Dear reader,

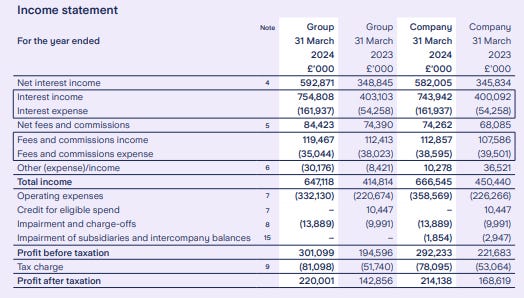

Starling Bank sees pre-tax profits surge as it benefits from a far higher net interest margin.

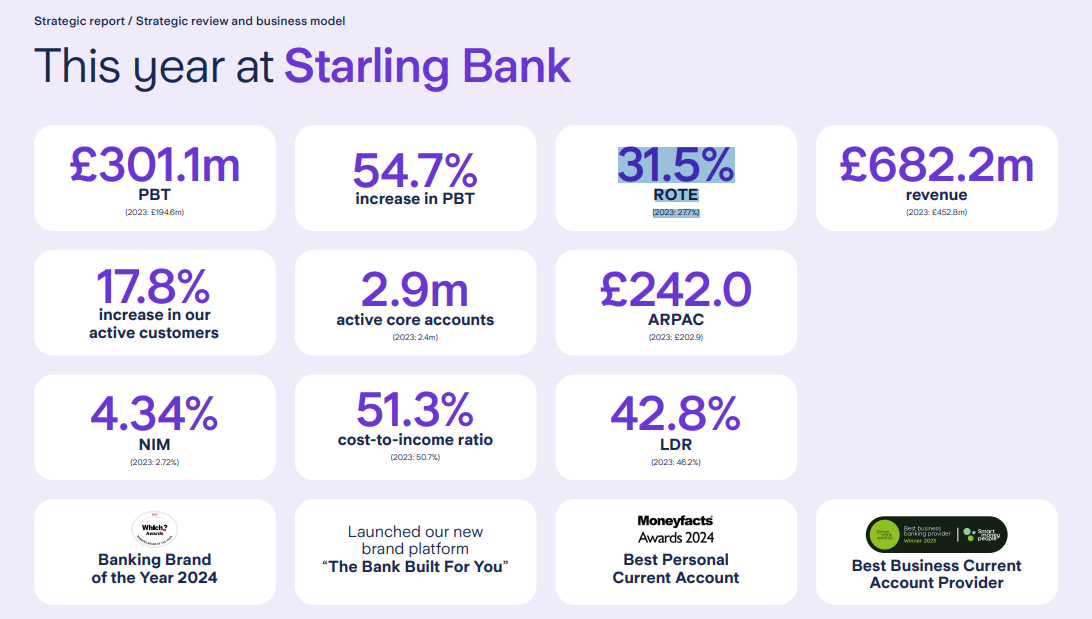

A 4.34% NIM is only part of the story. A ROTE (Return on Tangible Equity) of 31.5% is spectacularly good. A £242 average revenue per account is too.

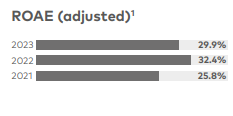

The winners of the World’s Best Banks 2024 Western Europe didn’t even achieve close to 31.5% ROTE! The UK big four have achieved record ROTEs in 2023 but theirs are less than half of Starling’s.

The only bank which equals it (to my knowledge) is Bank of Georgia who report average equity not tangible equity but is the closest comparable. If you ignore the recent fall caused by unrest in Georgia their valuation quadrupled in price since 2021.

This is Starling’s third year of profitability as it benefitted from higher interest rates and growth in customers. The digital bank posted pre-tax profits of £301.1million in the year ending 31 March 2024, up 54.7 percent on last year's pre-tax profits of £194.6million. Its revenue rose to £682.2million from £452.8million.

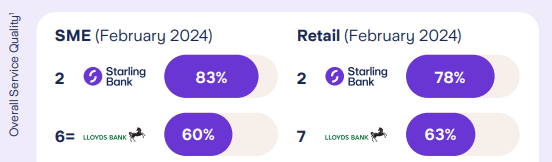

Its overall service quality was #2 in for both retail customers and SMEs

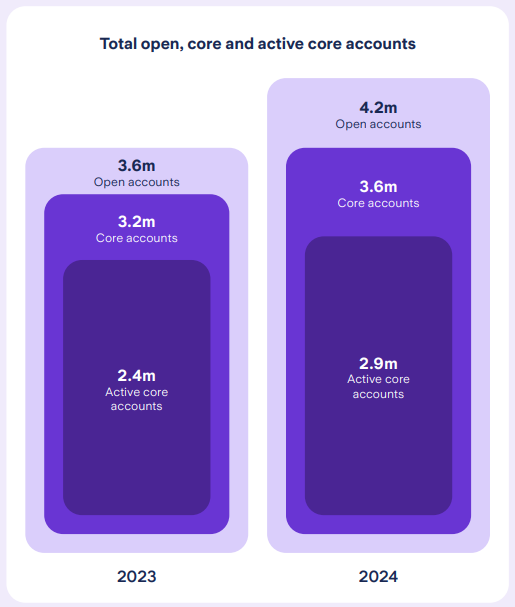

And grew its accounts by over 15%. The percentage of active accounts now stands at nearly 80 per cent, while total transactions rose by 21 per cent to £174.1billion during the year. Starling has more customers, using its services more often, continuing to deepen their relationship.

Starling also attributed its success to its first Software-as-a-Service sales through its software business “Engine”.

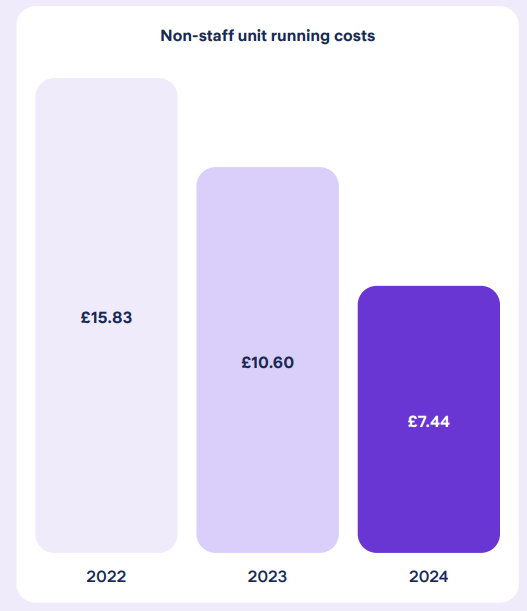

Excluding staff costs, Starling have halved their costs per core account by 50% over the past 2 years. This is thanks to Starling using its subsidiary software’s “Engine” product inhouse. AI is now used for onboarding as well as summarising calls and note keeping in the system.

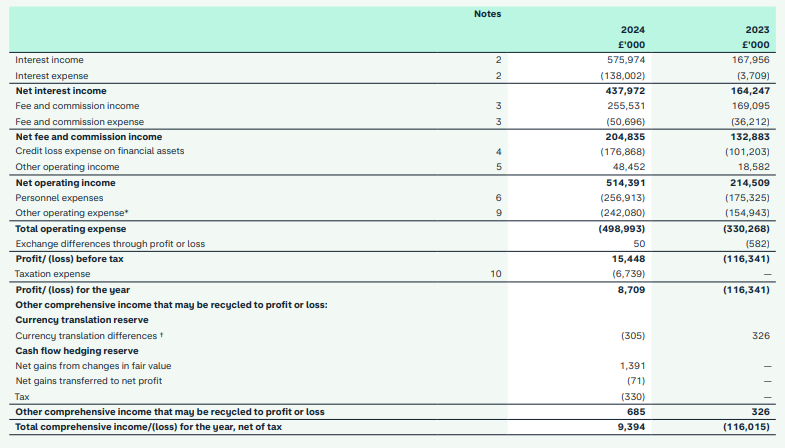

In May, Starling launched its first bank, Salt Bank, in Romania using Engine's software which onboarded 100,000 customers in its first 2 weeks (!) and 200k in 2 months and Engine is mid-way through launching a second digital bank in Australia (called AMB) due to come online early 2025.

New CEO John Mountain commented: “I see in Starling a well-capitalised bank that has grown rapidly but that has captured 2.8% of the UK current account market so far, leaving significant headroom for further domestic expansion. In Engine, I see a world-class technology provider that has just begun to crack open a £91bn global addressable market for SaaS Core Banking.”

These are the first results Starling has published since the departure of major shareholder, founder and former CEO Anne Boden. The group's new CEO arrives 24th June 2024.

Mountain continues:

“This is our third full year of profitability demonstrating a robust financial performance. It was a breakthrough year for Starling as we became a global provider of banking Software as a Service through our subsidiary Engine by Starling. We've heavily invested in Engine because we're confident it can one day become as big as the UK bank, or bigger.”

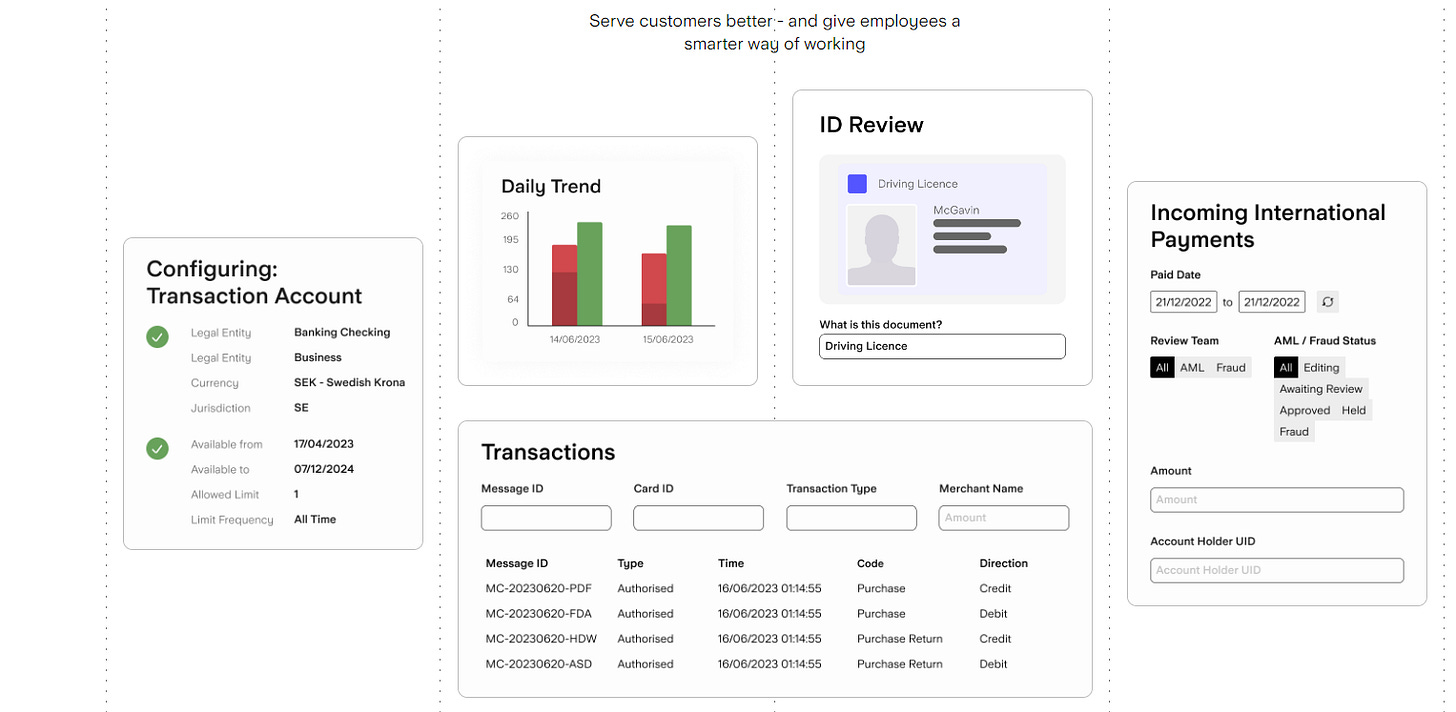

Engine is based on AWS (some GCP), Microservices, uses Restful APIs and is based on Java in the backend - so is standard business technology as opposed to legacy technology.

Its Ledger contains both a customer ledger and the banks ledger, with automated reconciliation and postings and FX calculations. Its payment capabilities span one-offs, scheduled payments, direct debits, notifications, location-based payments, settlement cycles, payment reversals, social and international payments. It also has configurable rulesets for KYC (know your customer) and KYB (know your business) for compliance, document storage, flexibility around complex ownerships and linked accounts (including parental controls on child accounts) and automated card management and provisioning. It enables banks to offer some or all products to offer packages or bundled services and apply pricing and eligibility rules and to enforce risk-based decisioning. Also rulesets to expose data to external services - for example to provide integration to business accounting softwares via APIs.

It’s not just about nicer interfaces for customers - Engine is also about making banking staff more productive too.

It really is early days, however. Revenue on its BaaS and SaaS products, grew by 13% in the year to £84.4m (2023: £74.4m). Only going live in the latter part of the financial year, Engine contributed £2.272m or 1.9% of total fees and commissions income (and 0.33% of all income).

Starling has been earmarked as a future Initial Public Offering and these results could be another step towards the bank, founded just 10 year ago, in being listed.

Read Across Valuation:

Monzo is valued at £4.1bn and reported £11.8bn deposits and £15m PBT in FY24. Starling has a similar amount in deposits, but earned £190m PBT in FY23 and £301.1m in FY24. 20x more than Monzo.

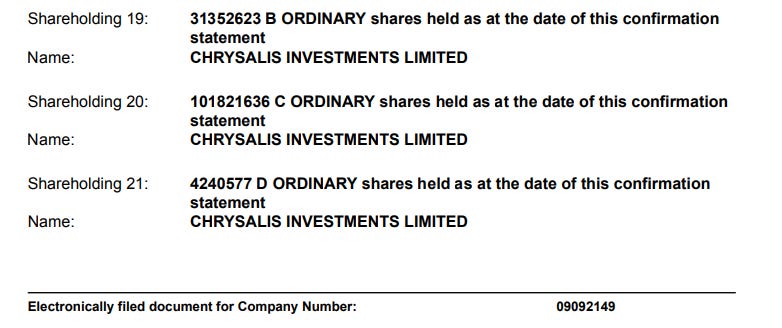

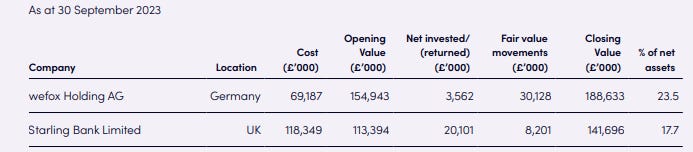

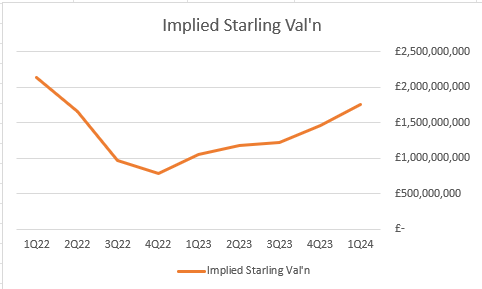

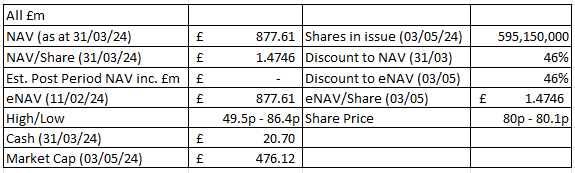

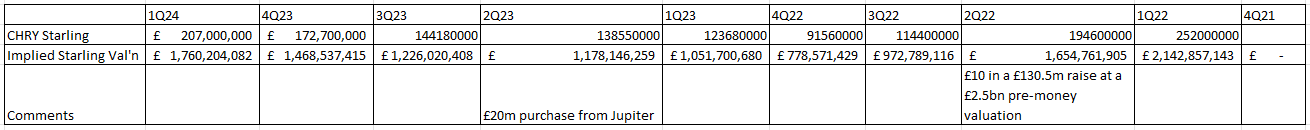

Starling had a valuation of £1.2bn at CHRY’s year end. This is based on the fact that Starling has 1,168,399,160 shares in issue. Chrysalis hold 137,414,836 shares owned: That’s 11.76% of shares. 11.76% ownership was valued at £141,696,000 at CHRY’s last year end (Sep 2023).

But since then its Q1 2024 update valued Starling at £207m. This puts Starling at a £1.76bn valuation overall.

The Financial Times recently suggested CHRY is targeting a £10bn valuation - though they leave the “how” bit out of their analysis.

Oak Bloke Valuation

Compared to its former up to £2.5bn valuation* in 1Q2022, Starling now has 50% more deposits, lending, and PBT is nearly 10X higher!

I tracked the valuation of Starling and using the 11.76% ownership* arrived at an implied valuation. 1Q22 is probably at or close to a £2.5bn valuation.

The fact that today Starling is 30% less valuable than 2 years ago feels inherently wrong. Also in relation to the oft quoted (in the press) that Monzo is £4.1bn so Starling should be too. So let’s compare.

Starling has much lower impairments (£160m), lower personnel cost, and a 2.5% higher Net Interest Margin. But Monzo has grown fee and commissions by 50% y-o-y and interest income by 340%, while Starling’s growth was only 6% and 70% comparably. Still impressive, but Monzo gets the growth award. Profits moved by a £125m delta vs £78m at Starling. And that’s why it has a higher £4.1bn valuation vs £1.76bn, probably. Yet if we compare those deltas and say £4.1bn/£125 and times £78m we arrive at £2.56bn valuation for Starling. Note that number because I arrive at £2.6bn quite a number of ways.

Comparing Starling to Revolut is harder. There are no 2023 accounts to compare, but we know Revolut was valued at £14.5bn by Molten Ventures and yesterday revalued to £18.5bn. Revolut had £6m profit, and 40m customers. We know it has 30m customers, compared to 4.2m at Starling. Pro rata £2.6bn is a comparable valuation.

A P/E of 12 gets you to a £2.6bn valuation.

Engine Valuation:

It’s difficult to get too excited about a paltry £2.2m income for the FY2024 year.

But let’s say that is 1 month of income, and annualised in FY2025 (y/e 31/3/25) that is £26m a year. I suspect it’s not that simple. £2.2m income is probably for one-off config and project fees.

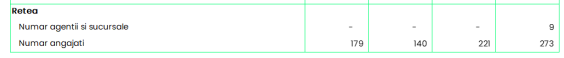

But a SaaS model would likely be a per user model. Based on the savings achieved in the non-staff unit running costs I’m going to go with £8 net margin per customer (200k) and £2225 per member of staff (179). (i.e. I’m assuming actual fees are higher but there’s running costs to consider)

For its 1st customer, which is Salt Bank in Romania there are 200K customers that we know about and Salt’s business plan is to grow to 1m in 3 years and 180 staff going to 500. That’s £2m, £5m, £12m, £20m between now and FY28. They are part of a larger parent Transylvania bank, so they have plenty of powerful backing to get there.

AMP in Australia, meanwhile, is actually a much larger customer, around 6x larger than Starling based on AuM. They speak of growing AMP to 3.5m customers over 10 years. So let’s say 350k customers a year and 200 Staff year 1, then adding 350k and 100 staff in years 2 and 3. That’s £3.3m, £6.3m, £9.3m between now and FY28.

Discounting that back at 10% I arrive to a NPV of £50m in the next 3 years so on a 20X valuation of adds £1bn (to the £2.6bn valuation).

Conclusion:

Certainly £1.76bn appears to be too cheap based on comparatives and on intrinsics; at least £2.6bn valuation today is realistic. Add to that Engine which is worth at least £1bn based on what I think are extremely conservative estimate of net income, based on just two customers. If by FY28 the footprint has grown to 8-10 customers then £10bn certainly isn’t beyond the pale.

CHRY’s £207m Starling holding at a £2.6bn valuation would be worth £98m more. Or 16.5p more than today’s NAV of £1.47/share. So a 46% discount to NAV grows to a 51% discount and Starling would cover 51.3p of the 80p price of a CHRY share.

At a £10bn valuation (and assuming no buy backs in the meantime), CHRY’s Starling holding would increase from 34.8p per CHRY share to £1.97 per CHRY share. That’s 2.5X times more than today’s share price for the whole of CHRY.

And this is for just 1 holding 20.2% of NAV and there’s 79.8% of other assets in the NAV too.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings even those held in VC stocks might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"