Dear reader,

Given the dearth of capital you’d imagine insolvency and corporate finance would be having a busy time of it. So when a reader suggested Begbies (ticker: BEG) I was surprised to see this trading at just 85p.

In fact in its last update in September 2024 it said it had made a good start and was trading in line - with double digit growth in revenue and profits.

So is this fall in price a great opportunity? Let’s try to find out.

“Business recovery” is insolvency practitioner speak for insolvency (i.e. keep it optimistic and let’s assume a recovery), while it also delivers other complementary professional services. Interestingly they deliver services for a bull market (Corporate Finance, Advisory) and a bear market (insolvency). An all-weather stock. A bit o rain niver hurt anyone ye micht say, ye ken? (Translator here)

From a segment perspective it’s two segements: Business Recovery and Services (advisory/valuations/asset sales) and secondly Property.

Management have lots of skin in the game. Ric Traynor is the largest single shareholder (17%).

BEG’s last results are positive. But notice the word “adjusted”. Do not adjust your set. We’ll be coming back to that word. Again. And again.

It’s latest results show a lower EPS but higher everything else. The “E” is after tax and what we see reader is Riski Sunak’s higher Corporation Tax in action (aka let’s increase taxes in preparation for a Labour government in case they say there’s a black hole). Oops. On a constant tax basis, EPS would have been 10.4p. We see just 40% of earnings are being paid to shareholders (60% ploughed back in to expansion).

Acquisitions:

13 acquisitions in 4 years accounts for 2/3rds of revenue growth but organic growth is 33% in 4 years so about 7% a year compounded. That’s pretty good.

Judging by the number and yearly value of acquisitions these come with a ~£4m average price tag - but we don’t get any kind of handy chart to show what the acquired profit was. So let’s try to work that out.

Based on revenue we see 2/3rds of growth is via acquistion. So let’s assume a similar 2/3rds of profit growth is via Acquired vs Organic. So let’s consider what that looks like.

We see above that acquisitions in 2021 → 2022 were 2/3rds of the total (£21m) so I’m splitting 2/3rds in 2022 (when the 4 2021 acquisitions would bear fruit) and 1/6th in 2023 and 2024. I’m then taking the difference in profit and applying the weighting to get how much profit growth was through acquisition. It’s a rough estimate but should give us an idea.

The results are below:

What we see is the delta in profit is pretty good. Remember the delta is the increase so in 2023 the total Adj. Profit through Acquisition is £3.2m + £6.2m and in 2024 it’s all three years so adding those gets us to £27.1m (over 3 years). For 9 acquisitions at ~£36m the increased profits offer a strong ROI. No wonder BEG are doing acquisitions - they are able to grow profits nicely. This flies in the face of those who decry its adjusted profits and lack of statutory profits.

(NB there’s no numbers for the profit from the 2024 acquisitions because we’d need to do that in 2025, do you see?)

The problem with acquisitions is that those one-off ~£4m per acquisition mean Adjusted Profit vs Statutory Profit are quite different. Some people claim the accounts are “too adjusted” for comfort. Is that a real concern?

I don’t think so. No more than if you invested in a marketing campaign to launch a product. Or if you invested in R&D to develop a new product. You have to speculate to accumulate and invest to get a return. Investing in an acquisition is no different. Of course usually businesses would capitalise some or all of such costs and then amortise them over time. Does BEG do that? No. IFRS3 largely prevents them.

If we consider the intangible assets arising on acquisition are being amortised by 33%-50% in a year and that the balance is £8.95m (as at 30/04/24) if BEG decided to stop acquiring then there would be a final £8.95m adjustment, plus the settling up of deferred consideration (presumed to be 100% from acquisitions)

£5.9m of that is “in the books” and £13.1m of that is “off the books”.

So that’s about £28m of future financial commitments. But what if we go backwards. We find a higher figure of £60.8m paid - that’s quite a bit higher than the £4m x 9 acquisitions estimate I came up with of £36m.

Which number is correct? I expect in the £22m of costs in the 2021 numbers contain elements relating to payouts from acquisitions going back to say 2020 or earlier. Also consider that the £13.1m of anticipated future liability is based on future financial performance - and future profits. So £36m still feel to be a reasonable number.

But let’s say it was the full amount of £60.8m to deliver a cumulative £27m operating profit and to add an additional yearly run rate of £11.5m operating profit a year - that equates to an estimated and decent 19% IRR. But remember reader we cannot include the 2025 delta because we won’t know that will be until next year. So £11.5m additional profit per year doesn’t include the delta from 4 acquisitions made in FY24.

So once the £28m is cleared adj. EBITDA would equal statutory profit in the future. Unless there were future exceptional costs of course - but there’s not been any exceptional costs in any of the past 4 years, you’ll notice.

The below chart shows the adjustments in 2024 and 2023 - which are done according to the rules of IFRS3 and how that acquisition consideration must be treated as a cost (and largely not capitalised).

FEE EARNERS

Another way to cut through the nonsense of the whys and wherefores of Adjusted vs Statutory profit is to consider the underlying profitability of fee earners. After all they, err, earn the fees. This is a people business isn’t it?

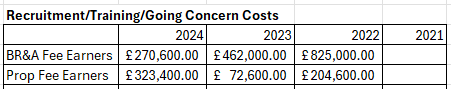

Now if I first of all put it to you that if you didn’t acquire you’d have to recruit. You’d have to train. You’d have to mentor. If you acquire a going concern with existing Professional Service folks then to my mind £20,000 per Fee Earner is exceedingly cheap. Recruitment alone is £6k-£10k per person. Training is £10k+++. So by taking the delta of fee earners “acquired” from 2021 → 2022 etc I see a £2.1m cost saving straight away.

But what about fees themselves? I notice immediately that acquisitions are made without any net additional support staff (from 2022). So you acquire a firm, make all their support staff redundant (I expect), and sweat your existing 150 or so support staff plus invest into systems and automation to ensure growing efficiency and scale.

Notice operating profit per fee earner net of support increases from £47.4k to £56.3k in four years? Isn’t that the proof the strategy is working?

What interests me is the growth of fee earners and their fees and particularly profits. Good news. If we divide the operating profit per year and per segment we see BR&A (Business Recovery & Advisory) grows by 8% per person. We see Prop (Property Mgt) grow a more impressive 40% albeit the profit is only 53.7% of that of a BR&A fee earner. BR&A is more lucrative.

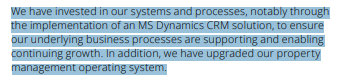

One of the ways BEG “sweat” their support is to put in systems for greater efficiency. This is the latest update to automation and digital transformation:

Shown graphically, where support costs are a negative cost but a static cost (per fee earner), we see growth in both BR&A and PROP.

A view from the top:

Comment by Ric Traynor:

I am pleased to report on another successful year of strong financial performance, which now represents a decade of profitable growth… We have delivered value to shareholders across the cycle having tripled the size of the business with a six-fold increase in profit since 2014.

We have started the new year confident of a further year of growth, in line with market expectations…

Outlook

“encouraging activity levels in all service lines with positive momentum”. Organic growth is anticipated to remain at similar levels for the new year.

Insolvency: activity remains at elevated levels, due to higher interest rates. There were 25,400 insolvencies during the year (previous year: 22,600).

Begbies is ranked #1 nationally for insolvencies, and within this is ranked #2 for administrations. Sectors under particular pressure now are construction, real estate, financial services and support services.

Advisory and corporate finance: should improve as M&A is anticipated to recover later in the year.

Property advisory: “well-placed to build on its recent strong track record”.

Balance sheet:

Net assets are £78m but these are majority goodwill i.e. intangible assets. The balance sheet includes £45m of “unbilled income” in debtors, up from £37m last year. ROCE is 16%, while free cash flow yield is 6.29%. Insolvency should be a good place to invest in a slowing socialist-run economy.

Conclusion

A £136m Market Cap, with a 4.84% yield, an underlying profit of £16m-£18m so a P/E of 8.2 with strong adj. EPS growth.

The consensus target price is 162.7p per share (84% above today). That would put BEG on a P/E of 15…. still not expensive.

In a defensive and counter cyclical sector. Where higher taxes, higher interest rates and higher wages and supply chain disruption has created a ready crop of distressed businesses, unfortunately.

What surprises me is quite why this has slipped down to a £136m market cap in the first place. I’m sure if the imaginary Begbie from the film held this share he would be furious. But then again he was furious about most things. I think in the film Begbie fell asleep and Renton made off with the loot.

Whoever the sleepy nutjobs are selling this well I see it as their loss and someone else’s gain.

Canny investors - like Renton - who are brave enough to defy the market (which is also asleep to the value) have a similar opportunity here.

Just be careful of that chap with a trainer.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

https://ii.co.uk/analysis-commentary/stockwatch-next-cheap-share-be-taken-over-ii535397

Thanks for this analysis. I found it very clear and easy to follow. I particularly like the analysis of fee earners. However, I also think that most stock market investors struggle to understand professional service firms and how they can grow their fees and profits, so I think something like GSF can more quickly attract buyers because the concepts of discounts to NAV, high and covered dividend yield are easier to understand.