ANX-oh wow

A S.T.I.C. Bargain Shares 2024 pick

Keynes once famously didn’t say "When the facts change, I change my mind".

But it’s true he wrote "When my information changes, I alter my conclusions".

Now I don’t know Keynes’ view on the recovery of impecunious losses. Ambulance chasing as it is sometimes called. But I’ve changed my view today, at least my view on Anexo.

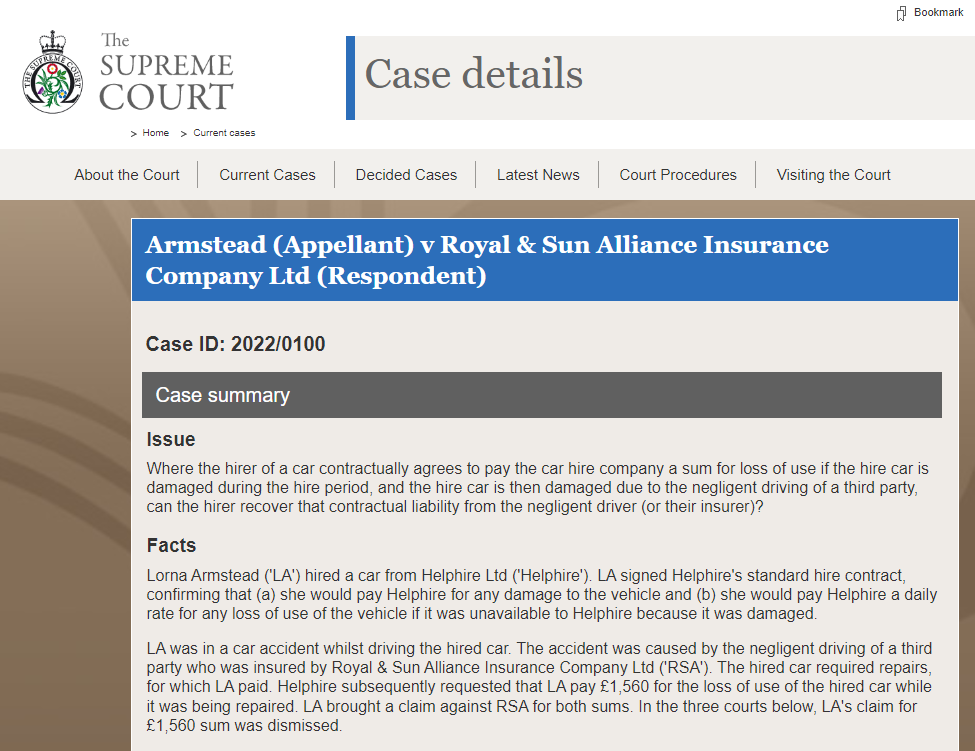

This morning I read a judgment which alters my judgment of Simon Thompson’s Anexo 2024 tip. The judgment puts the onus back on the insurer to defend why costs should not be recovered from a motorist who has had to hire a vehicle (due to their client’s fault).

I previously wrote in article 136 musings:

“Anexo I know ST has been a fan of over a number of years. I read the recent update and noted the Accounts Receivable remains stubbornly high. Considering they said their focus was to slow down and generate cash they didn’t do a particularly good job! But the housing division is doing well (albeit is still small) and the legal cases are an upside “not in the price” (albeit the VW outcome of £7.7m disappointed most people - combined with the lack of transparency or should I say confidentiality of the win). It might do ok but I’d be surprised if it surprised (to the upside obviously).”

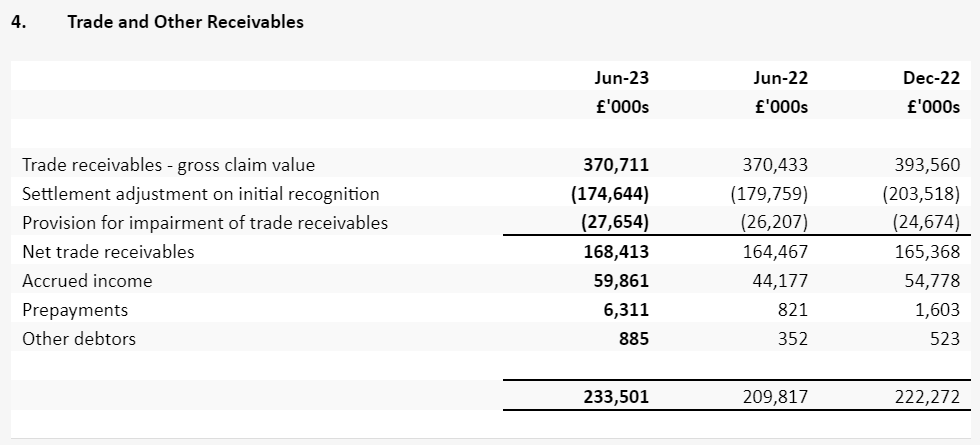

Let’s re-examine the facts. While it’s extremely difficult to piece together Anexo’s accounts and performance my concern was with the stubborn debtors. It remained at a theoretical £370m with over £200m considered uncollectable - in their June interims. The problem seems to be even the net £170m debtors grow and grow even when they are slowing their case load.. so the key question is are these assets real? Can they actually turn into cash?

Today’s judgment gives me optimism that at least more of it is and will be. An insurer now knows they cannot bury their head in the sand and case law has gone against them. I’m very surprised how as I write at 08:30 the share is hardly up at all (3% today)

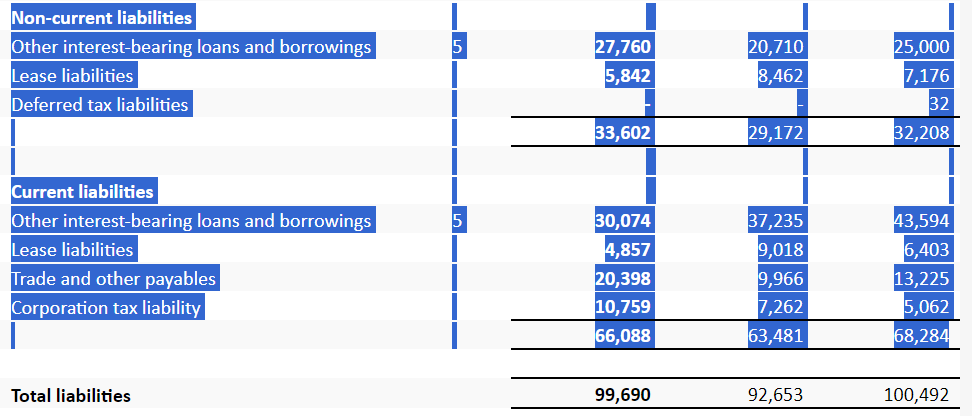

If a meaningful chunk of debtors say 30%, realise that’s over £50m flowing in. Debt is stubbornly high at around £57m but realising debtors and cash from operations would obliterate 100% of its debt in a single period.

Based on the interim accounts the NAV of the business is about 85p (so a 23% discount to NAV). This is for a growing a profitable business where DCF and not NAV is the appropriate measure. On comparative valuations according to Zeus, and an EV/EBITDA basis people should value ANX at 150p/share.

The Value of VW?

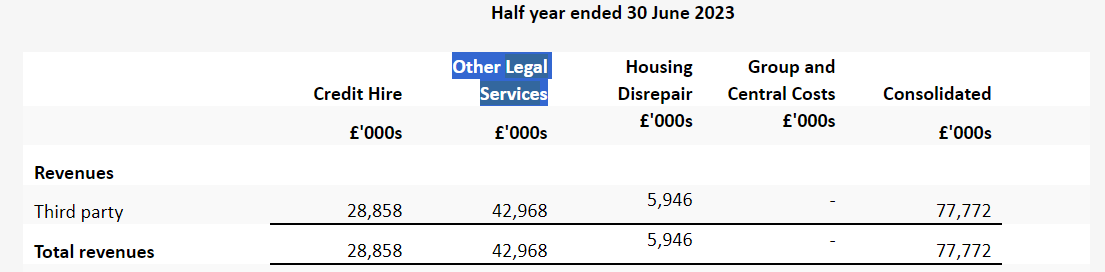

VW’s settlement is buried in “Other Legal Services”. By my calculation where 2022 revenue was £74.6m (so around £37.3m for H2) and of that Housing Disrepair was £9.3m, (so around £4.7m for H2) so £32.2 net grew to £43m half to half.

So a £10m difference from VW. We know £7.2m was the “cash amount”. My unanswered question was/is did that include the accrued costs. I do not know the answer to that but it appears (crudely) the £7.2m was profit and recovery of costs isn’t in that number.

ANX’s latest trading update now shows emissions to be 32,000 claimants.

Even if the payout is the approximate £600 per claimant (as it appears to be with VW) that’s £19.2m profit not in the price (and not in Zeus’ 150p valuation).

Interesting that in the US the Mercedes case was $3,290 or £2600 so over 4X as much as ANX’s VW win. If (and bear in mind not all the 32k are Mercedes), this were achieved we are talking £83.2m (plus costs). That’s over 70p a share upside on top of the 150p Zeus valuation.

Will the case change everything? I can’t be sure but case law often does, especially as the Supreme Court trumps all lower courts. Unless a future government legislates against this (and of course they did for whiplash claims you will recall). But recovering out of pocket from an insurer isn’t quite the same and doesn’t feel like a political hot potato, so the risk feels quite low.

That’s why I’m surprised the needle hasn’t moved for ANX today, and good on Simon Thompson making this his top tip for 2024. After years and years of tipping ANX it seems Simon - and ANX shareholders - may yet have their day in the sun.

This is not advice

Oak