Dear reader

The past few months contained attempts at Fear Uncertainty and Doubt (FUD) that should have been repelled on today’s results.

There’s plenty of positives to take from the 2023 results, even euphoria that no great shocks lay in the numbers… except one number. The dividend cut has caused many to abandon ship. Judging by yesterday’s volumes the UK extensively sold and the US extensively bought. The white Ensign shall be replaced by the Stars and Stripes before too very long, Royal Marines with Marine Corps. What should DEC-hands do?

Summary of positives:

Exit rate 129.2 is 0.3 MBoepd less than my forecast (129.5 Mboepd)

137 MBoepd average production in 2023

3.8TCfe reserves as at 31/12/23 (plus 0.6TCfe post period)

2023 Net Income of $760m

2023 Adj EBITDA of $543m

+$126m Adj EBITDA post period (Oaktree)

2023 FCF $219m (well in excess of 2023 dividends)

>$1bn revenue

$139m liquidity as at 31/12/23

83% of FY24 production is hedged at $3.30, and 76% of FY25 production is hedged at $3.21; well ahead of peers

The deadly Cut

4th Qtr dividend cut from 69.3p ($0.875) to 22.8p ($0.29). Rusty tells us this is a new floor run rate for dividends and it represents around 10% yield at today’s market price (albeit potentially ~3% for DEC hands who bought in at higher prices). But this frees $110m a year for buy backs or accretive purchases - and there’s lot of opportunity out there with gas prices what they are.

Meanwhile, Rusty, goes from receiving $1,056,689 dividends in March 24 to $350,217 in June 24, so a $2.8m annual reduction. So he shares the pain felt by DEC-hands today.

In fact DEC demonstrate this with an acquisition which doubles reserves premium price Central region holdings post period…. where export of LNG is possible. Remembering that UK gas pricing is (as at 23/3/24) $8.92 mmbtu; EU gas pricing is $8.86 mmbtu. Vs US $1.70 mmbtu

PV10 of reserves based on the 10 year strip rate is substantially down to $3.2bn vs my estimate (which was correct based on a pro rata of reserves but was not adjusting for price, i.e. at 2022 prices the same reserves would be valued at $5.9bn. In other words the 10 year futures price of gas has reduced the future value of that gas. Note 4 tells us that if future gas prices are $2.04 (gas) and $39.23/barrel prices persisted then a $473.5m impairment would happen over the future. Equally at a $6.42 (gas) and $94.79 barrel of oil price the assets would deliver $7.53bn headroom (upside)

It sounds like we are drifting into a positive so lets continue now with positives:

Plugging zero to hero

DEC plugged 404 wells in 2023 at a net cost of $5,961,000 in 2023, which is just $14,754 per well based on 404 wells, or $26,851 per well based on 222 DEC wells. Take your pick. The 404 total wells comprised 222 DEC wells and 182 3rd party wells. Income from NextLVL was $28,360,000. So $155,824 per 3rd party well less costs. Next LVL’s expanded retirement capabilities now include 14 teams and 17 rigs.

DEC speak to further investment in Next LVL in 2024, and clearly as Appalachia’s largest P&A operator, building a $28.4m revenue business operating at say a 9% net margin, which at a $17m cost of 3 acquisitions plus further investments of some $5m, possibly reflects a PE of 8-9 in its own right, with room to grow. If a $2.55m Next LVL margin is correct then spread over 222 DEC wells that’s a $11.5k per well offset so the true cost of plugging per well might be $38.3k per well.

As part of MERP there are $350m of additional funds to plug abandoned wells. Of which $288m lie within NextLVL Territories. That equates to 1,848 wells at $155k each or over 10 years of work at NextLVL 2023 3rd party run rates.

Texas Commission on Environmental Quality: $134,151,343

Pennsylvania Department of Environmental Protection: $44,457,220

West Virginia Department of Environmental Protection: $37,791,464

Ohio Department of Natural Resources: $19,941,597

Illinois Department of Natural Resources: $17,367,009

Louisiana Department of Natural Resources: $15,661,335

Kentucky Energy and Environment Cabinet: $12,912,198

Michigan Department of Environment, Great Lakes, and Energy: $5,022,306

State of Virginia Department of Energy: $2,643,702

“DEC can’t possibly plug its wells at a reasonable cost” said a numpty.

Yet again the fanciful claims made by some people based on something they read or a documentary from a few years ago somehow makes them expert in DEC’s plugging costs are not borne out in the numbers:

The potential for Next LVL could grow further, too, since DEC is exploring potential opportunities in alternative energy uses for wellbores (e.g. hydrogen production, carbon storage and mechanical battery storage)

The 2021 Infrastructure and Jobs Act gives $12bn to support investment into carbon capture. Exhausted wells are perfect locations for carbon storage. A liability becomes an asset. The IRA added $85/tonne tax credit to stored CO2.

An ARO points up

DEC’s ARO meanwhile has a $16m increase for cost revisions based on DEC’s recent asset retirement experiences. On $1.7bn estimated future ARO this a is ~1% increase. There is also $26.6m charge due to discount rates (which will reverse probably in 2024 as discount rates reduce again). We also see a sensitivity analysis that the $1.7bn future ARO could grow to $2.5bn or could shrink to $1.6bn depending on how you discount cash flow and factor in timing and resources.

People like anti-DEC enthusiast and regular detractor at this blog, CapitalBleed, speaks to how DEC doesn’t properly account for its ARO. This revision in the accounts is a case in point as to why that’s simply not true. The ARO is subject to audit and is subject to amendment so is in a sense “regulated” (from an accounting perspective). In this case management and/or internal/external auditors reviewed the accumulated ARO and decided the value was too low so obliged DEC to set aside a further $42.6m as a liability. This has the effect to reduce the net assets by that sum. The ARO now stands at $507m.

As well as increasing liability, the business is also obliged to examine assets, and a $41.6m impairment is recorded during 2023. This is based on DCF at 10.9% and a decline curve analysis of specific assets.

Methane

DEC achieved its 2030 Scope 1 methane intensity goal (-50% from 2020) seven years ahead of schedule. A stunning 33% reduction in Scope 1 methane intensity to 0.8 MT CO2e/MMcfe from 1.2 in 2022. NGSI(j) Methane Emissions Intensity 0.11% CO2e/MMcfe vs. 0.21% in 2022! A drop of over one third in absolute emissions too.

It won the ESG Report of the Year from ESG Awards 2023 and was Awarded OGMP 2.0's Gold Standard for emissions reporting for the second consecutive year. It increased MSCI sustainability rating to AA leadership status.

Apart from the kudos of this achievement it also does several things. It ensures no methane taxes since the intensity is well below the 0.2% threshold. Second it addresses Honorable Pallome & the Democrat Senate concerns. Third, it translates to higher production and lower waste! Part of being a successful hypermiler is to put in place measures to obsessively avoid waste. Fourth, since the ABS are linked to green goals, it avoids a 0.25% rate rise in 2027 on ABS V & VI.

Workovers

Workovers prove very profitable for DEC during 2023. At a $2.9m cost, 155 wells increased production by 24mmcfe paying for the cost in 2 months. Low-cost, high-return projects mitigate approximately 30% of annual production declines

The mathematics are stunning: Every $1 spent generated 1 BOE extra every 14 days.

When people speak of “10% declines” they ignore the key number of depletion ($168m), which is 6.7% in 2023 (168/2490). Remembering too it was 6.7% in 2022 also (170.4/2555)

Shut ins, workovers, pneumatic devices, capillary veins, build out of midstream, right sizing of compression are all approaches to smarter asset management amply demonstrated by DEC in 2023 and evident in its cost reductions and improvements on emissions.

Unit costs of production are down 3% in 2023 vs 2022 despite inflation challenges from $1.73/Mcfe ($10.40/Boe) in 2022 to just $1.69/Mcfe ($10.14/Boe) in 2023

Judging the $200m SPV divestiture

“The assets with a hedged EBITDA of 2024 $35m and a PV-10 of $230m (16.6 Kboepd)” are revealed as $178.7m of assets divested and $164.2m of liabilities divested so a net reduction of $14.45m of assets for a gain of $30m + 20% ownership at a cost of $2.89m. A one-off gain of $18.44m is recorded to the P&L and an unrealised gain of $4.6m to the balance sheet. The $4.6m gain is because the assets were acquired (pro rata) for 2.6X less than for what they were sold. (2.6X being 7.5/2.9). So this implies the “robust economics with a 5.7X adj.EBITDA multiple” implies the buy price on the assets were at a 2.2X multiple. (5.7/2.6).

$230m PV10 as a proportion of DEC’s $2.9bn PV10 as at 31/12/23 means the prior PV10 would have been $3,130m and the SPV represents 7.3% of assets. As a proportion of 68,000 wells that could be 5,000 wells leaving DEC owning around 63,000 (and 20% of 5,000 via its SPV)

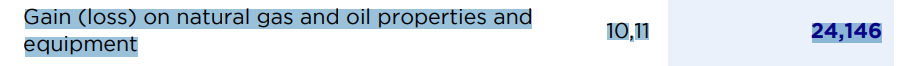

Other Divestitures/Gains

July 17th 2023 non-core acreage in Oklahoma sold for $16m, which was held on the books at $2.4m so triggering a $13.6m gain.

We learn other non-core acreage was sold for $12.1m, which was held on the books at $1.6m so triggering a $10.5m gain.

So a $24.1m gain overall.

Judging by the Bonus

2022 adjusted EBITDA per share was $0.57 in old money ($11.40). 2023 was to grow that by 24c. Rusty achieved 17c rise in adj EBITDA in a year of low prices.

Cash cost 2022 was $1.47 per Mcfe. Target was to achieve $1.21, 26c reduction. Rusty achieved a 21c per Mcfe reduction.

ESG - Rusty scores (unsurprisingly) 100% on the “E”, 50% on the “S” and 0% on the G. “E” was the one that mattered in 2023, I’d suggest.

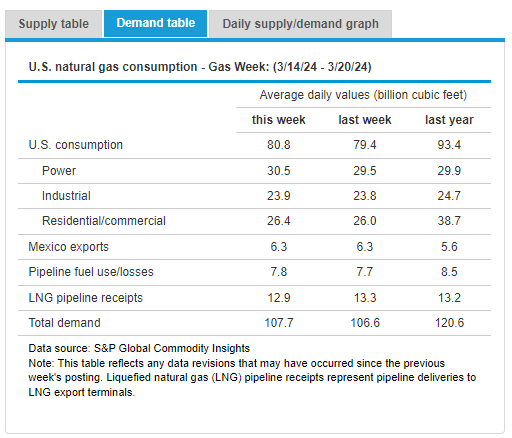

Insitutional Investors

An interesting perspective is to focus on what’s happening around the smart money. The jury is split but the nays all appear to have a common challenge….. outflows.

Sellers of DEC

Abrdn 5.06% → 4.06%

Blackrock 5.03% → 4.32%

GLG 4.86% → 4.69%

M&G 4.8% → 4.2%

Buyers of DEC

Vanguard 4.89% → 4.89%

JO Hambro 4.56% → 4.8%

Columbia 4.15% → 5.03%

Post Period - Highly Synergistic and Accretive Acquisition of Oaktree Interest

Key Acquisition Highlights

Consolidates working interest in existing DEC operated wells in the Central Region by adding ~510 Bcfe of PDP reserves at an attractive value of approximately a PV17 of PDP reserves (PV10 value of $462 million)(k)

New reserves stand at 4.3Tcfe ($3.7bn)

Estimated gross purchase price of $410 million (approximately $386 million net, including customary purchase price adjustments)

Favorable per unit cost benefit resulting from no additional G&A Expense and reduces unit costs by 2% (to $9.96 boe)

Offsets natural declines with expected 122 MMcfepd in additional production (~80% Natural Gas) (20.6Kboepd)

Run rate jumps from 129.2 to 149.8 Boepd (less FY24 reduction in flow)

In other words a ~15% increase in overall Company production

Provides robust cash flow with 2024 Adjusted EBITDA of $126 million which is a ~3.1x 2024 Adjusted EBITDA multiple

Increases Diversified's exposure to favorable Gulf Coast pricing and takeaway capacity - this is important given LNG terminals Golden Pass and Plaquemines both come online in 2024 and Freeport re-opens.

Existing hedges transfer as part of the deal worth $70m. This is significant because the hedge average is $3.89 vs DEC’s existing $3.09 mmbtu. So lifts the average hedge to $3.19 (albeit the percentage hedge falls to 80%)

2% Reduction in Unit Costs forecast as a result of this acquisition compared to FY2023 operating performance through ~$15 Million in Cost Efficiencies.

The 4 assets being acquired are 48% of Indigo, Tanos III, East Texas, and Tapstone. Going through the 2021 and 2022 accounts we learn the NAV of 52% was:

Indigo $117.3m, Tanos III $148.5m, East Texas $47.5m and Tapstone $212.6m = $525.9m

Assuming a 6.6% annual decline and adjusting for 48% I arrive to:

Indigo $94.2m, Tanos III $119.2m, East Texas $41m, and Tapstone $170.7m = $425.1m

2024+ Forecast

When I model for all of the above as well update the model based on the Q4 out turn I arrive at a rosier picture.

For a start we see $425m of assets (I’m assuming they go to properties) and the $70m m-2-m derivative value offset by the adjusted $368m increase to borrowings is immediately accretive. $127m accretive.

Assuming the $368m of Borrowing is not subject to the 2.5X adj EBITDA covenant then $1,276 requires an adjusted EBITDA of $510m or more in 2024.

Also of note $725.6m across 47m shares is $15.18 or £11.95 per share. That £11.95 is only considering the net book value of assets and not the PV10 of future cash flows. So this is why DEC speak to a higher number of $28.26 (£22.25 per share).

Of course the market believes a 25% discount to book is appropriate or 59.5% discount based on NPV.

Let’s examine my revised production model next:

I’m basing the 2024 and 2025 Per BOE on the 83% and 76% hedge also calculating for the gas/NGL/oil mix. I am accounting for $15m reduction in cost with a drop to $9 BOEPD (or $1.50 Mcfe). I’ve updated NextLVL based on the 2023 revenue. It is likely the $5.1m per Qtr cost is being double counted (i.e. there is no separate cost for NextLVL except in a presentation deck which spoke to a $0.43 per BOE cost (and $0.57 per BOE revenue) for NextLVL.

Bearing in mind that the DD&A of $57.5m is a non-cash cost so effectively that cost replaces production (probably with accretive benefit based on every acquisition of the past years). We also see a $150m per year margin of safety which could be directed to buy backs, acquisitions or paying down debt.

This is another model where I use my operational model, above, to review the P&L. I create my own adjusted P&L where I remove the IFRS9 UNSETTLED derivatives and instead include only the SETTLED. I also focus on depletion ignoring amortisation/dep’n, so calculate the sustainability of the model as current prices. I also treat the dividend as though it were a P&L cost in order to look at sustainability. Finally the left columns include both cash and non-cash adjusted P&L costs but on the right side I strip out the non-cash costs. I particularly not the $240.6m tax bill gets wiped out in 2023 partly in 2024 since there is a tax asset used to offset the liability.

What emerges is the cut in dividend does free up resource although depending how harsh you are with “real” cash and non-cash costs you arrive to a circa $275m per year beyond the 29c quarterly dividend to fund buy backs, debt reduction, acquisition and investment. This is before any gains like the several we’ve seen here.

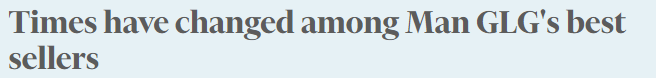

Peering across at DEC’s peers

I’ve compiled valuation criteria using data straight from Refinitiv, and a pattern emerges. First that the market cap of DEC relative to profit, is ridiculously cheap. DEC is nearly 3x cheaper relative to earnings to its next peer (Gulfport). 2x cheaper in terms of Free Cash Flow too.

None of its peers offer a decent yield, at 10% it leads the pack.

Where DEC scores worst (red) apart from smaller size is the strength of the balance sheet. Deleveraging and paying down debt to reduce gearing is no bad thing.

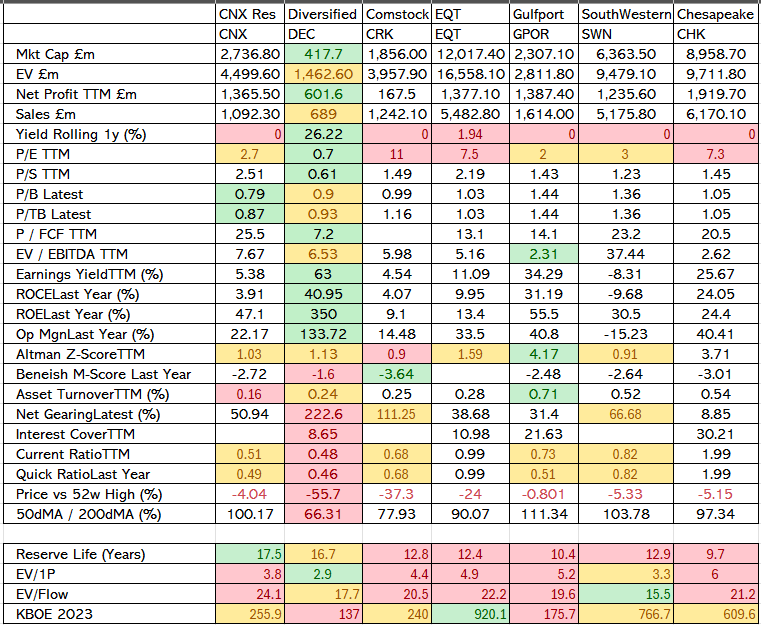

The problem of demand & supply

A mild winter has reduced demand. For example last week there was a 13BCF/day year-on-year difference, while disruption to the Freeport LNG facility temporarily reduced demand by 2BCF/day. 15BCF less demand per day no wonder the prices are so low!

But it’s easy to take that out of context. Overall the difference of 2023 vs 2022 is a smaller 1 BCF/day. A 365 BCF over hang.

Gas demand is forecast to grow in 2024. What will supply do?

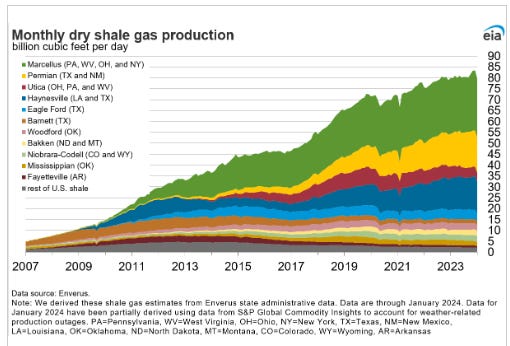

Now it’s true supply at some fields supply grows and grows. Can it ever stop growing? Is there a magic porridge pot? Does vast mean endless?

Natural gas demand grows and is forecast to grow. The US switch from coal to gas historically added around 2-3Bcf/day of demand and there’s more than a decade’s worth of switching to go.

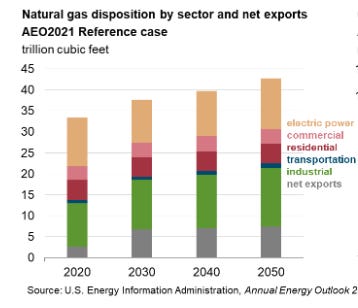

Moreover exports grow, even if Biden’s LNG export freeze is not overturned and if President “Export Baby Export” Trump doesn’t get into power again exports will grow. LNG by ship or by pipeline to Mexico. LNG will grow by 2BCF/day in 2024 alone (+2BCF for Freeport) = 4BCF/day. Exports (demand) grows by 10TCF a year by 2040 say the EIA.

Meanwhile has total shale production plateaud? It plateaud in late 2021 so well before today’s low prices. Does that mean the vast porridge pot is settling towards a peak? Do you see half a bell curve?

What does that mean long run for gas prices and for DEC? Rising demand and declining supply?

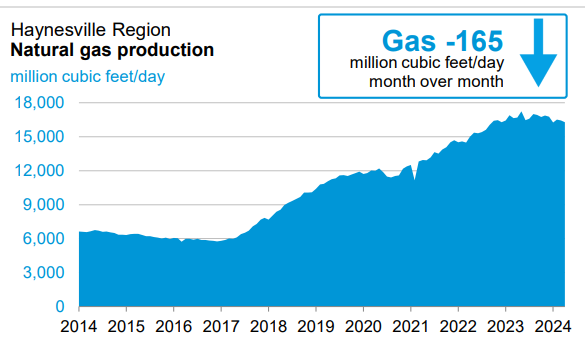

Does Hubbert Linearization explain what’s happening and what will happen? King Hubbert predicted a bellcurve to a gas field and that at 50% production peaks and then slowly declines. Several years ago GoRozen estimated Haynesville shale gas at 130TCF. It reached cumulative production of 65TCF in mid 2022. What’s happened since?

Hubbert Linearization explains Barnett and Fayetteville. These turned out not to be magic porridge pots.

GoRozen predict the Permian is very close to its peak. 2024 or 2025.

Which company survives best post-peak? The avid driller - or the eco-hyper-miler?

It seems to me there’s not an if but a when, and if the when is soon that’s transformative for DEC.

It seems to me there’s not an if but a when, and if the when is soon that’s transformative for DEC.

Conclusion

To conclude, even at rock bottom prices DEC remains highly cash generative. It has paid down debt in 2023 and can - and should - continue to do so in 2024. Also to buy back shares while they are £9 and at a discount to NAV which benefits shareholders. The numbers in the Oaktree deal give another slug of production at a good price and with very low (or no) risk since the assets are already known to DEC. It doubles premium located resources relative to LNG ports. Ports which are going to be rapidly growing their exports. The acquisition of Oaktree’s assets also means any investment it makes to develop or work over those wells flows 100% to DEC (and not just 52% as before)

Many say they have given up hope, and/or are angry with Rusty. That’s too bad. The fact is, however, the numbers in DEC still look extremely attractive and Rusty & team have delivered on so many commitments but reneged on what some see as a sacrosanct commitment - unchanging dividends.

Keeping with the nautical theme, our Captain has slashed rum rations and shareholders have duly mutinied. But should we not trust the Captain to operate the ship as he sees fit? The Captain gets less rum too. He shares the misery of watered down returns. Yet I see other ship Captains give zero grog, so 10% grog is better than none? The bigger picture is at this stage of the business cycle strengthening the balance sheet and driving production on advantageous terms, as well as leading with well plugging - these will lead to a strengthened business and capital returns in time.

A stream of US investors unencumbered by negative sentiment to Rusty can clearly see the opportunity and this is why they buy the mutineers abandoned holdings each afternoon and evening when the NYSE opens.

This is not advice.

Oak

It seems that, in the acquisition of the Oaktree assets, DEC is spending ~54% ($386m) of DEC's market capitalization to increase DEC's production (or production per share) by 15%. That is, per unit of production increase per share, the deal costs DEC 3.6 times as much as buying back its own shares.

The SPV divestiture was not the Conoco assets. It was a package of wells in Appalachia.

They basically took this package of wells that had $35m of cash flows ($230m PV10), used that to finance out $162m via two different ABS notes. Then sold 80% of the remaining equity left in the assets.

Class A notes had an 8.24% interest rate, class B notes had a 12.72% interest rate. So in total, about $14.3m of interest. So the sold the equity tranche which had ~$20m of cash flows after interest for about ~2x.

They basically were able to create a sale at 5.7x by securitizing the asset and getting another party to assume the equity. Really smart IMO

https://www.sustainablefitch.com/corporate-finance/sustainable-fitch-spo-provided-for-decs-kpi-linked-asset-backed-transaction-23-01-2024