Dear reader,

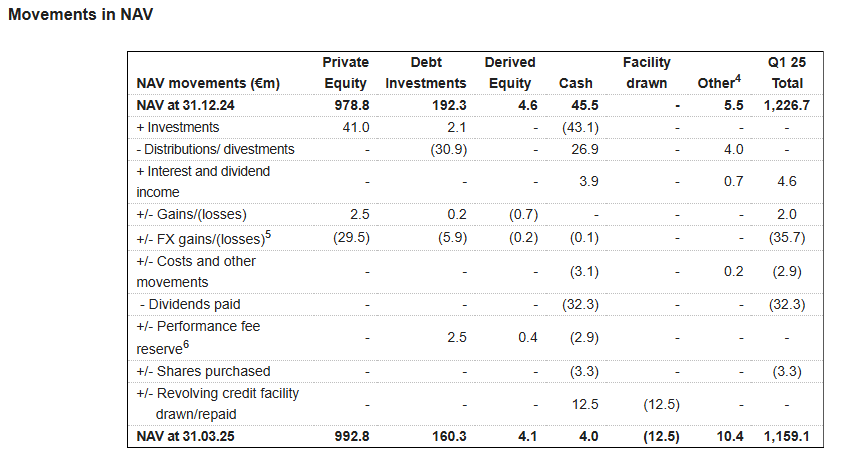

A net €2m valuation gain in 3 months isn’t huge but it is positive. Dividends and Debt Interest Income received of €3.9m brings the gain to €5.9m.

Annual dividends in 2024 totalled -€64.6m so the fund needs to generate more than just €5.9m to keep an even keel. Post period we know a €35.5m gain will be booked relating to PayCor while Assured Partners delivers a €0.3m gain. Considering Assured Partners fell by over -18% in 2024 an above NAV sale is a reasonable outcome. So €41.7m total gains YTD (that we know of) and 8 months remaining.

2024 portfolio gains exceeded the cash cost of dividends also by over €10m. This excludes income from dividends, debt income and other income, but also excludes costs. 2021 delivered a €336m gain so €75m keeps the lights on.

Eagle-eyed readers will say oh hoh but the NAV fell, in 1Q25. That’s true. A -€35.7m loss through FX losses, mainly due to US Dollar weakening. The ECB are dropping rates while J.Powell is reluctant so there are grounds to think that the FX rates will revert in 2025. 60% of the portfolio is denominated in USD so is a weakening dollar a permanent state of affairs?

The NAV movements below give us important clues to performance:

I am particularly pleased that the portfolio’s EBITDA growth accelerated from 14.1% to 16% for last 12 months (LTM). Revenue growth accelerated too to 10.6% and valuations rose to 18X EV/EBITDA.

The most recent cohort of holdings in Fund XI grew far faster. 25% EBITDA growth.

The Healthcare portfolio is being run down and has been a stinky performance. Great to see 20% of the remaining ones gone as at 31/3/25 with the better-performing sectors now accounting for 96% of the portfolio.

So APAX’s share price in 2025 has performed badly despite the:

Substantial constant currency YTD gains of €41.7m (inc. post period gains)

Despite the 3m shares bought back at a substantial discount to NAV YTD

Despite the accelerating revenue across the portfolio companies of 10.6%

Despite the accelerating EBITDA performance of holdings of 16%

Despite improving EV/EBITDA valuations (18X)

Despite binning off of 20% of the remaining stinky Healthcare

Despite all of that here we find ourselves in 1Q25 able to buy APAX for over €110m less than we would pay back at the start of 2025.

It is an irrational fall in price, in my opinion.

Lib Day impact? No not really. Unless you consider the indirect effect of second-order impacts. No sign of those as yet, and Dr Copper, Dr Oil (assuming Oil is also an indicator of economic distress) are telling us nothing to see here. The US economy remains strong, the jobs report for example delivered a bumper number of new openings, while sentiment is rapidly improving in Europe too. Political backdrops in Germany, France, the UK have settled down. 90% of holdings are classed as no impact from Tariffs and only 3% with “some impact”.

APAX is “Largely insulated”

Just under 2/3rds of the portfolio is US and 1/3rd Europe (inc. the UK) with 10% ROW.

New Investments

We learn three S&W, CohnReznick and DLRdmv were new investments. I was curious to get into the detail of what sort of businesses are held by Apax:

#1 S&W

A search returns Smith & Wesson as the top result, but no, this is another S&W. Smith & Williamson. A UK top 10 accountancy firm with strong representation into insolvency you might say this is a good choice, what with Labour’s penchant for red tape. Of course you have no choice with red tape than comply. You might say the government puts a gun to your head.

Estate planning has become a more popular expense since Labour came to power too. But also Private Credit has grown by a vast 50% since 2020 in the UK and arranging the legals and dealing with complexity requires the services of the likes of S&W. Private Credit is forecast to double from its current levels by 2029.

I thought this was a fascinating observation for those who bemoan the “failure” of AIM. Are companies simply taking more debt and less equity?:

#2 CohnReznick

Like S&W this is an accountancy and professional services firm, but based in the US. It’s not identical. Its services span ERP implementation (Netsuite), Tax Advisory, Compliance, Audit and outsourced Accountancy.

With 5,000 global employees and 350+ partners in 29 offices across the U.S., CohnReznick has a demonstrated track record of above-market organic growth, posting $1.12B in FY25 revenues owing to its deep pool of talented advisers, industry expertise, and extensive service offerings. Today, the Firm serves as a trusted adviser to clients in a wide range of industries, including real estate, financial services and financial sponsors, private client services, consumer, manufacturing, renewable energy, and government advisory.

In partnership with Apax, CohnReznick intends to invest further in its talent and business to continue to drive growth. Apax will apply its operational expertise and deep experience in professional services to support CohnReznick in advancing its value creation plan, which includes expanding service lines, developing technology-centric client solutions, entering new markets, developing best-in-class talent and advancing its existing tech platform to drive further innovation and efficiency. Apax will also support the Firm in pursuing its targeted acquisitions strategy to further grow its client offering.

Advisory/Consultancy Professional Services is an interesting subsector for APAX due to:

Increasing client-level business complexity, where clients lack inhouse expertise

Recession-resilience with annual, recurring revenue streams

Opportunity to address a fragmented customer base where scale creates a barrier to new entrants (the virtuous circle of expertise and reputation)

Opportunity to expand and consolidate via M&A in what is a fragmented industry of small firms, typically owner managed.

#3 DLRdmv

This is a US software company that digitises the “title” of an automobile. “Licence and registration” is the classic chat up line when a US Cop stops your vehicle. Registration is the title and historically was a bit of paper - that you ruffle through your glovebox to find all the while conspicuously keeping your hands visible and your movements gentle not to spook the Cop.

DLRdmv creates a digital process for car buyers and car dealers along with integration into Dealer Management Systems, so for the likes of Pinewood Software it means you sell a car and up pops the Title screen, and populates with the buyers details and whoosh the NMVTIS are notified, just like that.

Concern on the Services portfolio

Deep Dive into SafetyKleen

Apaex acquired an interest in SafetyKleen for €11m, in 2017. Today it is valued at €30.6m. 178% more. Is that justified?

SafetyKleen’s ultimate consolidated parent is Shilton Midco 2 Limited. Its 2017 accounts show a £35.8m EBITDA from 13/07/17. 35.8/171*365 = £76.4m EBITDA.

The latest accounts (2023) show EBITDA of £104.2m. That’s a 36% increase or 6% per year.

Safetykleen was acquired for £700m and has £900m of debt (up from £800 debt in 2017) so an EV/EBITDA of 15.4X is being applied per the last accounts and you could argue it is treading water….. the past annual accounts speak to covid disruption, supply chain disruption, inflation disruption…. it’s been a bumpy ride and it has ridden over every bump.

Since 2017 Safetykleen has acquired Metalwash which the press declare will “drive significant synergies” but it seems very small company (18 employees and a P&L result of -£285k in 2023) so appears of limited relevance.

Conclusion

It is in my opinion an irrational drop in price, where the three new holdings appear to offer exciting prospects. Where the realisations are at chunky premiums.

Will 2025 be a vintage year for Private Equity like 2021 was? Possibly not. Lib Day has thrown a spanner in those works potentially. But that’s not to say on a forward basis that the market doesn’t start pricing in a 2026 recovery.

Deal making works both ways also. A depressed market is bad for sellers and good for buyers. And guess what? APAX buys AND sells, so if 2025 is going to be a stinker then it’s good to know it has >€400m of firepower to acquire new holdings at bargain prices.

So far 2025 has been nearly double that of 2023 and 25% higher than 1Q24 - albeit less than half of 2021… so the market frets about impacts on APAX from Lib Day tariffs and vague prospects of doom APAX appears to be progressing nicely.

The prospects for revived 2025 dealmaking might be a relapse, but might also just be a relax.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Interesting write up, although I believe it all boils down to how realistic it is to exit their investments at an average valuation of 18x EBITDA I have serious doubts that’s achievable unless we go back to a 0% interest rate environment. I know the Tech portfolio less well, but on the Services side there are some assets where the carrying valuation is unrealistic (eg ToiToi, Safetykleen).

Thanks very much for this. I hold some. Bought 14 March 2025. Down 5% TR. Over 9% yield is very attractive.