Dear reader

Give me some dignity!

No, I don’t mean you reader, I know how much most of my readers respect and value the Oak Bloke’s articles.

I mean that Castelnau owns Dignity and is doing a swap. A swap with Augmentum Fintech for its holding Farewill.

AUGM gives its holding in Farewill (AUGM owns 25%) and they give AUGM £3.2m of shares equating to around ~1% of Castelnau (LSE: CGL). The other owners get a similar deal since Farewill is valued at $16.8m (£12.9m) so the new shares issued equates to about a 4% dilution for CGL.

Augmentum Fintech plc (LSE: AUGM) (the "Company" or "Augmentum"), Europe's leading publicly listed fintech fund, notes the announcement by Castelnau Group plc ("Castelnau") that Dignity (in which Castelnau has a controlling stake) has agreed to acquire Farewill, the digital financial and legal services platform for dealing with death and after-death services and a portfolio investment of the Company.

So in this article we consider what is Farewill, who are Castelnau and is this a good deal for AUGMers?

FAREWILL

Over the next 10 years, £1 trillion of inheritance will pass between generations in the UK (assuming Reeves doesn’t plunder some or indeed all of that to feed the imagined black hole).

Farewill (www.farewill.com) is a digital, all-in-one financial and legal services platform for dealing with death and after-death services, including wills, probate and cremation, augmented with funeral plans in 2024. Will-writing is ripe for digital disruption, and dusty solicitors offices and reams of paper get, er, torn up and replaced with algorithms, an AI assistant and lots of automation. Where there’s a will there’s a way.

The disruption worked.

In 2022 Farewill won National Will Writing Firm of the Year for the fourth year in a row and in 2021 was Probate Provider of the Year for the second consecutive year at the British Wills and Probate Awards. Farewill also won Best Funeral Information Provider and Low-cost Funeral Provider of the Year at the Good Funeral Awards 2021.

Always interesting to read all of 9 out of 17,500 1 star reviews and how they are basically customer service requests - not actually reviews. Or just weirdo complainers: “I wish to complain! I bought this seaside holiday and no one told me there would be fish in the sea. I demand a refund.”

Since its launch in 2015 Farewill’s customers have pledged over £1.03bn to charities through their wills, and in fact if you are willing to leave a pledge to a Charity some offer a free will-writing service e.g Great Ormond St.

Show me the money!

Augmentum led Farewill’s £7.5 million Series A fundraise in January 2019, with a £4 million investment, participated in its £20 million Series B, led by Highland Europe in July 2020, with £2.6 million, and in its further £4.8 million fundraise in March 2023, with £0.8 million.

That’s £7.4m

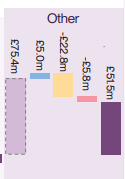

Wait. You said £3.2m. Yep. I believe that £4.2m of the unspecified £5.8m reduction in AUGM’s “Other” holdings pictured below in the FY24 accounts relates to Farewill. I know that AUGM own just under 25% of Farewill and a sale price of Farewill is at £12.8m so 25% is £3.2m. We also know AUGM say no material change to NAV ergo the NAV must be £3.2m. (A £1.6m loss of another non-top 10 also occurred)

Quite why a Will writing service at £100 a pop with 17,500 reviews averaging 4.9 would need to sell itself at a 60% discount is not revealed. But considering Farewill’s last accounts to 31/7/23, its revenue grew from £3.6m to £4.9m (so ~49k will at £100 each?) and gross margin grew from 50% to 68%. However its EBITDA loss is revealed albeit shrinking from -£8.3m in 2022 to -£4.2m. With net working capital as at 31/7/23 of £3.9m and even assuming further growth the reason for sale appears to be plainly a cash crunch. Assuming the same 68% gross margin sales would have had to have grown by over 100% to £11.5m a year to hit breakeven (assuming static admin costs). At £100 per will that’s a growth to 115,000 people per year. And that assumes steady costs but cash flow reveals a one-off £0.7m R&D credit - and of course 2023 was a year of rising costs so assuming static Administration costs is not realistic either.

Castelnau

Castelnau, meanwhile, has been enjoying stellar performance through its Dignity and Hornby holdings - at least in respect to its market price.

Castelnau is basically Dignity (aka Valderrama) at £323.6m with a smattering (if you can call £63.3m a smattering) of other stuff thrown in with -£69.5m of debt.

Dignity is actually 50% owned by Castelnau and 50% Phoenix Asset Mgt and the other 70% of Dignity shareholdings were purchased last year for £281m (so a £140m cost to CGL). Phoenix and other Asset Managers own 75% of Castelnau - providing an important clue as to the reason for its lack of discount to NAV - it is tightly held.

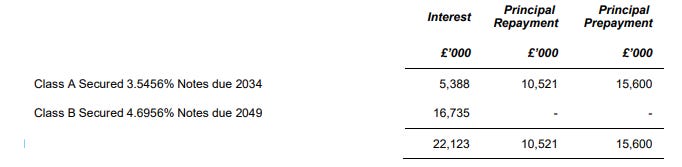

Dignity, itself, is highly leveraged but the nature of its business (selling funeral plans) is that it holds a large amount of money in trust. Just under £1bn actually. This trust money must cover the future cost of funerals i.e. it is not a piggy bank to be raided. Well, not unless the piggy bank is adequately full that is! £100m released in 1H24 from the trust paid down a tranche of debt saving £1.5m in finance costs per year. There was £50m released in 2023 too. But a -£50m loss in 2022 to be covered by the Trading Co.

Dignity meanwhile has been pruning its locations despite its web site still saying “over 800 locations” disappointed funeral purveyors who cross check the sales material against its investor material can learn the number is actually below 600. Dignity says there are further closures to come too.

“Nobody told me there would be a reduced number of branches, I demand a refund”

A fun fact reader - Dignity are the 44th highest on Trustpilot but 44th still gets a 4.7 (out of 5). In other words it seems most people rave about their Funeral Director. Other categories don’t get anywhere near such a high average.

Dignity appear to have just over 10% market share of UK human deaths.

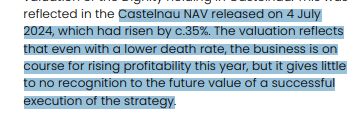

Castelnau appear to speak to a higher NAV but that the NAV reflects no recognition of future value. Hmmm. The market seems to give it full credit however - where its market price trades at 99% of its September 2024 NAV.

Going back a few years debt at Dignity has actually grown compared to that in 2021 and EBITDA in 2021 was £72.4m compared with £39.8m in the latest results. The decline is explained through stronger competition and higher costs but also 2021 “benefited” from the impact of Covid.

One bright spot is that debt is fixed and competitively priced.

Synergy

Could an internet-led funeral service be a genius move? Possibly. I saw a Co-op funeralcare shop pop up locally a few years ago replacing a closed down Bank. I was a bit baffled. Did people actually pop to a shop to arrange a funeral? I’ve never seen anyone enter that shop not that I’ve particularly been watching. You might say footfall is deathly quiet, boom boom.

I would expect increasing numbers of people would want to arrange a funeral online. Especially if you were pre-arranging. Does pre-arranging a funeral naturally follow from arranging a will. Now here I think the answer is definitely yes.

Is acquiring a leading form of Will arrangement a genius move? Yes I think so. Farewill were heading in this direction anyway (perhaps with Dignity) so perhaps the whole acquisition came out of someone saying hey there’s great synergy to just buying those guys and guess what they’re running out of cash and we can get them cheap.

Do I like Castelnau?

I’m a little baffled why Castelnau is valued 1% below NAV when its principal holding earned a £39.8m EBITDA profit for 1H23 to 1H24 - and is undergoing a turnaround.

The extent of its strategy appears to be cut costs and create a standardised operating model at each Funeral Director. Sensible enough I suppose.

I’ve not considered its smaller holdings like Hornby but these are turnarounds too with poor past period performance and an improvement in 1H24.

I’ve sought to find info on the Dignity business. I found there is reporting by a Dignity Plc for its bondholders. But this business is owned by a business called Dignity Group Holdings Ltd - and this reveals (below) it had in 2023 an EBITDA less depreciation equal to a £12m operating profit (ignoring exceptions) but then consider the finance cost and you arrive to annual net loss of of ~-£18m (again ignoring exceptions).

The remeasurement of financial assets of £105.6m in 2023 after a -£48.6m loss in 2022 and the reported further £100m in 1H24 is what makes the holding in Dignity interesting.

Fun Fact Interruption

A final fun fact to share reader is whenever I’ve attended a Cremation I wonder about the energy use. Dignity reveals it is consuming 0.1 TWh of fuel for about 10% of deaths - so if we cremated every human who died, the UK would consume 1TWh of energy per year. There’s a fun fact for you reader. Pet cremations are more energy on top.

Conclusion

Clearly someone believes the purchase of Dignity has been worth it. It’s true that CGL has made £125m profit on the acquisition based on its re-assessment of NAV.

Taking the average of 3 years of the £1bn Dignity trust’s performance you arrive to a £33m per year average surplus. (+£50m, -£50m, +£100m).

Taking the EBITDA less depreciation less debt and considering the improvements being made you can see how a run rate loss of ~-£20m (pre exception) can improve to £10m - £20m per year.

That’s puts Dignity on a £50m net earnings business. 50% of that is £25m. £323.5m puts that on a 13X P/E based on a forecast 2024.

It’s fairly valued from what I can see - and you’d want to see tangible proof of that £30m-£40m improvement I speak of above and in fact assume.

So am I happy that AUGM will have £3.2m of CGL? I’m not unhappy, but not particularly excited either. There will presumably be a 12 month agreement to not sell so AUGM can realise the cash in early 2026.

Getting the cash in the future and the fact that it’s now listed not unlisted is the win here I believe rather than that £3.2m growing in any significant way.

Final Thoughts

AUGM has bought back 2.4m shares since I last wrote about it 4 months ago. That’s 1.5% of shares and a 4.2p NAV accretion per share.

Meanwhile its market cap has fallen £8m to just £162m which compared to £1.71 is a wide 43.1% discount. If it continues to buy back shares until it exhausts its (forecast) cash there is a further estimated 46p of accretion. The £285m NAV includes an (as yet) unearned but accrued Performance Fee of £17.75m.

And that accretion is before you consider the 375% growth of the NAV itself, that it has achieved since 2020. Why some people invest in Castelnau and its main holding Dignity at a near zero discount and a fully valued P/E while others ignore AUGM at a 43.1% discount is more than a little strange to me.

NB: Interesting to see someone took Tencent’s holding in Tide recently in a secondary sale

If AUGM buys back £66m of stock at today’s prices and grows another 375% we are talking about a £8.13 per share future NAV in 2027. Could Dignity achieve anything even approaching that? Based on its past 3 year performance the answer is no.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".