Calling time on DGI9

One to Archive - ah

Dear reader

A £16.5m sale for 26.5% of Arqiva was uncontested by the 51.76% economic interest owner DGI9. No clear reason was given for this decision.

That partial sale valued the whole of Arqiva at just £62.3m so the implication being £31.2m valuation for DGI9’s share. Never mind the book value hundreds of millions higher. Today it was possible to sell out at 4.88p per share so that’s what I decided to do. That’s an -89.8% loss from when I included it in the OB 20 for 2024 ideas.

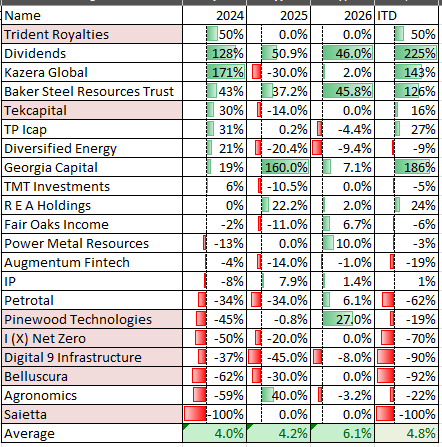

-89.8% is my third worst outcome behind Saietta -100% and Belluscura -96.6%. (All three from the 2024 ideas)

Not my finest hour. A Dunkirk with just 10.2% of the funds escaping on little boats. I’ve written about this idea extensively over the years so as I review the inevitable what did I learn.

Overvaluation:

At the time I included this idea its NAV was ~125p. The reality was that an independent review identified a £111.5m overvaluation; and recovered $2.8m of “wrongfully deducted funds”. It remains “termination negotiations.”

ShareSoc has engaged with the FCA; assessing interest for a formal shareholder campaign/group action.

The FCA are understood to be “listening” to the case, but maintains a policy of not disclosing active enforcement investigations until they are complete.

Perhaps further funds will be returned if legal action can/will be brought although it seems unlikely despite the evidence.

The decision to include this idea was based upon the valuation. But the value was falsified.

Poor Decisions:

Even if the true NAV had been known there were other red flags covered by Paul DeGruchy in this excellent video.

The amount of follow on fundraising was substantial and profiling cash flow is part of what I do as a result of my DGI9 experience - so a lesson learned.

The benign backdrop for IPOs and secondary fundraising was strong in 2021 and dried up in 2023 so that was a further red flag.

The complicated ownership structure of Arqiva was a further negative as was its inability to deliver cash generation a further red flag. Show me the money! Sometimes investing is as simple as that mantra. Show me the money!

The debt level and the terms of that debt were a further negative. Both the VLN and the RCF.

BAD DEALS

The deals struck for Verne, Aqua Comms, EMIC-1 and Sea Edge were all extremely poor. £25m of fees for Verne was staggering, and the deferred income element subsequently written down to zero.

I was critical of the Aqua Comms deal and that appeared justified when it reported EBITDA profits doubling in the period subsequent to its sale.

It may be the case that the Verne write down will be reversed as the assets themselves are performing well. In fact readers have messaged me this week to point this out. I hope so. I suppose I worry that there will be some small print that means it’s not just the EBITDA performance and some get out clause will exist for Ardian, the buyer.

ARQIVA

Today’s write down to zero was the final straw. I do not feel the new investment manager despite claiming to have a deep understanding on Arqiva, has ever demonstrated that to me, and this continual demure outlook is not the outcome I expected from them. My gut feel is that they’ve given up hope on turning this around and their heart is not in it.

Well in that case nor should my money.

While the write down to zero could be reversed and is nuanced as “dependent on a wide range of outcomes” I decided to salvage what I could and exit. With so many profitable ideas, I’ve decided not to waste further energy on this.

2024 ideas in the wars

I recently covered the remaining ideas in a year end review and other than DGI9 I’m happy to keep the remaining ideas in play. The ones in pink are those where I’ve called time through choice or necessity.

Kazera reported on target expansion today, Baker Steel continues to grow from strength to strength, DEC is on the cusp of reporting, POW after a quiet spell is now delivering near daily reporting of progress in its uranium portfolio, so happy with progress.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”.

Very painful outcome. This never happens to investors that buy index trackers. Citywire writers like David Stevenson were constantly pushing DGI9 as a defensive utility-like fund with growth aspects to it. I've been in DGI9 since it was about 102p a share.

I remember when 3iN considered a bid for the company when it was 82p and I misinterpreted that as the assets being popular, even though 3IN pulled out. But they must have pulled out because their due diligence raised red flags many years ago

Onwards and upwards Oak.....small beer in the scheme of things 😁