A Yu Group Plc vs Arqiva (DGI9) Smackdown

A super stock versus a stinker - but who wins? DGI9 or Yu?

Dear reader,

I was intrigued to listen to a passionate view this evening of Yu’s smart meter growth.

It made me wonder what the comparative looked like to buy DGI9 who own a 51.74% economic interest in Arqiva, which is another Smart Meter provider vs Yu.

I did look at this a year ago in “Deep Dive into Arqiva”. At the time DGI9 won hands down. But there was so much passion in the value of Yu, so let’s revisit and find out the truth.

Yu delivered £5.9m of Smart Meter revenue in 1H24. It delivered a £0.24m operating profit from that segment. On a market cap of £328.1m such an operating profit means for every £1 spent on Yu shares you enjoy 0.07p a operating profit per 6 months. After 7 years of such earnings you’d earn 1p operating profit on your £1 at current profit levels - less tax. Exciting? Or pedestrian?

Arqiva on the other hand. This is 51.75% owned by DGI9. The market cap of DGI9 is £164.4m. The below results are full year to June 2024 so I halved the numbers to give a comparable. I deducted the operations, technology and corporate costs pro rata to the EBITDA of the two businesss segments.

It might shock you to learn that via Arqiva you earn 5.7p operating income per 6 months via £1 of DGI9 you buy. 78X as much.

Growth

Smart Meters revenue 12 months prior at Yu were £5.56m. So that’s 6.3% growth.

Arqiva’s Smart Meter business recorded 5% growth. A bit less - but not much less.

What of the future?

Why is Arqiva 78X better than Yu?

Arqiva delivers the comms as well as the meter so has a value add that Yu doesn’t have. It is one of two communication service providers in the UK.

It has 5m smart meters vs 0.072m that Yu has, and it is targetting 10m more in Ofwat’s next phase. Yu only deal in smart gas/electricity meters, and installed 9,000 meters in 1H24 and aims for 16k in 2H24. 9,000 was 125% more than 12 months ago.

Arqiva generates revenues with respect to the build and operation of the smart ‘machine-to-machine’ networks and other data transmission services applications. With a continuing focus on innovation and market opportunities, Arqiva is embracing the fast-developing machine-to-machine sector, particularly for utilities, using our Flexnet network solution across our smart metering contracts. The Group has invested in building machine-to-machine networks, which support major energy metering contracts spanning 15 years and covering more than 10 million premises. Over 3.5 million have already been installed by Arqiva through the Communications Service Provider (North) contract with the DCC. Arqiva has invested substantially in infrastructure to support these contracts, which now results in recurring cash flows during the long-term operational phases of the network delivery. The utilities business remains a key part of the Arqiva business.

It is a strategic priority for growth due to the forthcoming Ofwat investment determinations. Arqiva’s SUN function has the potential to become the UK’s leading smart utilities network provider. In this area we are supporting our customers in being able to achieve their net zero carbon sustainability agendas including in the water market. The UK has seen the adoption of Advanced Metering Infrastructure (“AMI”) by major water companies due to regulatory and societal pressures on reducing customer-end leakage and domestic consumption. Arqiva has a significant proportion of the addressable AMI market, having already installed over 2.3 million AMI meters for Thames Water, Anglian Water and Northumbrian Water. The Group is the market leading provider of AMI metering networks at scale. The Group also offers satellite data communications for electricity distribution networks. The SUN products have an order book of £0.7bn (2023: £0.7bn), with contracts running as far as 2050. The Water industry is actively running multiple RFP processes for smart metering investment programmes, for the next 5 year-AMP3 8 period. Arqiva is actively participating in multiple bids with a view to increasing its market share of smart water metering.

When we consider Yu’s wider supply of electricity, gas and water to SMEs and corporates its earnings equal that of Arqiva’s Smart Utility business. 5.5p per year operating profit.

But unfortunately, we then need to consider Arqiva’s Media and Broadcasting business also and DGI9’s 51.75% interest in 6 months delivers £111.1m operating profit. That’s 35p operating profit - 7X as much.

-

What about Debt?

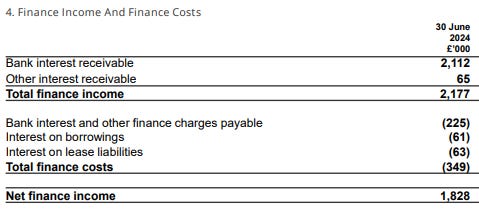

You might have got me on that one. After all Yu spends £0.35m on finance costs.

At first glance Arqiva spent £926m in interest payments in FY24! Eh? Well you have to consider the shareholder loan note is a debt owed to the equity owners so isn’t a real debt. It’s a debt to the owners. Halving the total net of this, for 6 months comparison the net finance costs are much less.

A half year of interest costs equate to -£71.45m. Much higher than Yu, it’s true. But we see P/FCF at Arqiva is twice as good and even deducting finance costs. So Arqiva delivers nearly as much cash to its owners as Yu. Arqiva would benefit from refinancing and gaining lower interest rates (currently its debt is 6.24%-7.21% fixed rate interest) and also suffers from an adverse swaps instrument which expires April 2027.

Does DGI9 just own Arqiva?

No.

But for today’s article I’m not even considering that DGI9 also own 100% of Elio, of Aqua Comms, of SeaEdge, the data centre used by Stellium and is selling EMIC-1 for £32.5m. Those assets and its cash at their very very least equal the remaining debts that DGI9 have. My estimates of assets less liabilities exceeds “at least equal” by £130m plus assumes the £52.7m written off for Verne doesn’t get reversed. So over £180m of wriggle room to that statement.

-

Here’s another thought. Can you compare Yu with Arqiva anyway? Smart Meters measure inputs of energy or water.

But what if it’s not just about measuring the inputs? What about the sniff sniff…. outputs? Oh poo, says Yu. Water companies have been in deep, err, trouble of late.

How much money could there be in providing meaningful insights to Arqiva’s water utility customers, helping resolve the political hot potato sewerage problem? It’s not just the fines you see, despite those averaging about £300m per year in the UK. It’s also that customers bills get reduced as a further punishment. Will the new government dream up further punishments for the - in their words - “greedy” water companies?

Solving sewerage is a multi billion £ problem. And opportunity. In 2022, a UK government-led taskforce estimated that eliminating storm overflows could cost the UK between £350 billion and £600 billion.

What would be the value of Arqiva’s new product that measures sewerage?

It’s not zero.

Conclusion

Sorry I can’t get excited about Yu’s Smart Meter business.

I probably should be excited about Yu. It’s an AIM success. It’s a 9.5X bagger since 2022 and appears to be firing on all cylinders. Yu pays a dividend of 3.3%, has strong PEG of 1. A P/E of 9.2X. It appears destined for greatness.

But not due to its Smart Meters business. The true excitement is growth of its utility (energy) supply business, it would appear. The market headroom for Yu of taking market share from the Big 6 and the utility new contenders is there as pictured. The opportunity and growth in Yu’s Smart Meters business is far less clear.

Arqiva meanwhile has an opportunity to meter both the inputs and the outputs, and to deliver the comms of those inputs and outputs. To also deliver such solutions to the burgeoning Internet-of-Things (IoT) market too. And a global media business as well as the long-term delivery of pretty much all of the UK’s TV and Radio.

There is a very limited intersection between what both businesses do; but where they do intersect, Arqiva is by far the dominant player and has far more exciting forward prospects, at a much lower price via DGI9.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

In general, Micro cap and Nano cap holdings including those held in an Investment Trust might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

YU Group is a classic owner driven business with the CEO controlling over 50% of the equity. This is reflected in superior execution capabilities, tight cost control and a very well managed balance sheet for a high growth business. (Interim results announced in September showed 60% revenue increase, £86.8m net cash on balance sheet and 52% eps growth with contracted revenue for the year ahead up 58%) Worth noting that YU have increased engineers on Smart meters from 25 at H1 23 to over 100 at H2 24. Analysts forecasts may prove too conservative with trading update and capital markets day on 21st January. DGI9 is down 37% and YU Group up 46% over last 12 months I will continue to back the management owned business over the fund owned business

YU have a five year commodity trading arrangement with Shell Energy enabling the Group to purchase electricity and gas on forward commodity markets. The trading agreement enables

forecasted customer demand to be hedged in accordance with an agreed risk mandate. YU run a capital light model but unlike a broker with an element of risk.