Ain't gittin 'n no plane you f-UUUU-l

Energy Fuels ain't for fools - and it's Idea #17 of the OB 25 for 25

Dear reader,

My Accidental Uranium Play: A Deep Dive into Energy Fuels (UUUU)

I stumbled upon Energy Fuels (UUUU) in a rather serendipitous way. It wasn't a deliberate investment, at least not at first. Instead it was a byproduct of a special dividend from another holding, Base Resources (as covered in the article “U308 leads to UUUU”) was bought by UUUU. I delved deeper into UUUU and realised its potential.

Oliver Stone helps me explain why:

At the time of writing, UUUU is trading at $5.97. I've recently increased my position, and here's why:

The Uranium Renaissance: A Tale of Two Eras

Uranium, a naturally occurring radioactive element, has a rich history. Discovered in the late 18th century, it was initially used to colour ceramics and glass. However, its true potential was realised in the 20th century, first for atomic weapons but later for nuclear power.

The first era of uranium mining was driven by the demand for radium, a byproduct of uranium decay, for medical treatments. Later, uranium was mined for vanadium (both often occur together), which was a critical component in steel production and weapons in World War One for tanks and battleships. The second era, beginning in the 1940s, saw a surge in uranium demand due to its use in nuclear weapons and power generation.

Today, nuclear power provides a significant portion of the world's low-carbon electricity, and demand for uranium is on the rise. As the world shifts towards cleaner energy sources, uranium is increasingly seen as a critical component of the energy mix.

The first commercial nuclear power plant in the U.S. was built in Pennsylvania, reaching full operation by 1957. Nuclear energy is also used to power nuclear submarines and aircraft carriers, with the first model becoming operational in 1958. Today, the U.S. boasts 96 commercially operating nuclear power units, followed by 58 in France, 47 in China, and 36 in Russia. Today, there are around 450 nuclear reactors operating across the globe, providing about 11% of the world’s electricity.

Since the 1950’s, major uranium deposits have been found – and mined – all over the U.S., primarily in the states of Wyoming, Texas, Utah, Arizona, New Mexico, and Colorado. The U.S. was a leader in uranium mining until the 1980’s, which also made the US a leader in the peaceful use of nuclear energy and non-proliferation. Since that time however, while the US continues to be a leader in the production of nuclear energy, it has significantly reduced uranium mining and nuclear fuel production.

Today, the U.S. is hugely dependent on imports of uranium and nuclear fuel. Until recently, most of these imports came from allies, like Canada and Australia. However, as allied production has dropped in recent years, the U.S. is seeing increases of uranium imports from geopolitical competitors, like Russia and China.

Energy Fuels: A Leading US Uranium Producer with a Diversified Future

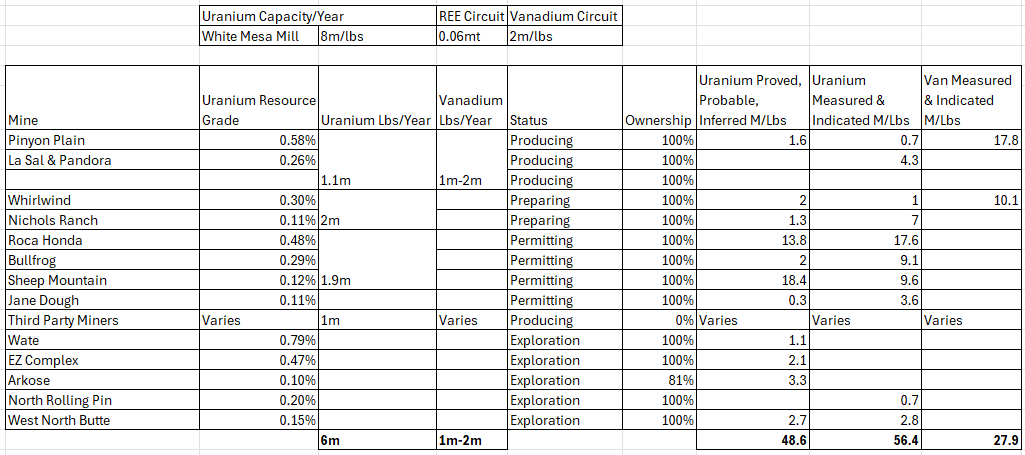

Energy Fuels is uniquely positioned as a leading US uranium producer. It owns and operates several uranium mines and processing facilities, giving it a strong foothold in the industry. The company is not only focused on uranium but is also a vanadium miner and miller, plus is expanding into the production of rare earth elements (REEs) and heavy mineral sands (HMS).

Why I'm Bullish on UUUU: A Deep Dive into the Investment Thesis

I'm bullish on UUUU for four reasons:

Strong Fundamentals: The company has a solid financial position, a strong balance sheet, and is well-managed. $183m of working capital as at 30/09/24.

Growing Demand for Uranium: As the world transitions to cleaner energy sources, demand for uranium is expected to increase. This is driven by several factors, including the retirement of aging nuclear power plants, the construction of new nuclear reactors, and the increasing focus on nuclear power as a reliable and low-carbon energy source. But more than this, the USA is reliant on other countries to mill and refine uranium ore EXCEPT for UUUU.

Three businesses in one. Heavy Mineral Sands, Rare Earth and Uranium with lots of synergies between these three areas of critical minerals. These minerals are of great geopolitical importance and dominated by China and Russia. Minerals that are essential for various industries, including defence, technology and renewable energy. Energy Fuels has diversified revenue streams and also is the only US mill with a circuit for Uranium, another for Vanadium, and boasts a circuit for REEs as well.

Inside the HMS sands is Rare Earth Element (REE) ore, and inside this ore is uranium. UUUU have worked out how to extract this. No one else in the world does this.

Strategic Acquisitions: Acquisitions and JVs across three HMS projects, has significantly enhanced Energy Fuels' global footprint and resource base - including its Uranium resource base. Its leading HMS project was via the acquisition of Base Resources which brings a highly-skilled and successful HMS mining team along with a world-class heavy mineral sands project in Madagascar, which will produce valuable minerals such as titanium, zirconium, and rare earth elements. But more than this the uranium contained within HMS is recoverable by UUUU as well - at a much lower processing cost than ISR or hard rock mining.

While there are always risks associated with any investment, I believe that Energy Fuels is a compelling opportunity for long-term investors. Its strong fundamentals, strategic focus, and exposure to critical minerals make it a promising play in the energy and materials sector.

Current Day Demand

While the U.S. enjoys abundant uranium resources – the U.S. Geological Survey estimates well over 1 billion pounds – the U.S. only produced about 1.5 million pounds of uranium in 2018, less than 3% of what its nuclear power plants require - let alone the needs of its allies. In addition, the uranium used in nuclear-powered submarines and aircraft carriers, and for national defence, must be produced in the U.S.

This dependence is why Energy Fuels has led recent efforts intended to increase the value of US uranium mining. UUUU is ramping up uranium production, and is expecting to more than double its production rate to 1.1-1.4 million pounds of U3O8 per year by late 2024. Meanwhile the company aims to produce 500,000 pounds in 2024.

It doesn’t stop there. It is preparing the Nichols Ranch ISR Project in Wyoming and the Whirlwind Mine in Colorado for production, which could increase production to two million pounds per year by 2026. ISR or in-situ recovery involves pumping in a leaching agent to the ground to dissolve the uranium. The solution is pumped via Recovery wells to the surface for processing.

The IAEA also tells us that planned nuclear stations will increase that demand by between around 12%-40% by 2030 and anywhere between 29%-250% by 2050. Which translates to world demand of 75,000-93,000 tonnes a year by 2030 and anywhere between 86,000-167,000 tonnes a year of Uranium by 2050.

Heavy Mineral Sands

TOLIARA

Toliara is fully permitted and awaits a FID which will take 12 months. 18-24 months construction suggests production from 2028. The “bolt on” PFS concerning monazite production for the Toliara project is very exciting and evaluated the possibility of recovering the monazite waste stream of the planned Toliara project.

The key findings were:

•21.8 ktpa LOM avg 90% monazite production over a 38-year life.

•59% TREO grade

•24.5% Magnet REO:TREO (Nd/Pr & Dy/Tb) ratio.

•35% payability for magnet REOs only.

•Operating costs of US$1,089/t monazite.

•Marginal US$71m capex.

•NPV10 of US$999m

An IRR of 79% (based on 2027-30 avg monazite price ~US$6,400/t).

-

This would generate about $300m-$400m FCF for 38 years.

-

When combined with the existing Toliara mineral sands project, the monazite component doubled the NPV10 valuation to ~US$2bn, increases the overall IRR to 32% (from 24%) based on an initial capex of $610m (HMS)+$71m (Monazite)

During 3Q24 the "Phase 1" REE Separation Circuit at White Mesa was Successfully Commissioned resulting in the production of approximately 38 tonnes of 'on-spec' separated NdPr. (10% above the 25-35 tonne range of expectations)

Samples of NdPr Actively Being Qualified by Potential Customers: NdPr produced at the Mill is currently being qualified with permanent magnet manufacturers and other potential customers to set the stage for a potential offtake in the future.

But there’s uranium in dem der sands!

*-I speak more about 3,190ppm uranium later on…. 0.32% Uranium, got it?

Other Heavy Mineral Sands Projects:

#2 Donald Project Joint Venture: Entered a joint venture with Astron Corporation Limited to develop the Donald Project in Australia, expected to provide a large-scale source of monazite sand for REE production.

During 3Q24 UUUU continued to advance the Donald Project (the "Donald Project"), a large monazite-rich HMS project in Australia, pursuant to its joint venture with Astron Corporation limited, announced in Q2-2024. The Company expects that a final investment decision ("FID") will be made on the Donald Project as early as 2025.

#3 Bahia is an earlier stage project where the resource needs to be defined.

During Q3-2024, the Company also continued to advance its wholly owned Bahia HMS project in Brazil (the "Bahia Project") with its Phase 2 drilling campaign, which is expected to continue through the rest of the year. Additionally, the Company completed bulk test work on a 2.5 tonne sample in March 2024, and recently shipped a larger 15 tonne sample to the U.S. for additional process test work expecting to announce a compliant mineral resource estimate on the Bahia Project during 2024.

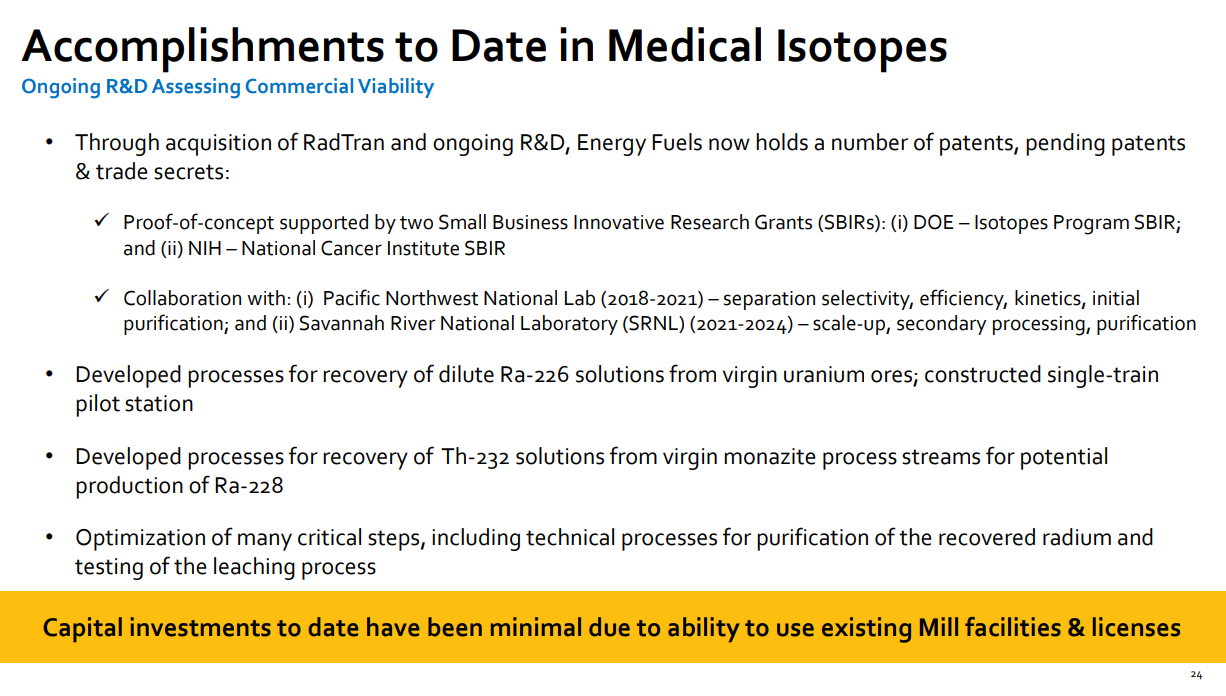

Medical Isotopes Initiative:

R&D License: Received a research and development license for the recovery of Ra-226 at the White Mesa Mill, intended for use in targeted alpha therapy cancer treatments.

On August 19, 2024, the Company announced it acquired RadTran LLC ("RadTran"), a private company specialising in the separation of critical radioisotopes, to further the Company's plans for development and production of medical isotopes used in cancer treatments. RadTran's expertise includes separation of radium-226 ("Ra-226") and radium-228 ("Ra-228") from uranium and thorium process streams. This acquisition is expected to significantly enhance Energy Fuels' planned capabilities to address the global shortage of these essential isotopes used in emerging targeted alpha therapies ("TAT") for cancer treatment.

The Company continues to utilise its research and development ("R&D") licence for the recovery of R&D quantities of Ra-226 at the Mill. Activities to set up the pilot facility at the Mill continued in 3Q24 and are expected to progress through the end of the year, with the goal of producing R&D quantities of Ra-226 for testing by end-users of the product by early 2025.

Financial Position

Robust Balance Sheet with Over $180 million of Liquidity and No Debt: As of September 30, 2024, the Company had $183.16 million of working capital including $47.46 million of cash and cash equivalents, $101.15 million of marketable securities (interest-bearing securities and uranium stocks), $35.91 million of inventory, and no debt.

Over $10 Million of Additional Liquidity from Market Value of Inventory: At October 28, 2024 commodity prices, the Company's product inventory has a market value of approximately $23.79 million, while the balance sheet reflects product inventory carried at cost of $13.38 million.

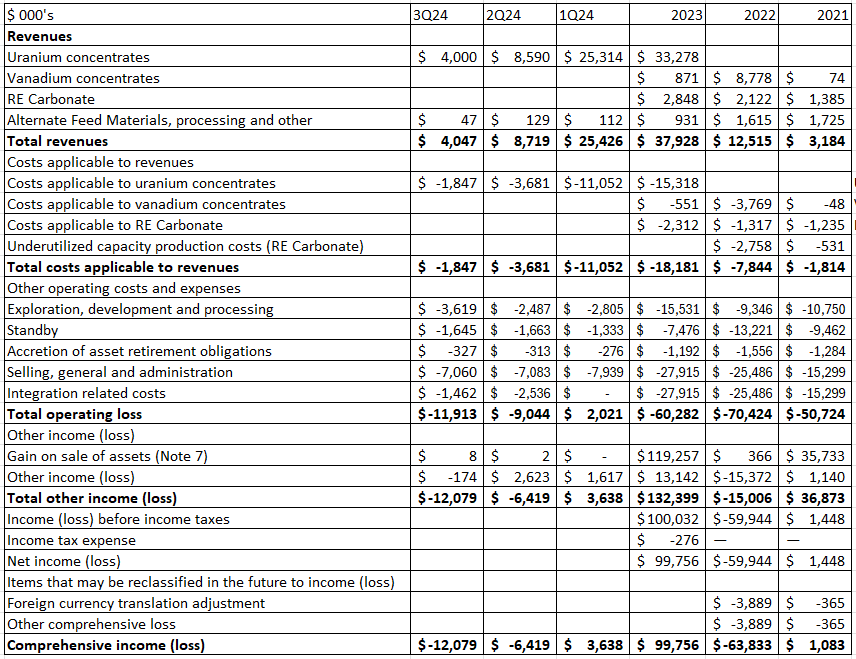

Incurred Net Loss of $12 Million: During the three months ended September 30, 2024, the Company incurred a net loss of $12.08 million, or $0.07 per common share, primarily due to transaction and integrations costs related to the Donald Project joint venture, the acquisition of Base Resources and recurring operating expenses, partially offset by sales of natural uranium concentrates ("U3O8").

New Long-Term Uranium Sales Contract with U.S. Utility: The Company added a fourth long-term uranium sales contract to its existing portfolio. Under the contract, the Company expects to deliver a total of 270,000 to 330,000 pounds of uranium between 2026 and 2027, and potentially an additional 180,000 to 220,000 pounds until 2029, under a "hybrid" pricing formula, subject to floor and ceiling prices, that maintains exposure to further uranium market upside and protection from inflation.

Well-Stocked to Capture Market Opportunities: As of September 30, 2024, the Company held 235,000 pounds of finished U3O8 and 805,000 pounds of U3O8 in ore and raw materials and work-in-progress inventory for a total of 1,040,000 pounds of U3O8 in inventory. This inventory increased from last quarter due to Pinyon Plain, La Sal and Pandora mine ore production and additional alternate feed materials received, partially offset by our spot sale during Q3-2024. The Company expects these uranium inventories to continue increasing as we continue to mine additional ore. The Company also held 905,000 pounds of finished vanadium ("V2O5"), 38 tonnes of finished separated neodymium praseodymium ("NdPr") and 9 tonnes of finished high purity, partially separated mixed rare earth carbonate ("RE Carbonate") in inventory.

Capitalising on Strong Uranium Pricing:

Due to uranium market tailwinds and upcoming commitments in long-term contracts with U.S. nuclear utilities, the Company is currently mining and stockpiling uranium ore from its Pinyon Plain, La Sal and Pandora mines and plans to ramp up to a production run-rate of approximately 1.1 to 1.4 million pounds of U3O8 per year by late-2024.

The Company expects to produce a total of 150,000 to 200,000 pounds of finished U3O8 during 2024 from stockpiled alternate feed materials and newly mined ore, which is at the lower end of our previous guidance of 150,000 to 500,000 pounds of finished U3O8 during 2024, due to delays in transporting ore from the Pinyon Plain mine to the White Mesa Mill, which is expected to be resolved in 4Q24. Mining continues at the Pinyon Plain mine, with mined ore being stockpiled at the mine site, containing approximately 180,000 pounds of U3O8 at September 30, 2024, which is expected to be processed at the Mill later in 2024 or in early 2025.

During 3Q24, the Company received positive results from drill holes during ongoing preparations at its Nichols Ranch in situ recovery ("ISR") Project in Wyoming. Both the Nichols Ranch Project and Whirlwind Mine in Colorado are being prepared for production and are within one year of a "go" decision, as market conditions warrant. Production from these mines, when combined with alternate feed materials, uranium from monazite, and 3rd party uranium ore purchases, would be expected to increase the Company's production run-rate to roughly two million pounds per year by as early as 2026.

The Company continued advancing permitting and other pre-development activities on its large-scale Roca Honda, and Bullfrog uranium projects in 3Q24, which together with its Sheep Mountain Project, have the potential to expand the Company's uranium production to a run-rate of up to five million pounds of U3O8 per year in the coming years.

As of October 28, 2024, the spot price of U3O8 was $81.00 per pound and the long-term price of U3O8 was $82.00 per pound, according to data from TradeTech.

Vanadium Highlights:

The Company chose not to execute any vanadium sales during Q3-2024 and holds about 905,000 pounds of V2O5 in inventory.

As of October 28, 2024, the spot price of V2O5 was $5.25 per pound, according to data from Fastmarkets.

Medical Isotope Highlights:

CEO Chalmers:

"During the quarter, we achieved numerous additional milestones to bring the Energy Fuels' vision to fruition for our innovative, low-cost, U.S.-centered critical mineral supply chain.”….."These developments have the potential to transform Energy Fuels into a world leader in titanium, zirconium, and rare earth elements production, while maintaining our position as a U.S. leader in uranium and vanadium production. All these materials are critical to the global energy transition and to our vision of creating a leading diversified critical minerals company."

Valuation

2021-2024 has been a time of re-organisation, development and bringing it all together.

We can see Uranium delivers a 55% gross margin, Vanadium 35%-55% and REEs about 20% historically but that was during a time of R&D.

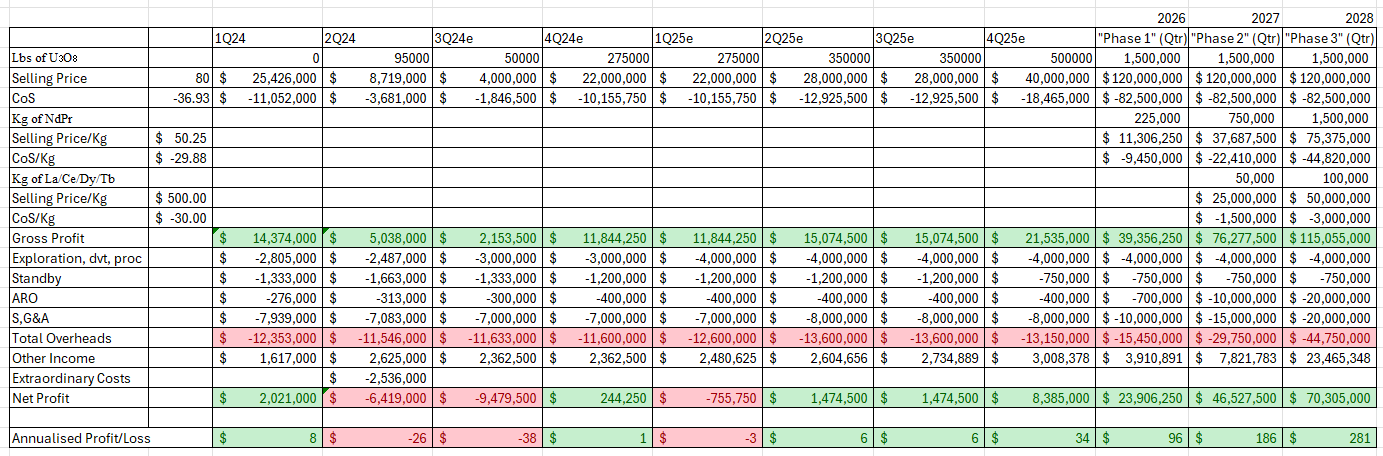

So we know UUUU can deliver profits if they sell above a certain volume and assuming mineral prices are favourable. Uranium is at a reasonable price ($80/Lb) and NdPr is forecast to increase. Vanadium is at a record low price although there are reasons to be optimistic for the future.

Based on a 1.1m Lbs scale up which grows in 2025 to 1.4m and then to 2.0m tonnes of U3O8 by 2026 even at today’s modest prices - and excluding Vanadium - $100m net profit on a $1,200m market cap puts this on a P/E of 12X, falling to 6.3X in 2027 and 4.2X in 2028.

If you factor in the possibility (likelihood) that Uranium prices will not remain at or around $80 per Lb then earnings will be higher too. $50 per Kg of NdPr is conservative too.

These numbers do not factor in any value for Radio-Isotopes, for Heavy Mineral Sands, for the Bahia project or Donald (beyond their potential to supply monazite).

It doesn’t factor in the Toliara project and its superb economics.

At 6m Lbs a year and 105 Million Lbs of proved, probable, inferred and indicated Uranium on the books at $168.4m means for every $1 invested you are effectively paying $0.088 per Lb of Uranium worth $80.00. With 28m Lbs of Vanadium thrown in for free.

But it doesn’t end there.

For each $1 invested you also getting 2.2 tonnes of Toliara’s Heavy Mineral Sands with 6.1% valuable minerals including Titanium, Zirconium, Ilmenite and Monazite.

I nearly fell off my chair when I realised I did the maths of how much Uranium UUUU could get from Toliara…… 166% of their 2026 TARGETED Uranium production (of 6m Lbs). That’s based on 2% monazite, and 0.32% of that 2% monazite is Uranium. That’s 170,000 tonnes which over 35 years is 4857 tonnes a year which is 10m Lbs a year.

Plus an as yet undefined Bahia resource. Plus 2.45 tonnes of HMS at Donald too with 3.2% minerals.

Plus a share of a radio isotopes business.

Conclusion

This idea requires quite a lot of calculation to get to its potential value.

The multiple resource types means this is a play on the growing and likely interest in Uranium in 2025, but also the critical nature of uranium refining and geopolitical restrictions imposed by China and Russia.

Of a growing market for radio-isotopes.

Of a recovery in Vanadium prices.

Of the importance of Rare Earth refining - and again geopolitical restrictions imposed by China and Russia.

Of three Heavy Mineral Sands businesses. Which are assessed as the #1 and #3 HMS projects worldwide.

This is an idea for 2025 - and beyond.

Even if Mr T thinks I’m a fool (if you read the Oak Bloke you get some nut?), I AM getting on that plane, what about UUUU?

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Interesting write up, and I tend to agree with the sentiment. In fact, I wrote about a different way to play the Uranium market a few weeks ago: https://rockandturner.substack.com/p/good-time-for-a-slice-of-yellow-cake

However, that Oliver Stone interview was awful. He rambles on, sometimes incoherently, often with erroneous facts. For example, the Fukushima disaster was primarily caused by a hydrogen issue, but it stemmed from a nuclear reactor problem. More particularly, the hydrogen explosions at the Fukushima Daiichi nuclear power plant did expose the environment to radiation and people did die from radiation exposure.

He speaks about putting nuclear waste in the ocean because, in his words, water demagnetizes it. What is he talking about?!?! This is about nuclear half-lives, not magnetic fields.

He also says that Marie Curie is the champion of nuclear power, which is arguably correct, but he neglects to say that she died early of radiation exposure.

The big issue in the US is that the oil and gas sector is powerful. It funds, and largely owns, the Republican party. It is not going to sit back and allow nuclear power to displace oil and gas. That's the elephant in the room.

However, nuclear will increase because it is the only viable solution to the climate change issue. And micro nuclear reactors are now available on site in industry which is a game changer. So Uranium demand will increase. But whether a US company is best placed to exploit that trend is questionable - especially with Trump coming to power for the next 5 years.

Yellow Cake may be a better option (link at the top of this comment).

Have a listen to the Palisades Gold Radio Podcast interview with Christopher Grove from last week, talking about REEs (UUUU discussed).