DEC-or Ate a Canvas

Considering the Canvas Deal acquisition

Dear reader

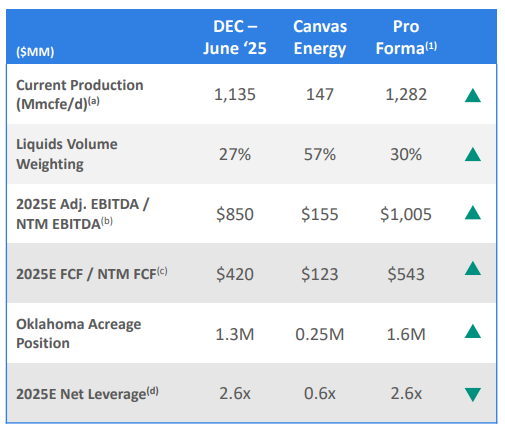

Diversified Energy Company PLC (LSE:DEC; NYSE:DEC) announced a further acquisition: Canvas Energy for ~$550 million.

While a few voices repeated their doom loop narrative, their creaking voices accusing Rusty of the sin of growing the business, the market meanwhile embraced that news taking the share up 6.6%. It’s not surprising.

Let’s examine the deal and look at DEC’s forward prospects:

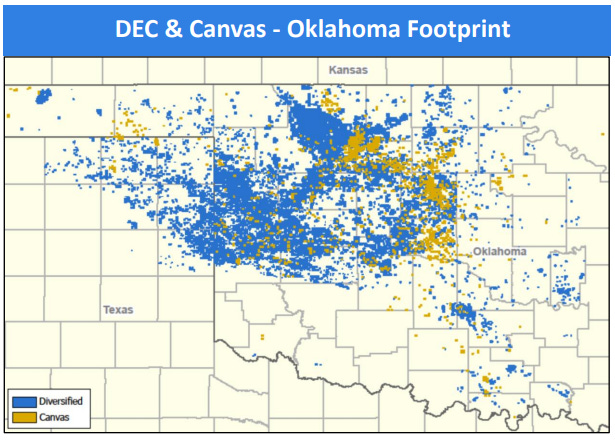

The Acquisition adds complementary operated producing properties and acreage positions in Oklahoma, concentrated in Major, Kingfisher, and Canadian Counties.

This is not a paint spatter on Canvas. This is a picture of future synergy.

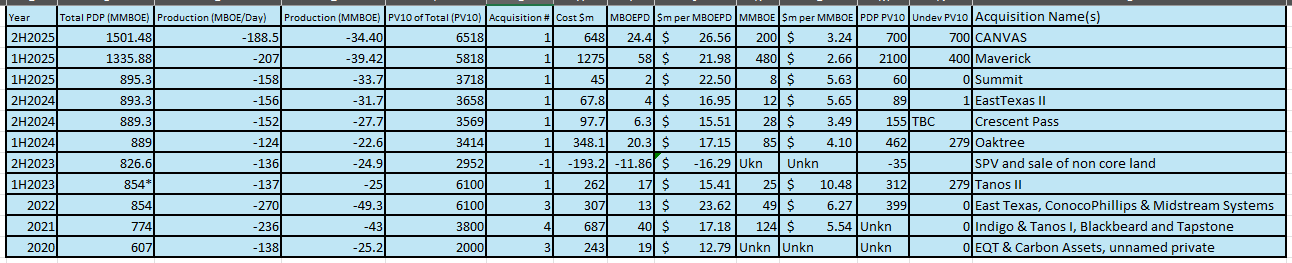

Location wise it’s got huge potential. Consider that the Maverick deal was $2.1bn PV-10 while Canvas is $1.4bn PV-10. Maverick is on track to achieve $60m synergies in 2025. Canvas will close in 4Q25 so will we see $35m synergies in 2026? There is potential. Rusty made the point today that they won’t know until they get in there. But when you consider Canvas’ G&A cost is $25m-$30m (I’m assuming $27.5m) then pro rata that is much higher than DEC’s by 10%-20%

Harrumphing was heard due to a 4.2% dilution since part of the deal was in shares. We will consider the effect of that 4.2% dilution shortly. Hint: it’s not significant.

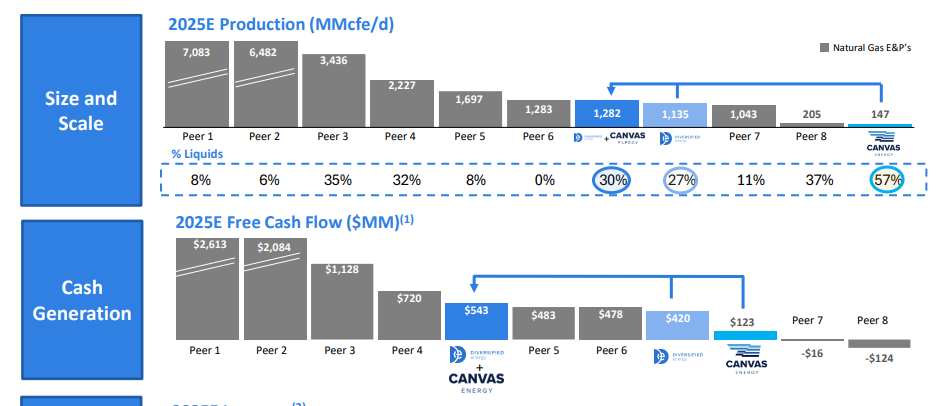

5th Place

A powerful insight to the value is consider that DEC is 7th place among its peers. Pre Canvas 1135mmcfe/d (188.5 Kboepd), at least 150 mmcfe/d behind one peer and 550 behind another. By adding the 147 MMcfe/d of Canvas it springboards past both to become the 5th largest cash generator by about 10% per annum.

29% additional Free Cash Flow is a huge upside to this deal.

A further statistic worth calling out is the 11% boost of liquids post Canvas. Pre Canvas the mix is 73% gas and 27% liquids and post-Canvas the mix drops to 70% gas and 30% liquids. Oil has 2.5X higher selling price than natural gas in the recent past.

Valuation of the Deal

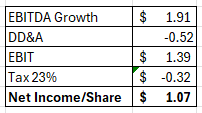

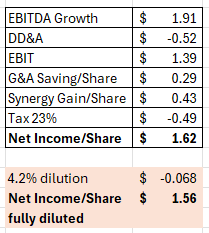

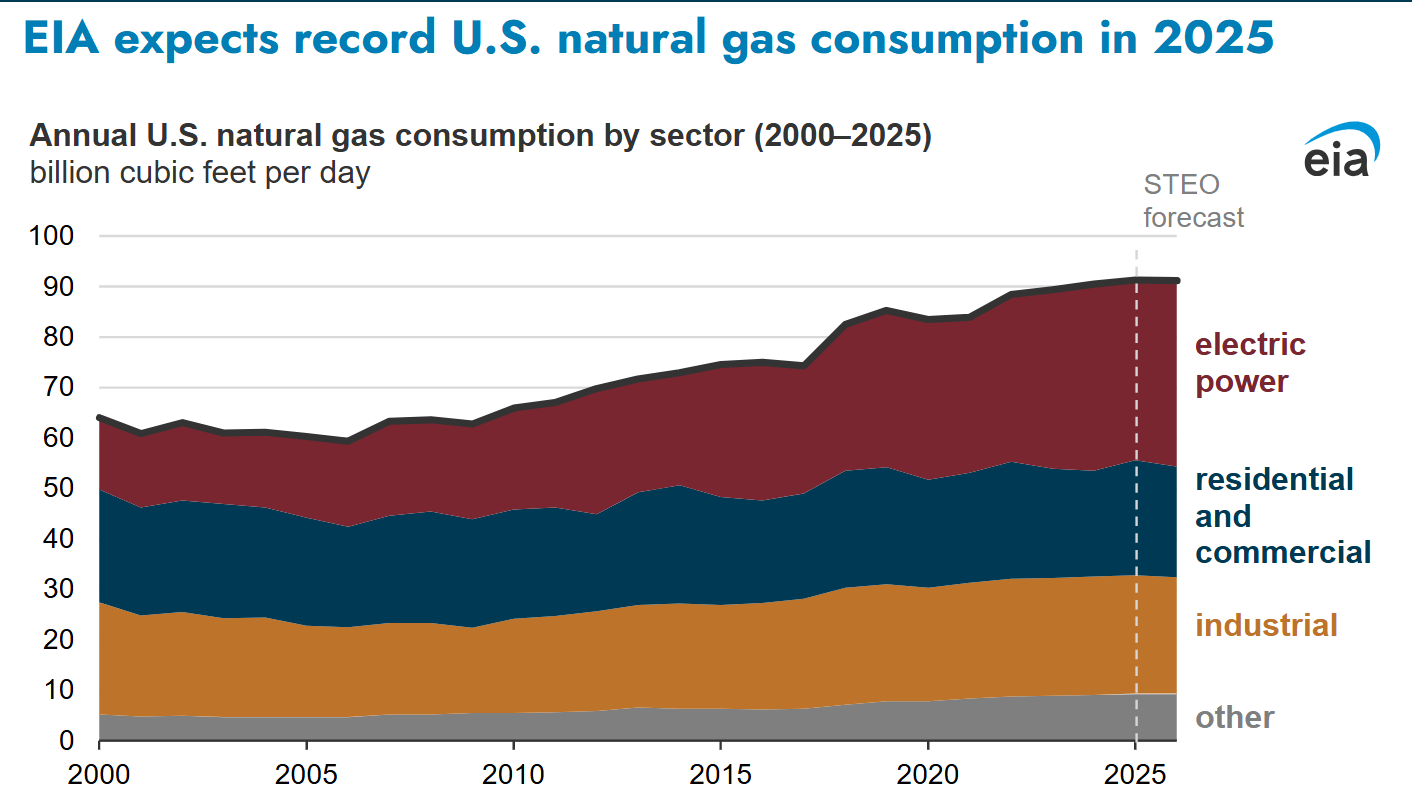

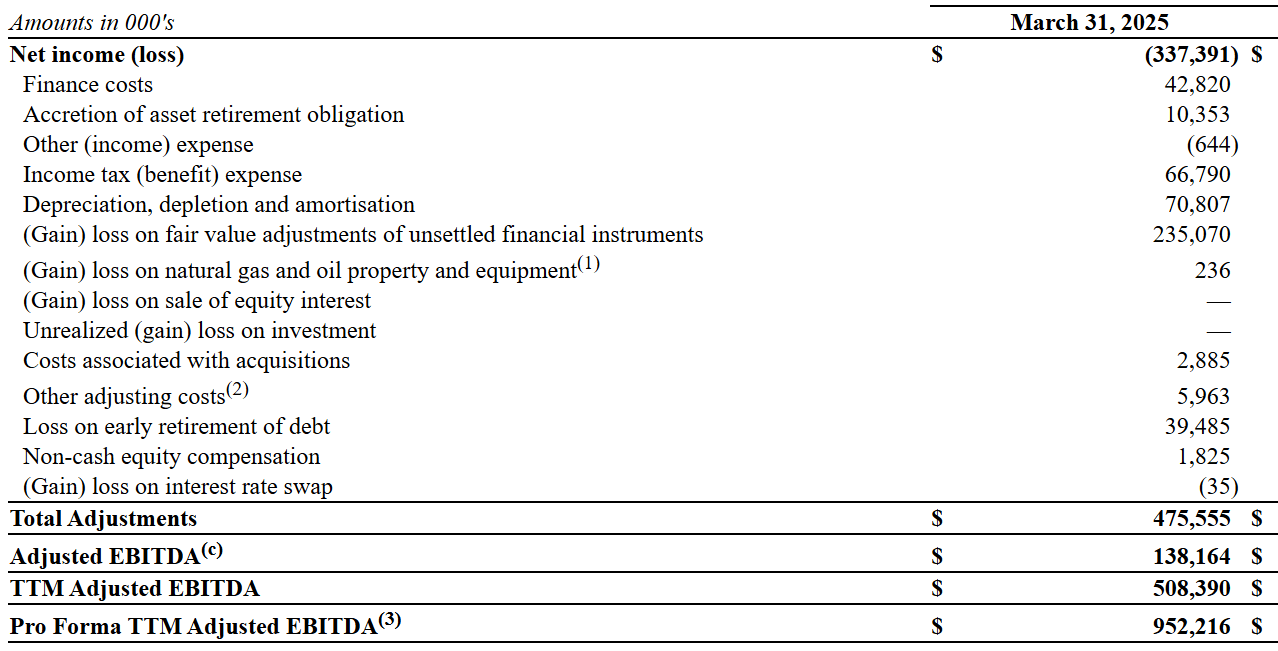

It’s true that debt increased 22.34% so by $0.5bn as well as $98m of existing Canvas debt was taken on too, but relative to earnings the deal keeps the ratio of debt to EBITDA at 2.6X. Meanwhile the deal delivers $155m of earnings which is worth $1.91 per share per year based on the LTM data. Is $1.91 EBITDA worth 4.2% dilution and 22.34% more debt?

In simple terms the net debt per share adds $7.35 of debt per share. In simple terms the Debt would be paid off by Free Cash Flow is less than six years.

But we should factor in an EBIT calculation and strip out DD&A as well to get a “replacement cost” to the production. By doing so we can offset declines.

$1.91/share EBITDA is $1.39/share EBIT so 5.3 years to repay the marginal debt and to break even or 6.9 years post tax so factoring in assumed depletion, depreciation and amortisation.

Synergy and Upsides

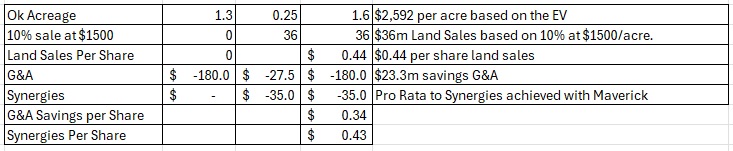

But it gets better. That $1.39/share EBIT ignores the 0.25m acres of land which has been selling for $1500-$2000 per acre in 1H25. Even if only 10% of the land acquired were sold at the lower $1500 per acre then that’s a $36m offset. Based on recent performance that’s fairly conservative.

If you disregard the value of PDP and 1P O&G reserves and just considered the land then DEC has paid $2,592 per acre for 240,000 acres. Recent land sales are up to $2,000 per acre. So the acreage ALONE could be worth 80% of the deal.

It gets better.

24.4 Kboepd where 57% is Liquids translates to paying $26,537 per flowing barrel based on the $648m EV price (i.e. $550m + $98m Canvas Debt). This is ~$4,500 per BOE more than recent deals it’s true but 57% liquids is slightly higher than Maverick and besides there is nearly double the undeveloped acreage. ($0.7bn vs $0.4bn)

I was intrigued to read about run rate G&A savings.

Canvas’ G&A of between $25m-$30m will be removed through the deal. Assuming the cost is $27.5m then that’s a $0.34/share saving per annum. G&A is part of the EBIT calculation. So the EBIT would be $1.39 + $0.34 = $1.74 per share.

It gets better.

Using a pro rata synergy number comparing the $60m savings on track with Maverick then a $35m saving would not be unreasonable. That would be a $0.43/share upside. Synergy is a boost to the EBIT per share would be $1.39 + $0.34 + $0.43 = $2.16/share.

So a $1.07 per share assumed return factoring in replacement of depletion.

Could actually be $1.62 per share net profit. Dont’ worry I’ve not forgotten the 4.2% dilution either. The net return is $1.56 net of that.

Don’t forget those dudes take 4.2% of the debt off the shoulders of other DEC-hands also. So it’s not actually $7.35/share of extra debt…. it’s actually a net $5.92 of additional debt per share.

So factoring all of that in $5.92 / $1.56 means the net income pays for the cost of this deal after 3.8 Years.

But there’s more. We also need to consider not only do DEC-hands get $1.56 per share of earnings they also get a share in $0.7bn of undrilled acreage.

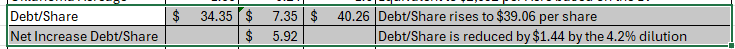

In this chart I consider the cost of the 4.2% dilution in terms of the PV-10 pre-Canvas. That is $74.10 per share. So DEC-hands lose $3.11 of that. We’ve already discussed $5.92 per share of debt. So then deduct the Land Sales (10% assumed at $0.44 per share) as well as the PV-10 value of PDP is $8.61 per share, plus the PV-10 of the undrilled acreage is a further $8.61 so net of all costs each DEC-hand gains $8.62 per share from this deal.

I’m not factoring in the synergies or the G&A saving in that number either. But if I did there is a further $3-$4 per share on a PV-10 basis, making this a circa $12 gain PER SHARE in my estimation.

The POSITIVE MACRO continues

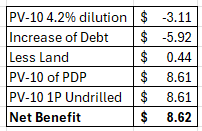

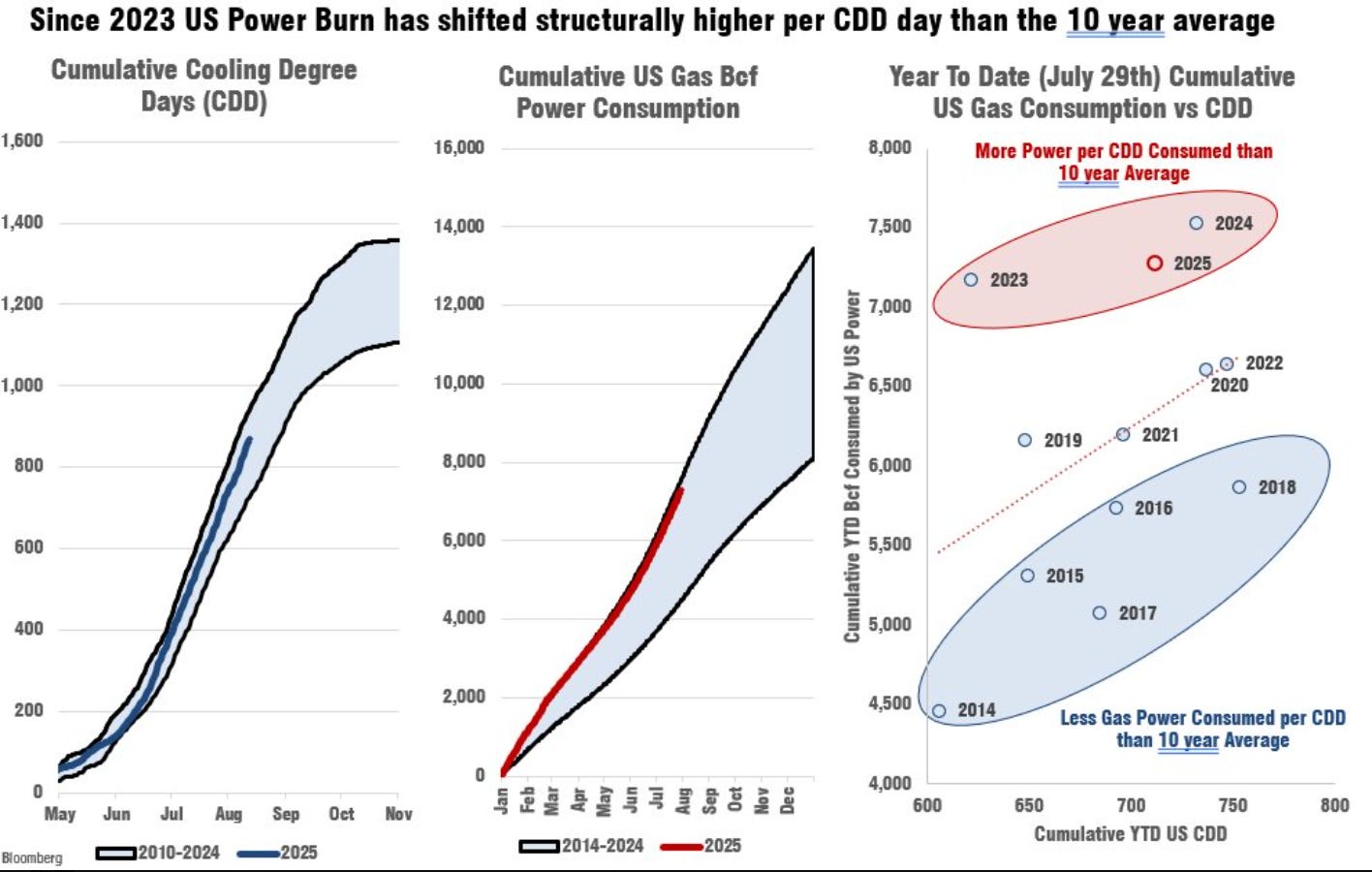

Recent updates from the EIA put natural gas consumption at record highs driven by electrical power generation. Siemens, GE Genova and other capital equipment suppliers are reporting record order books for natural gas power plant engines.

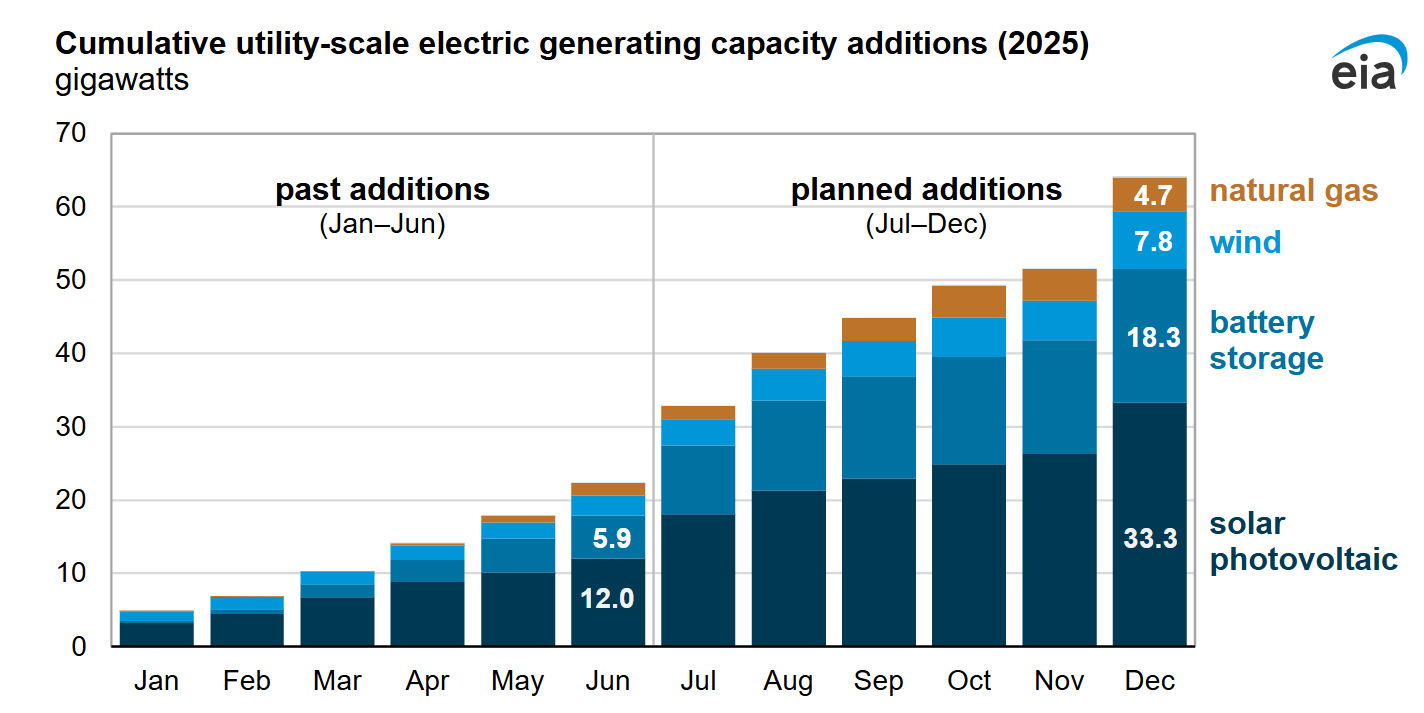

Planned additions in Natural Gas generation capacity is growing fast under the new Trump government.

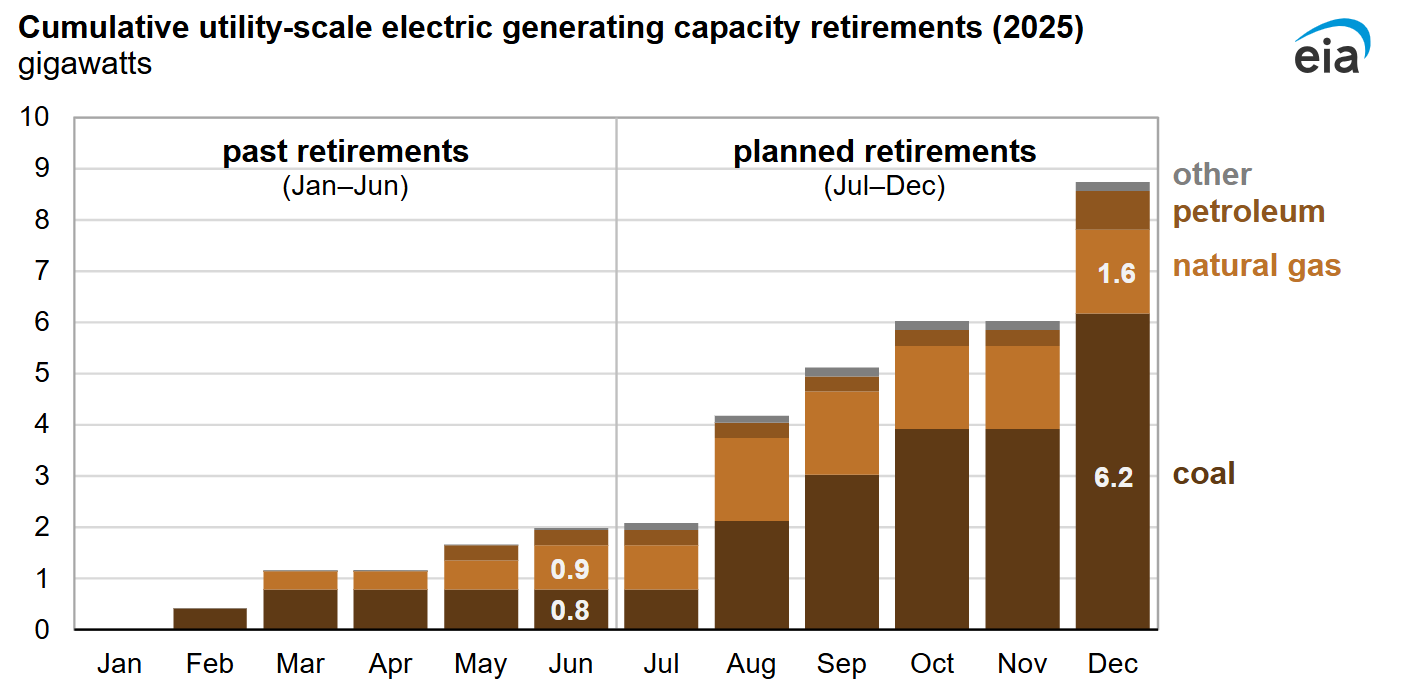

Meanwhile 1.6 GW of retirements are also occurring (vs 4.7 GW of additions) and the swap over of Coal to Nat Gas continues.

This is a very interesting chart. The USA consumed much more natural gas on cold days (CDD days) than in its own past.

2025 Valuation

Today 77.93m shares at £11.60 puts DEC at a £904m market cap.

Canvas will close in 4Q25 so will be probably have limited effect on 2025’s profitability.

If I’m right in my calculations about the adj.Net Profit for 2025 that DEC is going to achieve £220m, so an adj.valuation P/E of 4.1X.

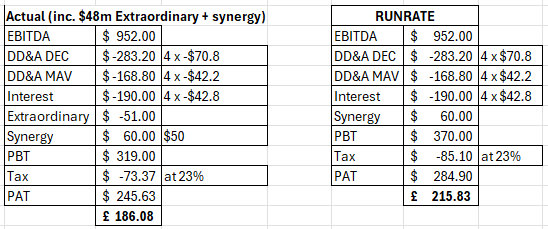

Looked at another way:

So even ignoring Canvas for now but factoring in the above numbers from Maverick to the above pro forma EBITDA and including $60m synergy and known extraordinary costs of -$51m you arrive at a £186m 12 months outcome, or £215m on an ongoing basis…. close to my £220m forecast. And at 4.9X earnings.

But where the run rate prospective earnings are higher with Canvas added on top but also with a positive backdrop of demand and supply there remains lots to like at this OB 2024 idea.

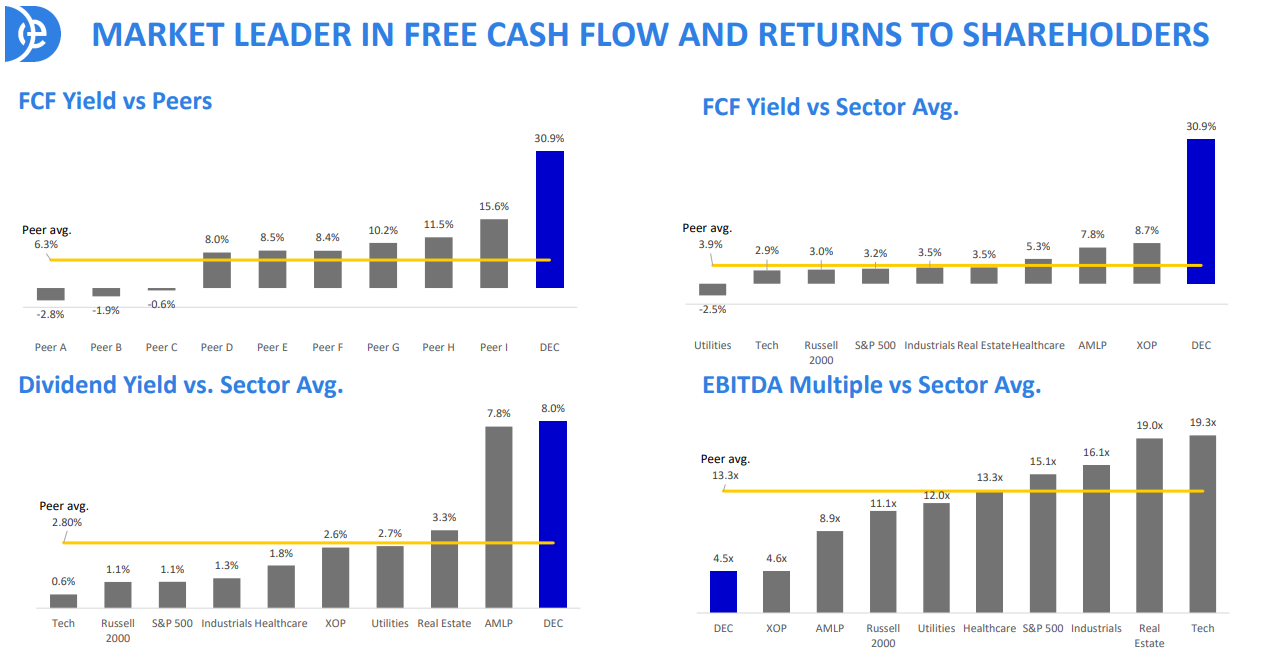

When you consider DEC vs other “contract assets” then you do realise how incredibly cheap paying 4X earnings actually is.

4X is 4X cheaper than the 19X average of real estate, and 3X cheaper than utilities at 12X.

Once again I’d point out that DEC’s ability to generate FCF is remarkable but it is not priced remarkably. And it has found a remarkable FCF addition (of 29% pre synergy) in Canvas.

I’m not surprised it has increased in price today in response to the news. Once you analyse it you realise what a great deal it is.

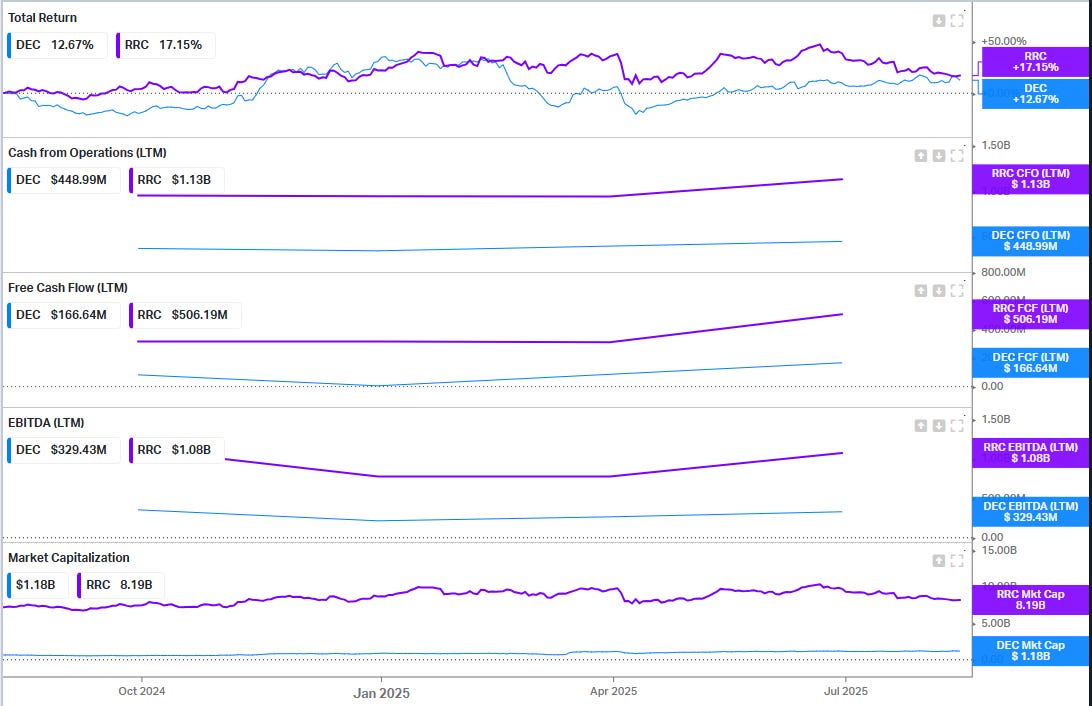

Consider that DEC is generating around just under half of the cash from ops and around a third of the EBITDA and FCF of Range Resources, a comparative US-listed company. Yet trades at about 1/8th of the share price of RRC!

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Fantastic write up thank you. One thing not mentioned anywhere (they I've seen) is whether any Canvas production is hedged? Or is that a dim question? 😕

Hi OB,

Great analysis (and nice video yesterday), as always.

On the Canvas debt, I am not sure that DEC shoulders it:

DEC had 2.6x leverage to adj EBITDA of 850M, i.e. 2.21B. The pro-forma also has 2.6x leverage of adj EBITDA of 1,005M = 2.613B. The difference between the two is pretty exactly 400M, which is the amount of the Carlyle ABS notes. Thus, I believe the 98M are not taken on by the combined entity.

Am I overlooking something?