Dear reader,

March 2025 update from Arqiva

We now have a March 2025 disclosure from Arqiva. This is aimed at Bond Holders but gives important clues for DGI9 holders.

Arqiva is the UK’s leading enabler of digital connected solutions across the Media Distribution and Utilities markets. It generates predictable earnings, supported by strong market positions, diverse revenue streams, long-life assets and long-term inflation linked contracts.

Media and Broadcast

DTT Multiplexes

As at 31/3/25 DTT platform capacity utilisation remained at 97%. Reveals discussions with large customers to extend contracts to the early 2030s, with two contracts concluded in April 2025 covering 5 channels.

Expectation is further commitments to the order book are expected to be signed by 30th June.

Radio

As at 31/3/25 both national DAB multiplexes are fully occupied, with 80% of Digital 1 (“D1”) capacity contracted until 2035. The second multiplex has contracts secured until 2028. Local DAB muxes have 83% average occupation with contracts to 2030. Mentions AM site disposals (7 talkSPORT transmitters) and FM renewals to 2030.

Direct to Home (DTH)

As at 31/3/25 DTH platform is close to full capacity with renewals to 2029. Notes 5 new HD channels planned to launch in the two quarters to 30 September 2025.

In 1H25 Arqiva won new channels from the Indian sub-continent and delivering Amazon Prime Football Association Premier League “Pop Up” channels for the 6th consecutive season.

Media Management Products

In 3Q25 Arqiva won a contract to migrate Hearst Networks to a cloud-based VOD platform from mid-2025, delivering assets across 40+ Pay TV and OTT platforms in EMEA.

We get an update that Arqads is on track for its mid-2025 launch for Freeview targeted advertising

Arqads already delivers targeted ad insertion for two customers on the Sky Platform across a portfolio of channels.

Position, Navigation and Timing (PNT) Services (eLoran)

The conversations continue within government to forming an alternative to existing PNT services (such as GPS). Arqiva in partnership with Hellen Systems could develop a British (and potentially European) eLoran service in the UK.

Government / Regulatory Updates

The DCMS-led forum (chaired by Stephanie Peacock MP) is advising on the future of TV distribution, running until at least the end of 2025. Public Service Broadcasters will be reviewed for performance and sustainability up to 2023 and second to consider future sustainability and relevance given changing audience behaviours and tech advancements.

Importantly for Arqiva the Office of the Adjudicator confirmed that all Arqiva’s existing contracts shall be upheld no matter the outcome, and only future prospective contracts could be affected.

Smart Utilities Networks

Regulatory Environment - Water

Ofwat’s PR24 (2025–2030) involves over £100bn in investments, with £2.5bn for smart meter rollout (10 million additional meters) and a 17% leakage reduction target.

Anglian Water

Arqiva deployed meters rose 0.1m to 1.1m meters in 3Q25. Anglian awarded Arqiva a 20-year AMP8 contract (2025–2030) for 1.1m additional meters. Sewer level and chlorine sensor trials and 6 AMP8 network sites were delivered by March 2025.

United Utilities

UU awarded Arqiva a 15-year contract in December 2024 for 1.1m meters in AMP8, with Arqiva as the prime contractor. Mentions potential for 2m additional meters in AMP9/10. Four network sites delivered by March 2025.

Affinity Water

Signed a 15-year contract in December 2024 for 0.4m meters in AMP8, with potential for 1.2m total in AMP9/10. 76 LoRaWAN gateways and 20,000 meters have been installed by March 2025.

Thames Water

Delivered over 1.2m meters since April 2015, the largest UK smart water metering network. Notes joint plans for additional meters in AMP8.

Portsmouth Water

Arqiva won PW as a new customer in 3Q254 and signed a 20-year contract (8 years delivery, 12 years support) in February 2025 for 326,568 meters (157,900 in AMP8, 168,668 in AMP9). One mast and 520 meters installed by March 2025.

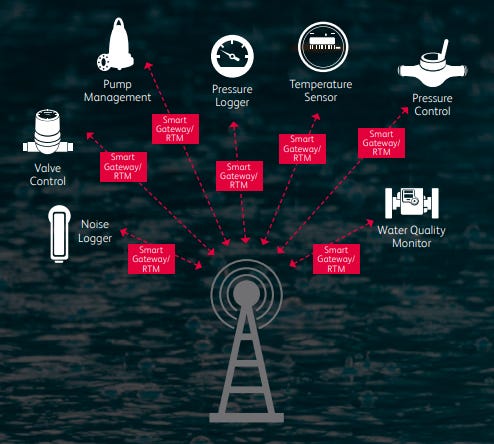

The Arqiva technology difference for Water companies is the prospect of a more integrated network environment in which devices like pumps, pressure regulators and valves can be controlled remotely – again, with decisions driven by the real-time data being harvested by sensors positioned across the network. Pressure loggers, noise loggers, temperature sensors, and water quality monitors, + pump management, pressure control and valve control.

The power to manage and optimise pressure in real-time by varying the rate at which water is pumped into a network, for instance, will help to prevent leakage and pipe bursts, two of the biggest causes of water loss. While the technology exists to start controlling water networks in this way, it’s not fully integrated with other sensors, devices and analytics software, so it does not currently facilitate the kind of control and optimisation water companies need.

SGN Hybrid Connectivity

Original 5-year contract for 230 sites expanded to include 174 additional sites.

Smart Energy Metering Rollout

Arqiva increased its numbers by 0.4m in 3Q25 and now supports 4m customers and 10m devices in North England and Scotland, and reports strong delivery performance. Arqiva is collaborating with DCC for installation improvements and ongoing technology development (Q3 deliverables achieved, Q4 on track).

Corporate Update

Arqiva’s CFO Sean West’s resigned (effective March 2025) and Nathan Hodge is now interim CFO from April 2025.

Capital Expenditure

Details capex for the nine months ended 31 March 2025:

£20.1m (contracted growth, up £1.7m),

£7.9m (non-contracted growth, up £0.5m),

£20.0m (maintenance, down £1.1m),

£1.6m (Bilsdale Project Restore, down £3.4m)

Totalling £49.4m (down £2.5m).

Capex is due to drivers like water site build, smart energy tech, and mast strengthening.

Conclusion

Arqiva’s role in contracted Water and Energy Meters continues to grow. 0.8m additional energy meters have come online during FY25 so that’s 25% growth.

2m Water Meters are contracted to grow by 3.8m nearly tripling the size of the SUN business. What’s more is a further 3.9m Water Meter opportunities are in the pipeline too. If that converts then Arqiva will single handedly have nearly 10m meters retaining its dominance in the water meter space. If its plans for Water Network products including Sewerage pipes develop then that could be worth just as much if not more - for compliance purposes.

The “Arq” family of Media products appear to be gaining traction too. That’s nowhere in the price.

The Public Sector Broadcasting question mark will prospectively be answered later in 2025 and meanwhile firms are already extending contracts and traditional broadcast “DTH” remains a route to market for many broadcasters.

I look forward to the Year End 2025 results 30/06/25.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Oak-B

Interesting update, many thanks, and a positive one. Certainly it seems they are cementing a dominant market position in water usage efficiency / cleanliness, which is certainly a growth and politically-in-focus industry, and are creating some form of 'defensive moat' with proprietary tech / infra and long dates contracts. Might be a slow burner re: the share price, but progress is being made. Perhaps more reponsivity when Dgi9 portfolio is cash+ earn out + Arqiva?

Arqiva bonds also holding steady last few months amongst the market turmoil (as infra should!) but given gyrating risk free rates that's certainly a vote of confidence given their debt pile.

Couple of questions / conversation starters.

1. I'm a gasping for an update on Arqiva stategy / any form of strategic write up from InfraRed as to the short term. I mean they are the bloody managers, right?! I find it incredibly irratating, I'd love a bit more understanding into diverstment plans... How do you see any P/E buyout playing out?What say you?! Likely / Unlikely / Never going to happen?!

2. Assuming Sea edge / Aqua Comms complete with 12 months or so, that'd leave Dgi9 with, say, 40m odd cash. if they remain so unloved, aggressively buying back their shares at 10p a probable / allowable strategy in a wind-up scenario?

All the best, D