Dear reader,

I’ve been mulling last Friday’s news from OB25 for 25 idea Avation.

("Avation" or "the Company")

SECURES $85 MILLION EXPANDABLE PORTFOLIO FINANCING FACILITY

Avation PLC (LSE: AVAP), the leading commercial passenger aircraft leasing company, is pleased to announce that it has signed a Term Loan A-style US$85 million expandable portfolio financing facility (the "Facility") in collaboration with a major international bank. This strategic Facility will initially support the refinancing of select aircraft in Avation's fleet, with the flexibility to finance additional aircraft, subject to lender approval.

The Facility enhances the Company's cash flow and strengthens its financial position. Funds are expected to be drawn in the coming weeks, following the completion of standard conditions precedent, in coordination with the relevant airlines.

Avation was advised on the transaction by the aviation team of the Singapore office of Morgan, Lewis & Bockius LLP, led by James Bradley.

Executive Chairman Jeff Chatfield commented: "This landmark Term Loan A facility is a positive step forward for Avation, offering the flexibility to add additional aircraft over time. The facility's interest coupon is substantially lower than the market for unsecured bond financing. Once fully drawn, this facility has the potential to improve the Company's cash flow by up to US$400,000 per month. We are delighted to have executed this transaction with one of our trusted long-term banking partners."

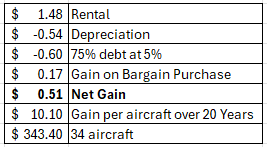

Eagle-eyed readers will know that I modelled a historic and revised model alongside depreciation and cost of debt. Worst case was that it barely made any money. Best case it made loads.

That was when I considered depreciation over a 25 year life and slightly higher rentals we could we interesting gross margins appear. A $343m gain over 34 aircraft over 25 years.

AVAP speak in the RNS of generating up to $400k a month so $4.8m a year. What would those numbers mean? Well in 1H24 ~$800m of assets (planes) generated close to ~$100m of revenue. So pro rata $85m of new leased aircraft could generate $10.6m a year. This implies interest payments and repayments (amortisations) totalling -$5.8m to generate $4.8m cashflow. Assuming a 5% cost of capital (-$4.25m), then assumes amortisation of just -$1.35m per year. That’s too low surely - it would amortise the capital repayments over 63 years!!

So the revenue must logically be higher for them to say “up to $400k” (or the cost of debt lower).

But let’s say revenue is 20% higher. Instead of $10.6m revenue, let’s say $13.1m is possible. That’s -$8.25m of deductions including -$4.25 of finance costs and -$4m amortisation, which is roughly 20 years amortisation. That sounds more like it…. The shoe fits!

“Up to” $13.1m annual revenue from $85m of aircraft is fab! From a P&L perspective -$4.25m finance costs and -$2.89m depreciation (assuming 25 year straight line with 15% residual) that generates $8.56m additional profit.

But, but, but that would equate to a doubling of profits in FY26! (See my prior forecast below). We are 2/3rds into the FY25 year (to 30th June 2025) and they speak of “in the weeks ahead” so once (if) the aircraft are bought and then leased perhaps year end is a realistic time line.

How did the market react to this potentially happy news?

Asleep.

Of course, it’s even funnier that the shares have dropped 15p since the 18th December when news of the buy back and that the NAV had INCREASED by around 15p per share (at a $1.21 FX rate - I use today’s FX rate later on when I speak of another NAV uplift).

Asleep also to the arrears collection news.

There is upside from the AGM statement where AVAP speak of collecting $6.4m. Even if the maximum amount “past due but not impaired” had been collected as part of this $6.4m, then that’s $2.13m impaired appears being reversed (i.e. gets booked as a profit) - but it could be up to $6.4m prior write offs being reversed.

The AGM statement also spoke of record passenger numbers at an all time high. Meanwhile Boeing remains in a quagmire. Booming demand and restricted supply. Even a mole-eyed reader would know that that is a recipe for success.

AVAP also speak of increases in lease rates and market values of 5% per year?! On the AGM video (via InvestorMeet) the expert clarifies the increases as 12% on new aircraft and 5%-7% on older aircraft (if you listen).

Even a 5% uplift in the value of AVAP’s $800m fleet is $40m. Remember some of its aircraft are relatively new (the average age of the fleet is 7.8 years - out of a 25 year life).

If that 5% increase is accurate, that translates to a £0.48 per share increase to NAV although a company can’t according to accounting rules revalue its aircraft upwards (the prudence principle), so that $40m is hidden value (until in the future those aircraft are sold at a gain of course)

Of course I’m merely working through what the PROSPECTIVE numbers could look like. Both the additional aircraft in the secondary market aren’t yet bought (nor do we know at what price) nor are they generating anything. Meanwhile the valuation increase is based on an industry expert and won’t be in the numbers - so you have to decide whether that expert is credible. The ~50% uplifts in funds like Amedeo and Doric provide some level of read across, although long-haul aircraft are in particularly short supply so that read across is qualified by the fact these are mainly short haul planes.

Conclusion

The interim results to 31/12/24 are due on the 25th February.

The news on the arrears, the $85m financing of new aircraft generating $400k cash flow per month, worldwide travel demand is all positive.

While this OB25 for 25 isn’t yet flying, and in fact is underwater -11.5% YTD, it’s certainly cleared for a take off and yes there appear to be tailwinds forming for its acsension.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Good article.

A very sleepy market - I bought some more last week as it hit 140p.

I don't think the $85m will be deployed for new planes, my impression was they have borrowed more secured debt to buy back the unsecured hence improving cash flow but either way this was a big plus that the market has missed primarily due to a strange seller who just bought shares off them for 150p on 28 November and selling down 3 months later for a loss.

Also a 5% generic increase cannot be applied to the fleet but there is very useful information in their investor presentation which they released on their website end of January. They are implying that the value of a 10 year old B777-300ER has gone up by 40%. Bear in mind AVAP's B777 is only 7 years old and they have just secured a lease extension that would generate c$12m p.a. for the next 5 years on that. The value of the A330 has gone up by 20% plus and the market value of a new ATR 72-600 is $23m ( their options are around the $18m mark). I get to a c$50m increase in fleet value applying these uplifts mentioned in the presentation but obviously this is just an assumption as each aircraft will have to be valued individually.

Regardless I see NAV around 350p whenever AVAP applies these uplifts.