I’d like to explore whether DEC has a problem with debt and with production.

Interest Rates: Can DEC pay?

This is what is stated in the Interim Accounts: As of 30 June 2023, 82% of our borrowings were in fixed-rate, hedge-protected, amortising ABS structures as compared to 30 June 2022 when 99% of our borrowings were in fixed-rate structures.

So debt was $1,555m, of which $265m owed is Variable Credit plus £8.3m for Misc.

The Variable Credit Facilities Available are:

Credit Facility of $425m maximum. Terms: SOFR + 2.75-3.75% (8.05%-9.05%)

August 2023 $135m line of credit. Terms: SOFR + 4-5% (9.3-10.3%)

Miscellaneous, primarily for real estate, vehicles and equipment $8.3m. Terms: Various/not material.

SOFR is the Secured Overnight Finance Rate and that is currently 5.3%.

We also know that Loan repayments due in the H2 FY2023 and H1 FY2024 periods is $232m. This will be the amortizing ABS (I - VI) Loans and Term Loan (balance $1,282m as at 30/06/23)

There is no repayment schedule for the variable, however there are covenants that the ratio of profit to loan amount should remain within limits. There are also 3 sustainability criteria which determines whether the lower or higher percentage applies:

a/ TRIR - the metric is apparently 1 injury per 200,000 worked is acceptable!

b/ Asset Retirement Performance - DEC earn money retiring wells but also pay less interest!

c/ Scope 1&2 CO2 intensity

Depletion: Can DEC produce?

Divestitures were $59.5m going into the 2nd half:

On 27 June 2023, the Group announced the sale of certain non-core, non-operated assets within its Central Region for gross consideration of approximately $37.5m. The divested assets were located in Texas and Oklahoma and consisted of non-operated wells and the associated leasehold acreage that was acquired as part of the ConocoPhillips Asset Acquisition, in September 2022. This sale of non-operated and non-core assets aligns with the Group’s application of the Smarter Asset Management strategy and our strategic focus on operated proved developed producing assets. During the six months ended 30 June 2023, the Group divested certain other non-core undeveloped acreage across its operating footprint for consideration of approximately $6m.

On 17 July 2023, the Group announced the sale of certain undeveloped, non-core, net acres within its Central Region for net consideration of approximately $16m. This sale of undeveloped, non-core assets continues to align with the Group’s strategic initiatives and focus on operated proved developed producing assets.

Production at 30/06 was 142Mboepd.

Production at 30/09 was 134-138Mbpoed (I’m using the halfway estimate) from the RNS.

So a 2.9% or 4.2% or 5.6% drop. (134/142) or (136/142) or (138/142)

Meanwhile disposals were $59.5m as a proportion of Oil Assets at 30/06 ($2,690m) was 2.2% of assets.

So the drop was really a 0.72% or 2% or 3.4% net of disposals.

Depreciation/depletion is $115m in H1 so $67.5m in Q3. This represents 2.57% of the net $2,630m assets. 2. Deduct that from the above percentages and you can see that 75%-357% of depletion is being handled through the accounts (via the depreciation charge!).

And guess what? If Q3 turns out to be only 134Mboepd what will happen to the depreciation/depletion charge in FY2023? It goes up. Depletion is a calculation to the accounts, at year end.

So for those people still bumping their gums about DEC “running out of production” sorry the numbers already take account of that.

Cash Flow

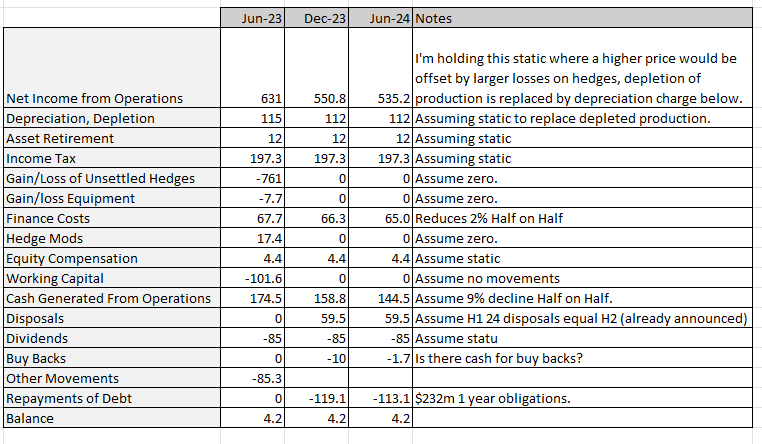

I’ve estimated the impact into Cash Flow, of debt, and importantly debt repayments. I’ve used the information from the Interim Accounts and then extrapolated into the next 12 months.

Importantly I’m assuming there is no “swapping out” of one form of debt for another. i.e. No robbing Peter to pay Paul.

I’ve maintained the dividend as is.

I’ve assuming no working capital gain or loss nor am I claiming any hedge gains/losses but am instead assuming the gains/losses offset against NET INCOME. (That’s the whole point of the hedge is that it is an offset)

I’ve approached this to prove there’s nothing to worry about. I was wrong.

I found that the $100m buy back is not wholly affordable. I stress this is based on the repayment of debt set out in the H1 Accounts, and not robbing Peter etc.

There are reasons to think cash flow would be tailwind at least in H2.

However what I have satisfied myself is that the debt is affordable. There’s quite a bit of wriggle room actually. I’ve reduced finance costs by 4% in the next 2 halves. However the debt reduces by 14% by H2 FY2024 (from $1,555m to $1,323m) so the variable debt’s SOFR could balloon higher without causing DEC an issue. On $265m a 4% increase in SOFR (an almost inconceivable rise by the way) would cost an extra $10.6m finance cost a year.

Conclusion:

Based on the scenarios I’ve run I would make the following comments:

To the people who insist there’s 10% depletion and DEC is on the road to ruin need to spend the time to understand the accounts. Because they are demonstrably wrong.

To the people who complain about the speed of the buy back (BB), Hutson we might have a problem there. If you consider priorities, I’m sure you agree meeting debt covenents is the priority. Not robbing Peter to pay Paul too. Either swapping debt for more expensive debt, or swapping equity for more debt. It’s a moot point as arguably 9%-10% debt interest is less than 19.8% dividend yield. But my analysis seems to reflect the fact that BBs continue to be smallish amounts.

To the people who have invested in this share because of the stunning dividend, apparent value and who believe it’s well run and ambitious, then digging into the complexity and the moving parts of debt/cash/divestments/depletions it appears the business can sustain its trajectory.

So this is my opinion and perspective. This is not advice. I wish you well in making your own investment decisions.

Oak.

PS: I’ll leave you with an intriguing possibility. M&As are heating up. For example, Chevron announced the acquisition of Hess yesterday for $53bn. That’s on an EV/EBITDA of 10. The corresponding EV/adjusted EBITDA of DEC is 7.5. DEC wouldn’t be an easy fish for a predator to swallow but any hostile approaches/rumours would drive up today’s depressed price and DEC potentially offers more than just acreage. It offers middle-ground approach to ESG, which for an Oil Major, I imagine, is like curry to the inebriated.

OB, first off I want to thank you for the multitude of in depth discussions about this company, very informative.

Regarding this particular post I do find myself scratching my head where you calculate the decline in production "net of disposals".

If I understood correctly the disposed assets where not producing to begin with? Then why account for them when calculating the organic production decline?