Dear reader,

I spoke before of my belief that robotics combined with AI will be a transformative form of productivity. It seems that Fillippucci’s research agrees. Certain sectors are ripe for disruption through AI. But even more than this the combination of AI and robotics is going to have the largest effect on future productivity.

Adding nearly 1% to GDP. For the UK which enjoys a $47,000 per capita GDP that’s $470/£370 per year - every year.

This idea comes from research I carried out earlier in 2024 when I grew annoyed that ETFs didn’t do what they said on the tin.

Except this one did.

BOTG is a Robotics ETF which contains conviction picks that actually offers Robotics in a meaningful way, and has decent Japanese exposure.

Why Japan? Because 45% of Japan trades below a P/B of 1. That means its companies are cash rich and have strong balance sheets. Very often have many patents and know how and a pride in their craftmanship.

Haslinda Amin from Bloomberg has produced a series of programs about Robotics and Japan. Great minds think alike, and fools rarely differ. You can decide which.

For me Robotics is all about the “Capital Goods” and the “Technology Hardware”. Pretending that Software IS robotics is a fallacy. Pretending that Semiconductors is Robotics is a fallacy too. Software is the brain synapses of Robotics and chips are the brains but for me robotics is how machines interact outside a screen or outside a VR helmet. How machines interact in the physical world. How they collaborate and enhance. How they drive productivity. The idea of Cobots, collaborating with humans to make them more productive.

BOTG offers over 50% exposure to the good stuff. With about 25% to software/semiconductor companies. And 15% health. But we’ll see even these seemingly irrelevant non-robotic areas are actually highly relevant to and supportive to an investment in Robotics. So let’s look at the top 10.

As I said BOTG is a conviction play. The top 6 account for over 50% of assets. Nvidia is #1 holding. I incorrectly assumed in part 1 that this was just semiconductors.

I was also concerned in prior articles about US holdings being at very high multiples. So this is why I wanted to find Japanese holdings. With BOTG I get 26% Japanese, 54% N.America and just under 20% Europe.

#1 NVIDIA 12.79%

You were only meant to blow the ruddy doors off!

NVIDIA has accelerated software and compute by a 1,000,000X in the last decade, far surpassing Moore’s law. People get wrapped up and giddy about AI but this is arguably computing speed and efficiency is actually the real breakthrough of the 2020s and quantum computers promise to deliver much more.

We associate Nvidia with chips and that’s only part of the story. NVIDIA is a platform too which is installed in several hundred million computers, is available in every cloud and from every server maker, and powers over 75% of the TOP500 supercomputers, and has close to 5.5 million developers using it.

With an EPS of $3.24 and a PE of 40 it is actually not as eyewateringly expensive as I feared it would be. Although a £2.54tn market cap makes it £0.17tn more valuable than the entire economic GDP output of the UK. Owning part of something that valuable rather baffles me.

NVidia GPUs are core to Data Centres and to gaming with revenue is up 122% y/y to $30bn, and engaging in a $50bn buy back program.

But it was fascinating to learn that NVidia isn’t just a semiconductor company. It has a number of programs and “platforms” that have become industry standards and add value in some serious ways. Especially when the rest of the Mag 7 are placing gigantic orders with this Mag 7 member (and not making GPUs and platforms themselves). That tells you something about the ubiquity NVidia has created for itself. Felix equipped with his handheld Mic and dog Winston in the below video sets out why he believes NVidia will grow to 11X more than today ($1520 per share vs $135 today). Despite the Oak Bloke not being a fan of big companies (too little hidden value), I can’t (yet) really argue with Felix’s logic here. Have a listen and I’d be interested for reader’s thoughts on the truth of NVidia growing 11X as Felix sets out.

Product#1 - Blackwell

Much of the valuation is predicated on a new generation product for Data Centres called “Blackwell”. But this next generation is just an evolutionary process. Meanwhile GPUs wear out and must be replaced at a rate of 9% a year but as AI usage increases that number of replacements rises too. On top of revenue of selling GPUs NVDA also charges a subscription for its platforms.

Product #2 - Spectrum-X

NVDA speaks to a new “Spectrum-X” product for AI ethernet, and how this will use 10X the number of GPUs of the current generational product.

Product #3 - NIM

Also NIM inference microservices which is a set of pre-trained large language models for use as a copilot for AI applications. This is a platform from which you can rapidly build out an AI service.

Product #4 - Isaac

NVidia sells the “Isaac” robotics platform for humanoids and mobile robots. It works with many of the Robotics firms worldwide by providing the Isaac platform. There is also an Omniverse platform which deals with the laws of physics. NVDA tell us that their AI Microservices allow Roboticists to enhance simulation workflows for generative physical AI. This is to further the development of humanoid robots.

While a P/E of 40 could be thought of as expensive the quality and range of capabilities is impressive. I hadn’t fully appreciated that NVidia is engaged in a far wider range of activities than just manufacturing GPUs. The fact that these wear out and must be replaced is also not widely understood, perhaps.

Besides the knowledge that it has evolved beyond Semiconductors and appears to be deeply involved in both the fields of AI and Robotics. So as a #1 Robotics pick I’m actually happy.

INTUITIVE SURGICAL 10.5%

The P/E of 73.6 makes this even more expensive than NVidia but the recurring revenue and ability to grow faster than the current 17% growth rate means I’m happy here too.

Doctors use many technologies that enhance their capabilities beyond what the human body allows. MRI and CT scanners, for example, enable doctors to “see” inside the body. Similarly, many surgeons perform robotic-assisted surgery using a da Vinci system because it extends the capabilities of their eyes and hands.

So Surgical Tools that make surgeons more productive, and drive better outcomes for patients going under the knives. This is a “Cobot” form of robotics, working with expert surgeons and making them more productive and more successful. Many hands make light work and that’s what these Cobots do.

The number of procdures is growing, and hospitals with at least one intuitive robot which have gone on to buy more robots are strongly growing the number of robots i.e. it appears clear they are proving their worth.

What is noticeable is the degree of recurring revenue from instruments, accessories and services. A 69.1% gross margin for physical hardware (and software) is an impressive number.

#3 ABB 9.4% of assets

A P/E of 23 with 13% EPS growth Swiss based ABB says “We help industries outrun – leaner and cleaner”. It is a leader in electrification, metallurgy and automation.

It speaks to secular trends to why Robotics matters

Electricity demand is growing >10x faster than other energy sources in 2022-2030, resulting in ~50% higher average annual investment into electricity networks.

Higher energy-efficiency ~45% of the world’s electricity is converted into motion by electric motors yet only ~23% of the world’s electric motors are optimised through the control of drives

New energy sources Share of low-carbon sources in global energy mix to increase +50% from ~20% today to ~70% in 2050

Shrinking labor force Global number of working age people (15 to 64 years) per Retiree (65+ years) will fall by ~20% over the next 10 years.

ABB works across a wide range of verticals, geographies and via a variety of channels.

Electrification is a key area of focus generating $14.6bn revenues with a 20.1% EBITA margin in 2023 (but reached 24% in 3Q24). Electrity demand is growing 10X faster than other energy sources through continued urbanisation and population growth and the energy transition. Smart Power is a growth area along with Smart Buildings.

Motion is $7.8bn revenues, with an 18.9% EBITA margin and focuses on industrial processes, drives, electric motors and generators.

Process Automation is $6.3bn revenues with a 14.5% EBITA margin and focused particularly on O&G, mining and process industries, chemicals and marine.

Finally Robotics is $3.6bn revenues with a 14.7% EBITA margin and focused on automotive, food & beverage, packaging and printing.

#4 KEYENCE 6.7%

Japanese Keyence say they don’t engage in R&D they engage in INTENSE in-house R&D. They proudly claim “world’s first”, “world’s fastest” and “best in class” titles to 70% of all their products. Serving 350,000 customers in 110 countries with sales of £5bn growing 10% for over 25 years and net income of £1.8bn on £14bn equity, and a £84.6bn market cap puts this on a P/E of 42. Clearly popular.

Its robotics division focuses on vision and sensors, with measurement a key core competency.

NCAV is astonishing. £6.9bn where even just its cash exceeds total liabilities by 2X! Their shyness is noticeable. With no Investor Relations web site, no presentations, and a minimal annual report. Clearly their focus lies elsewhere.

Earnings are forecast to grow 20% in 2025 and 20% more in 2026, with strong analyst recommendations. Much of that forecast growth is in the US and Europe, with China actually in decline.

#5 SMC 5.0%

Japanese SMC was not seeing any such decline in China with over 28% of sales and 44% to wider Asia ex Japan but more recently reports China is worsening. A P/E of 23.8 and net assets of £9.8bn and mar cap of £20.6bn. Analysts are bullish here too, and see a 40% average upside.

SMC is heavily involved in industrial automation and the “nuts and bolts” behind robots. Underneath the shiny exteriors of robots lie actuators, switches, valves, vacuums and sensors.

But also in process control automation across a range of industries. Replacing a human pushing, gripping and turning something with a compressor, dryer, valve and actuator that automates that.

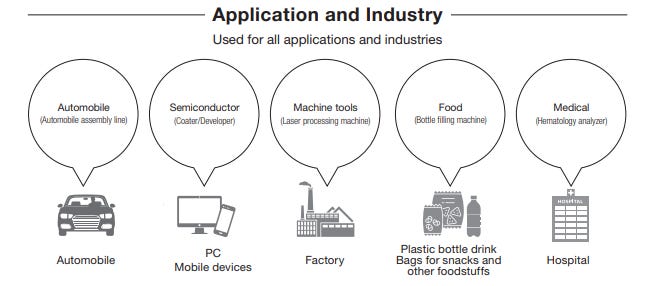

SMC serves a wide range of industries:

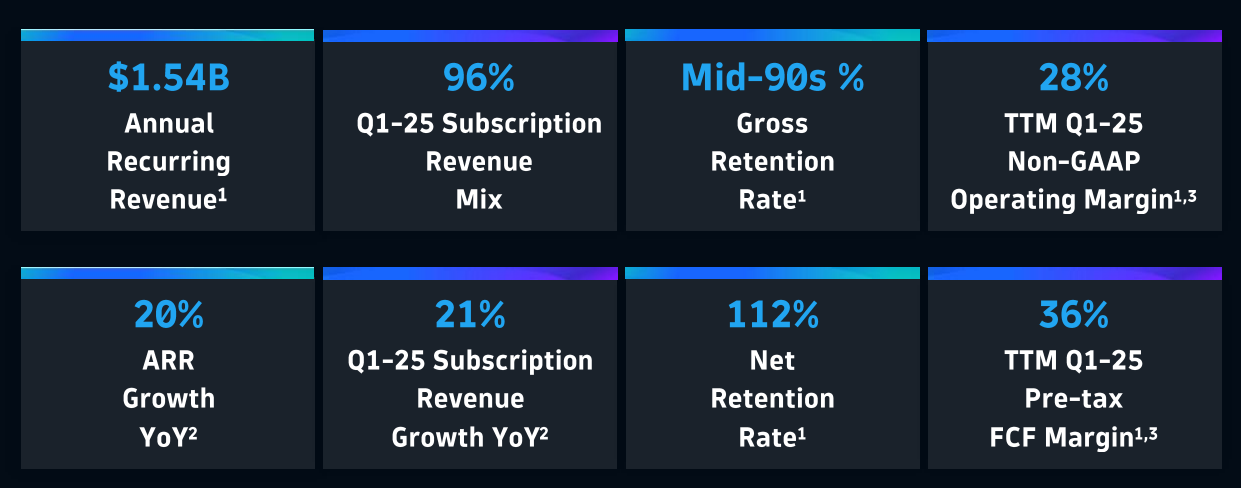

#6 DYNATRACE 4.66%

US Dynatrace is a process builder with an AI layer with some strong growth and retention metrics.

The commercial story is automation, alerts and efficiency - for British Telecom for example it reduced outages by 50% and felt like having “1000s of analysts helping us understand where to focus effort”

Jonesy can talk and walk you through the developer intricacies, if you want to know more. It is impressive and worth a watch if you are technically minded.

#7 FANUC 3.83%

Japanese Fanuc was at position #21 in RBTX and is #7th largest here. Fanuc is a Japanese Robotics company then we find a £20bn market cap, generating £0.7bn net income and growing with a P/E of 28.5. Quite reasonable numbers and a 50 year track record of growth.

Its investment in R&D is around £0.25bn a year. It holds a (I think) incredible 12,475 patents worldwide(!) and 30% of its nearly 10,000 workforce are engineers. Its relentless focus on aspects like reducing start up times and improving power efficiency on robots continually drives further value to customers. Another focus is on “cobots” to seek ways to drive human productivity through a robot assistant particularly in areas which are dangerous, dirty, difficult or monotonous.

Its range of ROBOMACHINE spans a ROBOSHOT (Rapid Injection Moulding), ROBOCUT and ROBODRILLs are up 12.8% year on year. It also has an IoT proposition for maintenance management with sensors monitored by an AI.

It sees 7.2% growth to net income over the coming 6 months.

#8 DAIFUKU 3.6%

Any Japan-ficionado will know that a Daifuku is a tender mochi ball filled with a sweetened bean or fruit filling as pictured. The word means “Great Luck” in Japanese and eating daifuku is part of what the Japanese eat for New Year, traditionally with green tea, as part of an Osechi which is a type of Bento box.

Daifuku the Japanese company meanwhile, is a £5.45bn market cap with an operating income of £0.33bn putting this on a reasonable 16.5 P/E, with a 41% growth in orders, 7.8% sales growth and nearly 100% income growth in 1Q24 to June 2024.

Daifuku’s largest segment is intralogistics - conveyors, picking systems, vehicle systems, rack systems and automated storage with retrieval.

Perhap you will encounter Daifuku the next time you fly. Those Bag Check In devices that spit out a sticker and you loop it around your handle and haul it to the conveyor. Its airport business has tripled in 2024 vs 2023 as airports massively bounce back to life and struggle with capacity and automation is top of the agenda.

Also the next time you visit a car wash your vehicle might be sprayed, foamed and brushed by a Daifuku machine.

#9 Pegasystems Inc

PEGA is a software automation provider working to automate and workflow both cloud and on-premise platforms.

Overheads appear to be fairly fixed at $0.9bn a year and its order backlog grew from $1.26bn to $1.48bn in its latest results so there appear to be good reason to think they could be right.

Pega is well regarded by analysts including with Gartner.

Pega abounds with positive customer stories. One I can directly speak to is my own past positive experiences with Booking.com - who chose Pega.

Pega transformed its customer support with Pega Customer Service™ on Pega Cloud®. This transition centered on the agent desktop, encompassing integrated knowledge management and BPM workflows across all customer processes – with channel solutions like voice, email, and chat on the way.

The company’s goal is to make it easier for agents to support customers and partners by way of an integrated, intuitive platform that enables them to provide seamless support. In addition, Pega’s out-of-the-box capabilities allow Booking.com to stay agile in the face of changing customer behaviour.

The Results

Since implementing its solution in Pega, Booking.com has seen the following results:

Improved compliance

Lower average handle time driven by simplified processes and automation

Increased agility through application reuse and low-code development

Higher agent satisfaction driven by the platform’s intuitive user experience

Where’s the robotics?

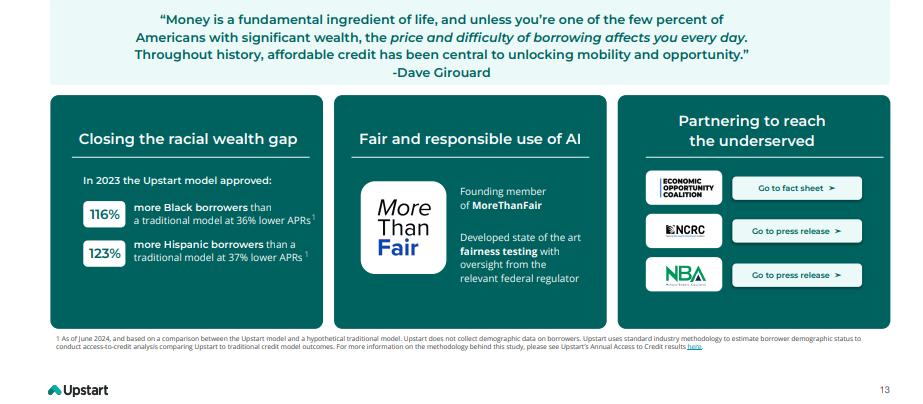

#10 Upstart Holdings Inc

A $7.7bn market cap which is EBITDA positive - just - and is heading towards profitability with a forecast $1 EPS in 2026 on a $83.97 share price would put this around a P/E of 80X. That’s pricey.

So why would you pay $7.7bn for this? Well if you’re a lender then since 2018 its AI has delivered a 9.5% return but today improved performance is delivering ~14% gross returns…. the AI has got smarter.

If you’ve watched the Big Short and remember the scene where the loan shark sales guys are high fiving each other and one was a bar tender and now owns a boat because they hoodwinked immigrants into unaffordable loans, then you can picture the efficiencies possible by introducing AI into lending decisions.

Minority communities would probably complain of the opposite problem - they can’t access money - and no one will lend to them….. it seems AI will, more often.

Thinking about Michael Burry the rock music aficionado character who said of the mortgages that “I read them all”. Everyone laughed - who reads those? Well today AI would read those.

Once it had if would have a way to grade default risk and credit scoring, to make smarter decisions and to optimise the APR i.e. the risk/return better than the next guy.

It has led $40bn of originations since inception, but the TAM is vast. 75X larger than today. PER ANNUM!

There are a couple of points of note - stock based compensation is vast $142.3m per year! So dilution is a consideration - about 6.5% a year.

The balance sheet has nearly $0.5bn of cash so this is well funded.

The Robotics connection here is tenuous and this holding could easily be in a Fintech ETF or an AI ETF rather than a robotics ETF.

#11 OMRON 2.8%

Japanese Omron is a turnaround play; its share price is down 60% from 2022. You may wear an apple watch or similar today but Omron were the first to market with a smart watch back in 2018. The first with automatic ticket gates in 1967 and the first with “Smart” Traffic Lights back in 1964 (how have we not had a 60 year celebration this year that at least some traffic lights turn green quickly because they know you’re the only one waiting! I’m sure there’d be universal backing for an Omron day to celebrate)

Today, Omron’s biggest segment is robotics. Its robots are used in warehousing and manufacturing for logistics but also collaborative production robots in an industrial setting.

Some of Omron’s robots don’t move around. The Oak Bloke, on a recent business expedition, encountered an Omron robot when checking in to the Purple Palace which is advertised, but not frequented by the 2nd most famous hobbit Lenny Henry. It provided automated check in facilities as pictured. No humans were involved in the checking in of this Bloke.

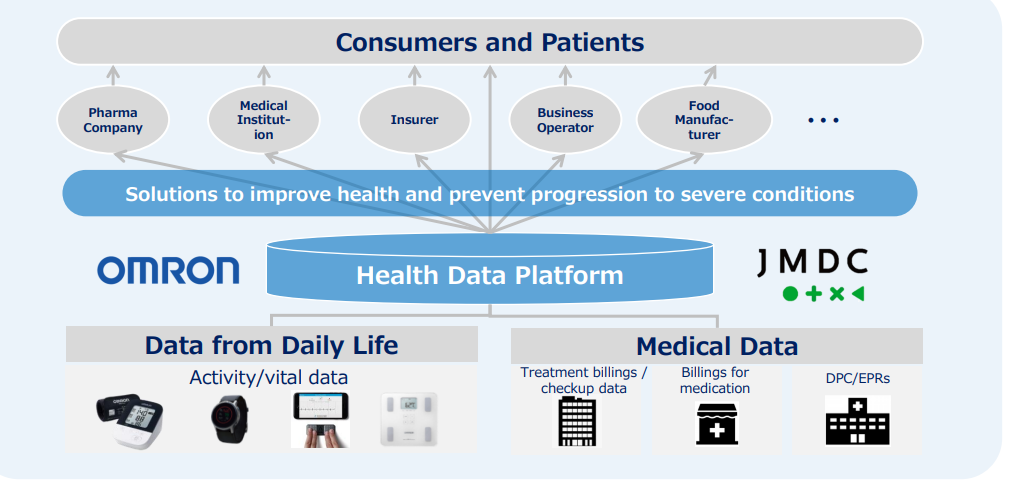

Omron is also focused on automation in a health setting with heart monitors, thirdly in “social settings” which is basically ticket gates. It also has a EV charger line of business.

It is rapidly building AI for health monitoring and preventative diagnostics. Omron is working on a platform to combine and share data across the spectrum of healthcare.

Remember reader FY2024 means the year that starts 2024 not ends (like in the UK) so FY24 is the coming year and a 1% growth in sales hides a 33% growth in profit to £245m putting this on a P/E of 25.

#12 COGNEX 2.75%

Back to the USA for the final number 10, and it all began with a barcode. Little stripes on a 2D flat surface. Keep it flat or it won’t read it, as any irritated Supermarket shopper knows waving their goods back and forth at the self service scanner, smoothing the sticker and wishing there was a human checkout operator. At least the “unexpected item in the bagging area” message has been removed from the lexicon. I wonder if that change occurred following multiple customers had an unexpected loss of temper in the bagging area.

Anyway Cognex has a P/E ratio of 78.8 on a market cap of £5.36bn. Annualised sales of £0.72bn, and operating profit of £0.11bn and FCF of £0.16bn, and a great long term track record.

So imagine no 2D barcode, imagine an AI which has depth perception, fuzzy logic so can partial read a barcode and “fill the gaps” and deduce the item. Can view the item and see it is yellow and the while the barcode is missing 2 of the stripes but it deduces the only yellow item that meets the criteria is a banana - ping - happy customer. Undamaged bagging area and efficient operation.

This is Cognex’s USP.

For Federal Package in Minnesota it provides an automated inspection service to catch defects with an accuracy above 99%

Conclusion

We’ve covered with the top 12 holdings, making a chunky 68.8% of the ETF by value - this is a conviction play. These Top 12 are not 12 identical holdings. These are plausibly connected with Robotics and the thesis I set out to find ways to invest in the physical manifestation of Artificial Intelligence.

Cognex’s eyes, Daifuku’s logistic automation, Omron’s process automation, Fanuc’s Cobots, Dynatrace’s AI/Software Automation, SMC’s “nuts and bolts”, Keyence’s sensors, ABB’s electrification automation, Intuitive’s Surgical Cobots and last but not least NVidia’s semiconductor GPUs and value adds come together to provide a compelling play on what “should” be a game changer set of technologies.

So the focus and conviction, the lower average valuation of holdings, and what I perceive as strong prospective upside makes this my preferred play on Robotics.

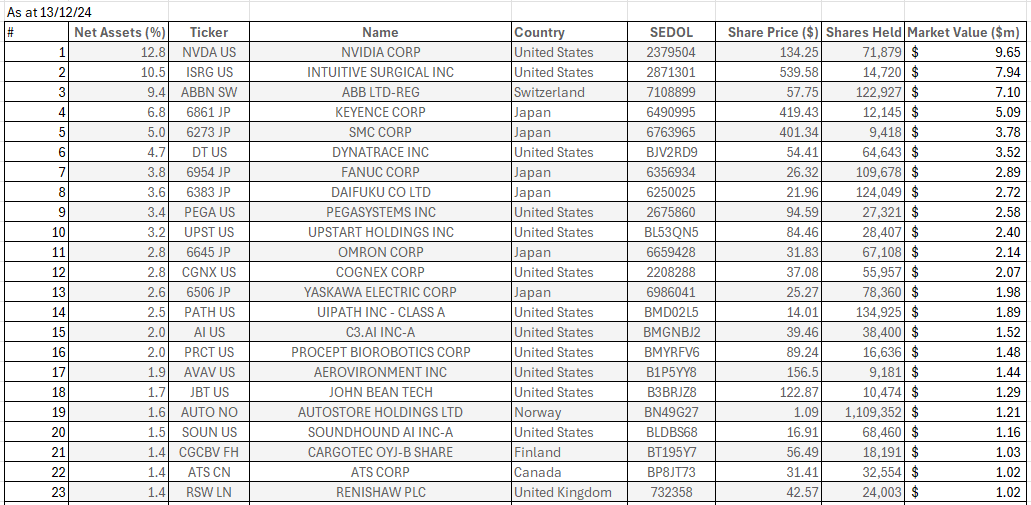

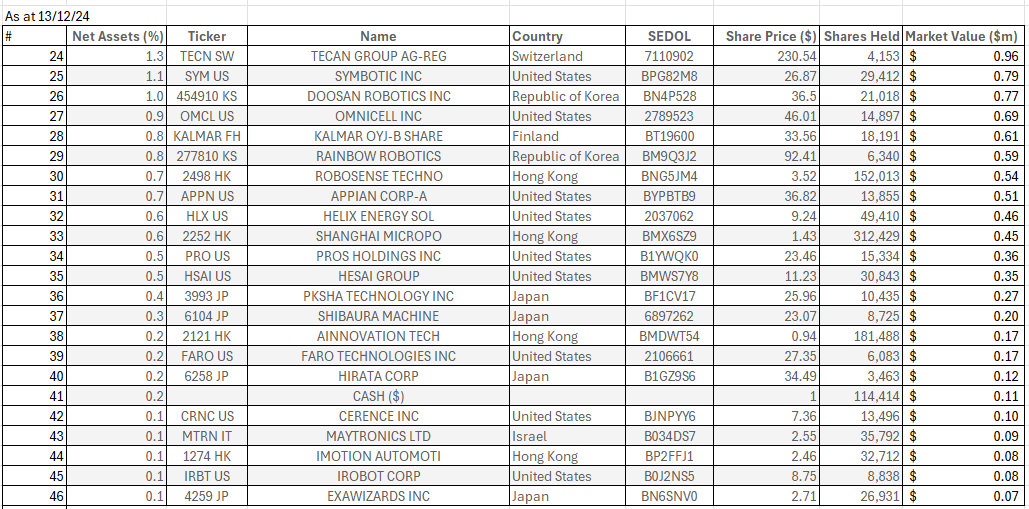

Here’s the full list (in case you were wondering). Some seriously interesting holdings past holding #12 like Doosan and Rainbow Robotics so I might cover these in the future article.

Funds Under Management: $75,446,561 Charges are 0.5% per annum.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings including those held in an ETF might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"