Dear reader

ATM announced some additional funding yesterday. Should we do a jig? Or is there a cloud over the news? How does a 77% improvement explain a 2.1% drop?

§ USD2.5 million funding facility to procure additional 100 tonne per hour tin processing capacity at Uis

§ The Plant will enable modular expansion of operations into proximal pegmatites without disrupting current production at Uis

§ Potential for immediate, significant increase in tin production and therefore enhanced cashflow

§ Discussions continue for higher-grade tin ore supply from miners in the Erongo region

I’m sure eagle-eyed readers already know this but ATM is processing 130 tonnes per hour at present at a 0.145% grade.

So we are talking about a 77% increase to throughput. But talk of “talks” about higher grade tin ore are intriguing. Talk to who? The Namibian government are pretty adamant that ATM is the only tin producer in Namibia. We’ll have to ponder that one. Eagle-eyed readers know that ATM’s Lithium Ridge site (used to be called TanTin) contains samples with 0.18% Sn and Brandberg West up to 4.47% Sn but historically up to 56%…. 56% tin!! If only it were as simple as rocking up with some equipment stripping off the over burden and trucking the ore to the wash plant. ATM would be worth a £1bn if it found a further 56% tin resource.

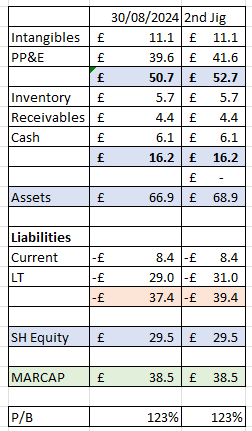

The $2.5m (£2m) price tag for the 2nd jig, is debt sitting on top of £17.7m debt (as at 31/8/24), and £11.7m “other liabilities” - royalties and derivatives (again as at 31/8/24). £29.4m becomes an estimated debt of £31.4m.

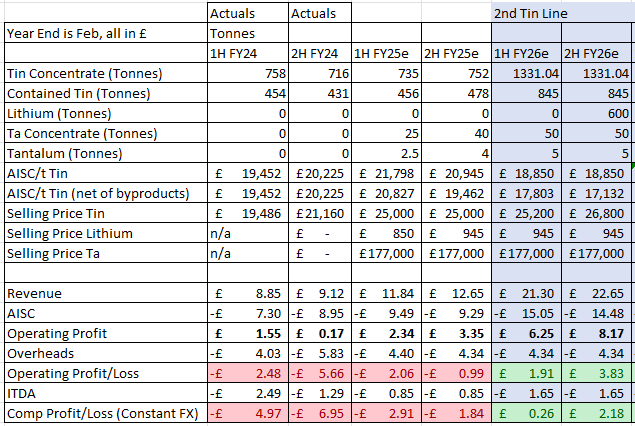

That new debt adds to a £2.4m finance charge to grow into a £2.8m charge. That possibly sounds unbearable? According to my model it is more than bearable. Taking FY26 as 77% higher than 2H25 (where I’m assuming 4Q25 is identical performance to 3Q25 even though ATM tell us they expect to see improvement in the current period), and then moving to a 77% higher level from March 2025 and assuming identical levels of recovery and yield, with 100t/month of Lithium from Uis from August 2025, then even factoring in the further debt payments ATM turns cash generative and profitable in the coming year. That’s based on yesterday’s $31,500/tonne (it’s above $32k today) tin price with $33,500/tonne from August.

This model doesn’t factor in any other CI2 initiatives or improvements either, to the existing line which of course is quite conservative. Although bear in mind also I’m assuming the “immediately” spoken of in the RNS means commissioning of line #2 can complete by 28th February 2025 which is obviously extremely ambitious.

However if I factor in a ~40% boost (average) from Line #1 CI2 initiatives in FY26 then you see profits ratchet by over £2m more.

$33,500 tin - what are the chances?

The level of LME tin stocks are falling; you can view them here. Some folks think we will see $40,000 a tonne although that could just be a nice round number they are plucking from the air. I watched some Australian mining analysts who were extremely bullish on Tin in 2025 so there are voices who believe Tin is poised to move higher.

If we were to see $40k Tin (average) for FY26 then profits ratchet £12.5m (in the +77% and +40% combined increases from introducing line#2 and CI2 boosts to line#1).

The backdrop to tin demand is strong: 80,000 tonnes extra by 2030 equates to 80 years of ATM production based on last year’s numbers!

Tin itself is growing in demand. So this expansion by ATM could be well timed….

Meanwhile supply looks ropey, and could quite easily cause a run on tin prices in 2025….. It’s always a bit tricky to know what’s going on on the ground in Myanmar and far flung corners of the world.

Grade Improvement News

Back on 6th Feb ATM announced an 8% improvement to grade which is no bad news either. Nor is a 30% increase (6.3mT) of measured lithium. At $10k/tonne that’s $63bn of potential future revenue, assuming 100% recoverability etc. Will we see some recovery in Lithium too? There is talk of that, but no evidence as yet.

Considering the ATM Balance Sheet

Adding the jig and the debt, adds to plant and equipment (PP&E) and to debt.

The way to consider ATM is to say working capital is/was as at last reporting a net £7.8m taking the current assets less current liabilities.

Intangibles is exploration, environmental studies and metallurgical test work so all good stuff and you can decide whether to include that value of £11.1m or not.

Crucially, beyond the £7.8m mentioned above, shareholders “own” 1/4 of the plant and land, and creditors “own” 3/4 in the sense that LT (long term) liabilities are -£31m and PP&E is £41.6m.

So if you bought ATM tomorrow you’re paying £38.5m to own £10.6m of “actual stuff”, £11.1m of intangibles, and £7.8m of working capital. So you’re paying £9m over their worth, or £20m if you ignore intangibles.

If my P&L model is correct and the business can generate £2.5m then you’re paying somewhere between a net (of liquidity) P/E of 4X to 8X for those assets.

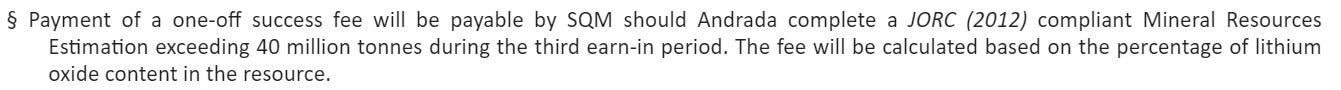

That calculation puts zero value on the SQM deal. Worth £1.5m once the approvals come through

There is also a success fee which isn’t defined beyond it applying for a JORC resource greater than 40mt and based upon the percentage of Lithium Oxide.

On the assumption that $20m spent on the JV raises the Intangible value to $20m then over the 3.5 years that translates to a gain of £10m to ATM. On the basis a DFS is $5m (similarly capitalised) then 50% of $25m means a further £0.4m gain.

If the $20m spend leads to nothing then there is no loss to ATM (beyond the initial assumed £1m intangible which was offset with £1.5m of payments). If the DFS is not progressed then, again, there’s the potential that the intangible gets written off.

So there is no downside and the expected upside “should” be around £10m assuming it gets to a DFS. But £10m places no value on the partnership and working with the world’s leading Lithium miner, nor the profit share assuming SQM progress beyond the DFS and a lithium mine is built.

So it’s quite easy in mind to rationalise why ATM at a 2.4p buy price is an incredible bargain.

Risk

The risk of course is that a 77% increase via a further 100 tonnes per hour isn’t achieved, or that tin prices plummet, or some other disaster. A mushroom cloud like in today’s picture would certainly make Uis and every other place on earth a very unpleasant place to be.

Conclusion

Hopefully the Continuous Improvement 2 (CI2) can deliver just that, improvement and progress along with stabilisation and the beginning of cash generation. All Andradadadies or if you’re proper old skool, all Afritinnies are crossing their fingers and toes for exactly that. As people sang in 1997, and perhaps again in 2025, Tins can only get better.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

with Tin prices on the hoof and a shade under $38k, with the chartists point to anywhere from $41k-$44k ... is it now worth a revisit of the numbers I wonder ?