Dear reader,

2024 was the year of elections. A major changing of the guard. The US, UK, Germany, Japan and France all have new leaders. They do say careful who you vote for.

A year back and Honorable Pallone (I’ve misnamed him Pallome across a number of articles!) was on a witch hunt and DEC was the Witch. A year later and it’s which regulation shall be put to death next.

Of course DEC survived its baptism of fire, survived a concerted short attack and put its head down and got on with business. Pallone survives too, a lonely Democrat in a Republican House.

A few nut jobs in the chattersphere continue to insist DEC is doomed while the grisly short mob are edging their bets down. Those that remain face growing losses.

Another dividend arrived 6 weeks ago and another is coming in 7 weeks. Shorting is an expensive business for DEC-tractors and the question arises how long will shorters remain until they finally melt? Which can take the pain?

What colour did the detractor George’s face turn, I wonder, when he saw DEC’s Q3 results? The colour must have drained at the news of DEC’s Relentless Focus. One shade of grey. Not a best seller.

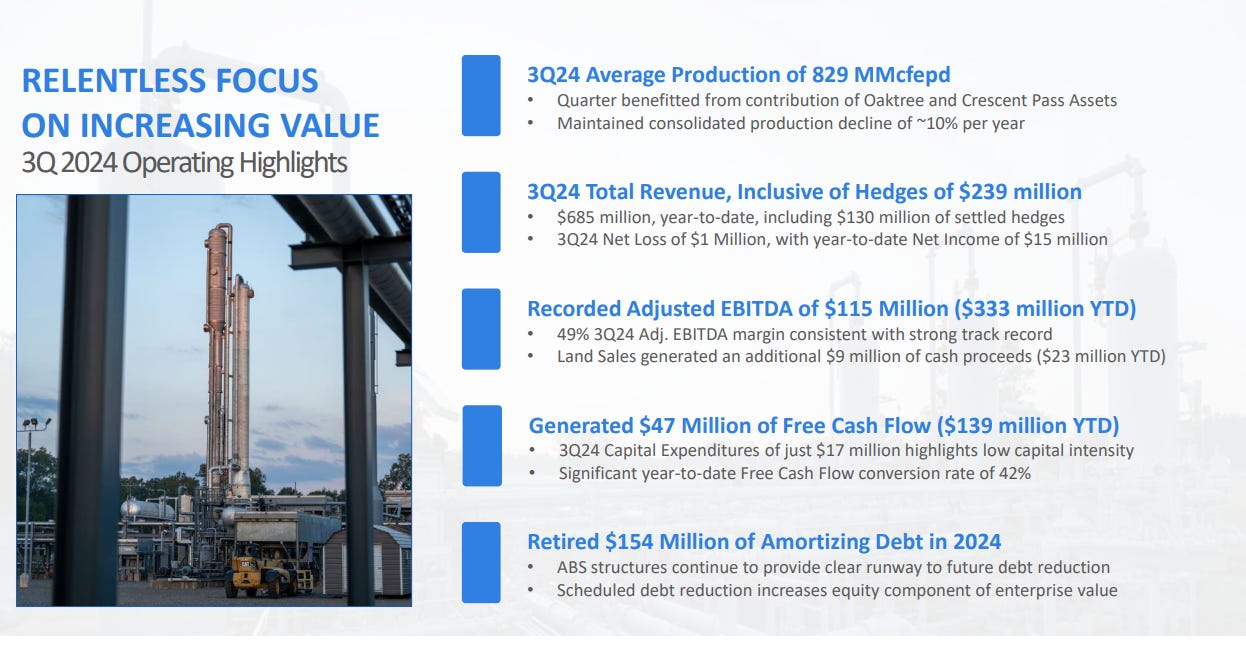

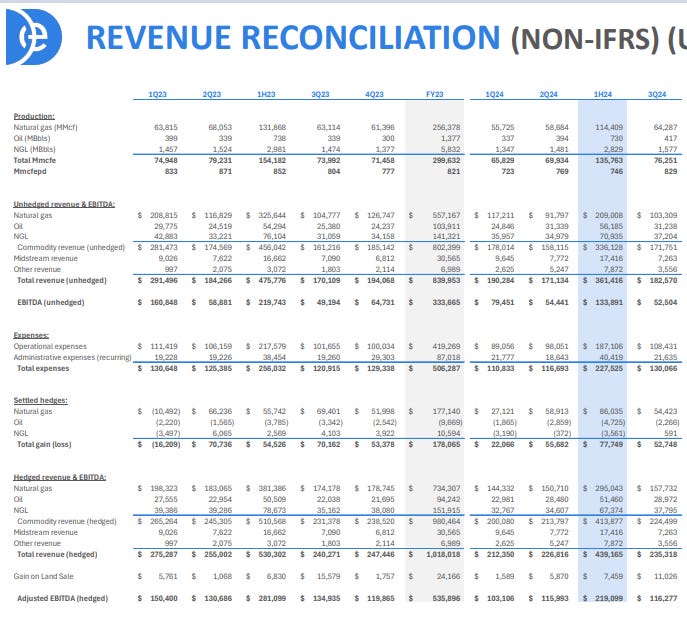

DEC’s focus generated $239m of revenue in 3Q24 despite thin pickings and a low gas price averaging just $2.23/mmbtu, and $685m revenue YTD despite sub $3/mmbtu prices for nearly all the year. Production declines continued at a consistent 10%.

Ashen-faced George witnessed an adjusted EBITDA of $333m YTD - that’s $444m annualised at the same pace. That’s on track for the $211m annualised adj EBIT estimated by the OB in June.

Detractors’ grey faces as they realise £341m of EBITDA for a market cap today of £563m but which hit a market cap of just £426m in late September! FCF of $47m (and $139m YTD is also on track to my estimate) and DEC produced Operating Cash Flow of $64m (and $177m YTD below estimate).

DEC achieved a price to operating cash flow of 4X. In other words if you invested zero back into the business and just paid 100% of cashflow as dividends that’s a 25% yield at today £10.90 share price. Sound like a familiar prior dividend level reader? Based on the September year low it’s a 33% yield at £8.20 a share.

The very fact that shareholders could theoretically feast through a famine is testament. The further fact that remaining wise shareholders endorse the balanced approach to pay down debt, to buy back over $20m of shares at a colossal discount, while receiving a decent yield. Some DEC hands abandoned ship losing money, probably. Others shielded their ears and ignored the sirens willing them overboard. Perhaps like the OB topped up believing the storm would cease.

US Gas production is now lower in 2024 than 2023.

GlobalLNGHub.com tells us that the U.S. benchmark price, after an expected 13 percent decline in 2024, is forecast to jump almost 55% in 2025 as new LNG terminals draw international demand for U.S. natural gas exports, and then increase a further 9 percent in 2026. International demand for gas, they say, is forecast to grow too.

The Oak Bloke DEC model forecast 140.2 KBOEPD production in Q3.

The start date of the added production was later than I anticipated so averaged just 138 Mboepd, but the exit rate points of 142 Mboepd points to an ADDITIONAL 1,800 BOEPD above my modelling. Who was it who thought that there was no opportunity for accretive production growth? That Crescent Path had already optimised production? 1,800 barrels a day equivalent says they were wrong. More to come in Q4 too.

I modelled $19/Boe but actual revenue was 2% above my modelling. I model $20.46 in Q4 but given current gas prices I suspect my Q4 numbers are too low this quarter too.

I previously speculated that unusual forms of revenue could present themselves. They did this quarter. CMM.

What do you notice if you overlay DEC’s wells (and 17,000 mile midstream network) with the above location of appalachian Coal Mines? A near perfect match.

The EPA tells us that the CMM project market already captures about 15 Mboepd of gas - equal to 11% of DEC’s current gas production.

The EPA web site also tell us that there are 30 current opportunities - so perhaps could add an extra 1%-3% of DEC’s gas production! So you get to sell the gas but additionally earn Carbon Credits as well as RECs/AECs (Renewable or Alternative Energy Credits) plus Tax Credits to boot! 1% of DEC’s hedged gas revenue per year is $8m and $4m EBITDA suggesting that a further $4m-$6m of earnings are credits of some kind.

Other opportunities are being explored too, according to the latest presentation deck. Will Wells aka liabilities become assets in a future world where wells could be used as batteries, used for carbon storage or used for Hydrogen storage? That turns an ARO into an ANRO…. an Asset Non-Retirement Opportunity. :)

I present further evidence to the permanence of this later on.

NextLVL

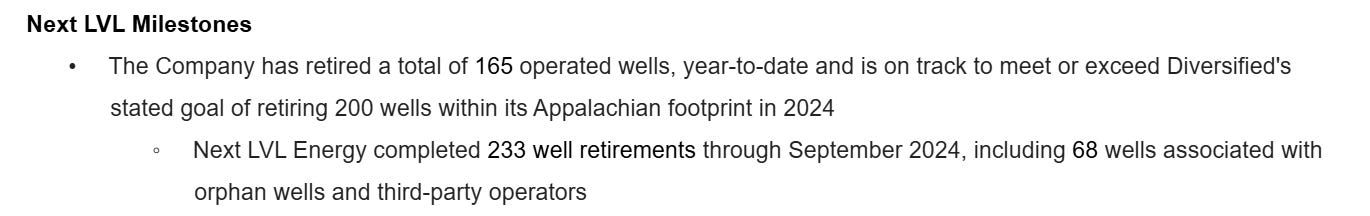

NextLVL has grown from 17 rigs to 19 rigs, although Rusty in the 3Q24 presentation, when questioned, spoke of NextLVL as steady as she goes. I forecast 65 and they achieved 68 3rd party retirements.

At the start of 2024 there were ~64,200 gross wells, including 56,700 wells in the Appalachian Basin and 7,500 wells in the Central Region. That number has reduced by 165 so far, plus the +331 East Texas and +827 Crescent Pass new wells added in 2024.

Of course DEC hands don’t have a solid wall of positivity. Detractors will be cheered by the single piece of bad news to learn that DEC appears to have lost a suit at a cost of $6.5m yesterday.

DEC has agreed it seems to an 18% acceleration of its program from “at least” 200 wells a year to 236 over the next 11 years. At a $24k average cost these 36 extra wells actually implies a $0.86m per annum additional cost - which is a $0.86m ACCELERATED REDUCTION OF THE ARO. There is no mention of this outcome in any of the .GOV web sites so it is possible this is a fake news report.

Consider, too, DEC is above its 200 minimum in any case. 14 wells at $24k is just $0.33m a year.

So while this possible news update could be painted as a vast negative and no doubt detractors shall dance to the single negative piece of news, in context it is fairly irrelevant and no actual new net cost in any case. It is a timing issue (apart from the $6.5m award of course)

Meanwhile in more positive news undeveloped leasehold has raised ~$23m cash YTD and an $11m gain in Q3.

A further positive is buried on Page 50 of the November 2024 presentation is the following info:

Taking the $235.3m hedged revenue less Op.expenses -$130m and DD&A of -$63.3m gives us an EBIT of $42m. Plus $11m on the Land Sale gives $53m. Given the statutory loss for Q3 there is presumably no tax. Interest for the quarter meanwhile is $39.6m. Leaves $13.4m profit for the quarter.

So what can we glean from all of that? That net of (non-cash) depreciation, depletion and amortisation which could be seen as the replacement cost of production, net of interest, that $13.4m was earned.

Or ignoring the replacement cost of assets, $76.7m of “EBDA” earnings. In one Quarter. In a quarter when Henry Hub prices averaged $2.23 and over supply led to shut ins at competitors. When DEC faced a potentially aggressive US administration for another 4 years, seeking to curtail LNG exports, among other things.

In Q4, today, it is backed by a supportive administration which wants to drive exports. Wants to Make America Great Again, whatever that means. Regardless of the morality question of America’s new leader, and the rhetoric, I suspect there won’t be a wholesale roll back of regulation. The USA is too full of compromise, checks and balances.

But this limitation to the roll back actually presents an opportunity for DEC. Just as with the Coal Methane opportunity. Just as I predicted the wholesale dismantling of the IRA (Inflation Reduction Act) appears to be out of the question too.

Besides, it’s just a fact that Methane emissions are really bad - 80 times worse than Carbon Dioxide at warming the earth. Plus it’s wasted money. Methane is production. Put it in a pipe instead. Satellites are increasingly able to detect emissions too. Plenty of Republicans were affected by floods in 2024, and ignoring climate change is an increasing toxic issue. I simply don’t believe the US will allow the Chinese to gain the moral high ground over environmental leadership either. Trumps rhetoric and subsequent actions are not one and the same.

Meanwhile regardless of politics DEC will continue to operate as a steward to its assets, and via NextLVL and perhaps Methane Reduction in 2025 and beyond earn good money tackling problems.

It is well placed to continue to do so.

Slamming the Accelerator?

Meanwhile even if Trump deregulates and cries “Drill Baby Drill”. Will we see success in “Drill Baby Drill”? I suspect slamming the accelerator could expose the Hubbert curve - or at least clarify its existence in the mighty Permian basin through further reductions in well productivity. Exposing its existence would be hugely bullish for DEC. Hypermiling and Stewarding suddenly becomes more important when drilling no longer taps and finds infinite resources. The accelerator pedal stops working.

I’ve presented a lot of evidence as to why this will happen and is happening - from the productivity of Permian wells, to production growth. Meanwhile “export baby export” will accelerate regardless of Drilling, and this, plus energy requirements of AI and Data Centers - and indeed the reshoring of US manufacturing will impact on the demand for gas.

So to conclude, once again DEC performs magnificently in Q3. With Relentless Focus. I remain convinced it has bright days ahead. I’m pink; the detractors ashen and shorters heading for ashes.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

If you don't know their work already, you might be interested in this: https://blog.gorozen.com/blog/us-natural-gas-production-is-plummeting?utm_campaign=Weekly%20Blog%20Notification&utm_medium=email&_hsenc=p2ANqtz-_1O8MZr-Y5A16Y3Xiu7KTPLDBih_q0H-FrqAPhL-2HU81_-PrbbDMsDPoS5bD5gFSREKBkPHMCNKvttmUimcUpyEj9_A&_hsmi=333003413&utm_content=333003413&utm_source=hs_email

Shucks. It was all looking so rosy again, and bow Rusty has announced another Investor Engagement.