motors but that’s my own speculation. “It’s a name you’ve heard of” has been said with a grin. Well I think everyone’s heard of TATA so I’m going with that. I have visited TATA’s European Vehicle headquarters at Warwick Uni where they had a kind of Roadster vehicle prototype in their reception so I know this stuff is right up their street.

Marine is “in talks” with several players. The whole thing has been designed, built and engineered - it simply needs to be commercialised.

Promotion

Now you might at this stage be worried about how does a little company like Saietta go to market, promote its product, and drum up some business? Isn’t the global vehicle market a little bit crowded?

Well, this is where it has positioned itself perfectly as a Tier 2 supplier. It doesn’t need to promote itself to consumers.

If you have an amazing PRODUCT, credible PEOPLE, and connections, then if you can pass the due diligence expected then the Tier 1 partners come to you.

Its Tier 1 partners like Conmet, like Padmini, are in turn selling into Vehicle Manufacturers. Or small vehicle manufacturers are coming direct to SED - like Aygo.

Physical Evidence

Much of Saiatta’s credibility is in its product performance and people. It’s managed to gain a seat at the table with the big boys. Unbelievable, really, for a start up which IPO’d 2 years ago.

READER! PART 2 BELOW!

SED-ition! PART 2

SAIETTA PART 2 We have covered 6 of the 7 parts of the 7Ps of Saietta. So now for the crucial one…. SHOW ME THE MONEY! Price I’ve now going to speak of Cash and forecasts. I’ve modelled the Indian VNA operation first. This is based on the “known” production.