Bubble...... and Squeak!

Gold and Silver Bubble Trouble?

Dear reader

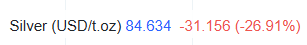

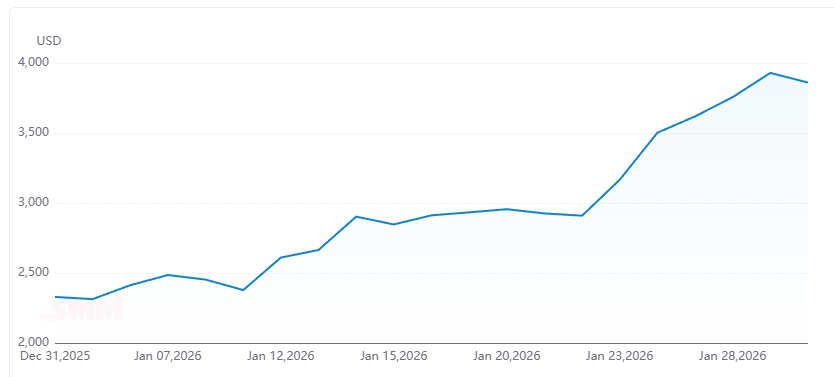

People gave an eek and a squeak when silver dropped nearly -27%

People looking at LME/NYSE Comex at least. Not those in the East.

It’s been easy to hear the word bubble in the same sentence as the words “gold” and “silver” in January 2026.

Bloomberg repeat that phrase like a mantra numerous times per day. Every guest is asked is Gold in a bubble? Is that question curiousity or an agenda?

Meanwhile the occasional nutter who spoke of the top of the market a few months back and about a bubble were mocked - and their videos do not age well 3 months later predicting the top of the market at prices 20% lower than where paper markets ended yesterday - even after a large drop.

Meanwhile others this week recorded inspiring videos umming and arring saying Gold might go up and it might go down. Yeah, cheers for that “insight” you time wasters. Rick Rule said he’d sold 80% of his silver. Jacques from MAFL had too. Jim Mellon too. I remained in the market, top slicing it’s true gathering dry powder for a pullback.

This article is to set out why I remain of the view that the drop yesterday was an opportunity - to add to certain holdings.

The January 2026 use of the word Bubble with Gold began with the Bank for International Settlements (BIS) which released a specific report in late December 2025 because it detected a "once-in-50-years" anomaly: for the first time since the 1970s, gold and US equities entered a simultaneous "explosive" phase.

The BIS uses a specific statistical metric called the BSADF test (Backward Supremum Augmented Dickey-Fuller). This test doesn’t just look at high prices; it looks for non-stationarity - when a price begins to “drift” upward at an accelerating rate that no longer matches its historical data pattern.

Essentially Stocks and Precious Metals shouldn’t both be going up at once. How can gold be a counterweight to risk if it is itself a risk?

The Fundamentals of Gold

On the supply side, the development in 2025 remained comparatively stable. Gold Mine production rose slightly from 3,650.4 tons in 2024 to 3,671.6 tons (plus 1%).

If producer hedging is taken into account, mine supply is almost unchanged: 3,598.0 tons after 3,596.6 tons in the previous year. Net hedging in 2025 was -73.6 tons (2024: -53.8 tons), which slightly influenced the reported mine supply.

Demand meanwhile was much, much higher. 1,330 tonnes higher. That quantity represents the degree that existing “above the ground” gold was used to satisfy demand. Gold is an inert substance and generally does not get consumed in irrecoverable industrial processes, so once it is “above the ground” it is stored somewhere. Its value is its scarcity and its acceptance as a medium of exchange. A Roman needing a toga and a slap up meal consistent with a Brit two millennia later visiting Saville Row needing a bespoke suit then a hearty feed at one of London’s fine eateries.

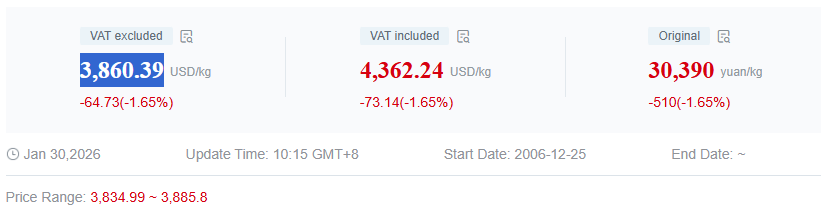

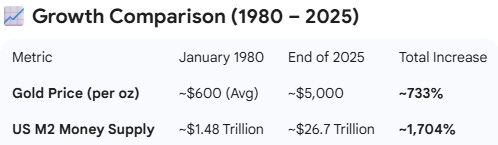

In fact compared with the US money supply Gold remains “undervalued” and $12,000 gold would be a logical point of equilibrium.

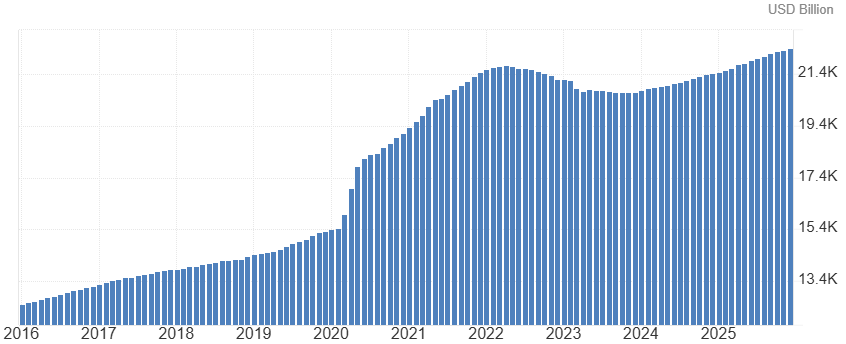

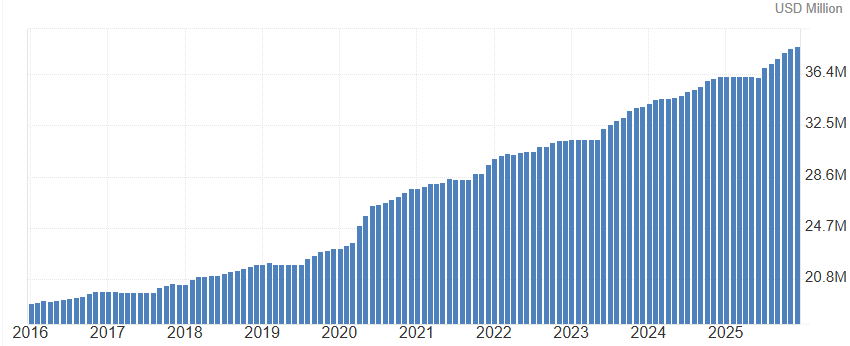

US national debt exceeds $36tn and that excludes off balance sheet commitments. Global debt is far higher still. Gold is not a preserve of the USA although it is the world’s predominant reserve currency as I compare the US M2 money supply vs Gold.

Is…. or was?

The Unit

The BRICS nations would love to undermine the power of the US Dollar. They have moved from “talking” about a gold-backed alternative to actually launching a pilot system. In January 2026, the project has entered a tangible operational phase. However, instead of a traditional “gold standard” where you can swap paper for bars, they are using a sophisticated digital-hybrid approach.

The recent accumulation of gold by BRICs central banks is a co-ordinated and planned action with a purpose.

It has led to other countries realising their gold matters. Italy is repatriating its gold for example and Poland’s Central Bank is rapidly buying Gold. There is a wave of central banks buying gold.

In late 2025, the BRICS alliance (now expanded to include members like Saudi Arabia, Iran, and Egypt) launched a pilot program for a new international trade instrument called “The Unit.”

How it works:

40% Gold Backing: The Unit is anchored by physical gold reserves held in secure vaults across member nations.

60% Currency Basket: The remaining value is backed by a weighted basket of BRICS national currencies (Yuan, Rupee, Ruble, Real, and Rand).

Wholesale Only: Unlike the dollar, which you can use to buy a coffee, The Unit is designed for wholesale trade settlement between countries. It is not meant to be a circulating retail currency (yet).

Key Infrastructure Milestones

The bloc is building a “parallel rail” to bypass the Western-led SWIFT system.

BRICS PayLive is a blockchain-based payment system allowing for real-time settlement without using US dollars.

BRICS estimated Gold Reserves > 6,000 Tonnes

BRICS nations now control roughly 50% of global gold production and have aggressively drained Western vaults to back their new system.

Interoperable CBDCs Testing:

India and China are leading the charge to link their Central Bank Digital Currencies (CBDCs) for direct cross-border payments.

The “India” Hurdles

While Russia and China are pushing for a total break from the dollar, India remains a significant internal check on the project.

Stability over Replacement: India’s External Affairs Minister stated in 2025 that India does not have a policy to “replace” the dollar, but rather to “de-risk” its own trade.

The 2026 Summit: India is hosting the 2026 BRICS Summit and is expected to focus more on connecting digital currencies for efficiency rather than declaring a “currency war” on the US.

Why This Matters for Gold

The move toward a gold-backed settlement has fundamentally changed how gold is priced.

Decoupling: There is a growing shift away from “Paper Gold” (contracts in London/New York) toward “Physical Settlement” in the East (Shanghai Gold Exchange).

The Floor: Because BRICS nations need physical gold to “mint” their Units, their constant buying has created a permanent floor for gold prices, which contributed to the $5,000+ per ounce levels seen in early 2026.

The Verdict: The BRICS nations are very close to having a functional trade alternative, but they are still far from replacing the US dollar as the world’s primary reserve currency for everyday global finance and debt.

It will all come out in the Warsh

Apart from month-end profit taking, yesterday co-incided with the appointment of new Fed Chair Kevin Warsh. Historically, Warsh has been known as an inflation hawk. Hasn’t ever been called a moron.

During his previous tenure as a Fed Governor (2006–2011), he was often out of consensus with his colleagues, arguing against aggressive stimulus and “unconventional” tools like bond-buying.

Balance Sheet: He is a vocal critic of the Fed’s massive balance sheet. Analysts note that he favors shrinking the Fed’s footprint, which typically pushes long-term bond yields higher—a move that usually strengthens the Dollar and acts as a headwind (not a tailwind) for gold.

There are measures which will reduce the Fed’s balance sheet such as revaluing Fort Knox’s gold and refloating Fannie Mae and Freddie Mac. These will be cover to a dovish pivot.

The Dovish “Pivot of Convenience”

In the lead-up to his 2026 nomination, Warsh has aligned more closely with the current administration’s preference for lower rates.

AI Productivity Argument: Warsh has recently argued that the AI boom is driving a massive surge in productivity. He suggests this allows the Fed to cut interest rates more aggressively without triggering inflation—a fundamentally “dovish” stance.

Trump has made no bones about the direction of interest rates and yields he expects the Fed Chair to pursue. Warsh’s marching orders will be dovish which is bullish for gold but which brings up full circle back to the contradiction for central banks that gold and US equities have entered a simultaneous “explosive” phase.

The media meanwhile heavily pushed the narrative that Warsh’s hawkish history meant bad news for gold and silver. Seemed intent on ignoring what Warsh was actually saying. Ignoring that Trump appointed a chosen successor to J Powell labelled too slow and moron for not cutting rates.

If the rising price of gold is linked to “the debasement trade” then US M2 is instructive. There is no tightening, there is no stabilisation to the debasement. It continues. More money chasing a fixed volume of goods and services equals inflation i.e. debasement.

US indebtedness continues to rise despite efforts to raise income via tariffs, and the failed and abandoned DOGE programme. The only way to tackle this is more GDP growth, more taxes, less spending or inflation. Any of those scenarios is positive for gold.

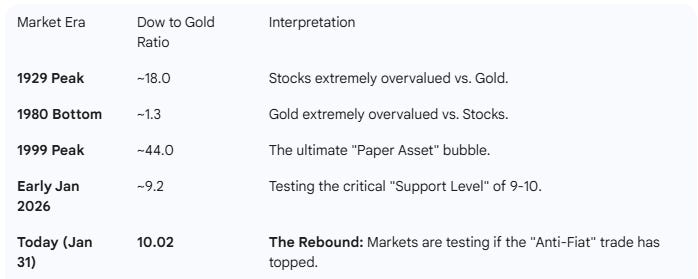

Consider the Dow to Gold Ratio at 10X is nowhere near overstretched. Relatively gold would need to hit $40,000/ounce.

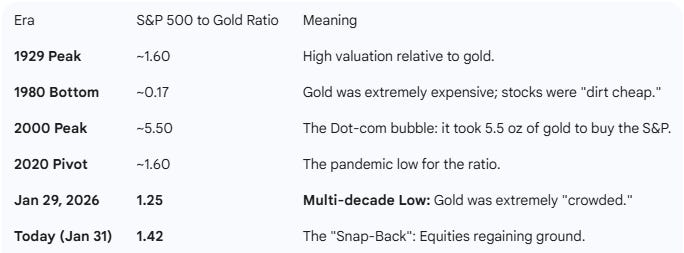

Or relative to the S&P500 the Gold ratio at 1.42X is well below gold’s top in 1980. Relatively, gold would need to hit $40,000/ounce.

The Hawkish Armada

Meanwhile the US Armada, the USS Abraham Lincoln carrier strike group is currently operating in the Arabian Sea, supported by at least ten other warships, including five guided-missile destroyers. The outcome of diplomacy with Iran could move gold either way next week. Gold has been rising regardless of geopolitical risk. The invasion of Ukraine, or Palestine’s October 7th attack barely budged the price of gold.

Commodities vs S&P 500

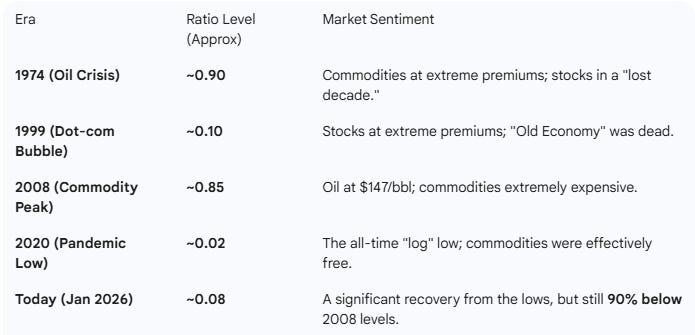

Are commodities now overvalued? The evidence is not there. Taking the log scale of GCSI vs S&P 500 the 4X revaluation of commodities since Covid (extreme) lows is 400%. Overvalued?

I don’t think so. Relative to 2008 there is a further 1000% to go. 0.08 vs 0.85 Relative to 1974 even more.

If the whole S&P fell by 90% and commodities remained static then commodities would be back to an extreme valuation in relative terms.

You also have to consider the ability of the supply response. Many and most miners do have the capability and funds to “turn the taps on”. Interest rates are still relatively expensive and in my coverage universe yes they are cashflow positive - but they are not awash with cash.

Tharisa is slowly building out Karo for example. There’s no queue of funders to expand its PGM output in Zimbabwe for example. It’s nearly two years away from first pour.

Try and Buy Gold Today. Not Paper. Actual Gold. Actual Silver.

From £3,801.32 is $5,200 per ounce. Yes there is always a 3% premium for manufacturing, shipping and dealer margins - but that still leaves gold above $5,000 per ounce - or the Royal Mint margin has doubled to 6%. That price is based on buying over 1,000 sovereigns too… £380k worth. For 1 Sovereign the premium to the paper gold grows to 8%

OB Positioning

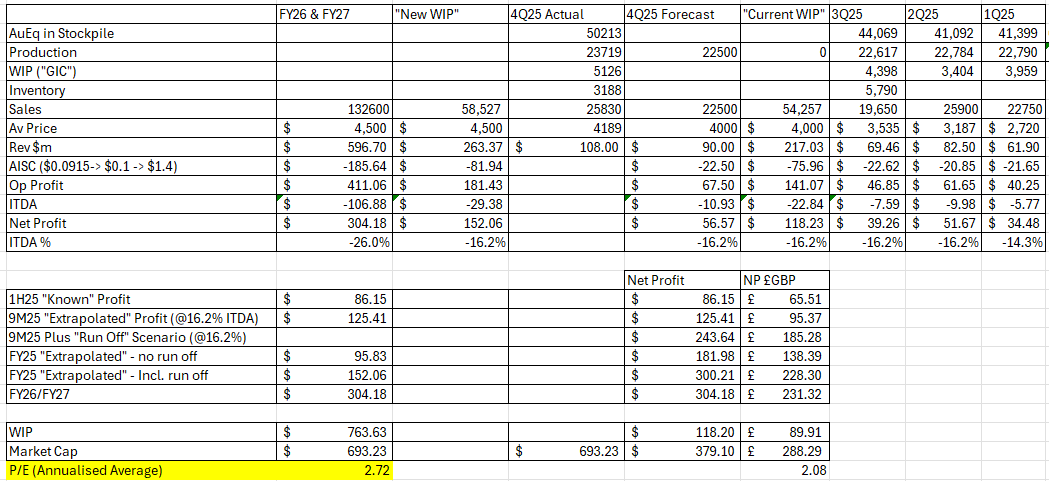

As I covered back on the 15th Jan in “THOR-ght for the day” despite the THX being much higher than 12 months ago gold miners remain inexpensive. At $4,500 gold (so a further 10% below per ounce where the price of gold closed) and with THX at 86p (10% higher than my article) still places THX at a P/E average of just 3x.

3X based solely on the Nigerian business while THX announced the PFS of its second mine with a post-tax project NPV5% of US$633 million and IRR of 61% (100% equity basis) at a long-term gold price assumption of US$3,500/oz calculated using statutory Senegalese tax rates and excluding any fiscal incentives expected to be granted under the Mining Convention. At US$4,500/oz the IRR would be ~115%.

Falls were observed at various OB ideas: THX down 5.6%, Silvercorp -16.8%, Golden Prospect -8.3%, Metals Exploration - 8.1%, Altyn -5.5%, Tharisa -5.2%

I decided to deploy dry powder to average up on the fall.

(Also to some new ideas which I shall be revealing soon)

Why?

While a miner’s revenue is leveraged to the price of gold the upside of that leverage is not yet in the price according to my calculations, so even if a rapid rebound in the price of gold and silver, were not to occur next week - and even if further falls next week were to occur - there remains a margin of safety where the margin of safety means it would take a fall to below $3,000/oz Gold and $50 Silver which would be long-term damaging to the price of miners at the price I averaged up…. and where we are nowhere near such a scenario.

SILVER

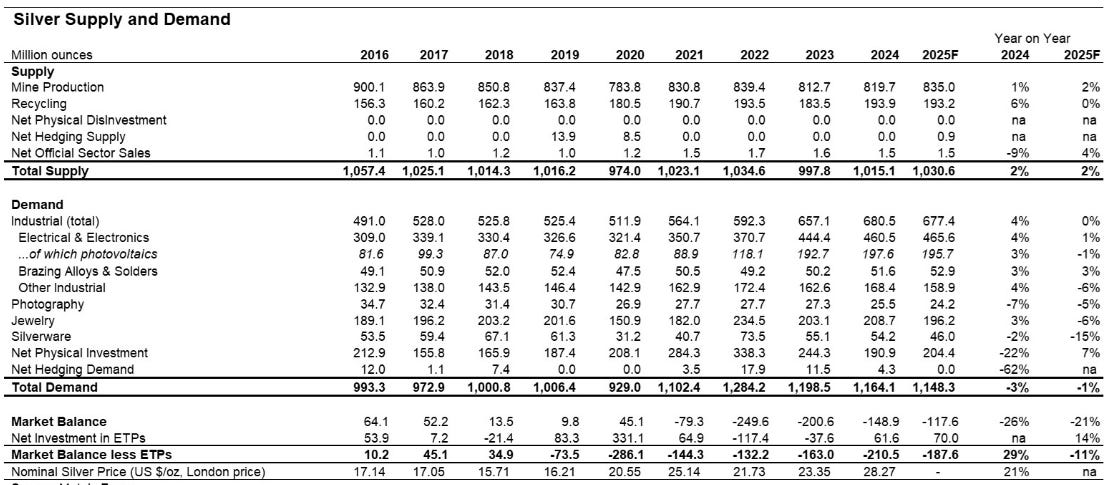

As an industrial metal the fact is demand and supply have been out of balance for years.

Supply in 2024 was in deficit by -148.9 Moz and by a forecast -117.6 Moz in 2025.

Will supply respond in 2026? Primary silver is 28% of global production. 72% is a by-product of Zinc, Lead, Copper, Gold with 1%-2% “other”.

It’s true that silver production from gold mines will have increased in 2025 and again shall in 2026. Primary silver are gearing for expansion including at OB ideas like SilverCorp, Cerrado, SantaCruz, Luca Mining, Silver X, however they face challenges as I’ve documented and increases to supply will take time. It’s further true that primary silver miners are also battling the depletion of grades - which have fallen by 40% since 2010. AISC per ounce of silver has risen a great deal over those 16 years.

Paper Silver vs Physical Silver

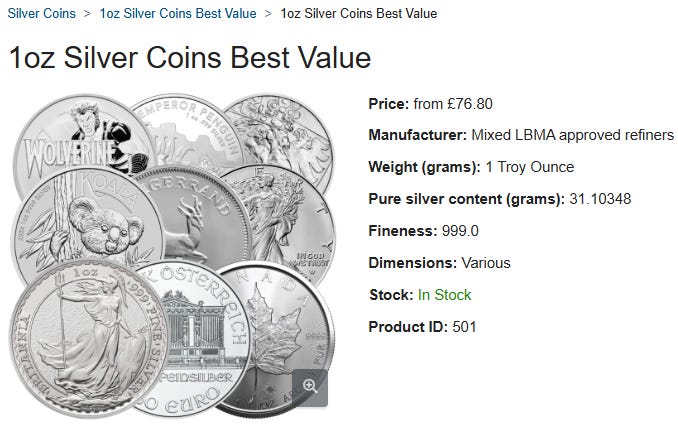

Similar to Gold the royal mint is selling 1000+ silver coins for $94.54 vs $84.63 paper price. Or $98 for a single coin. Ex VAT. 13% premium.

…..Or at least that’s the price is they had any physical silver. They don’t.

For physical coins be prepared to spend £80.90 for 1 or £76.80 for 1000+ (plus VAT). So $104 - $110 per ounce. 25%+ premium vs the apparent closing price of paper silver.

You can buy physical silver in Shanghai today but the price only dropped -1.6% yesterday. I’m sure some folk paniced and sold yesterday. Oh no. Let’s bank some profits.

But look at the fundamentals and then answer what price do you think Silver will be next week?

Let’s not forget either the actual ratio of silver to gold - physically - is 15 to 1. But where recycling of gold far exceeds that of silver. Therefore even the current ratio of 57.7X of gold:silver implies a silver price at least 200% higher than today.

Conclusion

Perhaps there’s a further fall in paper silver and gold prices next week, perhaps not. I sound like I’m hedging my bets saying that.

Personally I’m not.

I’m saying that because I’m not betting on the price of gold or the price of silver but instead investing a reasonable proportion into miners able to generate a stream of returns from their production at today’s elevated gold, silver and PGM prices.

I’m making what seems the reasonable conclusion that gold and silver are not at the start of a rout back to 2023 prices. That today’s drop is a flash crash and the price shall flatten or only fall by a limited amount. I have calculated I actually have a reasonably large percentage of margin of safety where miners can still generate profits even at prices lower than Friday’s close.

Meanwhile even if I’m wrong on that I still have a further margin of safety. Some like SilverCorp are polymetallic and the price of Zinc is also at a 5-year high. Copper is at record prices and production of copper is coming on stream in 2026 too. Others like THX have Lithium prospects as well as gold, or MTL has copper prospects as well as gold.

That’s why my conviction buying the dip made sense to me.

Regards

The Oak Bloke.

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Hi OB,

Last week I was in a quandary whether to sell my silver stocks or top slice at or near the highs, especially when they started to fall a bit. I did neither and now look at the sharp falls and wonder whether that was the right choice?

The long term demand for silver as a resource for manufacturing (which is different to gold) points to holding, at least in the medium term, as share prices should rise again. But whether to sell, top slice or hold tight is always tough. Especially as the falls are sudden and steep! Maybe I should have sold some? Maybe that would be a hedging of my bets? But time will tell as to where it goes from here. The one reassuring point is that physical silver prices are only down a very small amount, and that is what the silver miners sell. Also the demand for silver is a physical demand for manufacturing and not for just hoarding! Nervous times ahead.

Great article and thanks for all your work!

Graham.

For anyone feeling nervous Jordan and Clive are good to listen to

https://www.youtube.com/watch?v=_iLPhCiChgA

https://www.youtube.com/watch?v=uLL1nNF4lnc

Gold 200 day moving average points to a floor of $4400 with the major price damage probably has been done. Gold and silver were massively over extended short term. No getting away from physical demand in China at the moment though so paper and physical prices have massively diverged.

As OB says miners are printing cash like THX with a cash AISC of $1000.

BRWM (holding the majors) sold off and i topped up yesterday but thought would wait for weekend to review properly.

If you sell you need to ask where am i putting this cash and if no where better then keeping it where it is maybe the best course of action.