Commenting on the DEC placing 20th Feb

Diversified Energy puts together the numbers for the Maverick deal

Dear reader

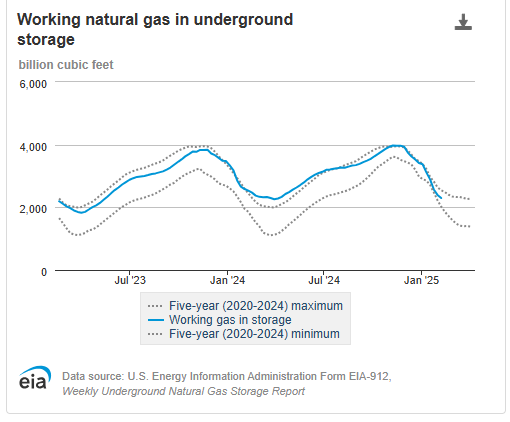

It shouldn’t come as a great surprise to learn the US gas reserves are now (no pun intended) well below the 5 year maximum of natural gas storage. Winter came.

If we consider a 2-year chart, the position is incredibly supportive for DEC to lock in higher hedges and also to enjoy better spot prices at prices nearly double of what they were February 2024.

Growth in demand in 2025 and 2026 will outstrip growth in supply by 0.7 Bcfpd - so over 2 years that’s well over 500 Bcf or nearly a quarter of all storage as it stands today.

LNG terminals are nearly maxed out and growing as fast as possible as Trump tariffs drive US LNG buying across the world.

Despite such an incredibly positive backdrop, DEC has fallen in price as it puts together the Maverick deal. The chattersphere is lit up with anger, whinging and harrumphing, but have shareholders actually sat down and considered the news?

Yes there is dilution. Shares issued at $14.50 (£11.44) are lower than the recent highs of £13.93/share. Let’s do a before and after comparison to determine whether shareholders are justified in writing petulent messages on DEC’s facebook page.

Compared to 2024 DEC-hands began the year with 51.3m shares. The placing announced this week and Maverick grows this to 81.86m. This raises $475m…. so nearly as much as the WHOLE of DEC was trading for at times in 2024 let’s not forget.

The most recent placing means assuming the underwriters take full advantage of the placing, that $130m will be raised. As can be seen below the $130m only slightly reduces the debt pile.

So comparing DEC in 2024 vs 2025 we see over $550m more debt, nearly 60% dilution but some higher earnings and reserves. So is a DEC-hand better off or worse off?

The answer only becomes clear when we consider a “per share” basis. The facts are that on the whole DEC-hands are BETTER OFF even after the events of 2025.

Yes there are negatives. The BOE of gas per share has dropped 14%, and the theoretical future PV-10 of reserves means you’re losing (sharing) 4% with new shareholders compared to what you had before. FCF is shared/lost by 2%. DEC-hands post Maverick/placing now have $73.30 of reserves per share (that’s over £57.80 per share in GBP terms instead of £60 per share). So you’ve “lost” £2.20 per share of future proven reserves.

On a plus side you now enjoy more liquids (NGLs and Oil). An increase of 78% per share. Crucially (least I think so) earnings are up per share by 6% even after dilution. In 2024 the adj EBITDA was $10.82 but going forwards (based on a pro forma as at 30/09/24) you have $11.42 - a $0.60 increase even with that dilution.

Leverage is reduced for DEC-hands too and now stands at -$26.97 per share rather than -$31.93 per share as at 31/12/24. So a new fellow DEC-hand has lifted nearly -$5 per share of debt from your shoulders (15%). Think about that.

So the harrumphing simply doesn’t stand up to scrutiny, and that’s in large part thanks to the attractive Maverick deal, it’s true. If DEC hadn’t got the Maverick deal on the table adding shares at $14.50 would have been dilutive. But the only reason for this placing is due to needing that additional equity to close the Maverick deal. A $1,500m facility was being sought so this placing reduces that to just needing a $1,375m facility instead.

It’s further worth considering that:

Let’s remember too, there were $21m of buy backs in 2024 at around $9 per share. So raising funds at $14.50 per share in 2025 is at a 61% premium to those buy backs in 2024.

The above per share numbers are based on 12 months performance as at 30/09/24.

Therefore don’t include synergy and cost savings which according to some broker guesses is a 10% upside. If that’s true then the pro forma EPS of +6% is potentially an EPS gain of +17%.

The other key point is we are considering the benefits based on data for the year to 30/09/24. A period of time when DEC suffered extremely low natural gas prices which are highly unlikely to reappear in 2025 and 2026. What EPS growth +% you place on that is up to you although based on 2022 performance a number with double figures would be appropriate. So EPS +27%++?

Bear in mind also that the above numbers also don’t include the upside of the Summit deal announced early 2025 PDP PV10 of $60m and 2KBOEPD

The above numbers also don’t include $42m generated through land sales in 2024 alone ($0.51 per diluted share) nor any land sales in 2025 and in the future.

Nor do they include any kind of development JV upside if DEC participate in anything of that nature in 2025.

The numbers don’t include any NextLVL performance

Nor do the numbers include the “avoided” interest cost of ~9% which on $130m is an $11.7m avoided cost (or $0.14 per diluted share)

Conclusion

It’s facile to see a share price that has fallen in the short term - as it always does in response to a secondary fund raising - and to immediately draw a negative conclusion.

When you consider the corresponding benefits DEC-hands should enjoy alongside the cost of that news, then the evidence shows that it is a positive, even if it’s easy to believe otherwise.

Some people most likely eagle-eyed readers will take advantage of the opportunity to take advantage of the lower price. Others are just determined to focus on a grey cloud inside a (very) silver lining.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I think part of the reason for the bad sentiment is that the vast majority of investors are not forensic accounts and, to be honest, I’m pretty sure most of them don’t want to know about the details they just care about the share price. The reality is that despite all these amazing deals the price is still massively down from the £20+ equivalent it was a while back when a lot of people bought due to the now vanished dividend income. So people sitting on significant capital losses and reduced dividend tend to not be happy when the share price tanks approx 15%.

Your analysis looks good and, assuming there are no more deals for a bit, maybe revenue/profit will increase as you outline and even debt may come down. However, it doesn’t really matter unless that pushes up the share price as that’s what investors care about.

What might help matters is if the company took an interest in its share holders and provided a bit more info in an easy to digest manner and outline how their strategy will grow the share price. Because the American market is only interested in growth and if you don’t provide it you eventually get dropped from portfolios.

Hi OB,

I would comment that for the placing itself, strictly speaking, I only consider points 1 and 8 as positives. The other points you make are valid for DEC's situation in general, of course - I agree, but the placing itself contributes savings on interest payments and could be considered as a kind of arbitrage trading gain earned by an opportunistic management in my mind.

Thanks for the analysis, as usual, of course.