Dear reader

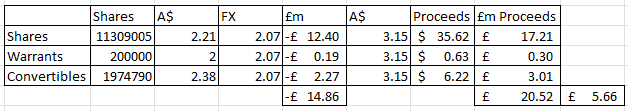

BSRT’s holding in Futura as at 31/12/24 looked like this:

11,309,005 ordinary shares (26.9%) valued at £12.4 million (at a FX rate of A$2.02:£1)

1.5% Gross Revenue Royalty valued at £16.8 million

A$4.7 million convertible loan valued at £2.7 million

A$4.7m at a A$2.02:£1 FX rate translates to £2.23m therefore £0.47m of accrued interest is inferred.

Post Period

A further A$1.4m bridging 3 month loan (interest 2% per month) was made

A$1.4m = £0.8m + £0.05 interest.

Included + 200,000 Warrants with a strike of A$2.0

Yesterday a prospective A$3.15 per share offer was made for Futura vs the current A$2.21 carry price for shares, at $2.02.

The deal - if it concludes - equates to a 5% increase to NAV and a 10% increase to the market cap since the deal would generate £20.5m cash and the gain would be £5.66m, based on today’s A$2.07=£1 rate.

The 1.5% royalty would remain in place, and if the buy out also meant an acceleration to the ramp up of saleable coal to 1.9Mtpa (which in my view is likely otherwise why buy it?) then at a future assumed US$230/tonne the value of that would equate to $6.5m or £5m per year. That’s a 19.8% net return on NAV (£5m - £1.68m = £3.32m) on the NAV carry value of £16.8m assuming you amortise that value over 10 years

Since there’s a 50% discount ex cash (pre-sale of Futura) and listed then on the share price a 39.6% net return relative to that component of the share price.

Post sale of Futura the net return from the Futura royalty, Prognoz, Cemos dividend and Bilboes royalty comfortably would bring in the equivalent of a 50% per annum return in the foreseeable future (2027+)

Regards,

The Oak Bloke.

Disclaimers:

This is not advice; you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Interesting stock. Still think the problem is the markets view on Investment Trusts. This one really is just too small for institutional investors, so who is this targeted at?

It’s also fairly illiquid with 700k monthly turnover on its 55m mcap. Really would take much to narrow the discount relatively speaking.