Last Tuesday Ceres signed a further contract with Shell for green hydrogen. What does that mean? Let’s explore that today.

About Ceres (CWR)?

Ceres' stack technology is used for both Solid Oxide Fuel Cells (SOFC) to make power and Solid Oxide Electrolysis (SOEC) to make fuel. Combined they create a round trip for energy generation and storage.

SOFC is where you generate electricity, water and heat by reacting oxygen with hydrogen or methane. Its power generation efficiency, which is around 60% but can even reach 85% with a heat recovery system, is significantly higher than the efficiency of centralised gas-fired power generation units, which are around 40~50% efficient. As SOFC can be built near places with electricity demands, it is able to avoid power transmission loss and other unexpected unstable factors during the transmission and distribution process. Hence, it's highly suitable for facilities that require stable power.

SOEC is basically the opposite. CWR’s SOEC technology produces hydrogen up to 25% more efficiently than incumbent low temperature technologies particularly when thermally integrated with industrial processes. With electricity coming from renewable sources, the technology can produce green hydrogen, which would be optimal for the decarbonisation of various industries, including steel and chemicals, which are seeking to replace the fossil-based materials in their processes to ultimately reduce carbon emissions. Green hydrogen is also one of the key ingredients to produce carbon-neutral e-fuels, with the support of carbon capture technology for its carbon sources. E-fuels are alternative energy sources for vehicles, ships and aircraft under the net-zero transition.

With global energy transition trends, it is expected that the global demand for hydrogen will reach 223 Mt in 2030, and 630 Mt in 2050. Hydrogen applications will play a crucial role in achieving net zero targets.

A 1MW electrolyser consumes 50 tonnes of H2 per MWH generated (at 60% efficiency). So that’s 3Mt per 1MW electrolyser per year (50x24x7x365) assuming non-stop use. So 223 Mt if that H2 is being used for electricity equals 75MW worth of electrolysers.

Ceres has committed £100 million for the development of its SOEC technology - with the aim of achieving a market-leading levelised cost of hydrogen of $1.5/kg by 2025.

$1.5/KG is the magic number where hydrogen becomes competitive with fossil fuels

In 8 days on the 17th June it plans a presentation for a hydrogen technology update - what update can we expect?

SHELL RNS

Last Tuesday a contract was announced to design a 10MW pressurised solid oxide electrolyser ("SOEC") module to produce green hydrogen at 36kWh/kg. The market gave no reaction to this news.

The 2nd contract builds on the data being generated from the existing 1MW demonstration of Ceres' technology at Shell's R&D facility in Bangalore, India, and CWR’s collaboration with Shell is now 2 years old.

The commercial aim is to build larger electrolysers (100+ MW) for use in large-scale industrial applications such as synthetic fuels, ammonia and green steel.

The programme will use key learnings and data being harvested from the existing 1MW demonstration project to develop a commercially competitive and scalable solution. Key to this is the significant efficiency gains offered by SOEC technology, which results in approximately 35% more hydrogen produced per unit of electrical energy when coupled with heat from industrial processes. The project will examine pressurised systems that can drive further efficiency, performance, and integration with other processes, targeting a module level efficiency of less than 36kWh/kg of hydrogen, which aligns to EU SOE 2030 technology targets.1

Phil Caldwell, Chief Executive of Ceres commented, "Our strategic collaboration with Shell continues to provide valuable insights, ensuring Ceres' SOEC technology is well positioned to meet our partners' needs for the green hydrogen and synthetic fuels markets. Building on Ceres' class-leading technology, our commitment to continuous innovation keeps Ceres' commercial offering at the forefront of the industry in terms of simplicity, efficiency, and performance."

Shell - Bangalore

The 1MW scale solid oxide electrolyser demonstrator went live November 2023 at Shell's R&D technology centre in Bangalore.

What makes CWR unique is the efficiency of the technology, particularly in systems with waste or existing heat, offering at least 20% more efficiency than PEM and alkaline electrolysis. While it has a slightly higher CapEx, the superior efficiency results in a significantly improved levelised cost of hydrogen. This makes the technology particularly advantageous for industries operating 24/7, crucial for hydrogen-based decarbonisation.

Beyond Shell

Interestingly, Liberum see CWR as having an 800p valuation based on a 2% market share of electrolysers worldwide by 2035. You’d need powerful allies to get worldwide sales, wouldn’t you reader?

You will your allies be?

Introducing Delta, Bosch, Doosan, Linde and Weichai.

DELTA FORCE!

Delta Electronics ("Delta"), a global leader in power and thermal management solutions signed a global long-term manufacturing collaboration and licence agreement with CWR for both solid oxide electrolysis cell ("SOEC") and solid oxide fuel cell ("SOFC") stack production.

Its agreement includes revenue of £43 million to Ceres through technology transfer, development licence fees, and engineering services, of which approximately half is expected to be recognised as revenue in 2024. There is potential for additional revenue from the sale of Ceres development stacks to Delta. The agreement also includes royalty payments to Ceres on future commercial production and sale to end customers by Delta.

Technology introduction and factory construction will start from 2024 and the initial production by Delta is expected to start by the end of 2026

Delta's expertise in mass manufacturing, power electronics and data centres for customers like Microsoft, has seen it diversify into turnkey decarbonisation solutions and the development of IoT-based smart buildings, energy infrastructure, grid balancing and energy storage for customers such as Tesla. It also provides solutions to customers worldwide, across a myriad of sectors including chemicals, energy, transportation and steel. It employs over 80,000 people across approximately 200 facilities worldwide and is listed on the Taiwan Stock Exchange with a market capitalisation of approximately US$23 billion.

Phil Caldwell, CEO of Ceres commented, "It's great to announce a partnership with Delta, a company with worldwide expertise in mass manufacturing, power electronics and system integration. We believe Delta can deliver efficient clean hydrogen solutions for its customers utilising both our SOFC and SOEC technologies. Green hydrogen has a key role to play in delivering a more secure and sustainable future energy system and today we take this first step towards what promises to be a strong collaboration with Delta to accelerate the industry globally."

Ping Cheng, Delta's CEO, said, "Hydrogen has high heating value and zero CO2 emission potential characteristics, and thus, will play a crucial role in the global transition towards net-zero. Moreover, Hydrogen SOFC systems boast reliability and high efficiency in electricity generation, making them ideal for micro-grid applications, distributed power systems, mission-critical facilities, such as data centers, semiconductor production lines, and other advanced manufacturing. SOEC systems will also play a key role in the chemical, utilities, and steel industries as they are adopting green hydrogen to replace fossil fuels in their manufacturing processes and operations. By leveraging Ceres' expertise in solid oxide stack technology and our industry-leading technologies in power and thermal management, Delta will enrich its infrastructure solutions portfolio by delivering high-efficiency SOFC and SOEC systems for our customers worldwide, hence, further contributing to global carbon reduction targets."

In addition to licensing key energy stack technologies, Delta will also establish a "Net-zero Science Laboratory" at its Tainan manufacturing complex to develop cutting-edge zero-carbon technologies, including hydrogen energy, and to enrich its own R&D capabilities in related application fields. From 2024 to 2026, Delta expects to carry out product development and production line integration at its Tainan plant with Ceres' engineering service support. Production for the aforementioned technology is expected to start by the end of 2026. Delta expects to further integrate its diverse smart energy solutions, including microgrid applications and energy management platforms, with these hydrogen energy systems to provide a more comprehensive and flexible low-carbon infrastructure offerings to its customers.

Bosch (17.5% shareholder of CWR)

Bosch is set to initiate the production of 200MW per annum in 2024, focusing on distributed power stations using SOFC technology, which is fundamental to Ceres' technology. The company announced its plan in 2020 to establish multiple sites in Germany for the production of 200MW of SOFCs under a Ceres license, with production starting in 2024. Bosch's investment in this venture is approximately €500m.

The intention is to integrate SteelCell stacks into various future systems, providing distributed power for small city power stations, factories, data centers, and electric vehicle charging points. With an annual group revenue of EUR 88 billion, Bosch is heavily involved in internal combustion engines (ICEs) due to its leading position in fuel injection systems. It also plays a prominent role in IoT, offering solutions for smart homes, smart cities, connected mobility, and connected manufacturing. Bosch has previously conducted PEM fuel cell and Solid Oxide fuel cell system development programs and possesses expertise in ceramic applications through its lambda sensor vehicle.

Doosan

Doosan starting with 50MW and likely to scale to 170MW – The South Korean group announced in October 2020, that it had been granted a licence by Ceres to manufacture Ceres’ proprietary solid oxide fuel cell stacks. Doosan plans to commence production at a 50MW pa manufacturing facility in South Korea in 2024. Since 2019 Doosan has focused on developing a 520kW combined-heat-and-power boiler-style unit for the commercial buildings market. Doosan is establishing itself as a world leader in the fuel cell industry and is now adding Solid Oxide technology to its existing portfolio of fuel cell technologies. Doosan’s existing stationary fuel cell business exceeded 1 trillion won (c. $850 million) in orders for the first time in 2018, just three years after entering the market.

Weichei (19.7% shareholder in CWR)

Weichai has become a major player in the fuel cell vehicle space, benefitting from Chinese government grants. The collaboration between Weichai and Ceres reached a significant milestone when the trial SOFC power system using Ceres' technology passed EU CE certification. Weichai's Fuel Cell Industrial Park demonstrated an SOFC stationary power system with impressive operational metrics, including fast start-stop capability, power generation efficiency exceeding 60%, and cogeneration efficiency surpassing 85%.

Ceres' SOFC technology has been chosen for EV range extension because it is a practical choice due to the wider availability and cost competitiveness of natural gas compared to high-purity hydrogen. Unlike PEMFCs (a competing technology) that work best with pure hydrogen, SOFCs offer greater fuel flexibility.

Weichai aims to scale its SOFC technology deployment to 1GW, anticipating a potential reduction of around 2 million tonnes of carbon emissions per year compared to grid electricity. Additionally, Heads of Terms (HoT) agreements between Weichai and Bosch expand on the existing partnership. These agreements outline plans for a 3-way System Joint Venture (JV) for SOFC systems' development and manufacture, as well as a 2-way Stack JV (Bosch & Weichai) to manufacture and supply fuel cell stacks. The model aligns with Ceres' approach of licensing its intellectual property (IP) to major partners, who contribute scale-up and manufacturing expertise. The finalisation of contractual details between Weichai and Bosch is pending before definitive contracts are signed - but this was due in 2023 and we should see progress in 2024.

Bosch and Linde Engineering

In March 2023, Ceres entered into a new partnership with Bosch and Linde Engineering, focusing on evaluating Ceres' technology for large-scale industrial applications as a means to achieve cost-effective green hydrogen production. The collaboration aims to conduct a two-year demonstration of a 1MW solid oxide electrolysis (SOEC) system, commencing in 2024 at a Bosch site in Stuttgart, Germany. The primary objective is to demonstrate the technology's efficiency in generating low-cost green hydrogen, presenting a viable solution for challenging-to-decarbonize industrial sectors.

This agreement leverages Bosch's existing expertise in Ceres' SOFC technology and incorporates Linde Engineering's renowned capabilities in hydrogen process technology, coupled with a global customer footprint in industrial facilities. Ceres envisions fostering an ecosystem of SOEC partners to enhance the competitiveness of its technology and pave the way for widespread adoption at scale.

Political Will

Our next government are committed to ideas like hydrogen. Great British Energy will be buying electrolysers, it’s a stated goal.

Nor is it just our next government. Look across the sea and EU will see an even stronger H2 agenda. H2 is seen as part of energy security while the improving capability of solar and wind provide a declining cost input that helps green hydrogen get to the magic $1.50/Kg parity level.

Valuation

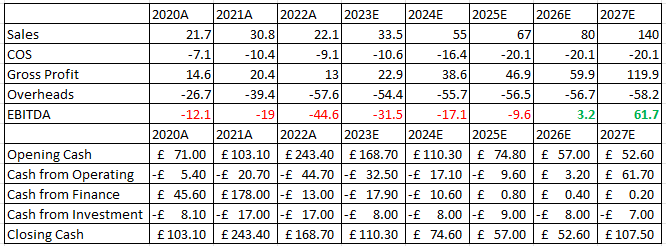

CWR’s valuation is based on DCF estimates and an EV/EBITDA of 1.5 based on FY30e. With the market cap at £404m it’s not inconceivable that the same 1.5 EV/EBITDA could be reached by 2028E instead.

Also supplying 2% of worldwide demand by 2035 also seems a fairly conservative target. If CWR achieved 10% of demand these numbers would be much, much higher.

As a play on the future and particularly given the fact that its cash buffer and more rapid cash generation also derisks this, it seems Ceres could indeed be a god of bountiful harvests.

CWR show this too, where licence income grows to royalties into the 2030s and beyond.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

They've posted some great results last Friday! And also announced a cost savings programme in Q4 and on 👍

Thanks! That was quick haha. So what is your conclusion? Something you would consider or wait a bit and then step in? Or simply not the kind of company you want to invest in, also an option.

I've bought CWR a couple of years ago, unlucky so far but it looks like it's changing now (I've bought more close to the low), let's hope for fruitful times 🤞