Arrrrr! It 'as a eye, you see?

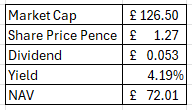

Considering ASA International (ASAI)

Dear reader and land lubbers,

ASA International (ticker ASAI) is one of the world’s largest international microfinance institutions providing small, socially responsible financial services to low‑income (as in $3-$5 per day) entrepreneurs, most of whom are women, across Asia and Africa. Chiefly loans but savings too. Plus in 2025 Income Insurance.

Nothing to do with 16th Century Pirates.

Far from plundering the Spanish main, ASAI delivers a strong social outcome from an ESG impact point of view and you might like this idea simply because you can “do good”. Assuming you also want to do good by yourself also, after all they call investing “risk capital” for a reason what does this look like as an investment? Is it just one for the dreamers and do gooders? Let’s get into the detail.

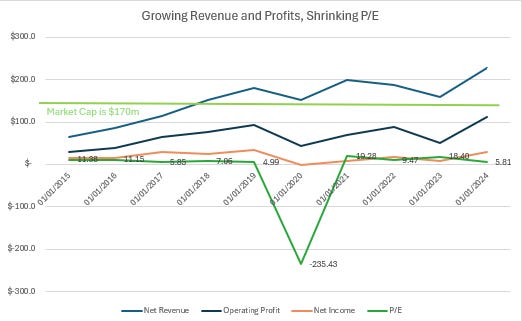

Please do not fall off your chair as you absorb the fact that ASA earns a 44.2% gross yield and pays an 11.4% cost of funding giving a 35.2% Net Interest Margin. UK Banks earn a tenth of that.

A return on tangible equity (RoTE) of 38.5% is 3X the return of UK Banks on average. Only Lion Bank (ex Bank Of Georgia) comes close to that, but even the mighty Lion didn’t achieve 38.5%.

How it Works

A $283 average loan perhaps doesn’t sound a lot for a business but this is the average loan value and will be used for working capital and capex, helping improve their business performance and outlook. ASAI operate via 2,145 branches staffed by loan officers who are usually part of and from the communities they lend to. Have you ever been to Weight Watchers? These are a good analogy. ASA runs “clubs” and meet ups and yes perhaps meet up in the local Church Hall or Community Centre every month or so. This is a picture of a club meet up.

Does your bank offer a monthly meet up to meet fellow customers from your local community?

The loans and debts are individual to each Client but they all hand over their Shillings or Ceci or Rupees at the meet and there’s a degree of shame to stiff the Loan Officer. It’s like turning up to WW and due to some overeating the flubber is wobbling under your shirt, that muffin top is spilling over and the scales creak as you weigh in and you turn bright red. Clubs that have non-payers can’t advance new loans so there’s a social pressure to keep up repayments. Possibly some degree of people helping each other out. Don’t let the rest of the club down. It’s a very different world to a UK bank, and its lending.

Portfolio at Risk or PAR was just 2.2% at end of 2024 and dropped to just 1.5% in 2Q25. Again compares very favourably.

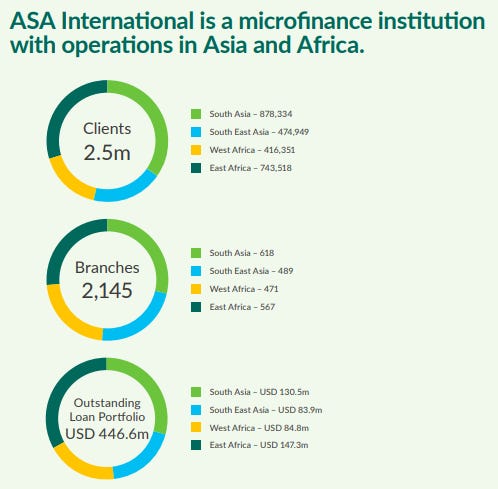

Their lending is currently to 2.58m clients and the loan portfolio is $539.5m at 30/06/25 up 37% YoY ($394.9m) and up 16% from $446.6m at year end 31/12/24.

This provides a picture of the countries in which ASAI operates.

West and East Africa are the best markets for profitable delivery and ASAI are running down their Indian portfolio due to the much lower profits there.

India

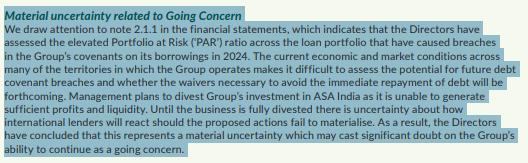

There are now 157 branches in India after 5 were closed in 2024 and 18 in 2025. In the last financial results on-book loans were run down to $0.7m from $5.2m in 2024. There are also $35.8m off-book loans ($36.5m total). By 2Q25 the total had reduced to $30.8m, and since ASA India has a 5% exposure to certain loans on-book is probably reduced to $0.6m. That $0.6m debtor asset is outweighed by larger creditors so if it were written off it would be academic.

ASAI describe India as having a “deterioration in portfolio quality” and that microfinance is a “low margin” activity in contrast to other countries and that Covid disproportionately impacted India with a deteriorating financial profile, liquidity concerns and lender defaults.

Tax in India appears to be around 70% of PBT, due to an inability to book deferred tax assets, leaving just a 30% share of profits for ASAI. Ouch!

ASAI is offloading its entire India portfolio and expects to do this later in 2025. Since ASA India is loss making it is likely that it will be sold for 1 Rupee. There was a material uncertainty where the Reserve Bank of India could declare ASA India in breach of its Capital Requirements. If that happened (and it hasn’t yet) ASAI would either fund ASA India or it would shut it down. The up to $30.8m of creditors would be stiffed and those creditors (IDFC, Fincare, Ujjivan and ESAF) who might harrumph and consequently affect ASAI’s future capability to borrow further funds and co-invest. There is no wider implication for ASAI than that. It appears those four lenders only lend to ASA India. Its equity in India is actually negative so shutting it down would improve the consolidated accounts.

Here are its segments:

Life Insurance

Launch of Enhanced Credit Life Insurance ASA International partnered with Turaco to launch a groundbreaking Enhanced Credit Life insurance product. Following a successful soft launch of ‘ASA LifeCare’ in Uganda on 12 May, the product has now officially rolled out in the country and is also launching in Kenya under the name ‘Maisha Care by ASA’, with plans to expand across ASA International’s six other African markets. The partnership embeds Enhanced Credit Life into ASA International’s loan products, providing affordable protection for clients from just USD 0.30 per month, covering credit, life, and health-related risks. This offering is expected to bolster client retention and generate additional non-interest income

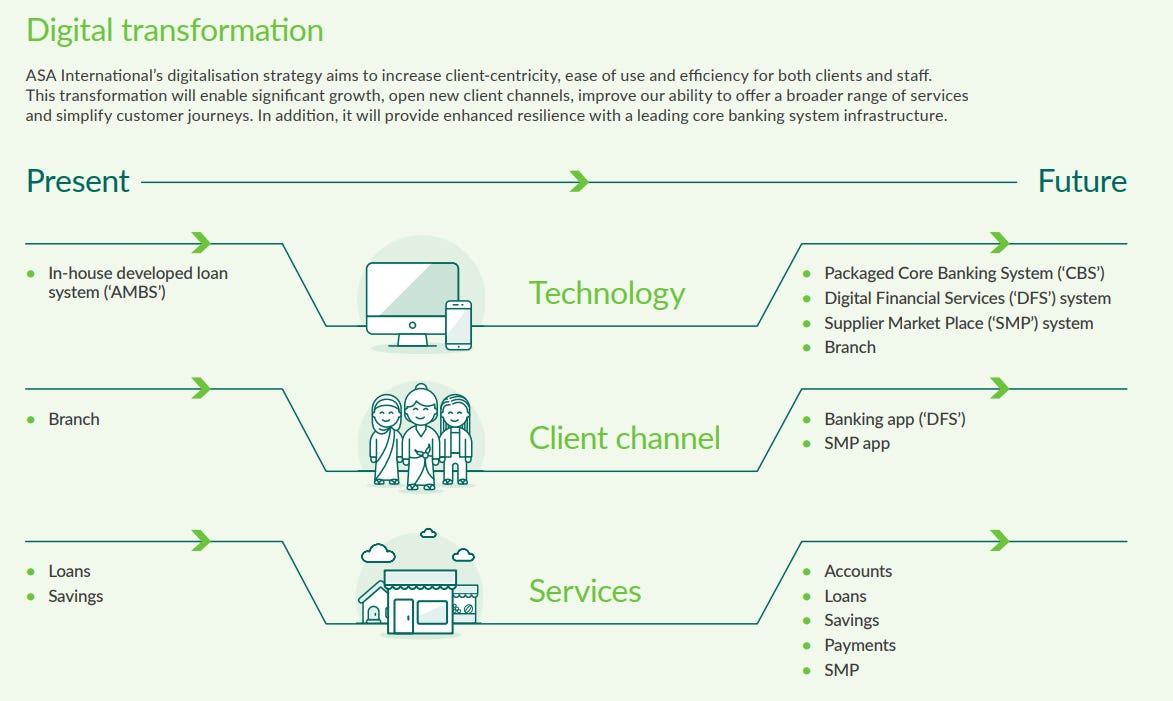

Digital Transformation

Pen and paper is being replaced by SmartPhone App and online payment. CBS or Core Banking System is part of this too,

Pakistan is transitioned, and Digital Transformation is currently underway in Ghana, and Tanzania.

The move from Pen and Paper is not just about digitisation, and efficiency, it’s about broadening the service to banking systems and other services, but also its no co-incidence that Pakistan’s Portfolio At Risk level has dropped since automation reduces the amount of manual admin by Loan Officers.

GDP Growth

If you consider the GDP growth of the countries in which ASAI are present includes some fast growing economies. In fact here’s their growth over the past 10 years. Average 4.4% including the effect of the GFC aftermath and the 2020 Pandemic. It would also be fair to say that commodities particularly Gold, Copper and Oil are major drivers of several of these economies and of course high prices and demand for these are a major fillip for these driving 13.91% GDP growth in Ghana in 2024 for example.

The world could look very different in the future. Goldman Sachs believe Nigeria and Pakistan will be larger economies than the UK by 2075. This share is a way to tap into those growth trends at a reasonable risk.

Talking vaguely about macro economic growth might sometimes feel disconnected from the “micro” i.e. at a single firm level. In this case the macro helps explains the growth of loans in particular regions and countries. i.e. compare the GDP growth above of Pakistan, Ghana, Uganda, Kenya, Tanzania then the OLP (Outstanding Loan Portfolio). The only country that confounds is India but that shrinking performance reflects the taxation and the bad debt, despite strong headline growth.

Risk

Hyperinflation, a further severe world economic event, trade disruption hitting commodities, climate change, foreign exchange risk, country political risk, impairment risk, there are of course a long list of risks. If this company’s portfolio were in the UK it would trade at 5X its current share price. Even though the UK growth rate is moribund and we tax some industries at 78% (Ed Milli) and aggressively target the wealthy with taxes and so-called loop holes that drive away their millions in their thousands. I say this to point out risk is sometimes a perception.

The mitigation is the large spread of countries and territories, the track record of ASAI, the “weight watchers” cultural norms it operates under and its brand strength in those countries and how it is embedded in those communities and represented by “one of their own”. Local banks are focused on lending to miners, to large businesses and earn fat rewards to do so. Lending $200 to a female entrepreneur is not a core activity or focus, and who knows perhaps there’s an element of traditionalism and mysogony too, where they lend to rich male industrialists not poor females. ASAI engage in hedgeing and financial instruments to limit their FX exposure and appear to consistently deliver results as the account illustrate.

Valuation

ASAI is currently on 5.8X earnings based on 31/12/24 and given the 16% increase of the Loan Book to 30/06/25 it’s likely that the P/E is now below 5X.

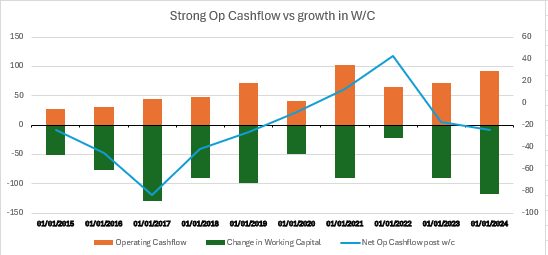

In other words consider the amount of additional investment into adding working capital since 2015 (the green bars). The amount of operating cash flow is growing too at nearly $100m in 2024. As savings products grow, this enables ASAI to use 3rd party capital to expand the loan book rather than rely upon direct organic growth. To evidence that the business has been pouring more and more into working capital for 10 years and despite being increasingly cash flow generative, the growth masks the extent of this.

Digital Transformation is another opportunity to drive more savings products but also provide leverage to improve cash generation and/or support growth.

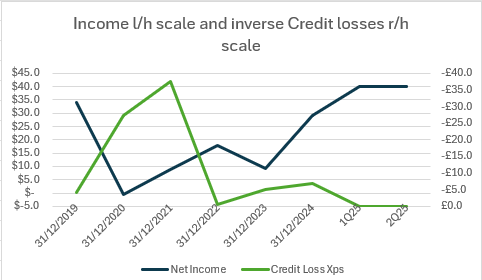

The six year performance of ASAI is punctuated by 2020 and Covid. The net interest margin look a large hit in 2020 and late payments (beyond a moratorium of 3 months given to all borrowers) leapt to 13.1% in 2020 and remained elevated until 2023.

Late payments also turned into actual credit losses too. Leaping from -$4.2m in 2019 to -$27.2m in 2020 and -$37.5m in 2021. Arguably a -$55m extraordinary cost that “but for Covid” would not have occurred.

Covid reduced clients (r/h scale) as well as hit the OLP and net income.

Contemplating these numbers you can see that over 6 year average profitability was $16m, if you add back the extraordinary losses you see a $25m average per annum underlying performance of historical profit. 2024 profit tripled that of 2023. What about 2025? $40m or (much) more appears likely. That would be 4X earnings.

With continuing growth in clients, loans and efficiency through digitising a paper-based process as well as new services like insurance and banking, net profits of $50m-$60m appear possible going into 2026 and more beyond. On a market cap of $168m a forward P/E of about 3X implying an upside potential and a target price of 250p a share or more.

Conclusion

At 128p this exciting idea where you can “do good” provides a decent dividend, stunning margins, a good track record, an opportunity to diversify into something unlike any other holding you probably own, plus where there is strong economic growth and therefore opportunity to grow profits over the long term.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings including those held in a Fund might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

This mornings interims were fantastic. In addition the CFO stated there was no longer any material uncertainty related to the going concern.Thanks so much oak bloke for highlighting this idea.

Thank you!