Dear reader

Is Avation (ticker AVAP) one to buy, or is it one to lease well alone. Let’s find out.

I owned AVAP back in 2021 & 2022 when the price appeared to assume humans would never fly again. I thought they would. I went to the airport with my binos. Not to spot planes but travellers. More travellers filed through as weeks and months passed and my conviction that the assets were undervalued were well rewarded. Since I sold I see AVAP has drifted but a Friday RNS caught my eye “Sale of ATRs”.

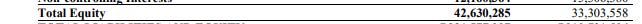

AVAP is a lessor of 34 commercial aircraft, and completed the sale of two aircraft at book value. The NAV being 256p a share and today prices AVAP at 136.5p a share. The deal generated $10m cash after repayment of bank loans.

Founded 2006, AVAP is a commercial passenger aircraft leasing group now managing a fleet of 34 aircraft. Avation leases aircraft to 16 airline customers spread across 14 countries in Europe and the Asia-Pacific region. Major customers include Vietjet Air, airBaltic, EVA Air and Philippine Airlines. The Group’s fleet includes 15 narrow-body jets, two twin-aisle jets and 19 ATR 72 twin-engine turboprop aircraft. Avation operates from its headquarters in Singapore where it benefits from the 8% tax rate Singapore Aircraft Leasing Scheme (“ALS”) tax incentive, and this has recently been extended to 2029.

Trade Discount

It recently “flipped” two aircraft at a gain of $3.7m*, which is a purchase (from new) and sale. Following this transaction, Avation has ten ATR 72-600 aircraft on order for delivery from ATR between 2Q25 and 2Q28. It then has purchase rights for a further 24 aircraft with an extended expiry date of June 2034. 34 aircraft in all.

These “rights” at 31/12/23 were worth $88m or $3.14m per aircraft. This value sits on the balance sheet so isn’t a hidden value, it’s part of that 256p per share. The point was that book value meant a guaranteed gain.

*$3.7m gain is the $10m cash gain less the $6.3m purchase rights - you don’t get to book the same gain twice!

Recent Loss (1H24)

Looking at the last accounts AVAP lost -$8.8m or 12.42 cents per share to the period 31/12/23. This is due a couple of factors. First due to recognition of finance costs being recognised (still) from 2021. Second a loss on disposal mainly due to an Indian aircraft which was repossessed and resold where dilapidation meant it fetched a lower than expected price. AVAP also owns shares in an airline (taken as part of a restructuring deal) and lost $0.5m on the fair value there. Beyond this a change to recognition of maintenance reserves revenue drops income by 10%. But this also increases assets since it recognises the gain/loss over the lease rather than having “lumpy” gains and losses. It makes sense.

Outlook on profit

For the period to 30/06/2024 Zeus estimates a $41.4m gain ($45m PBT less tax) from the -$8.8m loss in 1H24. Quite a spectacular turnaround of a ~$50m increase.

How so?

Well I can’t comment how Zeus arrive at their numbers (they don’t explain) but what do I notice?

In their 24th May trading update, they tell us significantly ahead! Despite this the share price is unmoved.

That Purchase rights grow to $115m. That’s a $27m gain in the P&L on the “Trade Discount” (see the above section) and $27m more NAV.

The monthly lease grows to $7.9m - so that’s $94.8m per annum which is $7.1m per annum above the revenue run rate for H1.

Debt is reduced by some $55.2m so interest is reduced by ~$6.7m

Net proceeds of $10m cash on the sale of two new ATR-72s is a $3.7m gain.

PAL Holdings Inc have a June 2024 Financial Statement where shareholders equity is up 30% so I suspect the remaining circa $6m difference is a gain on investments.

Meanwhile Zeus’ numbers speak to a $44.7m gain from Disposals/Other Expenses. But I can’t see how disposals of aircraft at book value can trigger any such gain (their cash flow speaks to just a $2.9m gain), nor can I see how “Other Expenses” can deliver any gain either, let alone $44.7m. Other Expenses is defined in the accounts as comprised of deferment fees and FX gains/losses. So their analysis is a bit weird!

About ATR aircraft

AVAP’s Purchase Rights and asset of $115m in the balance sheet is based on future discounts on the ATR-72 600 (and EVO) aircaft.

The perception around propellor aircraft might be a negative one. If you don’t live in the Highlands/Islands of Scotland or in Ireland then you probably don’t encounter turbo prop aircraft when you travel.

It’s worth being aware turbo propellers are the most efficient engines burning twice less fuel than turbojets, because they have a different propulsion system from the turboprop: the energy created drives a propeller in return. Because of the large diameter propeller, they require less power, so less fuel to accelerate the air. The turboprop will burn up to 45% less fuel, and emit up to 45% less CO2. They can use 50% SAF and from next year probably grow that to 100% SAF (Sustainable Aviation Fuel). ATR is owned by Airbus and Leonardo, based in Toulouse.

ATR next gen which is about 5 years away offers even more than today’s ATR. 20% further fuel efficiency (using battery/electric for take off), 20% further maintenance cost efficiency and loss further 20% CO2 reduction (or close to 100% with SAF). AVAP has purchase rights over these aircraft which could be in strong demand with airlines.

Valuation

The trading statement is a bit of a game changer. Yet AVAP has dropped from 146p to 136.5p since that update. The market is asleep to the value.

It’s likely that the NAV grows by circa $40m to circa $280m as at 30/06/24 putting AVAP on a £3.10/share estimated NAV so a 56.5% discount to that estimate.

Valuation Drivers

Fully utilised fleet. IATA reported passenger air travel grew at 13.8% in the year to 31 March 2024. International travel is showing particularly strong momentum with 18.9% year-on-year growth in revenue passenger kilometres.

AVAP’s relationship and purchase agreement with ATR is a source of current and future value. The ATR-72 and EVO are the only credible plane in this segment with troubled Boeing having no presence in this segment and others like Embraer exiting the market and DeHaviland/Bombardier being more expensive alternatives. “Cheap and Cheerful” both to buy and to run, with decent reliability seems a decent strategy and AVAP gets to benefit from that through higher margins and higher residual values (a real worry in the airline leasing business).

Debt - more expensive unsecured (8.25%) debt is being actively paid down as well as debt coming due ($92.1m estimated in 2H24 - spoken about in the Trading update) and the perceived risk of financing aircraft a very proposition to when AVAP last raised funds (during Covid). This is a $3.8m saving in 2H24 alone.

Expansion - intrguingly AVAP is at a cross roads.

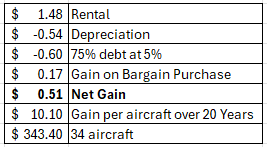

Rather than aggressively paying down debt and selling up its aircraft what if it embraces debt and looks to profit from leverage? Canaccord Genuity identify this as a key inflection where free cash flow is used to reinvest into and to grow the fleet. New ATR-72s appear to be priced at around $16m each based on the Aircraft Fleet and Note 12 PP&E. (Net $12.6m to AVAP less its purchase right). Annual depreciation is around $0.56m (pro rating depreciation 75% jets and 25% turboprops and the resulting $5.68m for 1H24/20 aircraft).

Rental is around $1.18m (25% of $94.8m run rate and divide by 20).

On these numbers it is barely profitable to expand the fleet, and that’s based on using around $3m of equity per aircraft (and $9m of debt) at an assumed 5% interest rate (which is higher than prior bond issues).

But there’s a number of qualifications I’d make to my numbers:

a. They don’t include the $3.4m per aircraft purchase right gain.

b. They assume rental at $1.18m which is a historic pro rated assumption based on a split based on depreciation. Newer aircraft with lower costs of operation would presumably attract higher prices than older ones with higher costs.

c. It assumes depreciation at historic rates. This may or may not be reasonable going forwards. AVAP’s current policy is 15% residual and 25 years straight line which is a slightly lower $0.54m than my $0.56 estimate.

d. Assumes debt being 75% of PP&E and at 5%.

Once we re-run the numbers to assume a 25% higher rental, a lower depreciation, include the purchase gain (amortised over 20 years) and factor in 20 years on income and 34 aircraft we arrive at a $343.4m net gain. An approximate to its NPV if you are happy to accept that rentals (and the value of the discount against the future purchase price of ATR aircraft) will rise roughly in line with the cost of capital.

But this also assumes a business leasing 34 aircraft has the same costs as a business leasing 68 aircraft. It doesn’t. Apart from being able to “sweat” fixed costs more efficiently, a stronger credit rating, and higher FCF and profits lead to better access to cheaper debt. Perhaps too it can negotiate higher rentals as a larger player in the market.

The model also doesn’t capture the residual value. Assuming 15% residual after 25 years that’s $81.6m on 34 aircraft. But eagle-eyed readers will notice my P&L model is 20 years so that adds back a further $91.8m to the residuals after only 20 years.

So a potential future (34 x $0.51) = $17m PBT net monthly income so $204m a year and perhaps $180m post tax. Even if we assume just a 1/4 of this ($45m) and apply a P/E of 6 is a $270m post tax valuation or £3 additional future value per share.

Risk

Obviously another Covid outbreak, or other reason for international air travel to cease would knock these numbers sideways. As happened in 2020-2021. My numbers also assume 100% utilisation of aircraft which is now the case with robust travel demand and limited supply, but post covid that wasn’t the case.

Changes in technology might also transform AVAP’s fortunes. If the world invents teleportation or Tesla’s boring tunnel travel, or something to replace aircraft or if Boeing or another manufacturer perhaps from China, Brazil or India released a superior aircraft. But aircraft purchases are pretty conservative affairs and step-change SciFi technology at least for the foreseeable might just possibly be fanciful impossibilities.

It is also apparent that AVAP is a smaller scale operator than competitors and a larger scale would reduce risk. Its customers operate in an industry which is notoriously boom and bust and the loss on a repossessed aircraft in India is an example of risk.

Conclusion

Certainly AVAP looks cheap relative to its prospects and its assets. CG point out its cheap relative to Aercap, Air Lease Corp and BOC Aviation AVAP is cheaper by about 2.5X (on a P/E and Price to Book basis).

Whilst people could incorrectly (as I did I before examining this stock again today) see the debt pay downs and aircraft disposals as a potential way to “asset strip” and wait for debt to be paid down and assets to be realised to get a net gain…. but it appears the opposite strategy is in motion.

In other words I’ve done a double take and realised this is a growth stock disguised as a value stock!

That growth strategy given the attractiveness of ATR aircraft and of the desirability of air travel, along with remaining in keeping with moves towards Net Zero, make this an intriguing and lower risk way rather than owning shares in an airline, but rather to invest in the growth of CO2-friendlier air travel in a net zero world.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Interesting write up. Do you know the main reason behind why the basic average sharecount increased from 63m in 2020 to circa 69m in 2023?