Dear reader,

I wrote in BELL-onging together the terms of the TMTA cash-quisition.

Since then the terms have changed in 2 important ways.

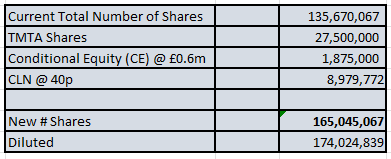

First of all, the number of shares changed. For the worse for BELL-folk. About 7% more dilution than expected, but loan sharks would’ve been worse still.

Second of all in a positive way, for BELL-folk. I showed this diagram which described 6 scenarios.

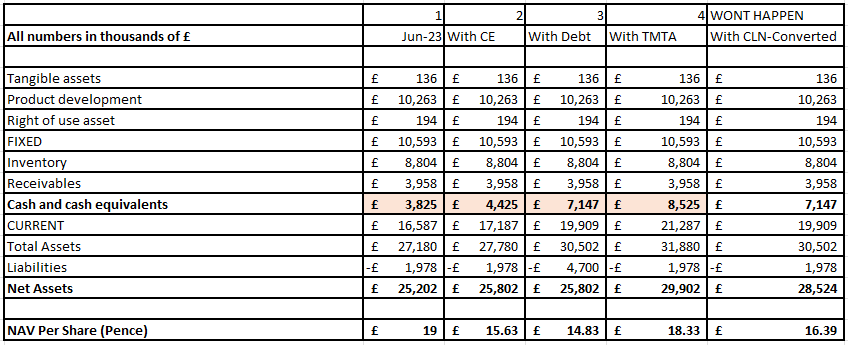

#1 was the status quo as of June 23. Each share had a net asset value of 19p.

#2 was a “conditional equity raise” of 1.875m shares to raise £0.6m

#3 was originally Convertible Loans. This is the positive for BELL-folk.

#4 As part of the TMTA cash-quisition the CLN (convertible loan note) holders all promised to not convert their debt. So scenario 5 now won’t happen.

So BELL-folk can point to a 0.67p/share “loss” or dilution but all in all even at adverse terms to those initially agreed it’s still a positive deal and takes BELL to forecast cash positive.

I’ve highlighted the cash in red but of course this is net of expenditure in the past 7 months.

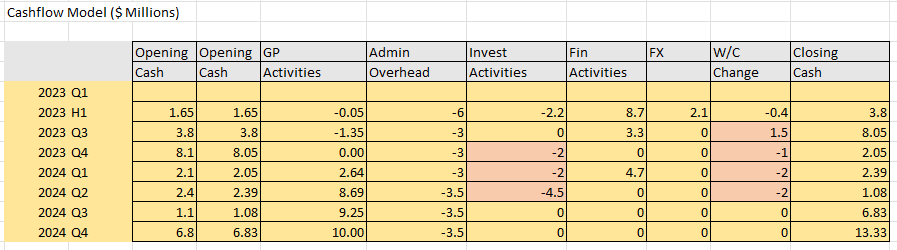

But revisiting my cashflow model where we see +£3.3m from the #2 placing and #3 CLN in Q3 last year, and now the TMTA in 2024 Q1, we see funded growth and the liquidity and readiness to MAKE MAKE MAKE and SELL SELL SELL

After all, there’s a pipeline of orders, there’s Innomax with sign off in China, Hong Kong and Singapore. There’s a new sieve which has meant significantly higher margins.

There’s much to play for, and while the endless stream of highly technical and dare I say the not terribly interesting and complex RNS’s about TMTA, it’s now complete. The shares get issued tomorrow and the money flows to the coffers.

The product is in place, the production is in place, the marketing is in place (and it looks amazing - check out the video below) and what other device has the weight advantage, and coverage - where providers are saying they will ONLY sell BELL.

Meanwhile, we have one of its giant competitors Phillips on the ropes falling foul of the Daily Mail’s favourite story - Cancer - how the mighty fall - £400m liability. Ouch.

We only have to look at its stablemate SALT to see how quickly fortunes can change, and how finding a way to secure and fulfil orders quickly turns sentiment from despondency to greed.

So now it’s time for BELL to SELL - Schnell! Donner und BELL-itzen!

This is not advice, ja?

Oak