DEC-iding on what's real

Is $20,000-$25,000 a well realistic?

How real are plugging costs?

There’s suddenly a world of ARO experts out there. It’s fraud they exclaim. It must be. Surely this is too good to be true. Who on earth can pay a 28% dividend? Any business on earth, which is committed to its shareholdaers, is profitable, cash generative but suffering a short attack.

Having seen a line of thinking, that somehow because some newbie pundits sometimes basing opinion on a report from Ted’n’Kathy written 2 years ago and which references research some dating back a decade or more, think plugging “must” cost much more than $25k. Bloomberg told them too. Is that so.

(Shall we throw in a Gallic shrug for good measure by way of reply?)

No let’s apply some good ol’ Oak Bloke commonsense.

Today’s article seeks to address this, and to demonstrate why I believe $20,000 - $25,000 is a reasonable amount of money per well. And why if DEC’s AUDITED ACCOUNTS say they managed to do it for $20,770 per well I (for one) do not disbelieve them. Is a 50 year or 71 year fraud really going on? Give me a break! Who benefits from the fraud? Rusty doesn’t.

The only fraud I can sense are people crying wolf about a fraud.

The rationale

We know (from the Q3 update) 16 plugging teams were on track to plug 336 wells in 2023. (It might be 369 Wells - I don’t know whether we got to 169 wells). So I’m going with the lower number.

So for 16 teams that’s 21 Wells per Team. A team is 3 or 4 people. Let’s say 4 people.

Let’s say they earn $60,000 each a year. $240k a team is a wage bill of $3.84m. Let’s round it up to $5.5m for Cement Drivers, admins, managers, taxes that kind of thing.

Fuel. Assuming they are driving a fleet of Cement Mixers and Water Trucks and rigs. Total miles for DEC in 2022 were 24.5m miles so let’s say 3.2m relates to Next LVL (200,000 miles per team sounds high, but factoring in multiple vehicles brings it to 40,000 per person). At $4 a gallon and 30MPG that’s a fuel bill of $0.5m.

Depreciation - 50 vehicles at $20,000 a vehicle and $0.5m general which is $1.5m.

Cement and materials. 200 foot holes filled with cement and sometimes expanding cement. At $115 per m3 and a 70m deep hole of 1/4 m2 circumference is $2,012 and 336 wells is a materials bill of $0.7m (the pull out the pipe and sell that or recycle - let’s assume the value of that covers any other materials)

That gets us to an $8.2m cost.

The above costs work out at $24,404 per well. ($8.2m/336 wells)

That’s Oak Bloke back of a fag packet maths but it feels realistic. Moreover to get to $125k per well you’d have to consume over 5X the above wages, cement, mileage, people AND wages ALL THE TIME. Is that bordering on fantasy to tackle something which looks like this?

Because if I had the knowledge, expertise, equipment, 3 co-workers, the vehicles, the fuel and the cement I reckon I could plug at least 21 of these in a year - less than 1 a fortnight. For a job which takes about 2 days to do. What do you think reader? In an interview with a guy who does this job says it takes 2 days per well. When does a 2 day job for 4 humans cost $125,000?!

Remember these are the steps they do to Plug a well.

By the way I’m running those numbers on making ZERO PROFIT on the 136 3rd party wells. So if I make $60k profit per 3rd party well that’s $8.2m profit (136 x 60k) so my gross P&A costs could double to $48k a well and the profit nets it back to $24k a well.

I don’t know what the exact numbers are and don’t pretend to….

BUT I KNOW THE NUMBERS SEEM TO ADD UP AND SEEM REASONABLE - ON AVERAGE. WHERE’S THE FRAUD?

Why did Rusty say $25,000 if the number was $20k-$25k?

I believe simply Rusty used the upper number to not get caught up in semantics as if you say $20k-$25k in a PUBLIC REPORT then you probably should be conservative in a letter to Congress.

This seems to have prompted a 19% cost difference conspiracy theory….. SEMANTICS!

AUDITED ACCOUNTS ARE AUDITED ACCOUNTS and it clearly says $20,770,000 of costs for plugging 100 DEC wells - which is sent to the P&L. That’s not to say I believe it will remain at $20,770 for ever nor that there could be wells which are more expensive to plug but this is an average - so some wells presumably cost less than $20,770 too. Also remember reader just as costs will go up with inflation so too will the selling price of gas go up too. So it’s relative. Not the basis for some bizarre fraud!

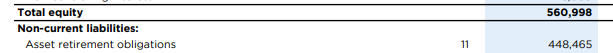

ARO is a Piggy Bank

I’d also like to take the opportunity to clarify my thinking on DEC’s ARO. I noticed comments suggesting I’ve said this money is “set aside”. That’s not true. The ARO sits on the balance sheet as a long term liability (not as an asset as some people seem to think). However the key point here is it is backed up - or BALANCED - (it is a balance sheet after all) by assets. In the case of DEC it had at 30/06/23 total equity of $560,998,000 to cover its ARO liability of $448,465,000. Equity is basically assets minus liabilities.

But the equity is net of ARO, and also net of $731,093,000 Unsettled Derivatives, which under IFRS need to be accounted for as though they were going to all happen today (when they actually will fall over the next 8 years - or may not happen at all).

So if DEC went bust tomorrow then it would have $1,740,556,000 of net assets to deal with its liabilities - including ARO - that’s before the increase of net assets via its 2H profit and its land disposal in 2H. How can you commit fraud when your assets already largely and potentially wholly cover the very thing you are allegedly defrauding! It borders on the bizarre.

It’s also true that going bust on the 16th January 2024 would be sold on a going concern basis, with wells that offer over 70 years of life (and a further $8bn of NPV10 profit). I’m not saying you SHOULD cap every well tomorrow but simply there’s no black hole in ARO.

DEC cannot pay dividends for more than 12 months

For today’s final chestnut, Alex Smith of Investec has (somehow and he won’t say how) estimated the company’s annual interest payments will increase to $174m in 2024.

We’ve just paid off around $180m from the most expensive debt, the RCF through the SPV sale. We’ve reduced shares in issue through buy backs reducing the cost of funding dividends. Interest was $59m in 1H 23. My estimate is that drops by 1/4 by paying down the RCF. That gets me to $90m interest a year so how can you arrive at $174m!!! Especially when the majority of debt is fixed i.e. the ABS notes are fixed! In fact the mathematics are you’d need to go from 8.65% to an interest rate of over 100% on the RCF to arrive at such a number.

Or you’ve made a mistake in your sums Alex Smith.

There has been free cash flow dividend cover until now, as well as spare capital for allocation for buy backs. Today’s update is a tacit “in line” - otherwise they couldn’t have said it. Again where is the basis for the sudden and completely unexplained misfortune?

In fact Net profits and FCF in 2H 2023 should be higher.

How?

The SPV falls into 1H2024 (02/01/24), so the $35m worth of EBITDA disposed of via the SPV, is still included in 2H23.

Meanwhile the interim accounts shows us the ConocoPhilips/Tanos acquisitions were $71.8m per year EBITDA accretive on a pro forma basis. Pro forma means we haven’t seen the full benefit in 2H 2022 and 1H 2023 but will see it in 2H 2023 and beyond. (I get to $71.8m by taking past adjusted EBITDA over the past 12 months (as of 30/06/23) of $282,864,000 + $279,194,000 compared to $633,875,000 pro forma TTM (trailing 12 months).

So adding the $16m land disposal (July 2023) at an unknown profit plus adjusted EBITDA of around $300m should mean DEC clears at least $100m PAT - plus or minus settled hedges (which should be a fairly big net gain given the low gas prices).

So profitable and cashflow in excess of the cost of the dividend. It would be very foolish to short DEC in my opinion on some shaky and illogical fraud story - when the preponderence of evidence is against you - and shorts must cover the dividends now running at 28% per annum.

Full ahead DEC-hands! Ramming speed! Short ship dead ahead! Make them cover!

This is not advice. (and no ships were harmed in the making of this article)

Oak

I really don't understand why DEC don't start dealing with this rubbish properly. Surely they should be able to simply challenge some of the stuff coming from paid analysts? They must understand that their accounts are complex so god knows why they don't start briefing people using simple words and pictures to clearly show how they are put together. Not everyone is an accountant!

They seriously need to up their PR game (unless of course there really is an issue somewhere...)

After reading the Alex Smith comments on DEC, I wanted to see if he might have something. I began working on a Google Sheet (shared and open to comments: https://docs.google.com/spreadsheets/d/12hKqxzFgqgn-7d-7WjQvwjVycIlhLn9o5JV9prTCxyA/edit?usp=sharing) to better understand DEC's finances. There are many omissions, as detailed in the notes, but I think it covers the essentials.

I settled on the proforma approach because the financials, with mixed hedging data, is too challenging to tease out the essentials. I have not attempted to incorporate adjustments for the land and SPV deals even though favorable to the net. DEC's financials are full of disclosure but in no way are they user friendly! I am hoping that the transaction statement due at month end and 4Q financials will provide more clarity.

While Alex has probably built a model of some kind, I can say that his interest rate expense number is pure nonsense by a factor of almost double.

In any event, in going back to the Nov 15 presentation pages 30-31 for hedging prices with which to make adjustment (adj table is under the proforma) to future revenues using the 2023 3Q as baseline, I find that the 2025 NG hedge pricing at 3.05 is far below the current forward NG average of 3.67 for 2025. Ditto for 2026: 2.97 vs 3.89 average. The net effect is that the 12.4% drop in hedge pricing for 2025 appears to have a very significant negative impact on DEC's net.

As to DEC's public relations, I agree with Ian. Every release has the name FT Consulting on it. DEC needs to dump these people and hire a firm with proven public relations crisis handling experience to start digging out of this debacle. I would think that Rusty, who is now sitting on some major personal losses on his 2.6M shares, would fire those who have allowed PR crisis to proceed unabated.