Check it! Keepin' i' RLE

Is there value in Real Estate Investors REIT?

Dear reader,

Another value play and this time it’s a wind up.

No comedy, just another REIT deciding to hang up its Air Jordans. Real Estate Investors Plc (Ticker RLE) has a 20 year history and will continue to have up to 3 years more…. and probably more like 1 year than 3. But more on that later.

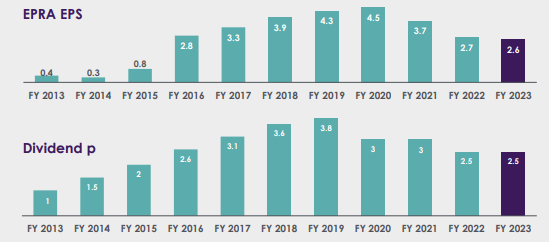

It’s a pity as it’s consistently performed, returning the equivalent of its market cap in dividends to shareholders over the past 11 years. That’s despite going through covid, inflation, interest rates zooming up, and commercial property malaise. Wilko’s demise hit RLE to some extent and ecommerce trends and working from home all landed body blows. Despite these repeated body blows like some pain fest Rocky at round 15, maintaining earnings as well as RLE has done is testament to the quality of the management team, in my opinion.

Its specialism and deep knowledge is the Midlands market and its current holdings range from Matalan to offices for the NHS and from the Co-op to a Travelodge. So 45% offices and the rest retail, industrial and miscellaneous. You can peruse the portfolio here.

Voids (empty property) were 17% at the end of 2023 but in 1H2024 it’s reckoned to shrink to 12% with new lettings and disposals.

Good ol’ covid, interest rates, concern with scale and Investment Trust pessimism with a dose of the return to the office has signed the death warrant of this REIT.

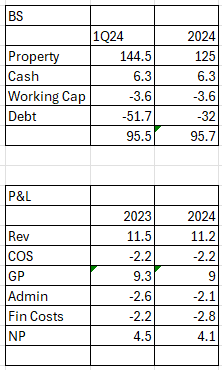

The emphasis now is on paying down debt then effecting returns to shareholders. Not before time because the amount paid on debt has doubled (because refinancing the debt was at double interest rates), eating into returns although it’s fair to point out both the net initial yield and reversionary yield exceed the cost of debt, by a hair’s breadth.

There is also something called a STIP which we’ll talk about in a moment.

Keepin’ it real?

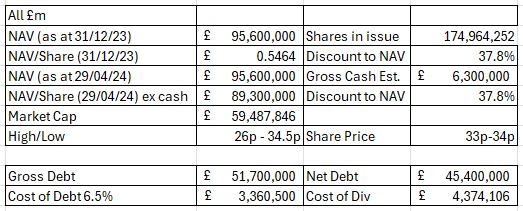

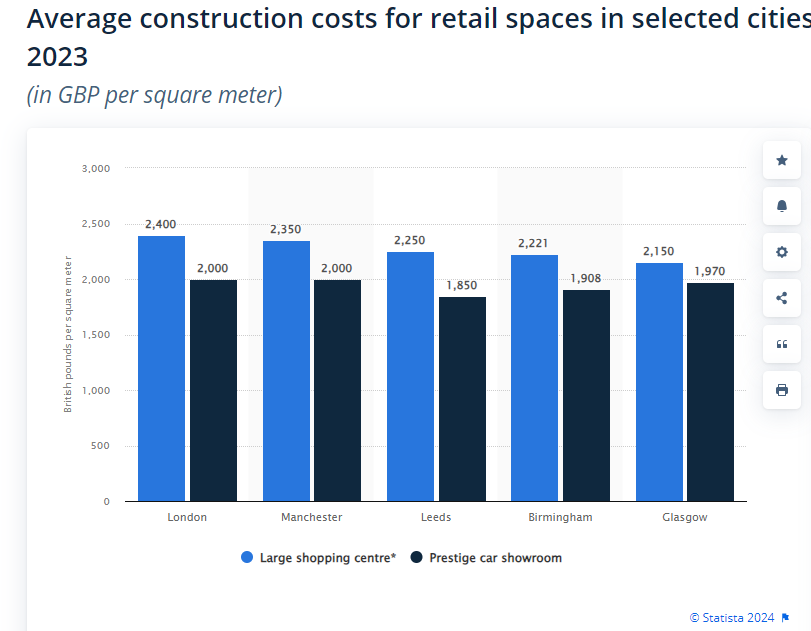

First point which catches my eye is the book value of property is £143.1m for 1.24m sq. feet. That’s £115.45 per sq.foot or £1,242 per Sq.Metre.

So 60% less than the Birmingham construction cost of £2,908/sq.m for Offices and 35% less than the £1908/sq.m for Retail.

But because RLE is at a 37.8% discount to NAV you actually pay £772 a square metre, so a whopping 73.4% discount for office and 59.5% for retail. That’s the construction cost and so that’s before considering the value of the land too of course.

Second thing which catches my eye is in 2023 disposals were a small 2.93% premium to book value at 2022’s year end. A 2.93% premium in an annus horribilus for REITs is testament to their commercial acuity.

Third, the dividend remains fully covered and provides a 7.4% yield, although it’s likely to reduce as the portfolio gets sold down.

Fourth, let’s talk about STIP. The STIP is a short term investment plan. This is based on rewarding the managers to achieve the wind up sooner rather than later. It’s based on the 31/12/23 market cap (which was ~£52.5m) and if the Company's sell down strategy is completed in 2024 then the Pool is calculated as 10% of the Gain. If the strategy is completed in 2025 the Pool reduces to 7.5% and if by 2026, the Pool reduces to 5%.

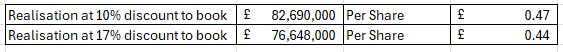

Assuming assets can be sold at book less 10% in 2024, then that’s £86m so a £3.35m (£86m-£52.5m*10%) Brucey bonus to the management team. If it completes in 2026 and is book less 10% in 2026 then they get half the bonus, at £1.67m.

In other words prevarication will cost them millions, so it’s likely we will see a value event during 2024 or at least 2025. This isn’t a management team which messes around. Track record ‘n’ all that.

The average discount for the UK REIT sector is 17% according to Liberum so that would be a £2.7m pay out under the STIP. A 17% discount yields £79.3m.

After deducting the STIP and even at a harsh 17% realisation discount, there’s a 1/3 upside in the shares - from today’s 34p to 44p.

The fundamentals of the portfolio look solid too.

Net profit of £4m+ in 2023 and forecast for 2024 even at depressed rent levels and with a 1/6th void rate could easily rise to £6m-£8m once voids are reduced and debt costs are brought under control, such as through realisations. And that’s also before any kind of property revaluation. It’s hard to see how the book value can fall further when the economy is growing again, and the Midlands region is doing quite nicely, thank you (please).

Valuing this on its rentals at 15X a run rate net profit of £7m puts this at a £105m valuation so 70% above today’s share price.

Valuing on its assets at a replacement cost basis puts it at 200% above today’s share price.

On either an income or asset basis it’s easy to see how a prospective buyer would - should - snap this up - and sooner rather than later.

The management team also have substantial skin in the game too (beyond the STIP) of around 11% of shares. So a sale at book less 10% also locks in a £3m-4m gain on shares for the management team too. Double Brucey Bonus!

Harwood is a large II invested in RLE and covers the stock in this video:

To conclude it’s not hard to think there could be a 5% return over the next 9 months via divdends, and at least 30% upside for a quick sale from today’s share price.

So I hope the “maffs” behind this idea is useful, and it may be worth considering to “Big Up” on RLE, for its West Side and East Side (of the Midlands)

Regards

The Oak Bloke

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".