Dear reader,

Arix is an Oak Bloke article sat in my drafts for a long while. The merger with RTW Ventures had kind of made it a low priority. This is a story of sleeping giant, perhaps a giant opportunity…. “one day”.

Today, Merck announced an all-share take over of Harpoon for $23 a share. Arix’ 5.8% holding on the books for £4m is “suddenly” worth £7.53m. (Initially based on all the data brokers, it appeared to be a £27m gain. Sadly, checking the latest 8-Q for Harpoon, since June 2023 Harpoon increased its shares 4.1X so diluting poor Arix to a mere 1.41% holding).

Still it’s a decent gain - on a holding sitting at a large unwarranted discount. And it made me write about Arix.

Arix’ market cap today is £164m (it was at £112m just 1 month ago, sorry reader).

So today’s market cap of Arix almost covers the listed portfolio, cash, and other interests ( -£1.3m or -1p a share).

Is it still worth buying?

On top of the above there’s an unlisted portfolio you get for “free” worth £66.4m (worth 51.3p a share).

But today’s news increases the listed by £3.53m (worth 2.7p a share).

So 53p less than current NAV.

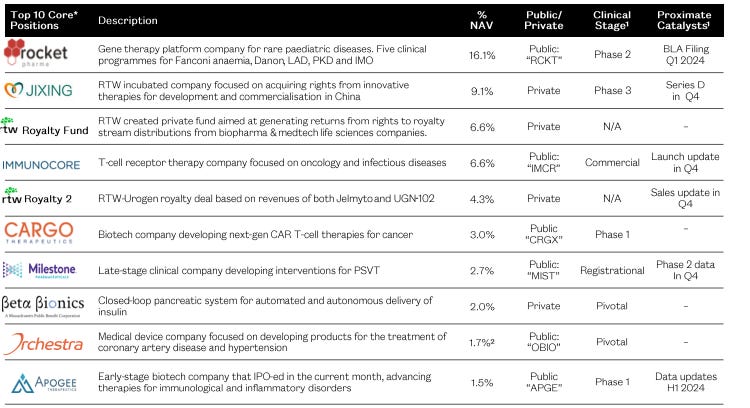

This shows the latest official NAV (as at 30/11/23)

What today’s news reminds me of is the range of holdings in here at similarly silly values that could be worth much more than their book. Look at all the “Clinical” holdings. Then look at the milestones.

This chart shows more info on Arix catalysts and next steps in 2024:

What’s the catch?

Well during 2023 I’d say the problem was with the leadership. ARIX sat on its mountain of cash month after month, year after year (after year). Sleepy giant. No dividend. “Prices are crazily low” they’d say. But no new investments (it seemed), no news, just a cursory monthly NAV that seemed to fall bit by bit. While the cash pile lay like the gold under the Lonely Mountain guarded by its Dragon. Frustrating!

What changed?

I sat up a few months ago. I saw friction and frustration. If you watch their presentation at 13 minutes 20 seconds you can see a clear bit of friction (or is it contempt) between the CEO and the MD. Not surprising to see on LinkedIn that the CEO has now left Arix and has worked for PureTech the past 3 months. New blood was needed. Would “I’ll take the slides from here” Tassos be the saviour of Arix?

It was not to be. Arix announced a merger with RTW. RTW are feisty Jacks in the Beanstalks. Supporting bioscience portfolio very actively and narry a sleep b’tween.

They’ve succeed in flogging holdings at premiums too. This one generated a 2,470% return for RTW!

The implied price (it was announced), if (when) the RTW merger goes ahead is £1.42 an Arix share. But, reader, that price was based on the price of RTW back then.

Based on the volume weighted average price of $1.1847 per issued share in the capital of RTW Bio for the 30 days prior to 27 October 2023 and the proposed terms of the Scheme, the exchange ratio values each Arix Share at £1.43.

The proposed terms of the Scheme represent a premium of approximately 46 per cent to the closing price of 98 pence per Arix Share on 12 July 2023, the business day immediately prior to the announcement by Arix confirming it was undertaking a strategic review.

£1.42? That’s not worth bothering, surely?

Hang on reader!

Under the proposed terms of the Scheme, each eligible holder of ordinary shares in Arix (an "Arix Share") at the Scheme record time will receive:

1.4633 new RTW Bio shares ("New RTW Bio Shares") in exchange for each Arix Share

At today’s market price of $1.38 per RTW share that’s ~ £1.09p and x 1.4633 values Arix share at £1.59 or 24.2% higher than today’s Arix buy price.

This is the most recent RTW presentation and Stephanie can talk you through RTW; I don’t get sleepy I get double dose espresso.

RTW Highlights:

There are lots of proximate catalysts for RTW too: (I like that phrase proximate catalysts, reader, you’ll be hearing that one again)

Acacia makes a sharp exit

One complication to the sale is that Arix’s largest holder (Acacia) was offered special terms not available to us lowly Private Investors. They will get £1.43/share. In cash, ahead of the sale.

Bye!!

So this chart shows the before and the after the merger. You’ll notice the cash on the left (converted in $m) reduces by just over $60m for Acacia’s exit.

Arix’s NAV includes today’s news and £3.53m uplift.

An Arix shareholder goes from £1.80 a share to apparently “lose” 50p a share………

Boo!!

Conclusion:

Buying Arix you stand to get £1.30 a share in RTW. So 13p a share less than Acacia.

Poor PI you’re a loser! Or are you? Hang on reader. Because you get 1.4633 shares per Arix share that’s 46.33% more shares.

46.33% extra! THAT’S A TASTY £1.90 NAV in the post merger per Arix share. The real losers here are Acacia, funding your 10p gain to NAV…… and with RTW, a more dynamic fund manager, extra shots on goal with their Phase 2/3 portfolio - there’s lots to like!

Another way to look at this is $1.38 per RTW share is £1.09p and divide by 1.4633 shares to give 74.5p. (that’s 54p less than today’s Arix share price)

It’s nice to get one over on the IIs!

This is not advice

Oak

NB the OTC cost ratio on RTW is a little high so you might dislike this for that reason. My thinking is I wouldn’t want to single share select biotech (well never say ever, eh?), and if someone can do a good job then I’m happy to pay for that.