Dear reader

I was interested to read an article “Why I decided against investing in DEC” on Seeking Alpha.

The summary is:

“Recent acquisitions and capital allocation decisions raise concerns”

Let’s tackle these two concerns in turn. The writer’s comments are in Italics throughout:

1.“Recent Acquisitions”

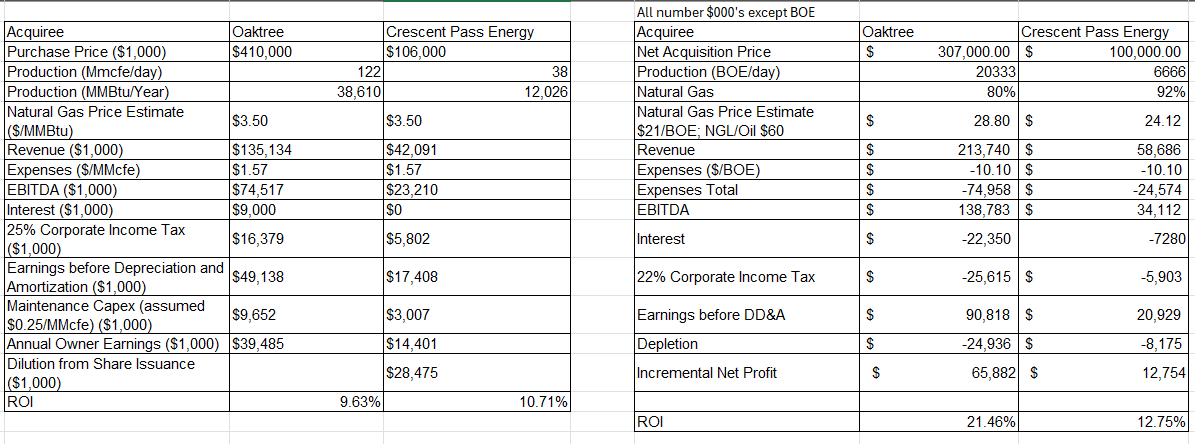

“I estimate the annual earnings … is roughly $40 million for the Oaktree acquisition and $15 million for Crescent Pass.”

Forward EBITDA is $126m for Oaktree and $26m for Crescent, so the key here is what is the “ITDA”? (I examined these acquisitions in DEC-iding and DEC-boy)

“These assumptions point to owner earnings, which equate to a roughly 10% initial return on capital next year.”

Is that true? Firstly I notice the gross price is used and not the adjusted actual price. Also considering Oaktree is $307m net purchase cost (after in-the-money hedges of $70m are stripped out) so $39.485m isn’t 10% of the capital and Crescent Pass’ net price was $100m so a $14.401m return isn’t 10% either.

The writer goes on to “assume”:

$3.50/MMBtu sale price for natural gas, $1.75/MMcfe production expenses and roughly $0.25/MMcfe in maintenance capex based on the company's own historical results.

The $3.50/MMbtu used in the NPV calculation is based on a 4 year future price so that is not a historical result, it’s a future price. $1.75 + $0.25 so $2/MMcfe (why change the unit of measure to your maths?) is $12/boe. That’s not accurate! In FY2023 the number is $10.14/boe, and in 1Q24 it’s a lower $10.10/boe.

Moreover savings are identified (such as Black Bear and Oaktree’s accretive acquisition with zero G&A, and Crescent’s proximity to existing production) so for FY2024 so if anything, $10.10/boe costs will be lower in FY2024.

However, keep in mind production from these acaquired assets will continue falling by around 10% per year into the future.

And this is why if you factor in DD&A and not just use EBITDA (the writer doesn’t use EBITDA he calculates a net contribution). The depletion within DD&A is the “replacement cost” of depleted production. It overcomes the Charlie Munger comment about EBITDA being a nonsense - Munger had a point - and certainly about extractive industry.

But examining the writer’s numbers he DOES consider the “ITDA”. But I didn’t agree with how the numbers are reached so I produced my own comparables which I set out below.

The acquisition looks better if you assume increasing demand takes the price of gas higher in the future, but my projected natural gas sale price of $3.50/MMBtu feels generous, with spot prices currently closer to $2.

A $2 spot price ignores that the majority of DEC production is sold at hedged prices so that $2/MMbtu is considerably below a realistic unit selling price for DEC, even when Henry Henry has been not much above that level in CY1H24. DEC has hedged seven years ahead and 85% in the current year.

In fact the only consideration given to hedging by the writer is the limit it gives to the upside (beyond the $3.18/MMbtu, 85% 2024 average hedge price) when he writes:

The company aggressively hedges production…. that also limits the upside for shareholders.

An even handed approach is to also say it limits downside too! Limiting the upside for a future gas price of $4/mmbtu - $10/mmbtu would be a nice problem to have!

A further misunderstanding is the variability of gas prices. In H124 max and min prices were $3.14/mmbtu and $1.51/mmbtu; in 2023 it was $3.79/mmbtu and $2.01/mmbtu. When you are hedging, you obviously grow your hedges at points where futures are higher too. DEC have a proven track record to do this in a shrewd manner.

A final misunderstanding is to assume 100% gas. That’s not true either. For Oaktree Oil and NGLs comprise 20% of the purchase and at Crescent the number is 8%. In my analysis I use the writer’s $21/BOE for gas and a conservative $60/BOE for NGL/Oil.

I set out a comparative based on actuals. Actual tax rate has historically been 22%; actual cost of capital (interest) is 7.28% (and I’m assuming these acquisitions are 100% funded by debt), I’m using an actual cost of production of $10.10 per BOE. Eagle-eyed readers will see I only consider depletion, and I consider it pro rata to DEC’s FY2023 number of $168m (over 50m BOE production) that’s $3.36/BOE. That’s how I arrive to a $25m depletion cost for Oaktree and $8.2m at Crescent.

I do not then include amortization and depreciation in addition (considering that this will be minimal to the 2 assets) but if you wanted to then the per BOE for FY23 was $1.12/BOE

Conclusion: $68m additional profit or $58m (including a pro rata for Depreciation & Amortisation) after you strip out the entire “ITDA” of EBITDA.

But the point which is missed by the writer is that you can’t worry about the replacement cost of production if you are accounting for it!! You mustn’t double count it.

you can’t worry about the replacement cost of production if you are accounting for it

2/ Capital Allocation

The writer says:

“I'm not impressed by recent capital allocation decisions and certain aspects of the business model concern me. While natural gas prices are currently very low by historical standards, most of the industry expects prices to rise again in the next few years as a multitude of developing LNG export facilities come online, and gas production assets seem to be priced accordingly. If industry developments play out to the downside of consensus expectations (as they often do) Diversified Energy may have a much harder time operating their wells profitably. The company aggressively hedges production, which is appropriate given their capital structure, but that also limits the upside for shareholders.”

It baffles me what any of this has to do with capital allocation. Is the writer using words a bit loosely here? The concern appears to be solely to do with the price of gas. Again. Natural gas prices are not a question of capital allocation but let’s examine this concern. Again. The fact is, no natural gas producer in the USA is profitable at $2/mmbtu or $12/BOE. Gas per barrel of oil in the USA is equivalent to nearly 1/7th of the price of said barrel of oil (at Brent prices). Common sense suggests this price cannot continue. Actual observation of DEC’s competitors is that it wouldn’t. EQT and other announced cut backs to production given the warm winter. The writer assumes permanently low Henry Hub prices (and argues this is the consensus) while acknowledging that Gulf pricing is higher and could (should) become much higher due to LNG exports. If, as the writer fears, prices go downwards production gets dialled back - as has happened in FY2024.

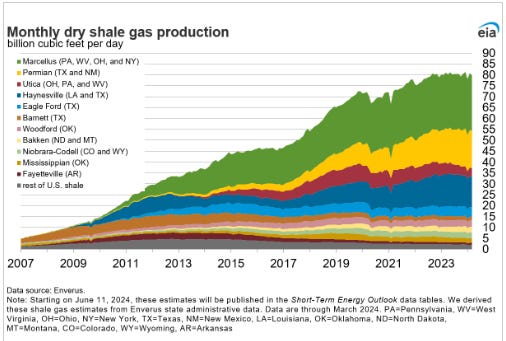

Elsewhere in their article the writer speaks to growing demand and shrinking supply, for example, that Shale is typically in a “harmonic decline” aka a rapid decline. There are two key considerations here. First is that much of the recent growth of gas production has been shale (and is therefore subject to harmonic or rapid decline). Second is that very few of DEC’s wells are shale wells. That bodes well for “hypermiler” DEC.

So rapid declines in supply and rapid growth in demand does not suggest price falls…That would defy the basic laws of economics.

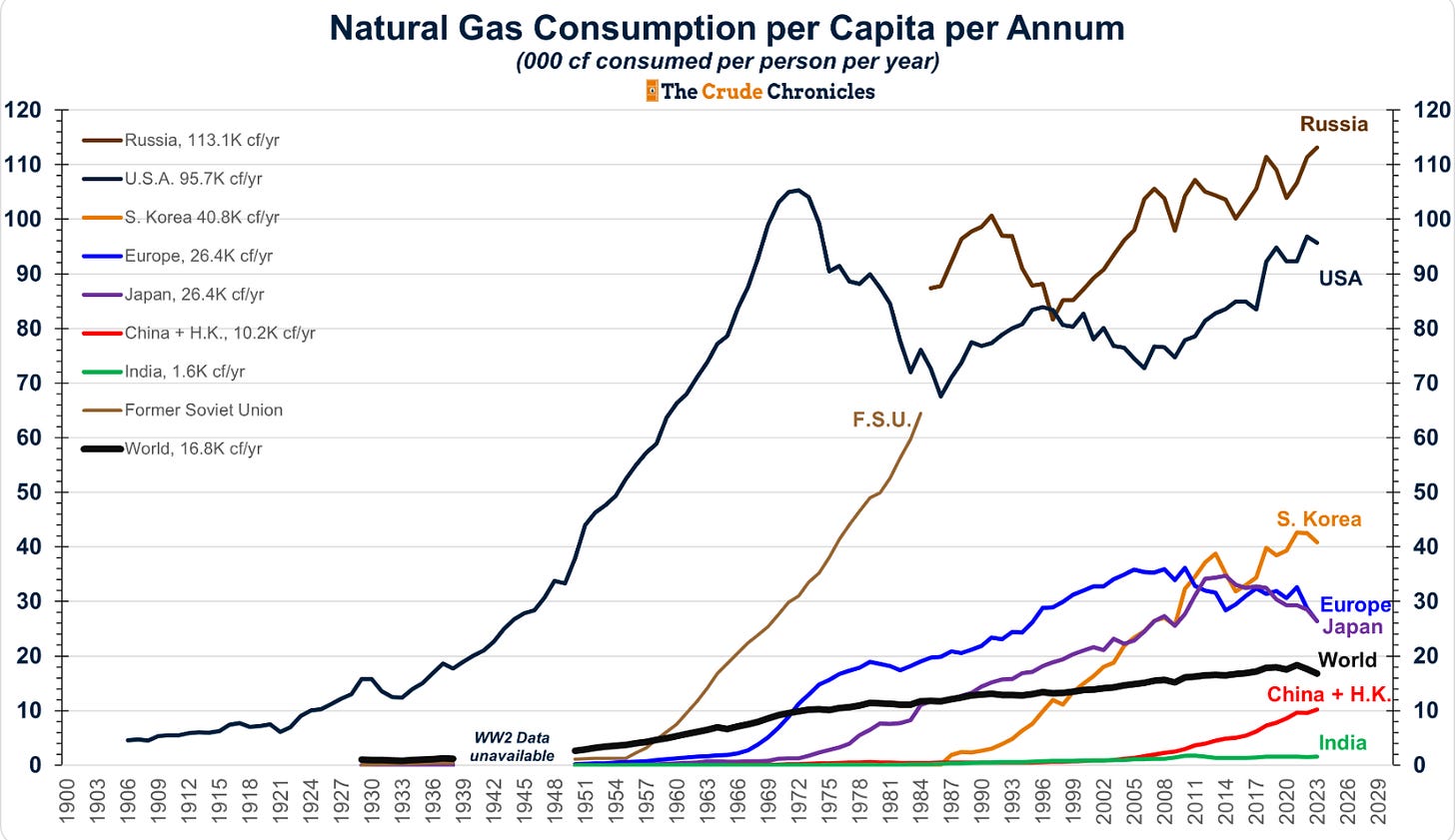

Meanwhile (in other news) it’s interesting to read that natural gas consumption per capita is growing in most parts of the world. Consider too, that populations are growing - a growing number of capitas, so to speak.

It’s not just the humans. It’sAI too.

Gas - is Immense is not unlimited

I would strongly recommend that every DEC-hand read Goehring & Rozencwajg’s Q1 2024 article: “ON LNG, AI & SHALE SUPPLY: WE EXPECT THE TURN IN US GAS IS HERE”.

G&R argue that gas is at an unprecedented price level compared to oil, and while a 500bcf surplus remains today, a number of factors will deplete that surplus - and are already doing so. A combination of supply is faltering just as demand is expected to surge. If their broad (and I think compelling) evidence is correct, the implications for DEC -and DEC’s share price - are immense.

Conclusion

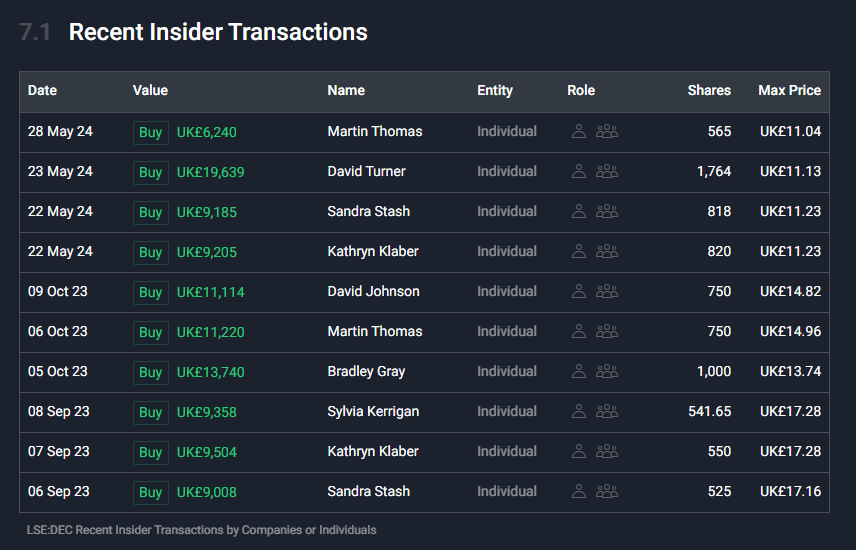

The writer concludes to say they will sit on the sidelines until a $10-$11 price for DEC reappears AND insiders start purchasing a significant number of shares.

There have been ~$150k of Director buys in 12 months, while isn’t Rusty’s $20m stake significant enough? (A $20m stake equals T.F. Karam at EQT for example)

Meanwhile, lots of luck waiting for a DEC $11 a share to come back around. How patient can that writer be, I wonder?

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings covered in other articles might have a higher risk and higher volatility than FTSE250 & Russell 2000 companies that are traditionally defined as "blue chip"

I would like to read your thoughts on North Sea producers like Harbour, Ithaca and Serica. Deep value or value trap?

Blackrock now buying big