Dear reader,

Amidst a near-universal positive reaction I’m not feeling peppy and positive about the 1Q26 results. The chattersphere is awash with positivity meanwhile. Tin is going to rocket some people say.

My estimate of the 2nd jig of September 2025 appears to be about right although it will be ready in “2H2025” could be the 31st December - we aren’t given a new percentage complete as we had previously from management. That’s frustrating.

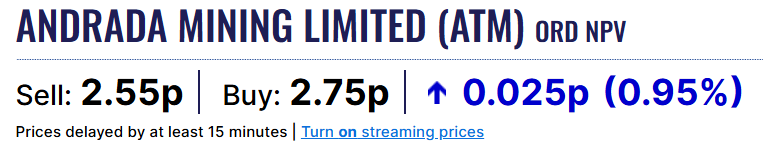

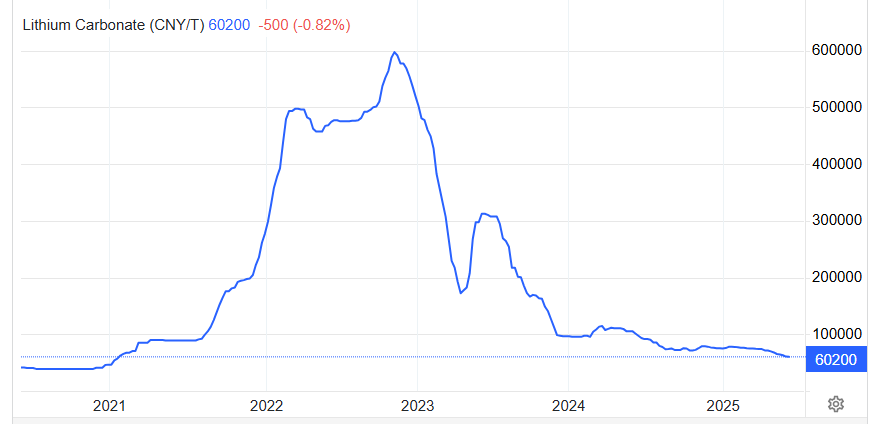

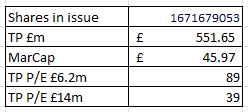

Perhaps the positivity was due to a broker that appeared to cut and paste today’s Operational Update RNS and tagged it with a 33p target price suggesting there’s more than 11X upside for ATM. At 33p per share ATM would be a £552m market cap.

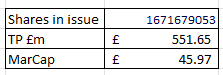

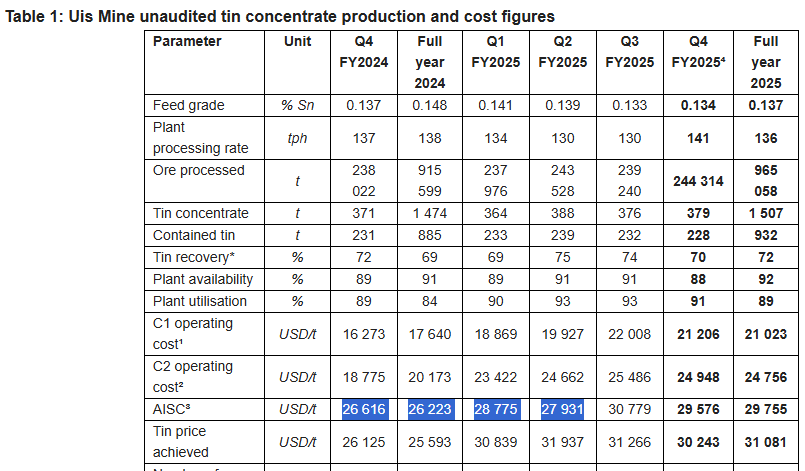

My model suggests a three year (FY28) achievement of:

A £6.2m annual profit

Based on 30Kt of Lithium Petalite Concentrate at a selling price of £1,133/tonne.

Plus 2.5X the volume of Tantalum

Nearly 2X the volume of Tin

Tin at $37,000/tonne

The cost of the “full scale” Lithium Partner adds -$20,000/tonne (per tonne of Tin) to the AISC. There’s 16.3 tonnes of Lithium Produced per tonne of tin so that’s the equivalent of $1,227 per tonne of Lithium. Is that too high?

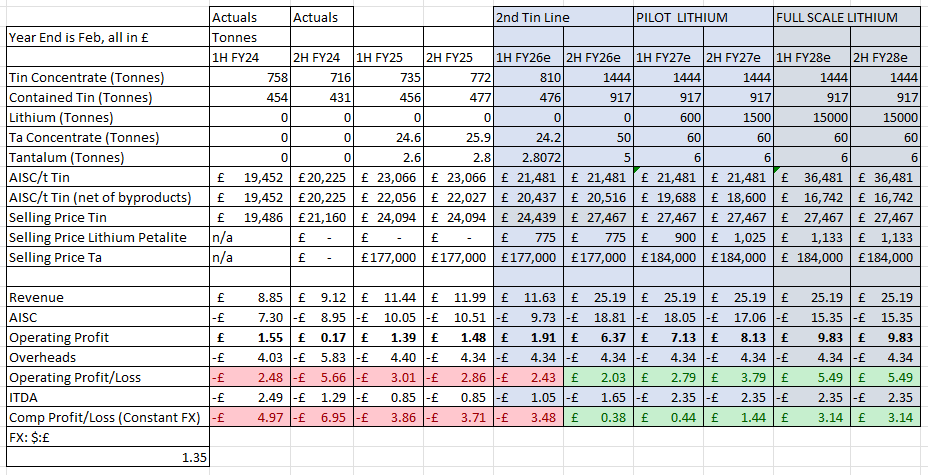

The Petalite selling price of £775/tonne is based on an 8:1 ratio to make Lithium Carbonate. A selling price of £1,133/tonne petalite assumes £9,000 Lithium Carbonate. Today’s 60,200CNY price is only £6,200 so only £775 a tonne for Petalite.

Lithium Pricing:

Of course it’s academic since no Lithium is being sold by ATM today.

Considering Tin

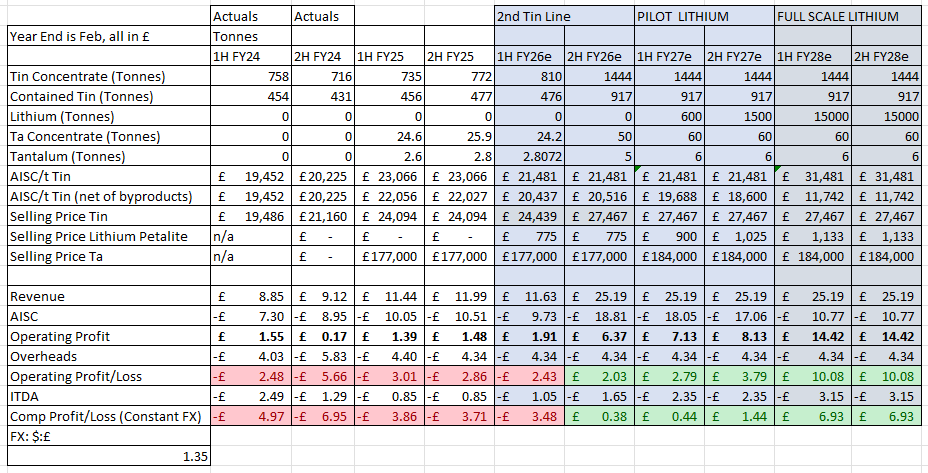

The 1Q26 AISC of -$28,999 compares quite unfavourably with all the periods up to 2Q25 so I was hoping for better numbers.

The 0.136% grade is down about 10% compared with the average of 2024’s feed grade. It’s 26X worse than Alphamin’s feed grade. Alpha *IS* worth £580m market cap today (i.e. the 11X target price of the broker). Alphamin is in the DRC so has its own problems but a low grade of tin is not one of them. Nor a high AISC either.

Considering Lithium

If I assume (much) lower Lithium costs of -$600/tonne then profits increase to £14m. But is a cost of $600/tonne of Lithium Petalite realistic?

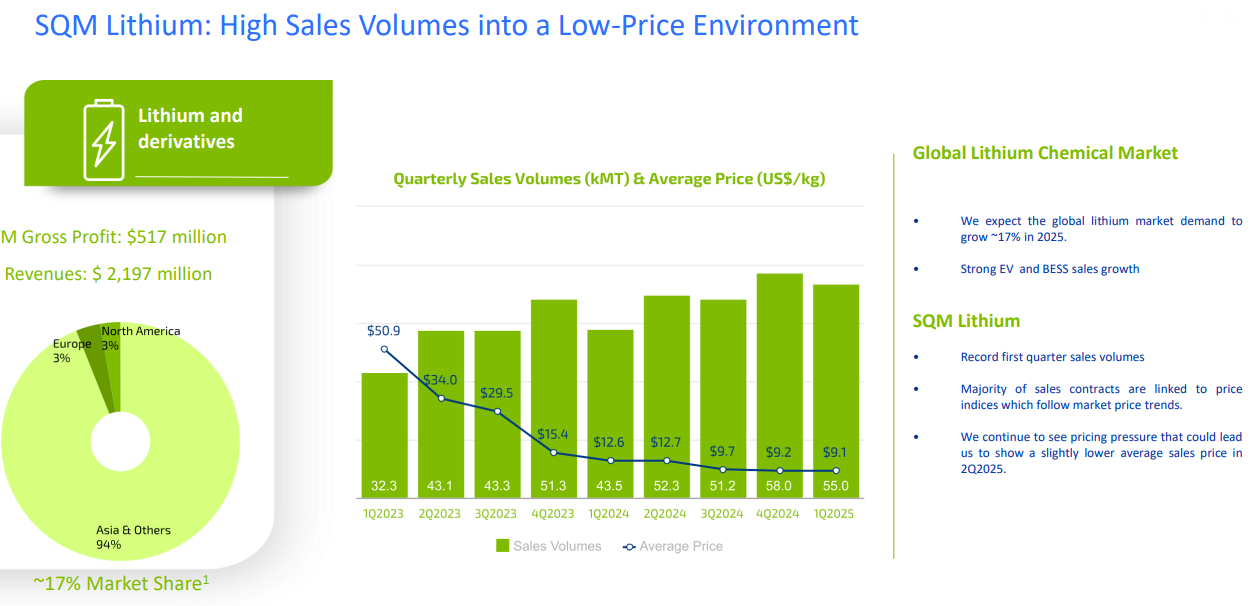

Who better to benchmark against than SQM Lithium?

Overall SQM achieved in 1Q25 $125m Gross Profit on Lithium. On 55Kt. That’s $2,272 profit per Tonne. That implies $9,400/tonne revenue and $7,127 of cash cost for Lithium Carbonate.

$7127/tonne carbonate equates to $890 per tonne of petalite cash cost…. 50% higher cost than my $600 to generate my £14m annual profit.

So no - assuming that the Namibian ground is as prospective as the average of SQM’s existing Lithium ground in Chile and elsewhere then a $600 cost would be unrealistic.

Even if it were possible (let’s be optimistic) then in that scenario you’re looking at a P/E of 39X to arrive at a £551m target price.

Or 89X at the lower £6.2m profit level. Miners do not get to be valued like an Nasdaq AI stock.

Remember that’s a +3 year profit level too. Not today’s profit (or loss).

NPV Basis

I’m not even discounting that future profit in my calculation. The broker DOES discount yet arrives at a $780m NPV even including RISK. Doesn’t show their workings just the outcome of their maths is $780m net present value for part of ATM’s assets (at an unknown discount rate).

They say:

Our target valuation is based on ATM’s existing operations at Uis, as well the potential for significant growth through a Phase 2 expansion, which we value at US$780m on a risked NPV basis. We add US$30m for Lithium Ridge and assign US$5m in value to Brandberg West, albeit with considerable upside likely as drilling continues.

(The valuation is actually $815m NPV but let’s stick to just the $780m)

It’s true there are dozens and dozens of pegmatites at Uis. Stretching over 100s of sq.kilometres. I think that $780m discounted for time and a risk valuation must be based on vast volumes of the Uis tenement is being mined in some distant future and perhaps a higher grade is assumed than the one 1/8th of 1% tin ATM are scratching out today. We simply don’t know how that number is reached and there is no logic given for that valuation, so it’s not a helpful number and a potentially a dangerous one to rely upon for unwary newbie investors.

My model is much more modest and nearer term. It’s based on an extrapolation of known facts. I’m working on a doubling of tin, and a bit more than a doubling of Tantalum plus a 30Ktpa Lithium operation at Lithium Ridge. A 2X of today’s 2.75p to get to 5.5p a share seems reasonable over 12-24 months - if things work out - and assuming that ATM can increase production, reduce costs, see higher tin prices, higher lithium prices and that SQM proceeds with Lithium ridge.

Of course each of those are risks, of cost, delay, success and assigning a 50% deduction for risk to all of the above assumptions suggests that 2.75p would be around the correct price for ATM. Not surprising therefore that the price didn’t move today, despite the hum of optimism as people gave their opinion.

But a target price of 33p a share? Rose tin-ted.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"