Dear reader,

I recently disagreed with Panmure Liberum’s use of the word “secondary sources” (or Uranium) and outlook for Uranium. Mine expansions claim, which hadn’t the permiting and FID, and a robust and growing demand from powerplants (and probably the military) led me to conclude differently. Moreover, in my world “secondary source” simply meant shortfall, which in the murky world of Uranium stockpiles could easily spike the price. Since our two articles the OB notices a $1 rise in Uranium.

So I was intrigued to read Mr Price’s latest missive today on Met Coal. Met Coal is the stuff used for steel making. It’s a special and high carbon type of coal.

Price quickly dives into using a phraseology of HHI. Pardon? HHI, HHI, then on page 5 finally explains the acronym. HHI is the Herfindahl-Hirschman Index. No, reader, nothing to do with resuscitation or chocolate, it’s what economists would call monopolistic (one) or oligopolistic power (a few)… so the power of suppliers to determine pricing.

Met coal apparently has moderate levels of oligopoly, while EV Batteries are highly oligopolistic, and lead (Pb) apparently has zero levels of pricing power. Who knew?

What drew my attention were those 3 words everyone dreads….. prices are falling.

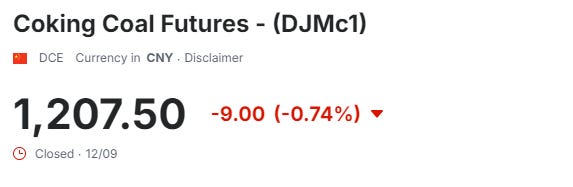

Despite growing demand (2020-2024) and shrinking supply in Australia (down 20%), growth in supply from Mongolia and Russia and ongoing problems in China has meant Met. Coal was 2000 Yuan/Ton and is now just over 1,200 Yuan/Ton so has fallen 40% in price YTD or $170/ton

Growing demand meanwhile, particularly for India (21%) which is catching up on China (24%), with strong imports to Japan (18%) and the EU (16%). No bear risk of green hydrogen yet troubling the Met Coal crowd.

So Panmure forecast a pretty bleak future for met coal. Imports for China by 2028 will nearly halve compared to 2023, and overall worldwide demand falls by 10% by 2028 compared to today. But supply is forecast to fall also. So there’s no clear surplus (or shortfall).

There’s no clear reason to disagree on the price of Met Coal so let’s assume $190/ton as being a long term price.

Considering BSRT

The reason I’m musing the long term coal price is to consider Baz Rat.

BSRT or Baker Steel resource. One of the OB ideas for 2024. This is up 20% YTD (47p bid/50p ask) mainly through the discount to NAV (79.6p) closing. But how real is the discount? What if the answer was the NAV is massively understated?

Let’s consider Futura. A pair of met coal mines.

Its first Wilton, from a standing start from opening in March 2024 to June 2024 produced 70Kt in 2Q24. So is on plan and budget with a 1 month slippage due to heavy rains. The coal is trucked to the nearby Gregory Crinum Coal Handling and Preparation Plant (CHPP) and batch processed into the final product. It is then loaded and railed to the port of Gladstone on the Queensland coast before being shipped to customers.

Futura obtained a A$35m pre-payment debt offtake and marketing facility with a major coal trading company and is 2 months away from opening its second shovel-ready open pit mine, Fairhill, which is contiguous to Wilton, which will allow mining at the 2nd mine to commence from around November 2024.

Once ramped up to planned production levels will extract between 3 and 4 million tonnes per annum of run of mine coal which after processing recoveries at the Gregory CHPP will result in sales of between 1.5 to 2 million tonnes of final products to the international markets with industry competitive operating costs of around US$85 per tonne.

Assuming a $190/ton price despite BSRT speaking to an industry consensus of around US$230 per tonne longer term. Let’s consider both.

BSRT own 24.3% of the equity of Futura assuming full conversion of the convertible loan together with a 1.5% Gross Revenue Royalty over all coal production from the Wilton and Fairhill licenses.

Let’s work that out mathematically:

PAT for BSRT’s 24.3% share is based on 25% straight line depreciation of US$11m (A$16m) of A$65m, and an assumed US$8m (A$12m overheads), and 40% Tax (assumed) - even though fellow miner Kestrel (with a royalty with ECORA) pays 30%.

This equates to a $11.5m-20.3m PAT to BSRT, or £9m-£15.5m per annum. (Or higher if 2Mt can be achived). Astonishing numbers.

An £9m - £15.5m annual return from an asset which (33.9% of BSRT’s NAV of £84.7m) is book value of £28.7m and due to a 39% discount to NAV you can “buy” for £17.5m (via BSRT’s holding). A P/E of between 1.1X and 2X.

But that is just the profit, what of BSRT’s royalty? At $190/ton that’s £3.3m a year more and at $230/ton it’s £4m a year.

Now to get to 1.5Mt - 2Mt will take time and initial estimates of royalties are much lower. Wilton was meant to begin at a 10Kt/month run rate but it’s already at 23Kt/month (0.3Mt/yr) and that’s before Fairhill has opened.

I previously spoke to a much lower £3.5m royalty and £5m dividend income, for 2025, based on an interview with BSRT’s investment manager.

So £8.5m in 2025 but £12.5m-£20.5m total from 2026 is a P/E of 0.8X-1.4X.

Even if BSRT earned nothing else, and if prices are at $190/ton and production at just 1.5Mt, the £12.5m return equates to a 25% ROE over the £50m market cap (or 40% at the higher coal price).

Even at relatively low future coal prices the economics of this remain compelling.

But there’s much more to BSRT. We are only getting started.

Prognoz 2% of the market cap.

BSRT have written down the Silver Net Smelter Royalty of 0.5%-2.5% to just £1m the reality is that the Kazakhstani part of Polymetal is on the hook, contractually, even though the mine is in Russia. Polymetal is now called Solidcore by the way.

And guess what reader?

Solidcore announced record net profits of US$243m announced today.

I previously spoke to “doing a deal” with the Russians. But there’s no need. The Kazakhs owe the dough, so BSRT expect the first payment in 4Q24.

The Prognoz mine began operations Q3 2023 and is forecast to deliver AuEq. 13.5Kt. The value of the royalties are worth £1.5m-£2.5m per annum over 20 years, so an NPV of £28m. Bear in mind this was, until it opened, the 3rd largest undeveloped silver deposit in the world.

Yes, reader, the current NAV of £1m puts this at a P/E of 0.4X-0.6X.

PUBLIC:

MTL

Metal Exploration is now at 4.2% of the portfolio announced bumper 2Q24 results with quarterly production at 20.1 Koz at $2,320/oz and AISC of just $1,066/oz. It completed the YMC acquisition which eagle-eyed readers will notice has a great musical abbreviation, and a great growth prospect to replace the RunRuno mine in 2027.

CMCL

Caledonia is another gold miner now at 5.2% of the portfolio continues to assess the underground exploration drilling at Bilboes-Motopa which offers substantial further upside and economies of scale (an attractive AISC of $1,035).

BSRT stands to gain double here since there’s a NSR of 1% over Bilboes. Plus BSRT gets a ~£0.5m dividend from Caledonia.

Silver X

Silver X continues to be in the wars and dropped flat YTD as it undergoes its strategic reset - but it plans to turnaround and reach 2Moz silver in 2024 and there are grounds for optimism on this. Its 2Q24 update last week was very strong:

Silver is, as I write, over $28 an ounce, while its latest brownfield exploration reports an initial inferred resource at Plata of 448,812 tonnes, at grades of 220.81 g/t Ag, 2.55% Pb, and 4.58% Zn.

The turnarond combined with silver’s price moves up could be very positive for Silver X.

First Tin

Tid bits of news continue even on BSRT’s holdings which have declined due to junior mining blues.

But interesting to note that Tin is now north of $31k/tonne and that 1st Tin reported “significant improvements to recovery rates”. Ahead of the DFS, even this £1.6m holding (2% of NAV) which you can “buy” for less than £1m may prove to surprise to the upside.

My eye remains drawn to its IRR calculation of 58% (which presumably will be revised upwards on “significant improvements to recovery rates”).

Nussir

Nussir valued at £3.6m NAV (4.3%) is a green Copper/Silver/Gold project, fully permitted and has a DFS but is awaiting a FID. It has a 23% IRR. But based on what? A $6.5k Copper Price! So the IRR is 28% IRR at today’s prices. BSRT owned 12% of Nussir, but in August, upped their stake to 21%.

The NPV is $286m (so worth $60m or £46m NPV to BSRT). That’s based on P&P (proved and probable) copper. The Inferred takes the project value up another 50% to $430m (at $8k/tonne copper). Yet the NAV holds this at £3.6m and the market think a 21% stake in Nussir is worth 12.8X less than its NPV.

Tungsten West

Even at bombed out Tungsten there might (just) be a glimmer of hope. The draft permit has been granted last month. Meanwhile there’s undisputedly the need for tungsten as a strategic mineral (i.e. it is used in ammunition and can you think of a need to produce more ammunition right now?) and if it can raise finance then it could be in production in 2025. Tungsten at $340-$360/tonne would be profitable and the Hemerdon mine has 100Mt of proved and probable tungsten with tin credits, and needs just £23m-£33m CapEx (and more luck than it enjoyed in the past) to get to an NPV of £297m, or £232m according to H&P’s last analysis based on annual production of 3.5Kt of Tungsten at $340/tonne and 0.5Kt of Tin at an assumed $30k/tonnne.

But can it get there? The parallels to Futura, which was in a similar bombed out state, until suddenly it wasn’t, aren’t lost on me.

TUN’s last accounts shows £38m of assets, £16m of liabilities so £22m net assets vs a market cap of £6.1m (up from a low of £2.5m).

Valuation

While there’s still some BSRT holdings which are struggling, and even may fall to zero the progress at Futura’s Coal, and Cemos’ Cement is very encouraging and the 39% discount to NAV remains very attractive.

Cash is £0.5m

19.7% of the holdings (33.3% of the market cap) by NAV are gold/silver so are earning vast amounts with gold at record prices above $2,550 currently. These are publicly listed (except the Bilboes royalty) and at 31/08/24 were worth £16.7m

Excluded from the above at 1.2% of the NAV is Prognoz and applying a P/E of 4 to the lower estimate gets you to £6m.

33.9% of the NAV is Futura which is Met Coal where there is zero incentive for new entrants and near zero funding for coal. Applying a miserly P/E of 4 gets you to a £50m valuation (100% of the BSRT market cap)

31.1% of BSRT (£26.3m) is Cemos whose profitability and production are both heading upwards in 2025, helped by its “green cement” cresdentials and calcination plant and 2nd grinding plant which will double production from 200Kt to 400Kt of cement. Trevor Steel speaks to Cemos generating a £4m/year dividend so at a P/E of 10 gets you to a £40m valuation.

That gets me to £113m or 2.2X today’s market cap before we even include Nussir, Kanga and First Tin.

Conclusion

Poor Bazzer, he ended up on and over a cliff edge. Will BSRT investors face a cliff edge here?

Poor rat. Springfield can be a dangerous place for pets. Will BSRT investors enjoy a feeding frenzy?

With just over 80% of the NAV actually in production, with profit enhancing progress and cash flows, this is actually substantially de-risked. The NAV hasn’t yet really caught up with the reality of this - but it will I believe.

A pareto rule of 80/20 is an intriguing final thought here. BSRT took a further 9% stake in Nussir on extremely advantageous terms in August. It did so with Futura too. The earlier stage 20% of the fund could be funded from the income-generating 80% and when you are looking at IRRs of 28% for Copper at Nussir, 58% for Tin at First Tin Plc, 25% for Tungsten at Tungsten West and 22% for Kanga those returns could generate some enormous future returns.

Alternatively a 10%-20% dividend looks eminently achievable in 2H25 onwards.

Regards,

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Excellent clear analysis OB (as always). One to tuck away in the bottom draw and forget for 3- 5 years and then eat well on the divs. Buying discounted assets at a further discount at close to a cyclical low ..😎