APAX crescit in MMXXV Idea #24

Get a piece of this, for growth in 2025 - with this OB 25 for 25 Idea #24

Dear reader

With no connection to a film of a similar name, and focused on a profit and not a prot, Apax Global Alpha (AGA) and ticker APAX offers access to a diversified portfolio of high-quality companies by investing in Private Equity Funds, advised by Apax.

These companies are identified and selected by the Apax team, leveraging their deep sector insights, and drawing on the firm’s 50-year experience.

Just like the aforementioned film APAX might be a hidden gem containing its own hidden gems (if you want a film to make you think, then watch Kpax this Christmas).

Apax do speak of a picking “hidden gems” strategy. As can be seen below until they do uninvested funds are invested into a debt portfolio to give an extra bit of tickle to earnings. You’ll also notice there is a legacy healthcare sector and also a legacy “derived equity” which basically were direct investments (as opposed to assets under management). Those are being run down to zero.

Apax Funds focus on target sectors on tech, internet and services and generating alpha (returns beyond the market) by buying under-optimised assets where business improvement can lead to an acceleration in financial performance as well as an increase in relative valuation multiples compared to peers.

Once it’s achieved that, APAX sells them on. So it’s like a Homes under the Hammer, but it’s Private Equity under the hammer, if you will. New bathroom, new kitchen, lick o’ paint to earn a growing “rental income” followed by a sale.

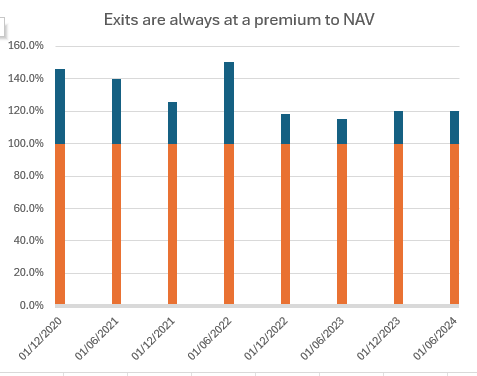

It is pleasing to see that those sales “later on in the show” are 20%-40% above NAV - these are the premiums to NAV achieved via exits over the past 4 years on average. Although not always. This news from 12 days ago was that €51m is being realised but at a 10% discount to NAV.

So exits are on AVERAGE always above - or at least that’s true over each period of the past 5 years.

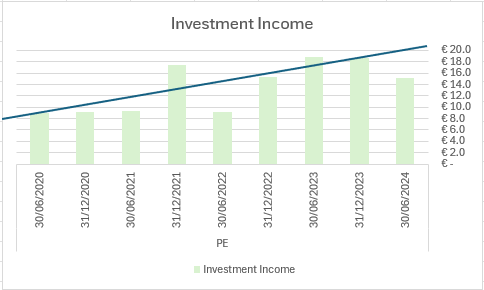

Pleasing to see investment income has grown throughout too. The drop in 1H24 is due to a larger proportion of the fund being in Private Equity.

Pleasing to see that there is a “baseline” of around 16.5X earnings to enterprise value but also that during a period of bullishness (as was the case in 2021-2022) that you can see your multiple grow by a further 5-6X earnings.

But that’s a potential future ratchet on top of evidence that earnings strongly grow during such periods too. As was the case in 2020 and 2021 at a 35.4% average annual growth. Combined, the NAV doubles in a year through earnings growth and a higher valuation multiple. But even as a minimum notice that revenues and EBITDA have grown in EVERY period even during the dreadful past 3 years.

It is tentative, but comparing 30/06/23 of 13.7% EBITDA growth to the latest 3Q24 LTM EBITDA growth of 16.3% we are starting to see that level increase.

Of course not every portfolio holding is growing earnings - but 78% are. Or revenue - but 81% are. Nearly half are growing their EBITDA earnings by above 15% a year.

If I’m right and if what we are seeing is an acceleration of growth in EBITDA (albeit modest), then growth in the multiple should follow.

I say “if I’m right” APAX themselves say there’s an uptick, this isn’t just OB wishful thinking (and numbers derived from 5 years of performance).

If we consider the latest results and ignoring FX a 1.6% net performance was achieved in 3Q24. 1.6% for 3 months is a ~8% compounded growth.

The valuation is not just about the multiples. APAX trades at a record discount to 10 years of history. A discount of 10%-15% would be average so today’s 31.1% est. discount or 33% “official” NAV grows to 34.8% once you strip out cash. So the discount is a further ratchet too. There is zero debt at fund level (there is debt in portfolio companies at 4.6X EBITDA earnings)

53% of the portfolio is North America, with 16% UK and 18% continental Europe with the 13% balance RoW. I won’t deep dive into any portfolio holdings in this article.

APAX classify their sub funds into three phases. It is interesting to consider these according to a valuation method. It is possibly quite harsh to consider earlier stage on a 2/3rds multiple but if we do that and moderate maturing holdings at a 90% moderation to NAV but consider those at harvesting stage at 125% (the average exit premium) then we arrive to a £1.84 per share valuation. If you consider 90% too harsh and think 100% is fairer then you can add a further 12p per share to the valuation.

Of course you need to factor its other assets too, and my valuation approach gets me to 1.2p above the estimated NAV today. So £2.05 per share seems a fair target. (vs £1.41 today)

In a good year you could add 33p per share per year from portfolio gains - in a bad year find you’ve lost about -10p a share. But the 5 year average gains/losses is a €37m per year gain - so about 7p gain per year average. If you consider Investment income is also now around €37m a year of 7p gain that more than covers dividends of -11p per share.

Why APAX?

For this pick I wanted to pick a software or services pick. Something like an Intercede or Beeks which has served fellow fun runners so well in 2024. But the sky high prices and single stock risk kept me from choosing them.

Besides I started to wonder about their moats? Gartner tells me that there are alternatives to Intercede, including some large competitors so how large a moat does their authentication enjoy versus alternatives? I simply don’t know - but I’ve not seen a proper investment thesis setting out the business case of how their technology proves that moat.

Similarly, I came close to picking Beeks, who offer hosting for Financial Services. But how unique is their offer really? There is certainly know how and a focus and reputation for their chosen financial services sector, it’s true.

But I quickly found alternative providers who appear to do what Beeks do including financial services specialism and experience. Like ChartVPS.

Who have an excellent reputation according to Trustpilot.

I didn’t find the same when I looked up Beeks. Now 11 feedbacks is a really small sample, and we all know people love to have a moan. The 11 might not be representative, and they could have plenty of happy customers who’ve just not posted feedback. But I concluded that Beeks and Intercede are highly speculative, and not for me.

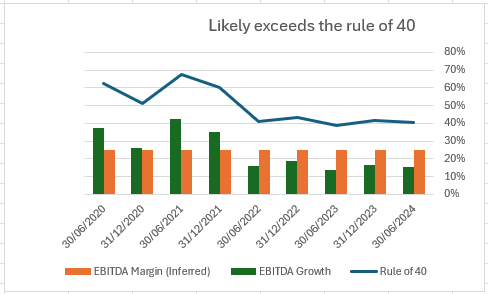

So I decided to look for consistent outperformance according to the rule of 40%. Add your EBITDA margin and your EBITDA growth and if it is consistently above 40% then it is highly attractive.

APAX share their EBITDA growth and I have inferred a 25% EBITDA margin (how else can you deliver growing earnings and dividends over 5 years unless you are generating at least that much). On that basis even in the thin years APAX sitting at or above the rule of 40. In a good year the EBITDA growth alone is above 40% - let alone the profit margin!

So APAX feels like a safer choice, even if it not wholly SAAS or software, and contains some service-based businesses too.

These are 80+ holdings so if one of them has dodgy Trustpilot feedbacks or suffers competitive pressure from a limited moat the impact is 1.25% of the portfolio (roughly), and the others take up the slack. At least that is my expectation and what their 5 year past track record sets out in the above chart.

This is my penultimate idea and nearly brings me to the end of the OB 25 for 25.

Latin speaking readers will hopefully have spotted a play on words in today’s title A-PAX crescit in MMXXV - peace grows in 2025….. and let’s hope so!

And even before 2025 begins, peace and goodwill unto all readers, this Christmas time even to the harrumphers. A very Merry Christmas to all. Switch off from your phones and computers go and spend time with family and friends. You don’t get this time back if you don’t.

Thank you for reading the Oak Bloke substack and also supporting Emmaus this Christmas.

OB will resume on Friday, although watch out on Christmas day, maybe just maybe, there’s a Christmas treat to follow…. and no it doesn’t involve chimneys or mince pies.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings even those contained within a FTSE250 company might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks for the write-up. I've held this for a couple of years and the share price has done very little. But the discount does seem excessive given the dividend yield, share buyback programme and generally good record at realising above NAV.

Thanks for the post. Be careful with one thing with these PE investment trusts. I question the EBITDA growth they post; the historical NAV growth does not reflect the ebitda and multiple development. For example in 2023 movement in underlying earnings was 17.8% and there was a -4% decline in comparable valuation multiple. Yet Private equity only contributed 3% to NAV growth. Even correcting for the 80% PE exposure there is a large gap between these numbers.