Dear reader,

I added some more AUGM following a fall back below £1 a share. Here’s why.

Cash 33.3p a share.

Augmentum Fintech (AUGM) reported they had a £44.8m cash balance as at the end of May.

Since then:

Onfido was divested for £10.1m. (a £0.4m gain to the last NAV)

Monese disposed for £0.8m

= £55.7m

Monese (part of the above)

The £0.8m Monese disposal hasn’t been announced via RNS yet, but it’s been bought by Pocket. It appears to be a £9.2m loss for AUGM unfortunately. AUGM owned 5.5% of the £207m valuation i.e. a £10m holding.

It’s the 7th disposal and the first disposal below NAV.

AUGM are conducting buy backs. If they were to use all the estimated £55.7m cash the discount to NAV would rise to nearly 53% and the NAV would accrete to £2.03 a share (a gain of 34p)

Tide 30.6p a share (64p total)

Tide already has 10% market share of all UK micro (0-9 employee) businesses, with more than 650,000 customers (up 60k since May this year) and over 1m customers worldwide.

It bought Funding Options in November 2022, has FCA approval providing a credit offering to customers from over 120 lenders. It also provides a series of business tools for businesses too small to have a finance person (or team). Namely to provide card payments, direct debits, card readers, invoicing, accounts, or if your business needs are a bit more complex then out of the box integration to small business accounts (Sage Business Cloud Accounting, QB, Xero, and others). All the functionality is done from within a single app. It has just bought Onfolk a UK Payroll app which will be rolled into that single app. To what extent is this a bank and to what extent is this a SaaS business? Very different valuation approaches.

2023 saw Tide launch in Delhi and Mumbai, India and in its last announcement it had more than 350,000 customers (up from 225,000 in May this year!) in India (this has grown by over 100% in the past year). The market size in India is enormous. There are 63m micro businesses in India. It has also launched in Germany where there are a further 2.19m micro businesses as part of an EU expansion. So there’s plenty of runway ahead and the TAM has grown by 14 times by entering those two new geographies.

What I notice here is:

1/ A “bank” with a growing 85.2% gross margin (2022 79.4%) for what is recurring revenue.

2/ Recurring revenue is between £0 - £50 a month. Assuming a midway £25/month for 1m members (and we could further consider some of that £25 is bank charges) gets you to £300m revenue; £255m gross profit (at 85% margin).

3/ A large chunk of “Administrative” is the build out and development of services and “one off” to some extent.

4/ Even with further investment aka “Administrative” beyond the £144m cost in 2023, it’s quite hard to think that Tide remains unprofitable in 2024.

5/ Even if it is unprofitable in 2024, it then becomes nearly inconceivable for that to be true in 2025.

What valuation do you place on a business with a vast growth runway, that is delivering value in a way that Accounts software providers and Banks (separately) cannot? Some secondary sales placed it at $1bn in 2024.

But at what I see as fairly conservative £50m net profit out turn in 2025 (if not in 2024) and at 30X earnings a £1.5bn ($1.95bn) valuation seems more than fair. Or turning it around, would a 15X valuation be reasonable for a business able to grow >100% at a 85% gross margin? Even 30X is arguably too low, and is a £55m further growth in administrative cost going to grow significantly too?

AUGM owns 5.1% of Tide. So if you agree with the above that equates to a £35m increase in valuation or 21.4p per AUGM share hidden value.

ZOPA 23.5p a share (87p total)

Just four months after hitting a £4bn milestone, Zopa recently hit a £5bn milestone.

Zopa also announced a strategic tieup with JohnLewis Money to offer personal loan to the 23 million John Lewis and Waitrose customers. Considering that Zopa Bank has 1.3m customers, this partnership is very exciting.

But that’s a 2nd partnership on the back of Zopa’s partnership with Octopus Energy and its 6.8m customers to offer “green energy loans”. Will we see some green energy giveaways on Hallowe’en? It will be spooky if I’m right. We know Ed Milli is strongly pushing for this. If the government steps in to support the cost of loans then clearly Zopa are going to be a large beneficiary.

Zopa’s savings products have also won multiple awards in 2024, including:

Best Savings App, Best Fixed Rate Cash ISA Provider, and Personal Savings Provider of the Year at the Moneynet Awards 2024

Best App Based Savings Provider at MoneyComms 2024

Highly Commended for Best Savings Provider at the British Bank Awards 2024

Commended for App Only Savings Provider of the Year at the Moneyfacts Consumer Awards 2024

Zopa also reported its first full year of profitability. Launched in June 2020, the milestone makes Zopa one of the fastest digital banks in the UK to turn an annual profit.

Zopa Bank swung to a pre-tax profit of £15.8 million for the financial year ending 31 December 2023 from a pre-tax loss of £26 million for the year ending 31 December 2022. Total operating income for the same period to 31 December 2023 was £222 million, up 47.8% year-on-year.

Zopa’s customer base grew to over 1 million in the period across its newly expanded product offering. The bank’s deposit base increased 14.9% to £3.4 billion (now £5bn); loans on balance increased 27.3% to £2.7 billion.

Alongside its impressive growth, Zopa Bank maintained its 2nd best to Tide net promoter score (NPS) of 72 aided by its proprietary technology which enabled it to offer great value, straightforward experiences at speed. Zopa’s technology has also allowed it to operate efficiently as it has scaled, further driving its cost-to income ratio down to 38.7%.

Zopa’s profitability was first announced at Innovate Finance’s Global Summit and comes off the back of a strong year. Despite the challenging macroeconomic environment, Zopa Bank saw a 30% growth across its products and a 29.7% increase in total revenue to £226 million.

Grover 21.4p (£1.09 total)

So we now get to the 1st share where we exceed the current share price (by about 11p a share). How do we feel so far reader? Cash is cash, but Tide and Zopa feel like their NAV is likely to be going up and not going down.

So what about Grover?

Good news here also. Follow on funding of EUR50m has been agreed for Grover due to growth. It will “demonstrably increase profitability” for one of Europe’s fast-growing scale-ups.

Grover is already at EBITDA break even:

Grover offers tech rentals and has over 500,000 customers doing exactly that. What does tech rentals mean exactly? Imagine if all mobile phones were capital purchases rather than contract purchases? Pay £100-£1000 to get a phone and then get a SIM only contract. Some people do do that. Including the Oak Bloke.

But now imagine why don’t we just rent tech? Why are only mobile phones like this? Why not other stuff? Grover is a way to rent what you need, so not to tie up cash on stuff. Grover also gives a 2nd life to stuff and refurbishes so yes you can rent the latest and greatest but also rent refurbished at a lower cost. Grover also has a rent and then buy option. So you get to try it before you buy it (at a cost).

Volt (15.2p a share) £1.24 total

During 2024 Volt obtained an electronic money institution licence from the FCA. It has also expanded operations to Australia, but also deepened its range of products to include ecommerce checkout, verification services, fraud detection and other aspects all managed within a single API making this a “developer friendly” platform.

Volt plans to replace payment rails - the oligopoly controlled by Visa/Mastercard/Amex with account-to-account payments connectivity for international merchants and payment service providers (PSPs). Using Open Banking Volt provides account-to-account payments where funds are moved directly from one bank account to another. A very disruptive fintech with enormous opportunity to disrupt the long-held status quo including with cross border payments.

Its foray into stablecoin launching a means to on/off ramp with exchanges, issuers and OTC desks - connecting the Crypto world with the real one.

I am no fan of crypto as readers possibly know, but would I sell picks and shovels to crypto fans - you bet! The interconnectivity between fiat and stablecoin meets a need.

Can’t beat ‘em?

Would the oligopoly would look to buy Volt at some point? Or would the likes of the Magnificent Seven look to buy it to “cut out” Visa/Mastercard?

Volt’s Series B funding round was 2.7x the prior valuation and provided a £11.4m uplift (6.3p a share) to AUGM. It also meant Volt has a $60m warchest too. Volt has partnerships with Shopify and Worldpay.

Bullion Vault (7.8p a share) £1.32 total

So we are now at 1/3 above the NAV and Bullion Vault (BV) is a FinTech holding for 2024, surely. Its 2023 profitability rose nearly 50%, and AUGM earned a tasty £0.75m dividend (a 6% yield) from its 10.8% ownership of BV.

BV in its last account had 106,526 users and traded £288m of bullion.

In the last accounts BV holds around 80KG of gold, which is worth £6m at $2747 an ounce, and that represents about £1.5m profit.

But perhaps just as importantly there has been in 2024 a brisk trade amid renewed interest in precious metals. It’s not just Gold and Silver - even Palladium has suddenly jumped given that Russia supplies 40% of the world’s Palladium.

There’s a further 37p of other holdings ranging from (soon) Castelnau which I covered last week, to new and exciting holdings such as Artificial - transforming the insurance market - there are plenty of reasons to cover the fall below £1 an error - and an opportunity.

Buy backs are continuing and have been renewed. The estimated NAV is £1.69 a share once you include the performance fee accrual and liabilities.

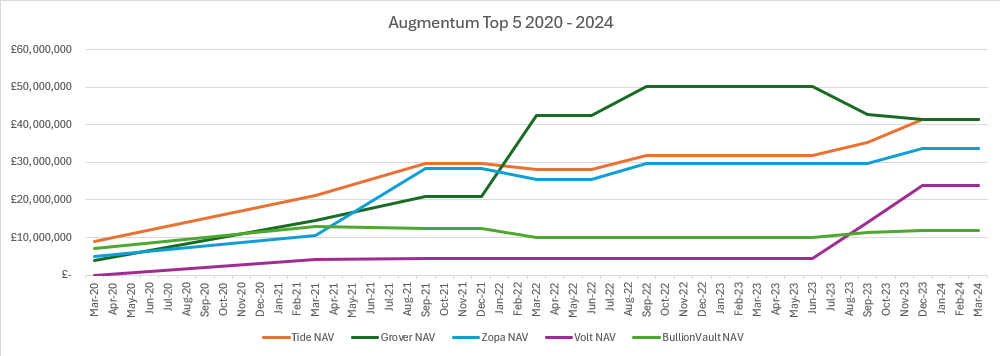

A long term IRR of 16% is one reason why a 42%-53% (ex cash) discount is wrong. Another is the progression of its top 5 holdings in 4 years.

We should be discussing the level of premium not discount to NAV in my view.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Augmentum Fintech plc (LSE: AUGM) (the "Company" or "Augmentum"), Europe's leading publicly listed fintech fund, notes the announcement by nCino, the NASDAQ listed US digital banking platform, that it has agreed to acquire FullCircl, the RegTech platform and a portfolio investment of the Company.

The transaction implies a valuation of the Company’s investment in FullCircl of £6.0 million subject to final adjustments, which represents a 75% increase on the last published valuation of £3.4 million as at 31 March 2024.

I believe the company to be further strengthened by the appointment of William Reeve as Chairman https://augmentum.vc/appointment-of-william-reeve-as-chairman/