Dear reader,

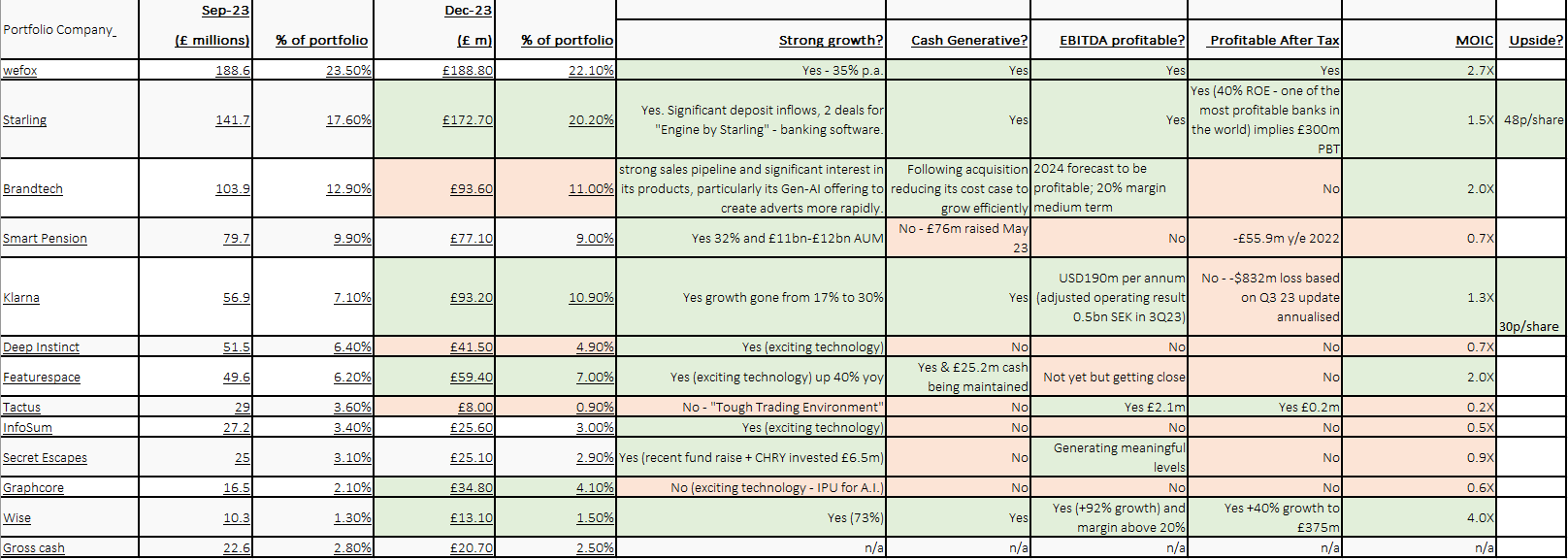

Impressive results today from CHRY. A gross 10p per share increase to NAV (less fees and FX nets to 8.72p) over 3 months or 6.5%.

The market was all over that news. Not!

The updates themselves were impressive.

Starling is Startling. Did you know that Starling sold its Engine “Banking as a service” software in Romania and Australia to its first 2 customers in the prior quarter. Nope nor did I. But my value radar activated when I heard about that. Meanwhile its banking business is continuing to do well. Its value to CHRY grew by over £30m in Q4.

Klarna is possibly/probably going to IPO this year. Its competitors Adyen and Affirm are up 65% and 131% up in Q4. Buy now pay later went through a rough patch. But if Klarna is expecting improved profits in FY24 after a $800m annualised improvement in operating performance:

Klarna’s last valuation is an implied $6.7bn valuation based on a downround investment round in 2022.

But compared to peers like Affirm, it “could” (according to Klarna’s managers) be worth $18bn - even though Klarna has already been revalued up by 63% in the period! To put that increase in context CHRY’s holding (about 1.11% of Klarna) would be worth about £157m so a further uplift of £64m, and if that were achieved and CHRY turned its Klarna holding to cash that cash would represent around 35% of today’s market cap, with £760m of holdings left.

Featurespace has a £10m gain. Its business is at the forefront of fraud detection and rates have increased 11% in 2023. It holds a competitive advantage with the world’s first Large Transaction Model (LTM) which is an AI application for the financial services industry. The application of AI for commercial use is where I see the sweet spot for gains from AI. Featurespace is a great example of this.

Surprised to see Graphcore doubled. How has it doubled - CHRY don’t say? Many have written off Graphcore as dead, yet even though its ambitions in China have been curtailed through US intervention it’s still fighting on with positive newsflow - and achieving breakthroughs. Graphcore holds numerous patents around its IPUs (an alternative to using GPUs for artificial intelligence) but is less than 1000x of the market cap valuation of NVidia (but basically does something pretty similar)

Its increase is about 3p a share…. is this the company CHRY mentioned as a 5.5p gain possible sale? (Rather than WeFox?)

WeFox reports its appointed some new people into key positions. Is Foxy out of the 5.5p Bingo stakes? Nope, Foxy Bingo still might call house. Are those appointments happening ahead of a 5.5p a share gain possible sale? One could interpret these appointments as such.

Even the reductions from Brandtech (the RNS speaks to a strong pipeline, significant interest in products and reducing its cost base), Tactus and Deep Instinct do not appear anything dreadful.

Pay Backs?

CHRY has a potential claim against Revolution Beauty (REVB), in relation to the shares that it bought in July 2021 for about £45m and sold in late 2022 for about £5.7m in total - losing some £39m

CHRY claim this investment was made on the basis of information provided to the company by REVB that contained misstatements and material omissions.

CHRY have written a formal letter of claim to Revolution Beauty in November 2023, which requested a response within 28 days. REVB have responded asking for more time. REVB might simply cough up £39m - or CHRY may launch legal action.

Buy Backs

CHRY wants to maintain a liquidity buffer of £50m to ensure funds are available to support portfolio companies, if needed. As of the 01/01/24 CHRY has liquid assets (cash plus shares in listed holding Wise), of about £34m at the end of December 2023.

While the discount remains wide, the £100m (and 14.99%) would be returned by way of share buybacks. A successful disposal is positive, but using the proceeds for a buyback gives a double benefit to NAV and likely the share price.

Once £100m has been handed back, capital allocation would be to 25% further reward shareholders (via additional buybacks or dividends) and 75% back into portfolio investments.

Conclusion

Brighter times ahead for CHRY? To remain at a 40%+ discount to NAV in the midst of such obvious success makes no sense to me. It certainly made me think CHRY-pes!

This is not advice

Oak

Hi,

Where did you get the Klarna $800 million figure from? All I could find is that they made about £9.6 million in Q3 last year (130M SEK). Ian