Dear reader,

Winter is coming I wrote. Winter came. Shorters melted ironicly, facing up to their chilling losses. You might say they decided to Bolt on.

A unseasonably warm Spring in the US then arrived, driving down demand for US natural gas. After arriving to the 5 year minimum stocks are now nearly at a median as shown below. Why do I believe the outlook for US Gas is very strong?

Before we explore gas let’s talk about Oil. DEC’s story is not just Natural Gas. WTI Oil has fallen in 1 year from $84 a barrel to $60 before bouncing to $65 but this has driven down many O&G shares, including DEC. But Oil is only 26.33% of DEC’s revenue. Is a -33% fall jusified?

Spring warmth goes both ways and the forecast is for a hot summer. A cold winter and now a forecast hot summer. What does that do to natural gas demand? Read on reader, read on!

DEC is at $11.75 per share this Easter, with 80,628,862 shares in issue that’s a $947.4m market cap. Let’s remind ourselves of the past and forecast future.

2024 Adj. Comprehensive Income $100.2m.

2024 Adjusted EBITDA of $472m

2024 Free Cash Flow of $170.4m

2025 Forecast FCF $420m

2025 Forecast Adj.EBITDA of $825m-$875m

There’s no guided “Adj.Comprehensive Income” but it’s difficult not to believe $250m-$300m given the much more favourable gas prices. Perhaps $350m read on reader, read on.

So a prospective P/E of 2.8X-3.8X

The thing is it could be higher still.

How?

#1 Drilling for Oil leads to more Gas - if there’s drilling….

The EIA reported growing Permian natural gas production in 2024, offset by sharp declines in Haynesville and Rest of US. Productivity is slowing in the Permian.

But the Permian is not growing in 2025 say Reuters. Lower Oil Prices are to blame.

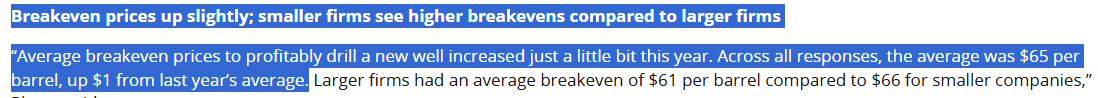

The Dallas Fed survey 31/3/25 informs us that the Permian’s “Average breakeven prices to profitably drill a new well increased just a little bit this year. Across all responses, the average was $65 per barrel, up $1 from last year’s average”. So with $60 oil who will drill?

Besides Trump’s “Drill Baby Drill” has spooked companies too. Who wants to take risk to suffer losses as supply cranks up?

Capex spend is falling across the sector say Rystad, down -6.4%.

The EIA are still forecasting growth in their assumptions but this is not backed up by the number of rigs (which haven’t grown) nor companies’ announcements. In fact the opposite is true.

Research by Rystad energy this week disagrees with this. Its research with US O&G is that tariffs on steel is having a negative effect and to expect “little or no growth” to supply in 2025.

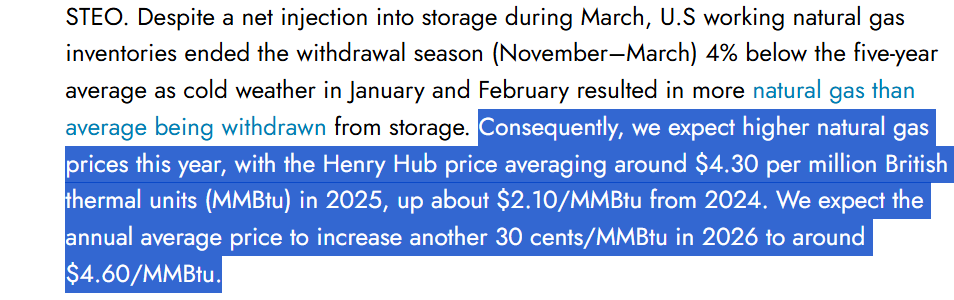

Despite believing that supplies will rise even the EIA is now forecasting an average $25.80/BOE this year moving to $27.60/BOE next.

I fell off my chair when I realised the implications of this.

My model assumed $24.00/BOE Natural Gas up from $22.00. If I plug in $25.80 (and $65 Oil) then I get to a “basket price” BOE of $25.54. This isn’t the hedge price - see later.

The Oak Bloke DEC P&L model (note the “Per BOE” is average $24.58 and moves to $25.54 average over the 4 quarters (of 2025)

The model tells me $270m net profit and $1.08bn EBITDA (well ahead of the $825m-$875m forecast) even including a -$40m additional interest charge, higher depreciation, a higher ARO charge and lower NextLVL activity.

The forward outlook for 2026 is even stronger.

#2 What if Demand is much higher?

Reviewing Rystad and the EIA nowhere are they factoring in a hot summer to their calculations.

The Weather Forecasters over at NOA tell us it will be SCORCHIO! Either above average or VERY above average with a 40%-80% likelihood. Nowhere in the US will be “near normal” or “below normal” they say. Remember this is a La Nina year, so below normal WOULD be normal. From a climate change point of view this is very worrying. From a gas consumption point of view then it is very highly that gas demand will remain extremely strong. Consider previous hot summmers.

Consider the “JUL 88.7 Bcf/d” below. Then look 10 years ago. The July spike was 66 Bcf/d. A 22.7 Bcf/d difference. We didn’t use to get a summer spike but now we do. Things are heating up for Goldilocks, so the aircon cranks.

Consider too that below the black line in the right hand chart below, is that there is record low amounts of storage relative to demand - below 20 days according to EQT corp. This is below the 15 year minimum range from 2008 to 2023!

Forecast hot summer weather will drive demand for Natural Gas power even though renewables continue to grow in the USA (despite what you might believe). Even so hot weather is not the only driving force.

I then fell off my chair to see 16.8 Bcf/d for LNG up further from my prior article where it had reached 16.6 Bcf/d.

Consider that the EIA assumed this 16.8 would only be reached in 2026 in their “Earlier” scenario. In other words we are a year earlier than their earlier forecast.

There is a further build out of at least 10 Bcf/d but potentially 3 Bcf/d more.

Consider global demand in 2030. 19+2+1+59 = 81 Bcf/d in 2030 vs 59 Bcf/d in 2025.

81Bcf/d of demand grows to 96 Bcf/d by 2050.

The EIA believe that electric power demand will be 1.1BCF/day lower in 2025. That’s not looking likely given the hot summer forecast. Air conditioners will be flat out. Plus the 1 BCF/day forecast for 2026 has been pulled forwarded to 2025 (as above), so you are looking, I believe, at least an additional 2 BCF/day increase in 2025 vs the EIA forecast …. on top of 4.6 BCF/day of forecast demand increase.

That’s over 2Tcf of incremental demand vs 2024.

That demand increase meets a static supply (or likely a falling supply) in 2025.

#3 Data Centres and Competitors

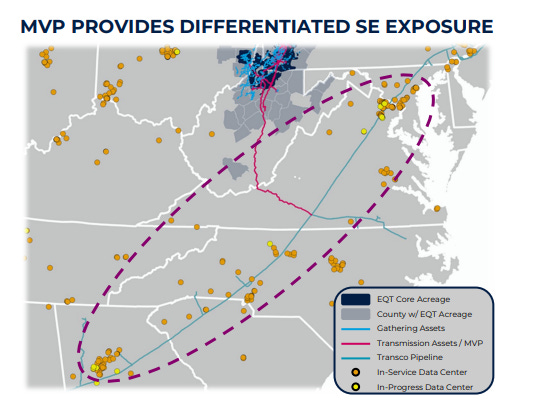

It was interesting to read EQT Corp’s latest presentation. They - like DEC - are working on a Data Centre demand strategy, and feeding Natural Gas directly to data centres “off grid”. They see a plausible ~18Bcf/d of incremental natural gas demand by 2030. The yellow and orange dots are where Data Centres are located and are being built. Ignore the dots in NC, SC, GA, but there’s plenty in Ohio, Viriginia, and WV.

They remind us that the swap out of coal to gas continues also.

Interesting to note that the Oil Price (and Trump turmoil) has done little to affect EQT. Does that make a -33% fall at DEC not seem to be an opportunity?

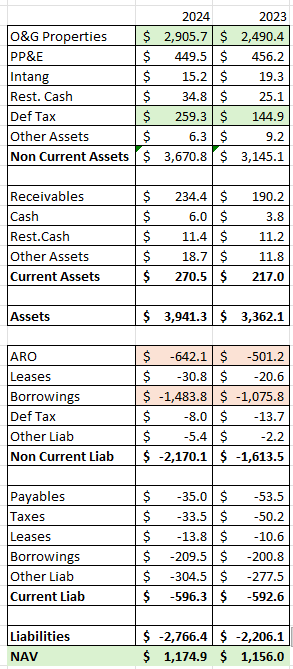

DEC is priced for destruction where the market cap $947.4m doesn’t even pay for the book value of its assets $1174.9m NET. If you ignore the $15.2m of inteangibles then $1159.7m perhaps, that’s an 18.3% discount to TNAV.

Think about that.

One where the market characteristics have changed. As EQT say there’s greater volatility where price can oscillate and you have to be of a certain size to survive. The chattersphere constantly reverberates with the ignorance that debt is by definition bad and that DEC should “settle down” and stop making acquisitions. “Hold Hutson accountable” and that Institutional Investors “are weak, passive and…. don’t understand the business” says one voice.

The opposite of course is true. They understand and appreciate that DEC’s focus has been growth and that growth of course, yes, does come at a cost. Borrowing money costs money. Why grow? Scale delivers benefits and synergies. It also means if you are scaling the supply of a product that is in greater future demand then profits will rise. Such is the case with energy. Human progress has created vast demand for energy and this is set to continue.

Several readers asked me why did DEC borrow money at more expensive rates recently. Desperation interject the detractors (detractors are always desperate to try to find a negative, and that’s growing more difficult for them).

The answer I believe, is that DEC have a far more precise understanding of supply and demand dynamics than the Oak Bloke does, and they have identified higher prices ahead. Therefore if you are of a certain scale then you can afford a greater level of unhedged production. Besides a condition of ABS Debt is hedging. Doing so guarantees that repayments can happen in any market. So I believe a further benefit to DEC of the $300m bond is the independence to enjoy a greater proportion of high prices.

EQT hedge 55% vs 80% at DEC for example.

DEC’s hedges are not shabby, saying that. $3.57/mcf is decent. So what gas prices does EQT and DEC foresee where $3.57 is shabby?!

$3.57 → $3.44 → $3.40 between 2025→2027

Of course, I used $3.50/mcf in my $25.54 as the basket but using the above 2025 hedge prices and then a range of unhedged prices you quickly find $25.54 is on the low side.

At $3.30/mmbtu unhedged and $3.57 unhedged….

At $4/mmbtu unhedged…..

$26.93 basket would deliver a $350m net profit. That’s ignoring the $70 hedge on oil too - I’m using $65.

The profit model moves to $350m net profit.

Which co-incidentally would also support the restoration of the old dividend. The new one of $0.29 per share per quarter costs DEC $94m a year.

3X that with nearly $70m left over.

#4 Other reasons to feel positive about DEC as a Trump Tariff “hide”?

Other countries are going to be doing “extraordinary” things in the months ahead to avoid punitive tariffs. That includes buying US LNG.A

A proposed 15% corporate tax for “producers”. The current Corporate tax rate is around 23% so potential Trump tax cuts could translate to higher net income.

DEC’s Net Present Value based on a 10% discount is $6bn. Based on a severely deflated commodity price ($2.46/mmbtu)

If we exclude assets that are not producing (PDP) then $5.6bn is still substantial.

$420m FCF forecast means for every £1 of DEC shares generates the equivalent of 43p of cash per year.

HEDGES. Regardless of where prices go there is a degree of insulation through 60%-80% hedges for 5 years.

Coal Mine Methane - Trump plans to be reopening and expanding US Coal Mines so CMM methane removal could become more important.

NextLVL and the 1.5m abandoned and orphaned wells, as well as other companies ARO obligations

9.5m acres and ~$1300/acre is a theoretical $12.35bn. 19.5X today’s share price. Or undeveloped acreage is $7.4bn theoretical. 11.7X today’s share price.

Or put a different way if 8.5% of just the undeveloped acreage can sell for $1300/acre then that is 100% of today’s share price giving you the actual business for free. In 4 years land sales generated $106m.

Synergies to come. Combining Maverick, Crescent Pass, East Texas, Summit and the older acquisitions combined should deliver synergies. $50m of savings is the target. Production has grown 30X in 8 years. Which other O&G can claim 30X growth in 8 years? EQT can’t.

$1.16 per share dividend is a 9.8% yield on a $11.75 share price.

I remain unabashedly positive about DEC, but this isn’t some sort of state of mind. It’s the evidence. As was once famously sloganed against Bush…. it’s the economy, stupid.

Or should I not end with a quote from Jon Snow: “Winter is coming. We know what’s coming with it.” But in DEC’s case Summer is coming. We know what’s coming with it.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thanks OB. I think that's arguably your best DEC article yet. I've been utterly bamboozled about the SP drop, ostensibly due to the Mav. acquisition at first, followed by continued doldrums for even less explicable reasons. Yes the SP often seems to weaken with warmer seasons (bit weird) but in 2025 from here, that would be daft. Donald-daft. Hard to see any downside at these levels but the market is nuts remember. Keep up the brilliant articles.

hi o/b just a thought on valuation with a depletion rate of 10% we need the price of gas to increase by 10% just to stand still....a discount rate on the share price of 10% would be wiped out by next year

bryaz