Dear reader,

This evening’s 72.8p/75p bid/ask this evening for AUGM is at an astonishing discount. The last NAV is virtually untouched from past Interest Rate carnage.

In fact its #1, #5, #7 and #10 largest holdings all recorded strong NAV growth in the results to September 2024 with disappointment from Grover and Gemini.

Share price slides but the NAV hasn’t.

Cash 20.8p a share.

Augmentum Fintech (AUGM) reported they had a £31.8m cash balance as at the end of September.

It has bought back 2m shares since period end which has added 2p to the NAV (I estimate) to £1.64. If it keeps going at today’s 77p price it would boost the NAV 13p more to £1.77 a share.

Pay 77p and get £1 of assets for free. (nearly a 60% discount)

#1 Tide 35.7p a share (55p total)

Tide already has 10% market share of all UK micro (0-9 employee) businesses, with more than 1.5m customers (up from 1m since March 2024).

It bought Funding Options in November 2022, has FCA approval providing a credit offering to customers from over 120 lenders. It also provides a series of business tools for businesses too small to have a finance person (or team). Namely to provide card payments, direct debits, card readers, invoicing, accounts, or if your business needs are a bit more complex then out of the box integration to small business accounts (Sage Business Cloud Accounting, QB, Xero, and others). All the functionality is done from within a single app. It has just bought Onfolk a UK Payroll app which will be rolled into that single app. To what extent is this a bank and to what extent is this a SaaS business? Very different valuation approaches.

2023 saw Tide launch in Delhi and Mumbai, India and in its last announcement it now has more than 500,000 customers (up from 225,000 in May last year!) in India (this has grown by over 100% in the past year). It is targetting a further 500,000 in the next 9 months to reach 1m Indian business customers. The market size in India is enormous. There are 63m micro businesses in India and many run by younger people where Tide is being embraced as “the way forward”.

It has also launched in Germany where there are a further 2.19m micro businesses as part of an EU expansion. So there’s plenty of runway ahead and the TAM has grown by 14 times by entering those two new geographies. It plans further European launches in 2025.

What I notice here is:

1/ A “bank” with a growing 85.2% gross margin (2022 79.4%) for what is recurring revenue.

2/ Recurring revenue is between £0 - £50 a month. Assuming a midway £25/month for 1m members (and we could further consider some of that £25 is bank charges) gets you to £300m revenue; £255m gross profit (at 85% margin).

3/ A large chunk of “Administrative” is the build out and development of services and “one off” to some extent.

4/ Even with further investment aka “Administrative” beyond the £144m cost in 2023, it’s quite hard to think that Tide remains unprofitable in 2025.

What valuation do you place on a business with a vast growth runway, that is delivering value in a way that Accounts software providers and Banks (separately) cannot? Some secondary sales placed it at $1bn in 2024.

If you consider potential for a £50m net profit in 2025 and at 30X earnings a £1.5bn ($1.95bn) valuation seems more than fair. Or turning it around, would a 15X valuation be reasonable for a business able to grow >100% at a 85% gross margin? Even 30X is arguably too low, and is a £55m further growth in administrative cost going to grow significantly too?

AUGM owns 5.1% of Tide. So the £59.7m valuation of the holding implies a £1.17bn valuation. At 30X earnings that would be £39m earnings, so a 25% upside potential.

#2 ZOPA 23.5p a share (78p total) i.e. 100% of the share price

Zopa recently hit a £5bn milestone of customer deposits. It has entered the Buy Now Pay Later space with its acquisition of DivideBuy boosting growth further. It funded that through a £220m funding round at the end of March 2025 with AUGM participiation.

It also has a strategic tieup with JohnLewis Money to offer personal loan to the 23 million John Lewis and Waitrose customers. Considering that Zopa only has 1.3m customers, this partnership is very exciting and could drive growth.

But that’s a 2nd partnership on the back of Zopa’s partnership with Octopus Energy and its 6.8m customers to offer “green energy loans”. Will we see some green energy giveaways on Hallowe’en? It will be spooky if I’m right. We know Ed Milli is strongly pushing for this. If the government steps in to support the cost of loans then clearly Zopa are going to be a large beneficiary.

Zopa’s savings products have also won multiple awards in 2024 and 2025, including:

Best Savings App, Best Fixed Rate Cash ISA Provider, and Personal Savings Provider of the Year at the Moneynet Awards 2024

Best App Based Savings Provider at MoneyComms 2024

Highly Commended for Best Savings Provider at the British Bank Awards 2024

Commended for App Only Savings Provider of the Year at the Moneyfacts Consumer Awards 2024

Zopa also reported its first full year of profitability. Launched in June 2020, the milestone makes Zopa one of the fastest digital banks in the UK to turn an annual profit.

Zopa Bank swung to a pre-tax profit of £15.8 million for the financial year ending 31 December 2023 from a pre-tax loss of £26 million for the year ending 31 December 2022. Total operating income for the same period to 31 December 2023 was £222 million, up 47.8% year-on-year.

Zopa’s customer base has grown to over 1.4 million across its newly expanded product offering. The bank’s deposit base increased to over £5.5bn; loans on balance increased 27.3% to over £3 billion.

Alongside its impressive growth, Zopa Bank maintained its 2nd best to Tide net promoter score (NPS) of 72 aided by its proprietary technology which enabled it to offer great value, straightforward experiences at speed. Zopa’s technology has also allowed it to operate efficiently as it has scaled, further driving its cost-to income ratio down to 38.7%.

Zopa’s profitability was first announced at Innovate Finance’s Global Summit and comes off the back of a strong year. Despite the challenging macroeconomic environment, Zopa Bank saw a 30% growth across its products and a 29.7% increase in total revenue to £226 million.

Zopa has recently moved to Canary Wharf doubling its office space

#3 Volt (15.1p a share) £0.93 total

During 2024 Volt obtained an electronic money institution licence from the FCA. It has also expanded operations to Australia, but also deepened its range of products to include ecommerce checkout, verification services, fraud detection and other aspects all managed within a single API making this a “developer friendly” platform.

Volt plans to replace payment rails - the oligopoly controlled by Visa/Mastercard/Amex with account-to-account payments connectivity for international merchants and payment service providers (PSPs). Using Open Banking Volt provides account-to-account payments where funds are moved directly from one bank account to another. A very disruptive fintech with enormous opportunity to disrupt the long-held status quo including with cross border payments.

Its foray into stablecoin launching a means to on/off ramp with exchanges, issuers and OTC desks - connecting the Crypto world with the real one.

I am no fan of crypto as readers possibly know, but would I sell picks and shovels to crypto fans - you bet! The interconnectivity between fiat and stablecoin meets a need.

Can’t beat ‘em?

Would the oligopoly would look to buy Volt at some point? Or would the likes of the Magnificent Seven look to buy it to “cut out” Visa/Mastercard?

Volt’s Series B funding round was 2.7x the prior valuation and provided a £11.4m uplift (6.3p a share) to AUGM. It also meant Volt has a $60m warchest too. Volt has partnerships with Pay.com, Shopify and Worldpay.

#4 Grover 11.7p (£1.05 total)

Follow on funding of EUR50m was agreed for Grover to support growth. It will “demonstrably increase profitability” say AUGM.

Grover is already at EBITDA break even:

Grover offers tech rentals and has over 500,000 customers doing exactly that. Why don’t we just rent tech? Why are only mobile phones like this? Why not other stuff? Grover is a way to rent what you need, so not to tie up cash on stuff. Grover also gives a 2nd life to stuff and refurbishes so yes you can rent the latest and greatest but also rent refurbished at a lower cost. Grover also has a rent and then buy option. So you get to try it before you buy it (at a cost).

#5 BullionVault 8.9p a share (£1.14 total)

BV has continued to thrive. Customer demand for a trusted platform that delivers low-cost access to vaulted gold and other precious metals shows little sign of slowing down, and client holdings have reached unprecedented levels of $5.2 billion, helped by record gold prices.

With their financial year closing in October, AUGM expect another record year of profitability following on from last year’s impressive numbers. While BullionVault remains a mature position in the portfolio, AUGM remains a patient holder enjoying continued growth in the bottom line and increased dividends.

#6 Gemini 5.6p a share (£1.20 total)

CNBC announced a potential IPO this year.

Gemini enables individuals and institutions to safely and securely buy, sell and store cryptocurrencies. Gemini was founded in 2014 by Cameron and Tyler Winklevoss and has been built with a security and regulation first approach. Gemini operates as a New York trust company regulated by the New York State Department of Financial Services (NYSDFS) and was the first cryptocurrency exchange and custodian to secure SOC 1 Type 2 and SOC 2 Type 2 certification.

Gemini entered the UK market in 2020 with an FCA Electronic Money Institution licence, becoming one of only ten companies to have achieved FCA Cryptoasset Firm Registration at that time.

Gemini announced acquisitions of portfolio management services company BITRIA and trading platform Omniex in January 2022. Gemini expanded into the UAE and Asia in 2023, and in 2024 was selected as custodian for Path Crypto’s Managed Portfolios, the first and only bitcoin ETF in Australia launched by Monochrome Asset Management, and a landmark ether staking ETF fund launched by Purpose Investments.

#7 XYB 8.7p a share (£1.28 total)

XYB, a Coreless Banking platform-as-a-service (“BaaS”) was spun out as a separate business in May 2024. AUGM own 20% and it allegedly powers HSBC retail banking.

Augmentum invested a further £1 million into XYB via a secondary transaction in September 2024 and now owns around 20% of this fast growing business. The strategy is clear following the separation earlier in the year, with a strong focus on delivery. The team, led by the seasoned tech leader, Derek Joyce, are currently building out the organisation and operation with strong commercial traction. During the period, XYB collaborated with IBM to leverage advanced technology and consulting expertise for industry solutions, beginning with an operational resilience proposition for the UK’s largest banks.

#8 Anyfin 6.6p (£1.35 total)

Anyfin (www.anyfin.com) was founded in 2017 by former executives of Klarna, Spotify and iZettle, and leverages technology to allow creditworthy consumers the opportunity to improve their financial wellbeing by consolidating and refinancing existing credit agreements with improved interest rates, as well as offering smart budgeting tools.

Anyfin is currently available in Sweden, Finland, Norway and Germany, with plans to expand across Europe as well as strengthen its product suite in existing markets. Over 1 million people have downloaded the app. In July, Anyfin announced UC-kollen, a new service in the Anyfin app providing daily credit rating updates and tips to improve scores.

#9 Intellis 6p (£1.41 total)

Intellis, based in Switzerland, is an algorithmic powered quantitative hedge fund operating in the FX space. Intellis’ proprietary approach takes a conviction based assessment towards trading in the FX markets, a position which is uncorrelated to traditional news driven trading firms. They operate across a range of trading venues with a regulated Investment Trust fund structure that enables seamless onboarding of new Liquidity Partners.

Intellis continues to invest in developing new IP by not only improving their AI driven models in the spot FX market but are also planning to deploy their neural network into new asset classes in 2025. Having achieved early profitability, the company is well-positioned for significant growth in the year ahead.

#10 Iwoca 6p (£1.47 total)

Iwoca announced £270 million of new funding lines from Barclays, Värde Partners, Citibank, and Insight Investment in May 2024. The company has now provided £3.5 billion in loans to 100,000 SMEs across the UK and Germany.

iwoca has demonstrated consistent growth and profitability, ranking among the UK's top ten fintechs alongside Monzo, Starling, and Revolut. 2024 has so far been a record year for revenues, profit and originations. The company first achieved net profitability back in Q4 2022 and has since maintained strong financial performance with an annualised revenue rate of £251 million in Q3 2024, representing 62% year-over-year growth. With £1.5 billion in investment across equity and debt, iwoca now stands as one of Europe's best funded fintech success stories and lenders and continues to prove the profit potential of fintech lending businesses by harnessing machine learning and digital technologies.

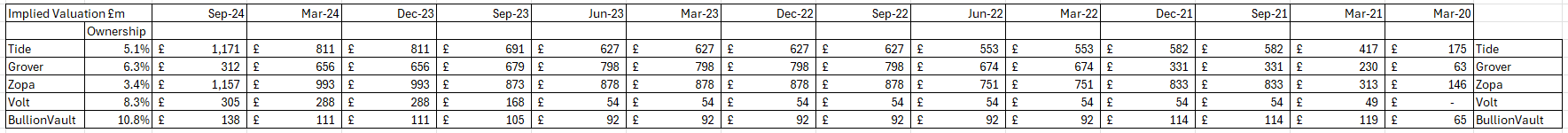

#11 Consider the progression of the top 5

Grover offered strong growth but latterly has disappointed. All of the other 4 continue to rise in value.

Those NAV imply the following company valuations

Portfolio Exits and Acquisitions:

In October 2024, Augmentum announced the exit of its portfolio company FullCircl, a regulatory technology platform, which was acquired by nCino, a Nasdaq-listed digital banking platform, for $135 million. This transaction valued Augmentum’s stake at £6 million, marking its seventh exit, all of which have been at or above the last published valuation. This move reflects Augmentum’s strategy of realising value from its investments at favorable terms.

Also in October 2024, Farewill, another portfolio company offering digital financial and legal services for death-related matters, was set to be acquired by Dignity, a company controlled by Castelnau Group. Under the proposed terms, Augmentum would receive shares in Castelnau Group as consideration, though the deal remains subject to regulatory approvals.

New Investments:

In November 2024, Augmentum led a $7 million funding round with a $4 million investment into Pemo, a UAE-based fintech providing expense management solutions for SMEs. This investment aims to support Pemo’s product innovation and expansion into high-growth Middle Eastern markets, aligning with Augmentum’s focus on backing fintechs in emerging regions. Perry Blacher, a partner at Augmentum Fintech Management, joined Pemo’s board as part of this deal.

Leadership Changes:

On October 14, 2024, Augmentum appointed William Reeve as the new chairman of its board, effective November 1, 2024. Reeve, a seasoned tech entrepreneur, is expected to bolster the company’s growth strategy. His purchase of 100,000 ordinary shares at 98.8 pence each in December 2024 signaled confidence in Augmentum’s future prospects.

Market Sentiment and Strategic Outlook:

Commentary from Augmentum’s CEO, Tim Levene, in March 2025 highlighted optimism about a potential resurgence in fintech IPOs, with Klarna’s upcoming U.S. listing seen as a bellwether. (On hold for now of course)

Levene noted a long pipeline of fintech IPOs, suggesting Augmentum’s portfolio could benefit from this trend. Meanwhile, the company’s shares have been noted to trade at a significant discount to NAV, prompting analysts to view it as a value opportunity despite market volatility.

Conclusion

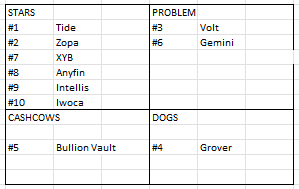

I continue to believe the discount here is highly strange. If you BCG the top 10 then you have 6 star players evidenced by their growth achievements, and upwards valuations.

I’m placing Bullion Vault as a cash cow, and then Volt and Gemini as Question Marks, leaving Grover as a Dog based on recent performance.

AUGM was last as low as today’s share price at the depth of Covid, y’know when we HAD to stay at home and we didn’t know whether 100s of millions might die worldwide coughing on a strange virus in Intensive Care - if we were lucky.

In 2025 meanwhile with many of the holdings demonstrating strong growth and progression it is insane that the maket should value AUGM the same way…..

It’s not the same. The NAV of the top 5 is 3.8X higher than 2020 for a start!!

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I hold this. Sadly 30% underwater since buying on 01/05/24. Was v tempted to catch the falling knife over the last couple of trading days. Now more likely to do so.

Good article. Maybe worth having another look and doing a piece on TMT investments. I think the discount to NAV is even wider!