Dear reader

If you believe in this idea* and this strategy, and had the guts and gall to buy as the market panicked then you were able to pick up stock sub £30. Will that prove to be a wise move? Rapid progress to assemble a tariff negotiation team show the Japanese don’t mess around. Rapid progress to cement stronger trade agreeements with China and SE Asia also occurred during the week and Japan’s government are extremely commercially aware.

Japanese Smaller Companies Fund - ISIN Number GB0006014582 SEDOL Number 0601458

Before averaging down sub 3000p I’d considered the US tariff exposure to each of these ideas and in some cases it is zero due to being Japan domestic focused (Lifenet, Katitas, Cosmos, Infomart, Raksul, Avex, GA), or had a US operation (Nifco, JEOL, Gift) or predominantly sells to countries outside the US (Yonex, Nakanishi). Of course some holdings like Noritsu Koki weren’t so lucky, and automotive is complicated by a weave of relationships, so some hits to some shares were inevitable. But I did think it was overdone and strong bounces by yesterday confirmed this.

Even after the Lib Day carnage, the share prices of the top 20 holdings are up 8%, and top 10 down -1%, with strong recoveries noted once Trump clarified his plans and the Japanese delegation opened negotiations within 24 hours (Jack Bauer would be proud). Japan does operate protectionist policies towards its farmers and rice farmers particularly are spectacularly subsidised. There are no megafarms in Japan, only artisans practising methods hundreds of years old. Quaint is how the Americans might put it. But the Japanese take great pride in their craft. Having watched hundreds of hours of NHK Channel I’ve watched interviews from Cherry Farmers, Wagami Beef Farmers, Fishermen and others. I find it relaxing to do so.

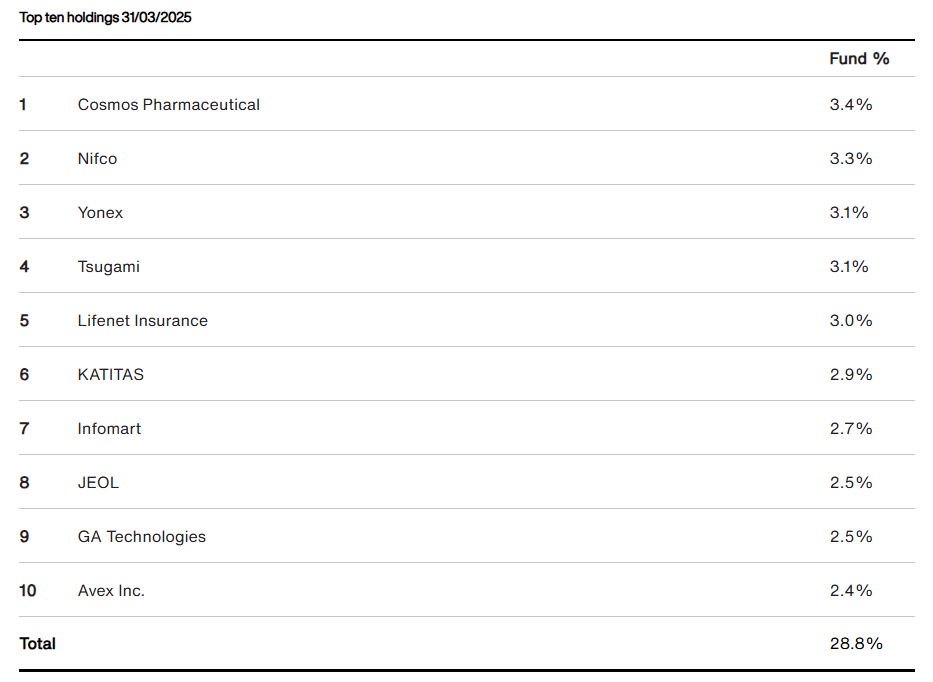

Anyway we see some movements this month “Racquet-maker” Yonex falling from #1 to #3 and “Boots the Chemist” Cosmos taking up the reins. I was pretty sure the Giffs had bought more for this Fund back in March - so smart move.

Others like “DJ Equipment” Noritsu Koki are dramatically down despite posting strong growth in 2024 profits despite making heavy investments in product development in 2024. This exports heavily to the US so is a victim of confidence, although with tariffs dropped from 24% to 10% and who knows a trade deal on its way (Japan will likely do an “extraordinary” deal in Alaska to develop LNG facilities and pipelines there - it needs the energy).

Meanwhile there is no reflection of the positives in many Japanese share prices.

The top 10 shows a new face GA Technologies. More on that later.

#Not Top 10 - Harmonic Drive

This is down a third since I wrote about it in March and YTD down 20%

Management released their medium term targets to grow the business and improve profitability. A 25% EBITDA would deliver a £138m net profit for this £1.94bn market cap putting it on a P/E of 14X.

They have just released new actuator products able to deliver up to 0.01mm mechanical accuracy. Actuators make things move. Things like Robots, Machines, EVs, Drones. The smoother you make something turn the longer its life and the lower its power consumption…. you get the idea.

HDS make ultra smooth gears which flex and deform using ball bearings inside the ring to reshape to suit temperature changes and other factors.

Management tell us:

“We expect demand for the Group’s products to continue growing, driven by their essential role in advancing technologies such as the transition to EVs and the adoption of surgical robots. Further, in addition to a projected increase in demand for collaborative robots amid a growing trend toward automation driven by global labor shortages, we anticipate an expansion in the adoption of humanoid robots, a new market segment, suggesting significant growth opportunities over the medium to long term. To capitalise on these opportunities, we will strengthen our management foundation and execute strategies that balance proactive, growth-oriented initiatives with risk management and stabilising measures, aiming to enhance corporate value over the medium to long term. Additionally, we plan to accelerate our cost innovation project launched this fiscal year, while continuing to implement bold, companywide reforms aimed at improving manufacturing processes and enhancing operational efficiency. Through these measures, we aim to further improve productivity and profitability.”

#5 Lifenet

This caught my eye. EEV is embedded value for March 2025, so the “fair value” of insurance contracts. This is up 40% YTD share price, but a 33% increase to adjusted net worth is the “NAV”. While they’ve not resolved the promised logo refresh (worse than ABRDN) the growth and profits growth is impressive.

#9 GA Technologies

Sometimes when you look at a business you ask what do you do? You read their about us page. You think yes but what do you actually do?

GA is a real-estate BTL (buy to let) marketplace platform - like a “Rightmove” of Japan. Except more of a “RightRent”. They connect sellers and buyers along with lots of metrics of rental yields in the local area, and other metrics so that buyers can buy properties knowing there’s good schools, fast internet, what the Council Tax will be…. because they can use that info to market that property to renters. AI is heavily involved and automation delivers info to buyers and sellers.

GA remains involved and provides a platform where you can set up a Direct Debit for your tenant and use an App to see the money flowing in from your portfolio, and it will even submit your tax return to Japan’s HMRC (NTA - National Tax Agency)

In fact GA will manage the property, find tenants, handle complaints and gripes, for a fee of course. So it is “Rightmove” cum “Savills”.

Fascinating to see the majority of renters in Japan are aged 30-50. Also thinking about Landlords that well over half are using it as a pension plan - harks back to the UK pre-George Osborne that Brits used to be able to do that too.

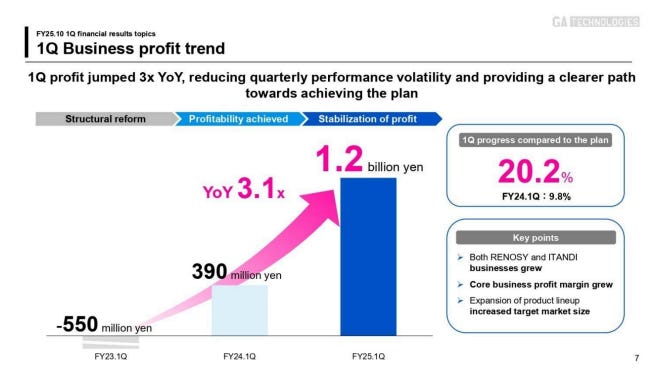

Profits shot up at GA in the latest results. GA have amalgamated what were separate websites and services for a/ investment b/ property management c/ leasing all into one web site with accompanying smartphone App.

GA don’t get involved in property development and non-BTL property sales. These are dominated by “Zaibatsu” conglomerates. Meanwhile its sector is a £202bn marketspace only filled with fragmented players. There is neither a “Savills” nor a “RightRent”…. so an opportunity.

If they can dominated Japanese rentals the broaders real estate investment market is double at £410bn (buy-to-sell) that doubles the opportunity.

If they can dominate Japan they plan to rinse and repeat overseas. They eye the US rental market worth £3 trillion.

The Japanese rental market is 19.25m and GA have 5.7m units so 28% of the market use GA for rental management. Yet only 0.1% of the market bought via GA’s acquisition service. Putting the web sites together was the key to drive higher level of cross sell and adoption of its buy and sell services for BTL landlords.

There are 114k Real Estate firms in Japan and 4.5k use GA’s data services.

GA Data Services is essentially a CRM system replacing pen and paper, people’s heads and excel spreadsheets - currently used by the vast majority.

GA have a medium term plan to grow profit margins from 13.3% today to 17.9% by FY26 and 20% longer term. 13.3% was a +205% increase on 1Q24…...

Slightly down on 4Q24, but 1Q is a slow quarter for Japanese real estate.

Conclusion

GA appears to be an exciting way to access “RightRent” consolidation of Real Estate rentals. 1209m yen profit 1Q25 annualised equals a £25.7m profit on a £281m market cap putting it at a 10.9X P/E.

Extraordinary value.

While battered stories like Harmonic are down a third, are releasing products that are world-class for rapidly-growing markets of robotics and EVs, and speak of focus on a turnaround strategy.

I remain optimistic about the prospects here.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings including those held within a fund might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Hi Oak Bloke, Thanks for your posts which I recently discovered. Great Stuff.

Am interested why you choose this fund and not the investment trust version though? The Shin Nippon trust is on a discount to NAV so may be better value?