DEC - let's probe deeper still

The Clean Air report finally emerges!

The DEC yield briefly touched 26.8% today. If you bought at that price (£10.07) and reinvest dividends you double your money after 11 quarters (2.75 years)

Today £10,000 → 3 months £10,670 → 6 months £11,385 → 9 months £12,147 etc → After a year £12,961 → 15 months £13,830 → 18 £14,756 → 21 £15,745 → 2 years it’s at £16,800 → 27 months £17,926 → 30 £19.127 finally → 33 months £20,408

(Obviously take out trading costs/spread from that, and assumes dividends are reinvested….. The beauty of compounding, reader)

Or if you’re running a short for that length of time, you are losing 6.7% of your money each quarter if DEC’s price doesn’t fall any further. Shorters have to cover the cost of dividends when they borrow a stock.

But will there be dividends? I think so. Nothing fundamentally changes today. The oil, NGLs and gas are still pumping. Consumers and producers are still consuming product.

Today a reader (in his words) “made a little effort” (do I detect sarcasm?) to find and kindly share the report that provoked the Democrats to Probe.

I was interested in the methodology particularly. There’s not much in this regard. But reading page 8 was illuminating. Are you kidding?! So DEC, who are actively reducing emissions, and this report assumes there may be no reductions. Does anyone else already think this report may not have incorporated all the data? Are probing Democrats looking at a report which cried wolf?

We already know from yesterday’s article DEC is being probed that it has achieved SUBSTANTIAL reductions and has already achieved more in 2023 but because of the way reporting is carried out some of the good work doesn’t show up until a year later. A methane leak fixed on the 2nd January is only counted as a reduction from the following January 1st. So 1.2 MT Co2e/MMcfe is an overstatement. 1.2 is higher than it otherwise would be because it includes Tanos which was at a higher emission level than DEC’s existing wells.

Rather than use MT CO2e/MMcfe instead the report uses NGSI.

The key aspect of the Clean Air report is that it speaks to a NGSI Methane Emissions Intensity. The calculation is as below. I tried to do my own Oak Bloke calculation for DEC but gave up when I realised I had no clue how to calculate a molar fraction….. however that calculation is quite in keeping with yesterday’s and today’s picture isn’t it reader, ha ha.

So luckily for me I didn’t need to do any calculation. DEC had already done it for me. It’s there in the 2022 Annual Report.

**NGSI in 2022 is 0.21%**. Reduced from 0.29 in 2021. The data used in the 2023 Clean Air Task Force report was from 2021, apparently. A stark difference emerged…. But the difference is more than a timing issue.

Here’s an extract from DEC’s 2022 Annual Report. NGSI is the last row.

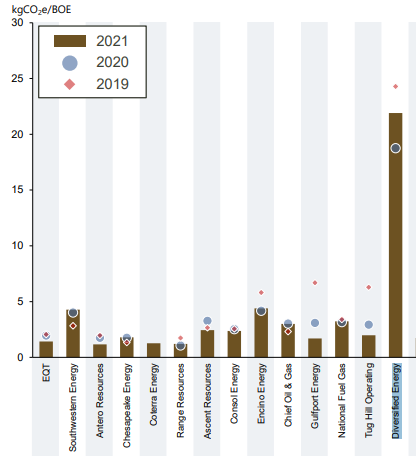

Returning to the Clean Air Report, DEC is deemed to have an unremarkable level of intensity in this graph.

And again unremarkable here for GHG (Greenhouse Gases). DEC is highlighted in blue.

The grounds for alleged concern seems to begin on page 33. As if from nowhere a new metric of NGSI is introduced. DEC is listed as #28 for production yet #5 for CH4 (methane) emissions.

Clearly a NGSI of **0.71%** stands head and shoulders above almost all others. No wonder they launched a probe. But here’s the problem. DEC’s own data (audited by several 3rd parties) says 0.21% and heading lower in 2023. Lower still in 2024.

So compared to Exxon, for example, DEC is actually lower. (0.23% vs 0.21%)

The bit where the DEC data and the Clean Air Report does tie up however is around GHG Intensity. 3.4 MT Co2e/MMcfe is 3400 tonnes of Co2 equivalent. Divide MMcfe by 177000 gives us 19.2 Kg of Co2e/BOE.

But this is not their area of concern.

Conclusion:

Clearly there’s a huge disparity between DEC’s numbers and the Report. On the basis that the NGSI is overstated 3.5X on the report there appears to be grounds for DEC to present a robust, comprehensive and evidential reply which undermines the basis for the claim that DEC is in the journalist’s words the “4th worst” offender. The report says 5th but let’s forgive that. Clearly at 0.21% in 2022 and perhaps/probably sub 0.2% in 2023, the report appears to show incomplete data.

But what strikes me too, about the Clean Air report is how much better DEC can become. Look at EQT. A gas producer just like DEC. With a NGSI of 0.04%. But what strikes me too, is EQT is working from a much lower starting point. DEC have achieved the same percentage decreases as EQT between 2020 and 2022. In absolute terms DEC is achieving more reductions than a lower emitter. The rate of improvement matters too. In fact doesn’t it matter more?

Let me finish by using an analogy. EQT is like Eton. Everyone get’s an A+ … intensity of 0.04. The brightest and the best. Good for them. DEC is like Coach Carter. Workin’ outta inner city Brooklyn, you feel me? Improving the lives of its wells from 0.29% to 0.21% NGSI in just one season. Past Schools data show the wells are all “drop outs” - so let’s point the finger and blame someone.

This probe is like Ofsted coming along saying let’s close down Coach Carter - his grades aren’t high enough. The fact is Coach Carter is making a difference. A big difference. Taking kids others gave up on. Orphaned kids. Who didn’t have a Tiger Mom. The wells are not drop outs their grades are 3.5x better than Ofsted’s records show. But someone persuaded the government to get involved.

Going after Coach Carter is a dubious play - why compare Eton and Brooklyn? Using inaccurate metrics? And how important is improvement rather than absolute grades?

And that’s why DEC-hands should feel relaxed, despite the short term drop, despite the probe, DEC has audited numbers - the Clean Air mob have, by their own admission, incomplete numbers.

DEC like Coach Carter is the Right Company at the Right Time. Keep believin’.

This is not advice

Oak

STOP PRESS: It appears almost all today’s losses are being recouped this evening in the US. Where the British are fearful and doubt, the Americans appear to take a different view.

Hi, i appreciate your work, but i don't think the statement "If you bought at that price (£10.07) and reinvest dividends you double your money in 9 months." is correct: the dividend yield at that price (~25%) is on a yearly basis.

The latest announced dividend was "4.375 cents per share" (USD), pre 1:20 reverse split, for the Q2. Hence, 4.375 cents x 4 x 20 =3.50 USD p.a with a dividend exchange rate GBP 0.78185=US $1.00 as per Dec 15 RNS.

https://polaris.brighterir.com/public/diversified_gas_and_oil/news/rns/story/w3p3ydx

https://ir.div.energy/news-events/us-press-releases/detail/158/diversified-energy-announces-third-quarter-dividend

Hi. Your comments are valid but ignore the elephant in the room which has always been the plugging costs. Is the $25k/well accurate. If it's $35k I don't see a problem but $100k is..... I believe that DEC can have the most competitive plugging rates depending on the ratio of third party vs portfolio AROs. Without this risk, the valuation is ridiculous. 8.5 million acres of leasehold for infill drilling and thousands of miles of pipeline together must be worth at least half of the current market cap in which case, the PDP assets are at a fire sale value. You still confident with their ARO calculations?