Dear reader

The Bos Veld or Bushveld is an area of “bush country” in South Africa, home to many mammals. Home, too, to Bushveld Minerals (ticker BMN) which became a critically endangered species in 2024. Given the multiple of funding updates, divestments and the 2023 results what’s the net result? Let’s explore that.

BMN operates one vanadium mine and two primary vanadium plants. It owns a 2nd vanadium mine (for now), a coal mine (for now), part owns a Vanadium electrolyte factory, a VRFB manufacturer and a solar array which part powers its Vametco plant…. all for now. It owns $2.2m of residential property in a place called Brits.

In its hunt for survival it is selling one plant - Vanchem - selling its 2nd mine, Mokopane, and has a proposed share of EBITDA agreement on its coal mine with its fully permitted and its existing Definitive Feasibility Study, but is keeping its Vametco plant and mine - then has put everything else up for sale.

Let’s work the numbers:

Cash

At first glance BMN has suffered catastrophic losses in 2023. The bad news continued in 2024. Shareholder’s equity has been wiped out in the 2023 balance sheet. But these losses of intangibles will partly reverse in 2024 since a stream of sales is occurring to sell and monetise those intangibles. More on that later.

Cash flow - the refinance in 1H24 completely transforms the seemingly insurmountable debt mountain.

Bear in mind, too, the $195.2m of incoming cash excludes:

a/ the future $15m-$20m earn in from Vanchem Vanadium plant

b/ the future 25% EBITDA earn in from the Lemur Coal Mine (to be finalised)

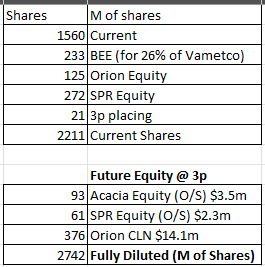

c/ $3.5m 3p equity subscription from Acacia due by end of 2024, a $2.3m SPR equity subscription ($14.9m equity includes $4.7m Orion so $10.2m of equity is SPR despite SPR agreeing to $12.5m of equity on the same terms as Orion i.e. 3p a share).

d/ Any Operational Cash flow (or deficit)

e/ Vanchem trade creditors which of course will belong to SPR (Vanchem’s creditors were $13m in the Q1 update)

f/ The sale of Belco (on the books at $5.9m)

g/ The sale of VRFB/Cellcube ($1.3m but in my estimates I’ve reduced this to zero)

h/ The $2.2m of residential property

i/ The $1m of mini grid

j/ $5.7m of new equity via Acacia ($3.5m due by end of 2024) and $2.2m further SPR equity to arrive at $12.5m equity.

k/ Conversion of Orion’s $14.1m CLN (Collateralised Loan Note) at 3p - so this turns debt into equity - and if the share price goes above 3p as I believe it shall it would make sense to do so.

But do bear in mind also that the $195.2m of incoming cash contains $87.4m of new debt (so it’s recycling old debt for new debt, in part).

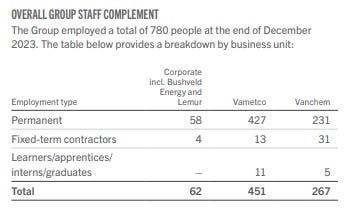

The disposal of Vanchem also reduces costs by at least a third based on head count or 40% based on Plant, Property & Equipment.

Plus $1.5m per annum head office saving have been achieved in 2024 via restructuring, as announced.

Post Vanchem/Mokopane and assuming a $67m 2024 gross loss (more on that later) offset by the cash generation (via equity/new debt) described above but also the estimated offloading of liabilities relating to Vanchem (environmental reclamation, medical liabilities) means the 2024 impact is serious but manageable.

A number of times Craig Coltman pointed out that BMN’s accounts have a “going concern” basis until June 2025 (I was surprised this wasn’t until December 2024). When you analyse the numbers it’s clear to see how this is achievable despite a series of setbacks in 2023 and 2024.

Profit & Loss

Assuming that the estimated vanadium prices quoted by BMN based on expert forecasts are correct then 2024 average selling price will be $27.70kgV (it was circa $26kgV in 1H24 therefore would be $29.46/kgV in 2H24) and in 2025 averages $34.40/kgV.

In my model C1 cash costs are a Vanchem/Vametco mix until 4Q24 (i.e. until the end of September this year) and then Vametco only thereafter. I model the Other Op Costs (which are selling & distribution mainly) based slightly falling costs so are approximately steady state 2024 - 2027. I see idle costs falling (many historic costs were Vanchem, and overdue capex measures). $5m of sustaining capex for Vametco and $5m of growth capex (slimes and barren dam) are referred to by CC in the presentation.

I model based on 240 tonnes a month in 2025 growing to 280/month in 2026/2027. I also model a reversion to a more normal $40 per kgV from 2026, partly based on targeting higher value aerospace and US markets. The model uses BMN’s own selling price estimates for 2024 and 2025. I don’t model for further improvements to admin costs although do assume reductions in finance expense as the debt burden falls. Finally I assume the full $20m of earn in from Vanchem arrives but that once Highveld Robust Steel is supplying slag-rich ore that Vanchem’s FCF leaps and leads to the full $20m earn in being paid (which I consider a perfectly reasonable assumption)

There is no consideration for income (or loss) from Belco (which might be sold or might contribute to the P&L - the jury is out), from Lemur (verbally 25% of EBITDA is said to be the deal under consideration - which could be upside from FY2027), or from VRFB/cellcube. I’ve not considered FX gains and losses in my analysis.

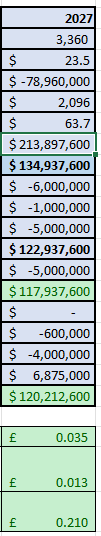

This is the effect for BMN for all of the above:

Valuation

Based on FY2023, FY2024 and FY2025 the valuation is a moot point. Zero potentially.

But based on forecast net profits in FY26 and FY27 even at a measly P/E valuation of 6, and a vanadium price of just over $40/kgV, make today’s half penny price a bargain.

0.5p is a future P/E of 0.4 falling to 0.3.

Price of Vanadium

A crucial part of my model is the price of Vanadium. Some might criticise and say why do you assume $41-$42 a kgV.

Far from being “optimistic” I think $41-42 is pretty pessimistic, actually.

Let’s consider 114 years of Vanadium pricing. Between about 1930 - 1970 the average was around $6 per kgV and 1970-2024 $25 per kgV is a more realistic average.

Adjusted for inflation and using mid points, we arrive at well above $41-42.

In fact if $63.7/kgV is the inflation-adjusted average then even at that average price the profitability of BMN grows astonishingly! 3.5p EPS and a 21p valuation. And that’s the average - not the possible $100/kgV+ that “could” happen.

Conclusion

I only have a small position in BMN but I decided not to sell that, following the FY23 results despite those “looking” atrocious.

Clearly many have decided otherwise following the 140% price spike on the Orion $10m funding news. The price falls this week leave it at a tempting half penny.

Though risks do remain, the overall risk level has decreased and the forward numbers look pretty interesting. The market meanwhile appears oblivious to the opportunity where yesterday’s bad news masks tomorrow’s brighter news.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

"Far from being “optimistic” I think $41-42 is pretty pessimistic, actually."

You are aware that the Chinese construction market is the main catalyst for vanadium price movements? With the sector on the floor due to the property crisis, I don't see V prices recovering for years. Unless VRFB demand significantly raises the requirement for vanadium (unlikely in short term as China is the only one building batteries and they don't import), Bushveld will go bust before the V price gets anywhere close to $40.