An Onyx day's work for higher profits

SDCL's Onyx Renewables delivers a further cryptic update - what does it mean?

Dear reader,

The new $260m facility compares to the 1H25 Interim Report where $51m of Project-level debt plus $115m lent from SEIT holdco (via the RCF) totalled $166m.

The news today suggests a further $94m of headroom has been obtained.

Onyx was last valued at $378m and delivered $5.3m … an EV/EBITDA of nearly 36 times! Let’s dig into that number.

To explain that valuation we are told:

The majority of Onyx's value is underpinned by contracted projects that are relatively straightforward to assess and value. However, a smaller proportion, up to 15% of Onyx's valuation, is attributed to its platform value, comprising growth potential and development pipeline, which is currently more challenging to capitalise.

So on a $378m valuation, $321m relates to “contracted projects” i.e. are operational and “in the bag” and $57m related to the “platform value” so could be thought of as kind of a goodwill value.

We know that bids did not achieve an acceptable level.

Platform value reduced during FY2025 as sites became operational and pipeline became sites under construction. Back in March 2024 it accounted for 20% of Onyx’s valuation vs 15% at 30/09/24.

“Platform Value” relates to the movement from CIP to Operational for assets. It also relates to an undisclosed development pipeline 2026-2030.

So has Onyx performed?

68,317 MWh to September 2024 annualised is 136.6TWh so that’s 26.6% more MWh of power generated than in CY2023 and 120% higher than CY2022.

Using the EPA.gov’s formula of 19% efficiency gives us a 1431 conversion factor for MWh to MW.

That MWh equates to an approximate capacity of 95.5MW for 1H25 (136.6TW/1431). But we know that “technical underperformance” meant this number was probably higher. We also know 14MW was added in 1H25. SEIT incorrectly refer to this as H1 2024, whoops, although the period of time was during CY2024 (1st April 2024 - 30th September 2024).

If we go back to CY23 we know that 2023 was 95% of budget performance and 107.9TWh produced converts to capacity equivalent to 75MW (using the EPA calculation of 19%), that generated $13.6m EBITDA.

But we also know in the annual report that as at 30/09/24 94MW was operational and 118MW was in construction/development.

We furthermore know that 14MW was added in 1H25 so 108MW and 104MW under construction.

Based on newsflow that since September 2024 that a further 15.2MW has become operational. So a 15% increase to MW capacity and a likely circa 123.2MW operational platform today (and 88.8MW under construction). It’s likely that smaller operational completions don’t get any specific press release as the below 15.2MW did, so it’s likely the number is higher still.

Taking the FY2023 EBITDA and extrapolating the same performance as was achieved (without the underperformance) at 123MW vs 75MW then that’s a 66% uplift to MW compared to CY2023 (75MW).

That in turn suggests a current EBITDA at or around $22m per annum (up $8.5m compared with CY2023).

14.5X EBITDA Valuation

Is the $321m operational valuation and $57m of platform valuation relative to today’s estimated EBITDA still the same? $321m is 14.5X EBITDA for contracted assets with a 17 year average PPA. That seems about fair.

The $57m of platform valuation relates to a development pipeline that is at the VERY LEAST $94m higher (otherwise why ask for an extended $260m credit facility?)

There is 88.5MW based on the 2024 Annual Report number less energisations of 29.2MW. The extra $94m could be extended to $184m given that the facility may be increased according to Onyx.

The folks (Apterra) lending the money are lending like billio to other companies like Onyx. Onyx is not a trailblazer here. Blackrock and other “smart money” are doing the identical thing - at a larger scale than Onyx. It is also noticeable that STORAGE is very much part of the plan here too.

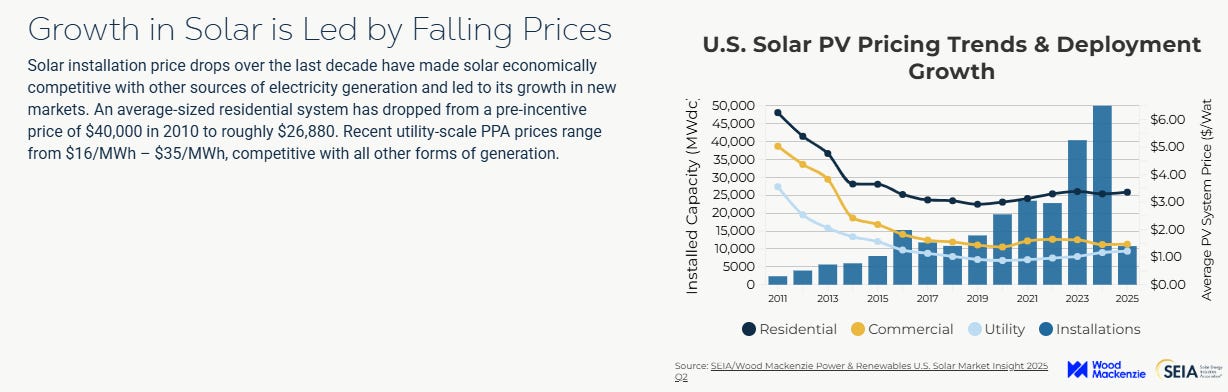

Wood Mackenzie estimate US solar PPAs lie between $16/MWh - $35MWh and compare that to a $1.2m per MW system cost on new projects.

That implies Onyx could at least double its estimated 110MW installed with the new line of credit, plus add storage. That would imply an EBITDA of $50m+ and at an assumed 5% cost of capital on $350m is -$17.50m and annual depreciation of -$8m delivers $25m+ net profit to SEIT.

Since depreciation enables replacement of equipment ($8m is based on a 30 year life and an assumed $240m capex) then a P/E multiple of 20X gets you to a $500m longer term valuation. That’s based on a current ACTUAL plus PLATFORM.

In other words, it is my assertion that not only is the discount on NAV relating to Onyx (about 50% discount to NAV) not at all logical (and from a 43p per share low point the market is starting to realise this) there are also grounds to think there is something of up to 33% upside to the NAV (relating to Onyx) based on pipeline and expected newsflow.

In other words plenty of meat on the table for a partner to come in and enjoy upside, if that’s what SEIT decide.

Conclusion

SEIT told us that they were investing into Onyx because it was an attractive and fast-growing opportunity. There’s no reason to disbelieve that.

Today’s news affirms the valuation for Onyx and removes about £2.5m of RCF cost boosting the dividend coverage. Moreover the likely increase to EBITDA earnings even accounting for higher project debt (and interest there) is likely to be accretive.

Even after the circa 10% rise in price the dividend at 12.8% and a 52.8% discount to the fair value excluding 12p per share of “noise” means you are buying about 105p of assets for less than 50p.

Do you subscribe to my YouTube channel?

This video is a talk through of this article and was released on June 11th.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings, even those held by a FTSE250 company like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

"The $57m of platform valuation relates to a development pipeline that is at the VERY LEAST $94m higher (otherwise why ask for an extended $260m credit facility?" I'm not sure that's necessarily the case. I would expect them to build in some headroom, as the last thing a lender wants is to be asked to reopen an analysis because the borrower has come back for a second bite - suggestive that the borrower didn't do its sums right first time. (Speaking as a former corporate lending official!)

But a really helpful analysis OB, thank you. I think the possibility of investing in storage is strategically right as it's increasingly apparent from Grid charts that spot power prices can frequently hit NIL at mid day when solar gain is at max: the time to be supplying power is late afternoon/evening, and the risk is that there could eventually be a glut of solar energy. (Hence the attaction of Gore Street et al.)

I would stay well clear of SEIT / Onyx. Even if you could maybe maybe maybe make a case for its current valuation as an ongoing, growing business, the amount of DD and risk-taking a buyer would need to do on dozens of tiny assets is prohibitive --> so that results in lowball bids.