#25 IVANHOE ELECTRIC

US Copper and Electric Pulse Detecting

Dear reader

Trump’s government has already lent support to domestic production of various critical minerals. Copper is one of those.

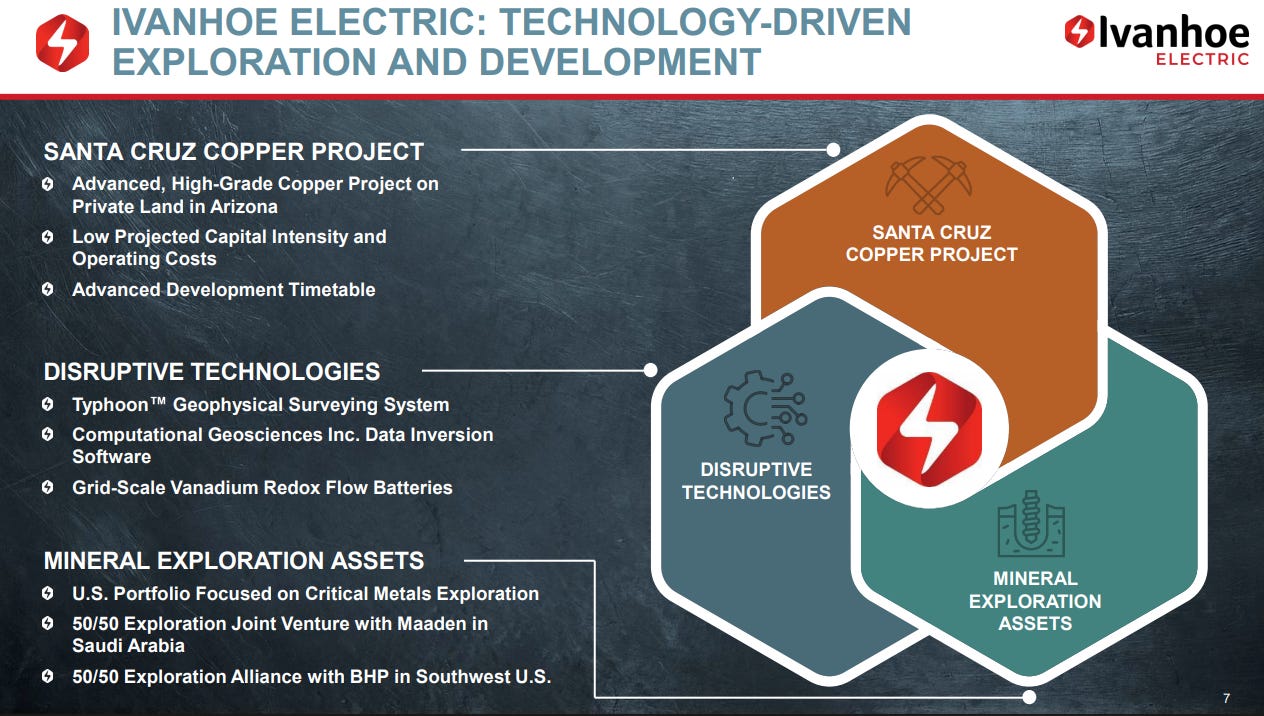

Ivanhoe Electric Inc (ticker IE) is a U.S.-based mineral exploration and development company focused on high-margin deposits of critical metals, particularly copper, with additional exposure to gold and silver. Founded by mining legend Robert Friedland, the company leverages proprietary technologies like its Typhoon geophysical system for efficient discovery and delineation of resources.

IE’s flagship asset is the Santa Cruz Copper Project in Arizona, a large-scale, high-grade underground mine, alongside the Tintic project in Utah and early-stage ventures in Saudi Arabia via a joint venture with Ma’aden.

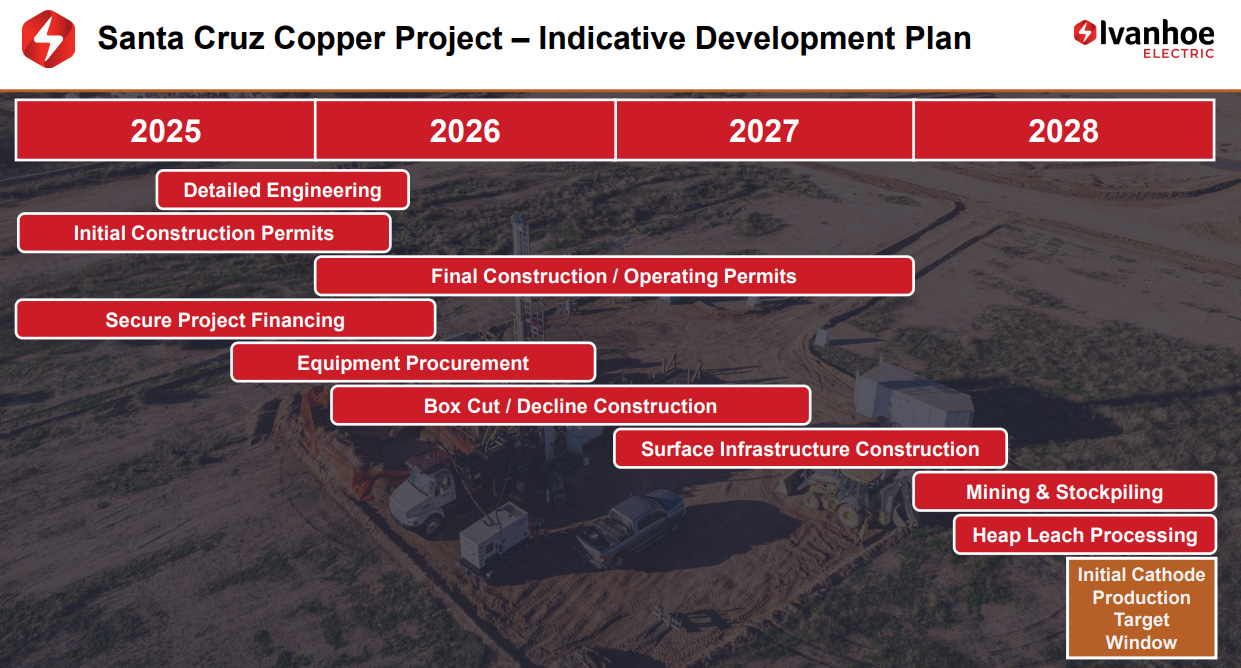

As of December 2025, IE is advancing toward construction at Santa Cruz, positioning it as a key player in the U.S. copper supply chain amid growing demand from electrification, AI data centers, and renewable energy transitions. The bull case hinges on copper’s structural deficit—forecasts from Citi and ING suggest prices could hit $12,000–$15,000/ton by mid-2026 due to mine disruptions, tariffs, and hoarding—driving value for IE’s assets.

Recent milestones include a June 2025 Preliminary Feasibility Study (PFS) for Santa Cruz outlining a 15-year mine life with average annual production of ~72 Kt per year of copper at low costs (~$1.36/lb after credits), and securing over 3,000 acres of private land for infrastructure.

NPV $1.4bn at $4.25 copper (so the NPV is $2.4bn currently at $5.25 copper with a 34% IRR)

Reserves: ~1.5 million tonnes at 1.08% contained Cu

Indicated: ~1.6 million tonnes at 0.95% contained Cu

Inferred: ~3.3 million tonnes at 0.79% contained Cu

Financially, IE is well-capitalized post a $150M equity raise in October 2025 at $15/share and a $200M bank credit facility closed in December 2025, providing liquidity for 2026 development without immediate dilution risks.

The US government’s EXIM bank has indicated up to $825m of further financing and support too.

Catalysts for the coming year include the Definitive Feasibility Study (DFS) in 2026, construction at Santa Cruz plus exploration upside at IE’s other assets Tintic (in Utah) and Hog Heaven (in Montana) - where Typhoon is on the case. Copper’s role in AI infrastructure puts IE as a key player in the USA’s “electrification of everything.”

However, as a pre-production junior miner, IE faces risks including execution delays at Santa Cruz (permitting, water rights in Arizona), copper price volatility (will it go up in 2026?) and ongoing losses (Q3 2025 EPS -0.13 vs. est. -0.20; TTM net loss -$55M on $3.7M revenue). Debt/equity stands at 25.2%, with a high PB ratio of 8.7 reflecting growth premiums but also concern if Copper prices weaken. Market cap is ~$2.44B at $16.85/share (up 123% YTD, outperforming peers), but negative ROE (-23.9%) underscores development-stage dilution and burn rates.

Analysts have a consensus “Buy” rating from 7 firms, with average price targets of $19.95–$20.08 (implying ~18–19% upside; high $28.50), citing Santa Cruz’s strategic U.S. location and low-cost profile amid domestic supply push.

This is largely based on a valuation of its Santa Cruz Mine. My eye is drawn to the value of its Typhoon technology.

STRENGTHS

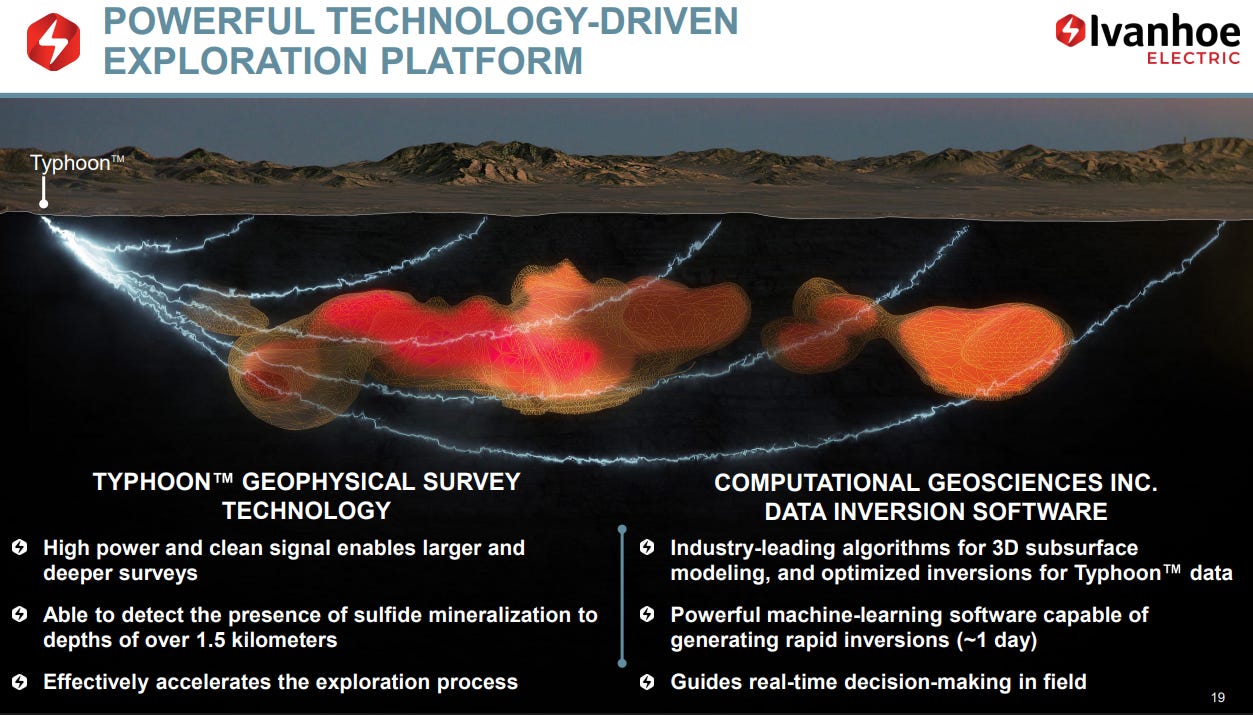

Proprietary Technology Edge: The Typhoon™ geophysical surveying system (high-power for deep detection) and Computational Geosciences Inc. (CGI) AI-driven analytics provide a competitive advantage in discovering hidden deposits, de-risking exploration, and attracting partners like BHP and Ma’aden.

Typhoon is adept at detecting Sulphides, and Sulphides are where Gold, Silver, Platinum, Cobalt and of course Copper are found.

Wait what? So how good is this technology? So far it has proven to deliver a 100% hit rate. Consider the alternative - cost of drilling. Substantial. Consider the months of desktop study that precede a definition of drill targets. Time consuming.

What if you could use a “radar” to detect what lies beneath? The principle is to send a burst of pulse electrical energy into the earth to detect electrically conductive material. Pulse is a “third way” to deliver power - the other two being Alternating Current (AC) and Direct Current (DC).

Friedland boasts in this video you could bury a 1957 VW Beetle 2Km deep and - like a CAT scan - “see” that it was not a 1958 VW Beetle due to the shape of its rear bumper. When a highly credible person like Friedland says his technology is this good - well it’s hard to ignore.

Ma’aden a $10bn turnover Saudi Arabian company had this to say:

The platform operates in two main modes: induced polarisation and electromagnetism . Its impressive technical specifications make it particularly powerful, including:

High voltage: With a power output of up to 10 kV, it can transmit signals through highly resistant conductive layers and host rocks, which would normally be obstacles.

High power: Up to 100 kW of power is used to stimulate large volumes of rock, allowing studies to be carried out over larger areas and more efficiently.

High current intensity: A current of up to 200 amps enables the detection of mineralization at significantly greater depths, up to 1.5 km, even under complex cover geology.

High-Quality U.S.-Focused Assets: Key projects like Santa Cruz Copper (Arizona) with a June 2025 PFS showing $1.3 billion after-tax NPV (8% discount, $3.80/lb copper) and 23% IRR; Tintic Copper-Gold (Utah); and Hog Heaven (Montana). Private land ownership reduces permitting hurdles, with potential for low-carbon, high-purity copper production using renewables (up to 70% of power).

Strong Leadership and Backing: Founded by mining legend Robert Friedland; institutional ownership ~50% (e.g., BlackRock 10.8%, Fidelity 10.7%); solid balance sheet with $98 million cash (Q1 2025) and no debt, plus recent $200M facility and $55M for VRB Energy subsidiary.

Diversified Revenue Potential: Beyond mining, VRB Energy (vanadium redox batteries) via JVs (e.g., $55M Chinese investment for manufacturing) taps into energy storage growth.

Strategic Partnerships: 50/50 JV with Ma’aden exploring 48,500 km² in Saudi Arabia (early copper hits); BHP alliance funding U.S. exploration - using Typhoon. These validate tech and provide non-dilutive capital.

Weaknesses

Pre-Revenue and High Burn Rate: No operating revenues, with ongoing losses (~-$103 million forecasted for 2025) and dependence on equity/debt raises or JVs for funding; described as “angel investment” stage with years to production.

Project Concentration Risk: Valuation heavily tied to Santa Cruz success (initial $1.15B capex); delays in PFS or development could erode value.

Long Development Timelines: Multi-year permitting (e.g., Aquifer Protection, Air Quality) and exploration risks; small team may strain managing multiple sites.

Commodity Price Sensitivity: NPV highly sensitive to copper prices (e.g., $0.20/lb change = ~$208M NPV shift); current forecasts assume supportive prices but volatility persists.

Opportunities

Surging Copper Demand: Structural deficits forecasted (e.g., 350kt in 2026, 533kt in 2027) from electrification, EVs, and renewables; BofA raised prices to $11,313/t in 2026.

Government Support: U.S. strategic focus for critical minerals tie in with the fact that Santa Cruz could produce 80kt/year. U.S. policies like IRA, Defense Production Act (invoked via 2025 EO), and $825M EXIM financing for critical minerals; fast-tracking for projects like Santa Cruz.

Tech Commercialisation: Typhoon™ would deliver high-margin revenue; expand VRB batteries amid grid-scale storage boom (e.g., rising lithium costs combine with vanadium’s safety advantages).

International Expansion: Ma’aden JV in underexplored Arabian Shield; potential new partnerships (e.g., recent MoUs with countries like Egypt, Russia).

M&A and Acquisitions: Consolidate juniors in a funding-constrained market; leverage U.S. tariffs/supply disruptions for premium pricing.

Threats

Commodity and Market Volatility: Copper price swings (e.g., 26% drop in 2020 downturns) could impact viability

Regulatory and Permitting Risks: Delays from environmental reviews, mining taxes, or changes (e.g., climate impacts like fires); non-U.S. ops exposed to geopolitical instability (Saudi, potential China ties via VRB).

Intense Competition: Majors like BHP, Rio Tinto aggressively pursuing copper; new entrants in sustainable mining.

Execution and Operational Hazards: Mining risks (hazards, cost overruns); supply chain disruptions (70% of miners faced delays in 2021); legal proceedings or JV failures.

Technological Substitution: Long-term shift to alternative materials or batteries reducing copper demand (e.g., new tech in EVs).

Conclusion

Overall Investment Perspective:

Ivanhoe Electric offers speculative upside for investors bullish on copper (e.g., via electrification deficits), with both its Typhoon tech and U.S. assets as differentiators.

IE is very well positioned for the future: Copper and the other minerals they target are absolutely essential for the energy transition , electric vehicles , and above all, for the growing energy needs of artificial intelligence . The supercomputers and data centers that power AI require colossal quantities of copper.

However, it’s fair to position this as a higher-risk idea due to development risks and funding needs. The mitigation is US government support.

Santa Cruz advancement and JV progress with either Ma’aden or BHP proving out the technology could provide upside, while downside from price drops in copper, or delays could pressure the stock. Diversification via partnerships mitigates some threats, positioning it as a growth play in the critical minerals space

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Here's Gemini Pro's take:

In Arizona, water permits are the killer for copper projects (eg., the Rosemont Copper project was blocked for years over similar issues).

Until the Arizona Department of Environmental Quality (ADEQ) actually grants the Individual Aquifer Protection Permit (targeted for 2026), the project cannot legally operate.

This is a bet on Robert Friedland's political ability to push permits through the Arizona system.

Fascinating OB. Just imagine, what if Typhoon was deployed deep underground within an existing mine, what sulphite signatures it might reveal and the future direction for existing older mines and their deposits?