Dear reader,

A reader expressed dismay today at Agronomic’s relationship with its lead investor, Jim Mellon. They said:

“for the year 2023 doesn't feel integer and fair. Not only is the amount disproportional (sic) to overall cash at hand and at a time when most shareholders suffer but also it is absolute in transparent for what services the fees are charged for by Shellbay Ltd. (For what exactly 3.5million?)”

I hope in this article to answer this very valid question.

Jim Mellon owns 15.56% of ANIC. He also owns a firm called Shellbay. Shellbay reached an agreement with ANIC in 2021 (06/05/21 RNS) to provide the following services to ANIC with no fixed fee. There is a performance fee. More on that later.

· Reviewing prospective asset purchases;

· Procuring and coordinating due diligence in relation to any target approved by the Company;

· Providing appropriate information to the Board in relation to any proposed acquisition or disposal opportunity;

· Providing transaction support services as requested by the Company;

· Assisting in operating, developing and commercialising any intellectual property and/or assets of the Company (including by way of joint venture, licensing agreement or other partnership);

· Developing new markets and/or territories for assets and/or intellectual property owned by the Company (including by way of manufacturing, distribution and/or branding partnerships);

· Supplying the Board with regular reports on the progress of companies and intellectual property where the Company has an interest (including any financings); and

· Assisting with recruitment of management teams and operational supply chain partners for relevant products and intellectual property.

My first question would be what is the value of the above? Well, if Shellbay didn’t deliver this service who would? There would need to be employees. Investment Managers. But ANIC has no employees. It’s costs were £1.65m (of which AIM listing costs close to £1m). So £0.75m excluding this.

Comparing ANIC to another of my holdings, RTW a biotech investment trust, and bearing in mind that RTW has double the assets under management and is denoted in dollars but pro rated these 2 facts £6m equates to £3m comparably per year. So nearly double ANIC’s operating costs, or quadruple excluding the AIM listing.

Ah hah, however what about Shellbay that adds much more. Once you factor the £3.4m fee, that’s £4.1m vs £3m so ANIC is worse.

True, however Shellbay is performance based. It only earns when investors earn (in terms of net asset value). RTW incurs $7.5m each year regardless.

So if ANIC hadn’t increased in NAV terms then it is better value.

15% of 2.26p is 0.34p so I get 1.92p and Shellbay gets 0.34p. If NAV is static or falls I get nothing (or a loss) and Shellbay gets nothing too. It earned nothing in the latest interims (1H FY24), as NAV went from 17.11p/share to 16.9p/share, despite the net assets of ANIC rising by over £4m period to period….. why did the NAV/share fall? Because of dilution of issuing shares to Shellbay!

Or put another way the Shellbay cost for the past 18 months dropped by a third.

For FY2023 0.17p per share was paid in cash and 0.17p per share was issued as ANIC shares, so ANIC shareholders get diluted (including 15.56% shareholder Jim Mellon of course).

Jim also earns £30k fees per year as a Director.

Jim also charges £60k per year for Accounting/Admin via “Burnbrae” so £90k or about 15% of of the non-AIM £0.75 expenses are “Jim” in some form, but there are costs of time and money to take out of that £90k - that’s not a passive stream, that’s payment for services and time.

Penultimate Thought - Food Tech comparables

I sought examples better that RTW but had limited choice. I did find this Canadian firm, Cult Food Science, who are losing money, and issuing 10% of equity options per year to its management. ANIC compares favourably here in my opnion, but here’s their investor pitch if you’re interested:

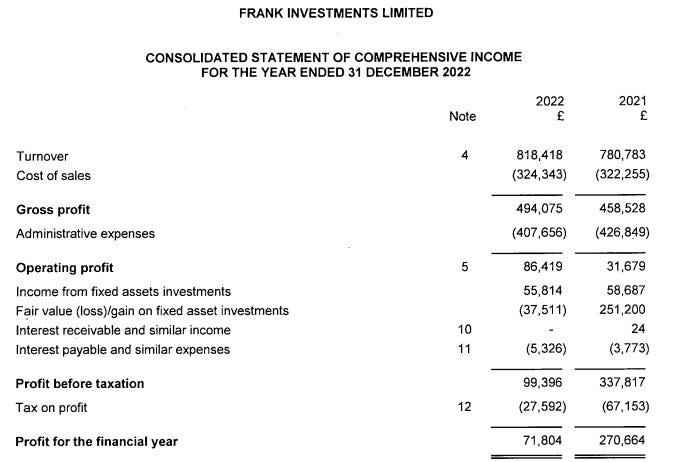

Synthesis is another option for UK private equity into Cellular Agriculture. They do not publish their fees, but appear to be aimed at high net worth individuals, and this would be private equity. So £100k minimum, perhaps? It wouldn’t be surprising if their fees were 2% and 20% but don’t quote me on that because I don’t know. Synthesis’ fund is actually Frank Investments and 90% of turnover for their last published accounts is swallowed up in cost. ANIC compares favourably here too.

CPT - CPT is another UK private equity option into Cellular Agriculture. This time small business exemption prevents us from seeing their costs but we see a modest £100k profit for their latest reporting period.

Conclusion

Having reviewed all of the options out there I conclude that I am happy with the cost structure ANIC offers. A performance based cost fee suits me and it focuses Jim Mellon and his various resources to deliver growth to NAV which will drive growth in share price.

Shellbay deliver success and keep 15%, and I get to keep 85% of the same success seems fair. Shellbay don’t perform then they’ve not cost me a penny. Their risk, and my joint loss from an investment perspective. Our gains and losses are aligned.

To revisit the reader’s comment, the arrangement actually feels fair but not sure what “feeling integer” means so won’t comment to that or their “suffering”.

Clearly Jim is flexible about the timing of the cash (the FY23 cash was owing and paid post period), and some dilution and some cash is fine with me. Having reviewed the arrangement it is transparent and demonstrably reasonable, if not good value, compared to and relative to the funds under management, especially as the cost is nil is success does not follow.

I feel happier having examined the arrangement, but disagree with comments from shareholders who perhaps are basing their view on the superficial analysis made by the likes of Stockopedia that there is an unfair arrangement in place. Relatively, the arrangement is more than fair in my opinion.

This is not advice. Advice usually costs, but only sometimes from Shellbay!

Oak

Something that may be worth highlighting when writing up companies is how liquid their shares are. For example, ANIC had less than 10 trades last week. Whilst we wouldn't invest into most AIM stocks expecting high liquidity, this one is highly illiquid and probably worth mentioning. Some of the shares you discuss (such as DEC, TEK) have a lot more liquidity with hundreds of trades per day.

Integer … possibly a new derivative of the noun “integrity” ? Just a wild guess though!

Not invested in this one (unlike DEC and TEK) but an interesting illustration all the same. Keep up the excellent work Oak Man !