2nd largest European Green Hydrogen Project

Dear reader,

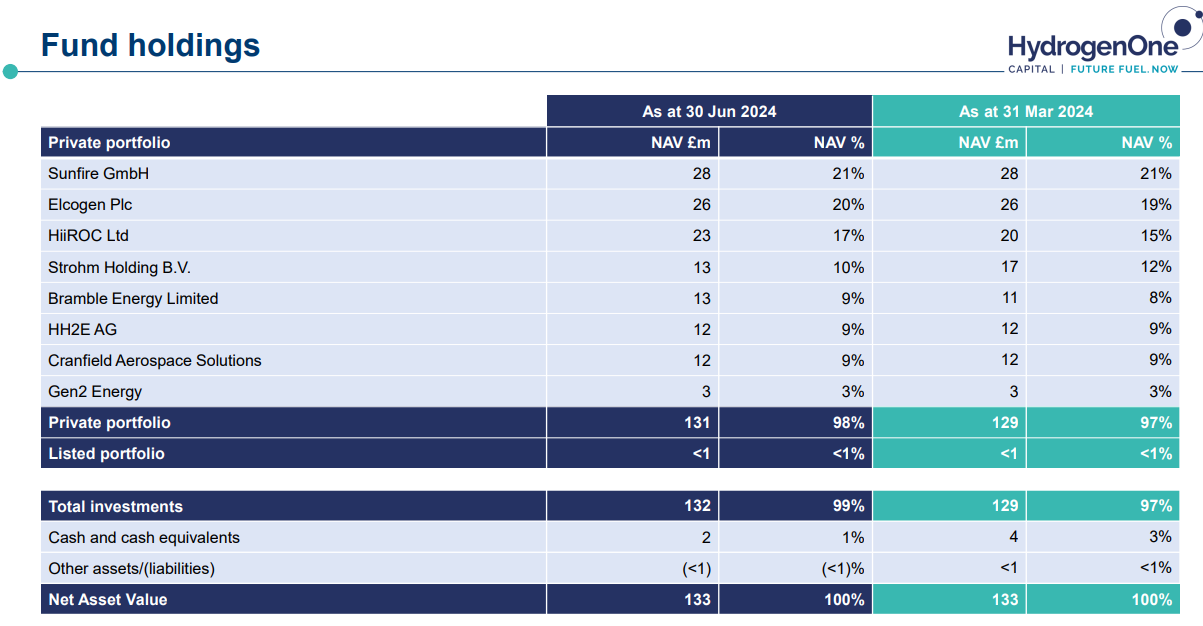

We know that HGEN reduced the value of its HH2E holding as at 30/09/24 to 8% from 9% so from £12m to £11m. The original investment was £7m. Today they announced they are entering administration. Insolvent? No, in administration, there are two types in Germany.

We know too, that the holding is £10m equity and a £1m loan. Apparently we are told the loan is toast, loan notes strangely are below equity in terms of the pecking order of claims on the assets of a company. So what of HGEN’s £10m equity in HH2E? That is equivalent to 9.1% of the NAV.

There’s a chance that £10m/9.1% of NAV has been lost too. £10m of £129.9m of assets.

I say a chance because it was also announced today that HH2E will pursue a “structured corporate restructuring process” with a focus on securing a new investor for its €1bn green hydrogen production plant in the Baltic port of Lubmin - where NordStream1 once flowed, so this location is on existing gas networks and part of the $40bn backbone being developed by the EU.

BNP Paribas and CIBC are among the lenders. BNPP is debt adviser to create a syndicate to finance the project. CIBC is running an equity process, and both are expected to complete in the fourth quarter.

HH2E is aiming to raise €200m of debt with an initial €200m phase of the hydrogen project able to produce 6,000 tonnes of green hydrogen annually. It could be scaled up to more than 60,000 tonnes per year.

€0.2bn is just over 0.2% of the announced EU/German funding for Hydrogen of over €93bn. Another €1.2bn of funding is being allocated in December 2024. Von Der Leyen is determined to ensure her cornerstone policy REPowerEU succeeds.

How do you think the EU and Germany will respond to the news coming out of Lubmin, reader?

So while there’s a chance that HH2E is toast. There is, it seems, a reasonable chance you will be able to toast its resurrection as HH2E comes back through an intervention. I particularly notice that the equipment and project delivery partners are all in place. REPowerEU wants to particularly support projects which make use of European companies.

How does HH2E fare on this criterion? Are HH2E’s equipment partners European companies?

Yes - the partners are Siemens GmbH electrification, Borsig GmbH electrolyser, Gebrüder Civil Engineering, BASF Batteries. Du liegst genau richtig!!!

It is also the case that the EU have relaxed the rules on State Aid under the TCTF (Temporary Crisis Transition Framework) following the shut off of Russian gas, and support strategic

Meanwhile does a possible 9% drop in the NAV justify a 27.5% drop in the share price? Yes, if HGEN had been trading at a premium, but it wasn’t. It traded at a deep discount before today.

Therefore even if HH2E is toast (and that is not certain) then you are still getting a 70.2% discount following today’s drop. If it is resurrected you will get nearly 73% discount.

Consider:

Consider that part of the HGEN portfolio sold for a 0% discount to NAV just a few days ago.

Consider that £560m of fundraising occurred for its holdings NOT at a 70% discount during 1H2024.

Consider that by pursuing administration HH2E has generated significant headlines and attention which I think is the point. To make the EU and German governments/agencies sit up and deal with the potential embarrassment of the 2nd largest European Green Hydrogen project simply not being funded, just because those unreliable Brits (in their view) at Foresight have pulled out. HGEN’s £10m shareholding remains safe for now, even if the £1m loan is toast.

Consider that even if only one of the 6 remaining main investments - Sunfire, Elcogen, HiiRoc, Strohm, Bramble or Cranfield continue to achieve the same level of commercial success and growth then the 27.5p per share is covered. If the other five are worth more than zero then you’re ahead.

What of the 6? Sunfire has secured a 100MW electrolyser sale, Elcogen is working on a European Hy2Tech program, Strohm is working on supplying pipes to deep sea rigs and prospectively supplying the European hydrogen gas network is going to need substantial upgrades (hydrogen is a much smaller gas than methane), Bramble is working towards manufacturing the Heidi Hydrogen (ho dee ho) bus and Cranfield are about 3 years away from hydrogen fuel cell commercial flight (using a tried and tested airframe, just the engine and fuel tanks are being adapted).

Consider too that the eyewatering discount rates applied to the investments mean that if these discount rates unwind then there is upside for every one of HGEN’s holdings too.

Conclusion

So while Foresight’s decision to pull out is a disappointment this isn’t necessarily a reflection either of the viability of Lubmin nor the future of HH2E. And certainly not a read across to the other main 6 investments. It is noticeable that Foresight Group tell us in their investor pages they are planning to launch a hydrogen fund for institutional investors. Did that fall through and cause today’s decision?

After all just 4 months ago Lubmin was one of three strategic priorities for Foresight.

Interest rates have fallen, not risen, and today there remains strong interest - as there was when they wrote this 4 months back - that there was “strong interest” from those sectors that need to decarbonise. Strong interest sounds positive to me reader, unless Foresight lacked, er, foresight on this.

To summarise, today’s sell off and the 70% discount to NAV even excluding the value of HH2E, suggests if the future is anything better than the imminent demise of nearly all of the companies in HGEN who are involved in the delivery of hydrogen infrastructure and systems, then you should be looking at a holding with a lot of potential upside in the price.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"