2023 has been a torrid time for IP Group. After a spectacular £456m operating profit gain in 2021 Oxford Nanopore floated, this reversed with an equally spectacular loss of -£344m in 2022. This was a visualisation of IP Group as at 31/12/22.

The ONT-ing presence

In 2023, ONT’s share price has continued to decline. It sits a further 23.2% below it’s 31st December share price as at 19/12. But at £1.99 it’s 8.3% below 30th June’s £2.17 price point (i.e. there’s a further £13m or -1.3% paper loss at year end assuming prices don’t change in the next week).

Oxford Nanopore (ONT) provides a DNA sequencing platform used by scientific researchers to solve real-world challenges through answering questions about the biology of people, plants, animals, pathogens and environments. It is also increasingly being used in ‘applied’ settings such as healthcare and food safety.

I would encourage you to read this presentation deck, before giving up on ONT as a lost cause. And if you just want the headlines:

£485m Cash - it has plenty of runway.

EBITDA break even forecast for 2026

Its TAM grows from $6bn in 2023 to more than $150 billion by 2032 ($300 billion according to Arc Research). Think about the Instrinsic value of future cash?

It has strong technology leadership and the falling price per sequence and rising speed per read will open up a whole world of possibility - like the silicon chip did. Think Forrest Gump investing his Bubba Shrimp Dollars into an Apple.

It operates in a near duopoly where Illumina is its main rival - and significant barriers to entry exist. A moat as Buffett would say.

I don’t hold ONT directly but this does feel like a huge British invention where the commercialisation (unusually) remained in Britain. Too often, inventors take the value to the US or Japan. Britain invented the LCD screen. The Japanese commercialised it. Turing the computer. The Americans commercialised it.

It’s as though we British have a great capability for invention - and Gene Editing (Multi Omics) could become one of the greatest inventions ever - and we don’t feel comfortable commercialising it. I’m not saying ONT is without risk, but when IP Group say they’re comfortable to continue to hold ONT I can really see why. I think IP Group are a big reason why they did commercialise in the UK. IP Group take the long view.

Hidden Value

Post Period Updates:

RNS 22/12 - One of the Top 20 Holdings has had a funding round which will be £40m accretive so provide a 4p per share uplift.

RNS 18/12 - A £20m buy back has been announced. At 55.8p, this equates to 35.8m shares, so would provide a 2.1p per share uplift.

RNS 17/11 - Autifony agreement with Jazz £5m accretive. 0.5p per share uplift.

So that’s +6.6p less -1.3p for ONT = +5.3p Estimated Per Share Uplift

NON-RNS NEWS - this IP Group news feed from its portfolio is well worth a read or a subscribe. The news flow - and significance of that news flow is very interesting. Not everything gets reported as an RNS (because it can’t) - doesn’t mean you can’t see the value coming.

Life Sciences looks ripe

Look at all the Phase 2/Phase 3 studies. There are numerous shots on goal and IPO speak of the maturity of their profile. Each one of these could provide a 10p-50p a share gain to IPO in the next year or two. (i.e. double bag IP Group)

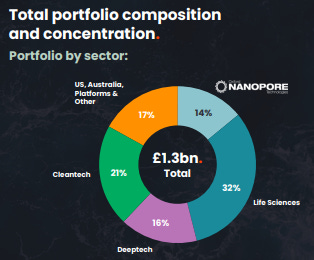

DeepTech Portfolio

From Quantum Computing to CyberSecurity there’s a number of interesting portfolio companies broken down into these 4 focus areas:

Notably, there are some maturing names among the DeepTech portfolio. An IPO for FeatureSpace in 2024 wouldn’t be a surprise.

Cleantech Portfolio

Notables among these are First Light. It quietly doubled last year (5.7p a share increase). Who knew? I’m a Nuclear Fusion fan so I did, but don’t think anyone realises that if we can “Crack” Fusion then you can hoover up CO2 using Fusion Energy and solve Climate Change. Because with Fusion energy becomes essentially free. First Light might be sitting on the greatest gift to humanity. And IP Group own 27.5% of it. The problem with Fusion is that it takes more energy to create the reaction than you get from the reaction. First Light appear to be working towards a solution to this.

Other less high profile candidates might still be catalysts to value - e.g. Test to decarbonise Marine Transport using Ammonia exceeds all expectations.

Or Oxbotica an autonomous vehicles software specialist, partnering with Beep begins its roll out in the US next year.

Bramble Fuel Cells

Or Bramble Fuel Cells - forget BEVs (Battery EVs). What if you could instead develop a cost effective hydrogen powered electric vehicles, and hydrogen portable power? There is an exciting news stream coming from this British energy player as it begins to commercialise.

Hysata - the problem with green hydrogen is its cost. But if you can convert at 95% not 75% then this drives down cost. It had Series A funding and offers a very exciting portfolio component addressing the development of the hydrogen sector supporting Net Zero.

The Read Across

Many people seemed to delight in the woes of Ark Invest during 2022. How the mighty are fall. In my view, Cathie Wood is one of the wisest and most inspirational people I know. I don’t agree (yet) on Bitcoin but if you wanted a UK equivalent to Ark that’s DEEPLY UNDER VALUED, it’s my belief that IP Group is it.

Reader, do you realise ARK’s flagship fund is up 71% this year? IP Group is flat for the year (up 30% from recent lows).

Conclusion

There are an eclectic mix of companies backed by IP Group. The aspect I find interesting is so many appear on the cusp of greatness and yes, some are early and cash hungry growth - so deeply unpopular - but about 90% get funding at same or higher valuations even during the 2022 drought, or 86% in H1 2023 - is that a sign of overlooked value reader?

It helps that IP Group are a liquid >£1bn beast. It has a (relatively) small £120m fixed at 5.25% credit line and is cash rich with £250m gross. These “nanocap” investments are somewhat derisked when IP Group can potentially support with cash…. it helps to have a gorilla in your corner! But as a Cornerstone Investor IPO’s track record is that it commits 8% of the overall capital. While it invests cash, it realises it too. In a good year (2021) IPO realised over £213m cash - and its track record is over £500m of realisations over 5 years.

How real is the NAV? Well around 4/5 are “mark to market” so recently funded, quoted or with direct comparables. Only 1/5 are “future event” or “revenue multiple” which might be seen as more reliable. At 69% discount (netting off cash) I find it astonishing you can buy IP Group so cheaply. I topped up at 44p and even today it remains remarkably cheap in my opinion.

For entertainment, the Oak Bloke is constructing a Top 20 for 2024. IP Group is in that list.

This is not advice

Oak.

You highlight the rosta of companies, and IP's long term holding nature. I'd add to that the rosta of heavyweight shareholders. Of particular note is their largest shareholder, Railway Pension Scheme' with 15%, who despite their 40%ish loss since purchase, haven't sold a share. They, like IP, invest for the long term.