Cattle? No, CTL

Lithium miners never had it so bad - is CleanTech any different?

CTL - Clean Tech Lithium, 27p ask 27.5p bid. 106.43m shares. Market Cap £29m. NAV £15.2m. Surplus to NAV 90.7%

Good evening reader.

Perhaps Oak Bloke has lost his marbles. Surplus to NAV 90%?! What on earth?

Lithium. And not in the earth. Instead in blue lagoons. Briny blue lagoons, high up in the Chilean Andes that hold lithium in a precipitate. If you could sieve it out using a pump and a technology which passes through a membrane you’d be on to a winner. CTL has 1,250Km2 of land, over 4 projects, with a NPV of circa $3bn and IRR 43%. Target price 295p. Lofty numbers. So how we earn such rich rewards?

Here’s a timeline but I want to focus on the first item the DLE plant.

CTL is building a pilot Direct Lithium Extraction plant which is a matter of weeks away from commissioning.

It will produce 1 tonne a month, and 1 tonne of Lithium Carbonate sells for ~$19,500 at today’s prices.

A plant which will generate $0.25m revenue a year. From a business whose overheads are $6.5m a year. This time next year Rodney. This time next year.

Delboy thinking about his pucker LCe revenue would be missing the point. The pilot does the following:

Demonstrates the approach for investors

Test the operating parameters of LCe recovery, water consumption and flow rates

Progress Offtake agreements through Sample products.

It’s the trial run for the main event. Production will be thousands of time greater - 20,000 Tonnes a year.

The basic economics to be “proved” via the PFS and DFS at Laguna Verde is Plant capex at circa $450m and operating costs at ~$3,650/t LCE. At today’s $19,500 price that a tasty $16k/tonne margin.

The $450m build cost would be paid back in 3.1 years. The long term assumption is a higher $22,500 price and 2.7 years payback. If Lithium returned to recent highs then $100k a tonne and a 6 month simple payback would be on the cards.

The resource is currently enough for 12 years production but it’s thought the JORC resources can grow.

So if you look at this investment in its current form as a standalone investment and purely what it can produce today or tomorrow it’s got no credentials. But given the exciting potential it’s a bit of a no brainer.

If you compare the valuation of CTL’s peers it’s a similar no brainer. Far from being a Dead Man - Hombre de Muerto has a $3.8bn valuation but similar capacity at higher cost - but is in production. Versus $69m for CTL. You can start to see why the NAV and cash flow isn’t a terribly useful measure at the moment. If I point out Great Salt Lake Utah too, at a similar stage to CTL but on a $1.23bn valuation.

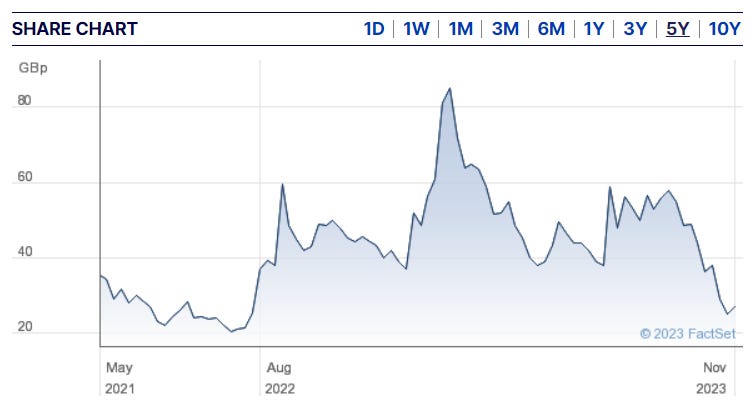

So why the 9% drop today?

Continued Lithium weakness seems to be driving down shares concerned with Lithium. But common sense says Lithium won’t remain low for ever, perhaps not for long.

We know car manufacturers are scrabbling to secure resources and the beauty of CTL is:

1/ Very green - no evaporation ponds so uses 50x less water, reduced environmental impact, and the plan is for this to be powered by green energy.

2/ proven technology - in use at several plants in China. (Where the economics are far less attractive than CTL)

3/ Great economics and some of the lowest costs per tonne of lithium in the world.

This is a a recent presentation from CTL:

Australian Listing Q1 2024

Further funds are being raised next year through a new listing on the ASX. 30% of shareholders are Australian already so this makes a lot of sense. We might see 50%+ dilution as they raise a further £30m+. This funds the company through to 2027 and it incidentally reduces the surplus to NAV to just 30%.

Off Take agreement Q3/Q4 2024

Majority of the Capex funds will be financed through an offtake agreement. This may lead to further dilution. Investors need to just relax about this as it’s part of the journey.

Risks

The moving parts stop - if funding is not achieved this company couldn’t continue. While this is a risk, the compelling economics make me think it’s a low risk.

The DLE technology fails - the CEO speaks in the video above to visiting China and witnessing the DLE technology in action. Go back up to see the Peers and Sun Resin is a proven method in China. It’s less well proven for Lithium outside of China. Just because the technology is Chinese doesn’t mean it doesn’t work. In fact it is working and we know China refines most of the world’s lithium. So who better to provide the technology?! There’s a lot of reasons - water being one of them DLE uses 50X less - that the Chilean government will have its shoulder behind making this technology succeed too. The local Atacama University are on the case, and Chile’s Lithium is big business. So I think this is low risk.

Chilean politics - a year back the share cratered on the fear of government interference. It seems clear this is now the opposite. But that could change. The risk is mitigated by Aldo who seems to foster good relations with government (he’s a local and seems well connected). So I am going to say low-medium risk.

10X Dilution, 100X opportunity

On the basis that you are going to be diluted by around 10X and the economics are 100X then you stand to gain 10X potentially. CG have a TP of 295p so a 11X gain if they are correct.

Upside Thoughts

a/ Read across - doing a read across to its peers it seems to be at least that. With CTL listing on the ASX and OTC why should a AIM market discount persist?

b/ CTL has 4 projects. The above numbers are just for 2 of these. There is a further upside (potentially doubling) with Llamara and Salar de Atacama, which is hidden value too.

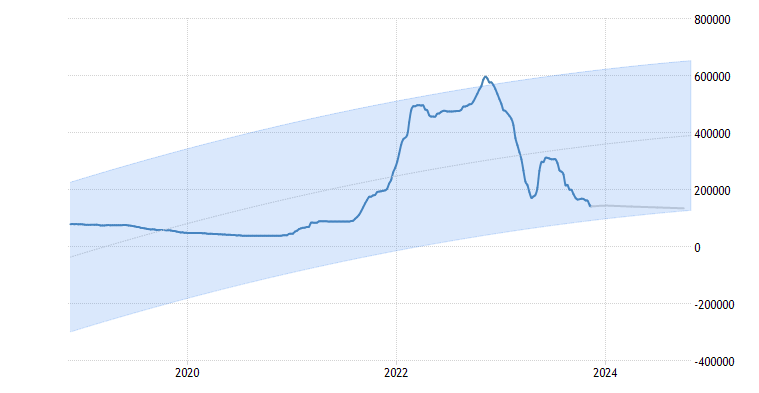

c/ The current price of Lithium is very low. Will it remain that way? Trading economics thinks so for 2024 but there’s a clearer long term trend driven by net zero and electrification.

This is not advice. If you need advice go and get it is my advice.

-

My little copse of Oak trees are going on holiday for the next 2 weeks, so reader, enjoy your weekend and I look forward to resuming transmission anon.

Oak Bloke.

Yesterday’s announcement of a discounted raise ahead of the ASX listing next year was a surprise but not unexpected. The principle of give to get still works. The 90% surplus to NAV is now close to zero following the raise and share price fall. The raise is ahead of another raise so the funds aren’t going to remain as cash but delineating the resource and progressing the PFS is driving value and offers potential upside too