Active Ops - AOM considered

Will this see special forces to its price?

Dear reader,

I see Active Ops were presenting at Mello so assuming you were in yesterday’s audience you can school me on what I’ve missed in this article :)

There are many workforce management, case management, and HRM (Human Resources Management) software platforms out there and some large players and smaller players.

ActiveOps (AOM) sits as a niche player and a dwarf in a field of giants. Its niche is banking and insurance as well as the business process outsourcers (BPOs) who support these sectors. Despite their Military Sounding name they are not used by any Special Forces - to my knowledge - and shh I couldn’t say even if they were. Mum’s the word, eh?

In the world of reviews G2 rates AOM quite far below many other products. I’ve added an OB next to the AOM symbol for greater clarity.

Yet its reviews at G2, while few, rave about its products. Easy, intuitive, enhances efficiency. In fact some customers contract with AOM on the basis that they will get £X saving or X% saving. This is a small part of customer orders - but fair play - I like brave ballsy companies that walk the walk and don’t just talk the talk. Save money or your money back - Victor Kiam style. More on that later.

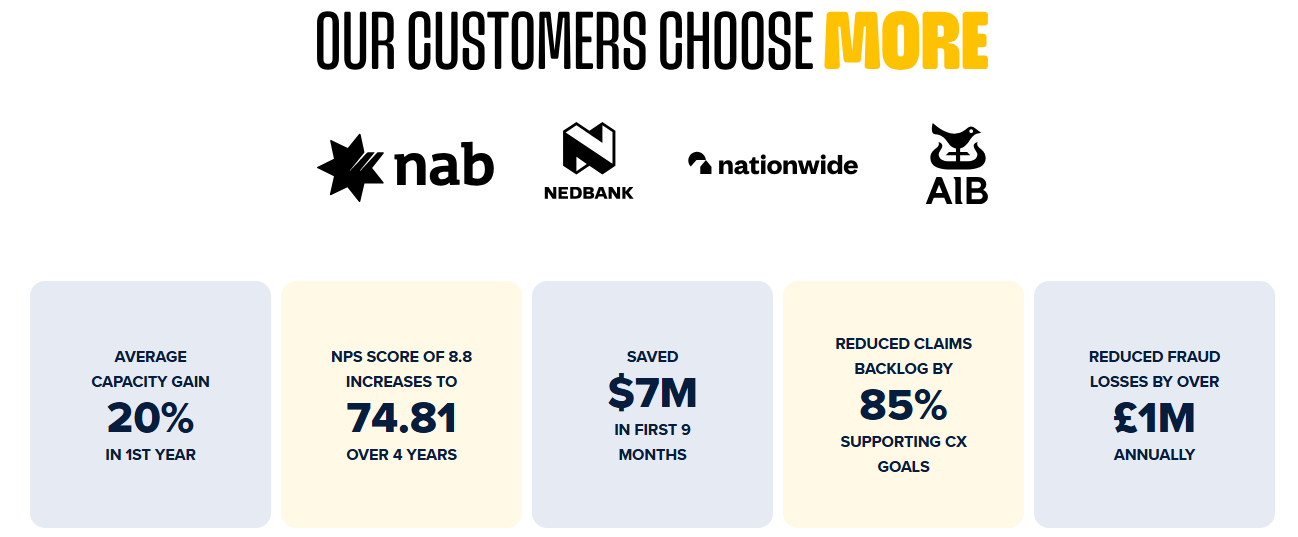

AOM is used by some banks you’ll have heard of and maybe some you haven’t - Nedbank is a large Southern Africa bank for example.

Its customers include some of the world’s largest organisations in banking, insurance and BPO, who recognise the strategic and regulatory value of a consistent operations management solution deployed across the whole enterprise.

A view of AOM software:

“Wow this will save us so much time. It looked good and was so user friendly”

“We set ourselves a target of 12% productivity again which we successfully achieved”.

It would seem Atlanta are below average since AOM tell us in their FY24 Annual Report the average capacity gain is 20%. Is a capacity gain a productivity gain? Hmm. Yes if you actually utilise that capacity would be the answer.

Clearly retention is excellent and the product reviews I read were universally positive. But only 13 reviews. Competitors like Deputy have hundreds and Rippling thousands of reviews. Of course banks, insurers and BPOs will tend to not want publicity so perhaps the lack of reviews isn’t a negative.

Also if you have large customers with large needs you don’t necessarily need a large volume of customers. In its 2024 report AOM had 74 customers and 121,198 users as a case in point.

Following the expansion of the Group’s R&D capabilities in prior years, the Group continues to focus on the development of advanced AI-based product features within ControliQ and CaseWorkiQ. The Group capitalised internal labour of £1.3m (2023: £0.9m).

Competitors are out-spending AOM by 100X. Verint for example. £1.3m vs $149m. Recruiting talent for AI is not a cheap endeavour and with a Dev Team of perhaps 6 people for that money covering 3 products and new versions and features, I’m struggling to see that the software can keep pace with the market. I mean this is real David & Goliath stuff. But David was a dab hand with picking out a sharp stone and it is all in the wrist. Perhaps plucky AOM can succeed despite the odds. AI driven forecasting, planning and service level management tools, and in late 2024 automatic skill cataloguing and a virtual coach that predicts the interventions required by team leaders and recommends the best course of action to make.

AoM describes its software as SaaS although the truth is that it is actually on premise software which can be privately hosted so although this can be presented as “SaaS” it is not “true cloud”…. and generally this is referred to as “legacy software” and Microsoft have been introducing 10%-20% price rises on Windows Server products per annum - and did so in 2025 after increasing prices by the same last year.

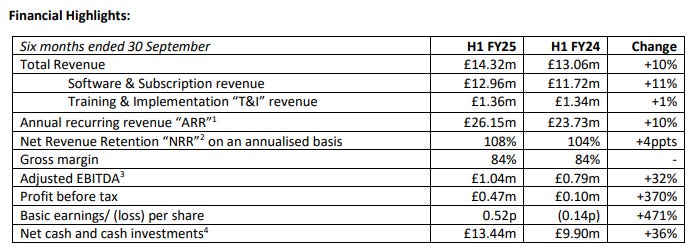

But its gross margins are certainly attractive at 84% but the net margin was only 0.9% in 2024. The question is can that grow? The Trading Update offers hope:

Strong ARR growth of 19.3% is great but that implies a fall in Training and Implementation. This would suggest a real slow down year to year.

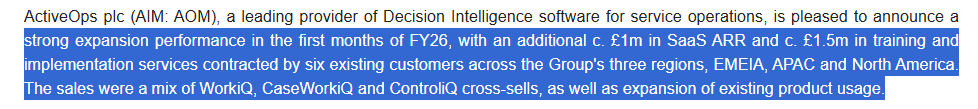

But that is not the case according to the full year trading update (24th April). SaaS growth on a constant currency basis is 14% year on year. What’s more is that customers rise from 73 to 82 - and these, we are told, are big customers. All due to be live by the end of June 2025.

This is reaffirmed on 13th May.

There’s no explanation for the sharp drop in T&I despite the tripling of customers year to year except to think presumably AOM have dropped their pants on price (done training for free or at a reduced rate) and if so we’ll see that in the results. Or being optimistic perhaps the software is now easier to implement today than it was in years gone by.

Remember their accounting rules are that you only recognise SaaS revenue once the customer live. It says that here - get them live to get ‘em paying….. the “single performance obligation”. So dropping pants can be a prudent move.

Post Period we learn some extremely positive news. £1.5m T&I in 6 weeks nearly equals 12 months! An additional £1m ARR equates to a run rate of £8.67m growth if they can keep up that pace!

Moving to the world of Stocko they say in the latest review of AOM that it “often seemed to be overvalued and in P/E terms that remains the case today. However, net cash of c. £21m covers about a quarter of the market cap.”

Well valuing a growth stock on a historical P/E (especially an inaccurate one) isn’t going to help you make a buying decision. By the time its P/E has fallen then the price has gone up! It’s like Schrodinger’s cat.

Moreover the comment on net cash is not accurate either. We don’t know the precise number yet (it’s not been disclosed) but it’s likely to be at least -£14.4m of contract liabilities (as it was at 31/3/24) which means (in plain English) probably 2/3rds of that cash relates to a future period. To assess the business properly it would be wiser to match the cash net of its future contract liabilities. In other words you’ve probably only actually got about £5.2m of net cash plus £15.5m of up-front cash from which you must deliver a service.

The P/E according to Stocko is 42.8. Is that accurate? No. Based on the latest numbers in 1H25 of 0.49p (x2 = 0.98p) and today’s share price of £1.225 the P/E is actually 125X!

This stock is one of Mr Hill’s ideas for 2025 in the Fun Run. I must admit I really like it. Despite there being Goliaths that should scare me off. The bit I’m struggling with is the 125X. Mr Hill believes its fair value is 154p based on 3.5X EV/Revenue.

I’m not sure I buy the “tighter regulation” line, nor even “the challenges of hybrid working” but I 100% buy in to the value of:

Staff Productivity via Automation (vs the nightmare of managing calendars and tasks in Excel and Outlook, or an ill-adapted ERP system)

Planning, Dashboards, Reporting and insights

SLA Adherence for case management

I suspect the “AI” is not as high tech as all that (it can’t be for that titchy budget) but “intelligently-written” parameters and application of business logic based on 15 years of experience combined with a nice-looking interface and with a deep focus on specific verticals can make it appear as intelligent as AIs where $100s of millions are being thrown at the problem.

Valuation

I can’t value a share using 3.5X EV/Revenue. That is meaningless to me. My brain aches to see the word profit with its best mate CASH. So I’m going to extrapolate what I see as a FY26 projection of the P&L and then I’m going to take a P/E + 1 year ahead (FY2027). Sound fair? Well you make your own investment decision but I’m not going to make mine based on a ratio of EV to Revenue.

Based on what I think are some fairly conservative numbers - that SaaS growth will be slower than FY25 - £32.5m is 14.4% growth. £1.5m T&I is already nailed on so I’m assuming £2.5m more. I’m assuming the cost of sale rises quite a bit due to pesky Microsoft licence costs and hosting. Also trainers get a chunky pay rise taking cost of sale to 44% of T&I revenue.

I’m assuming a chunky £4m Admin increase due to the headcount they told us about 6 Senior Sales people plus 1 Director; plus a pay rise for the 174 people - who cost £88k per person on average including NI, Pension etc. I think that’s reasonable.

Amortisation rises by 10% I assume. So none of that seems unreasonable to me. With all of those assumptions you get to a P/E of 58X from 123X in FY2026.

If I use the SaaS revenue growth rate from FY25 which was 19.3% not 14.4% then the P/E collapses far faster in FY2026.

If we can assume the same 19.3% growth for FY2027 then you get to 13X. At that level this is worth at LEAST double today’s £1.22 share price.

FY27 is 9 months away, and the end of FY27 is 21 months.

Recently the share price was just 80p and now 122p. Can it fall back again? I kick myself for not looking at this sooner. It’s sat (along with other ideas) in my OB Draft Articles for months… the rubbish G2 score put me off. Just shows don’t write things off just because of one negative.

Conclusion

Will you be like Victor Kiam? Will you be the person who bought the company? Well part of it - just some shares in AOM, more likely. Well get to 29.9% then make a bid, but be warned getting 100% of them could be a close shave.

If AOM can grow at the same speed for the next 2 years with reasonable cost control then AOM will be Going For IT! That’s what the numbers say.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Fascinating how you valued it. Of course, there is a decent chance of it being acquired which is bitter-sweet.