DEC the halls

Is a 21.09% yield too good to be true?

Strategy

Diversified Energy Company pursues a low-risk strategy.

Ironically, the risk of low risk is that it can appear high risk. What do I mean? I mean if you try to decipher the annual accounts you feel like you need an advanced degree in Accountancy. Well hopefully I can help demystify this share and set out why I believe it's one of the best opportunities in the market right now.

Leadership:

Its CEO is a Corporate Finance guy. Not an engineer. Not a geologist. But from a long line of Oil men. Over a 100 years of their experience is in his bones. To get a fascinating insight into what makes him tick you should listen to his childhood, upbringing and values podcast. What happens when you combine financial wizardry with O&G experience? Rusty Hutson.

Hilariously (least I think so) he speaks of how those geologists just love to drill holes. Don’t I just know it. Rusty is hard working and pragmatic. Hauling a lawn mower to earn money as a kid. Ha, I did that too. I don’t run a FTSE250 company, but I relate to the guy. He also sets the highest standards for DEC - be that ESG, operations or its finance. Looking at it from the numbers and DEC competes in the market in an area that is overlooked by most others. Making the most of holes already dug. Optimise those - both from a finance and operational point of view.

Compelling Value

Apart from chucking up various slides that you can read at DEC’s web site. Here’s my opinion on future value:

Gulf coast LNG - what happens when DEC sells its gas internationally and not via Henry Hub?

Proven capability to optimise mature wells. They have a USP. They don’t explore. They will buy cheap acreage. Optimise it. Sell off the exploratory bits - or partner where they don’t take the risk to drill holes but get a share if the drilling finds O&G

Current price makes no sense at all. Mispriced. Compelling dividend - which is well supported. 21.09% paid quarterly (5.25% a quarter). I kid you not.

“Investment Grade” - I think the professional way that DEC is financed and the finance is locked in at investment grade debt is a USP. Because of the cost of that debt. Recently the banks agreed to extend the debt by $50m (so there’s $120m head room). Would they do that without due diligence?! Who else has predominantly fixed, amortising debt like DEC. Maybe the oil majors, but NO ONE else among its peers. The picture below links to DEC’s latest presentation so you can read their approach for yourself.

So what’s the problem with DEC?

Diversified operates predominantly mature, natural gas wells (with some NGLs and oil). Its profitability can look strange. It hedges the vast bulk of its output. That means when Henry Hub prices are high (like in 2022) it makes a huge “loss”. In 2023 when Henry Hub dives by over 60% it makes a substantial “profit”.

Why?

The answer is IFRS 9:

Because DEC hedge 9 years ahead (the most future dated hedge are Swaptions dated 31/3/2032) they have to account for all 9 years of hedges in each Profit and Loss. That’s what the above standard says they must do.

But the LOSS is 9 years of losses.

And ***IF*** those losses occur.

Let me illustrate why people get confused with a simple example:

Oak Bloke Subscriptions

January 1st I sell you a subscription. The subscription costs me nothing to sell.

I always hedge your subscription at £1.50 for 9 years ahead. It costs 5p for each year I want to hedge. So I’m guaranteed a price 50p below current market price.

The price I discover during 2023 for that subscription is £2.

In my 2023 P&L on 31st December it says +£2-(50px7)-(5x9)p = -£1.95 loss. (I buy a hedge for 9 years 2023 to 2032. I have to assume that I will lose 50p for the next 9 years - I know the 2023 price so under IFRS9 I don’t account for a loss for the year already gone)

In 2024 (assuming subscription and hedge prices don’t change) my P&L says = -£1.55 loss +£2-(50px7)-(5px1)p (I only need to buy 2033’s hedge).

Even though at the end of 2024 I can quite rightly say, hey, I’ve got £3.55 in my pocket (£2+£2-(9x5p). Because I paid out 5p for 10 years of hedging and received £2 for 2 years running.

If in 2025 I’m forced to give you a 50% off subscription. My P&L says +£1+50p-5p = £1.45 gain. (£1+50p payout - 5p hedge for 2034). And I now have £5 in my pocket.

This is why to understand whether DEC is a sustainably profitable business you must do 2 things. Adjust out the UNREALISED GAIN/LOSS and Adjust In the REALISED GAIN/LOSS. Or look at the cash flow.

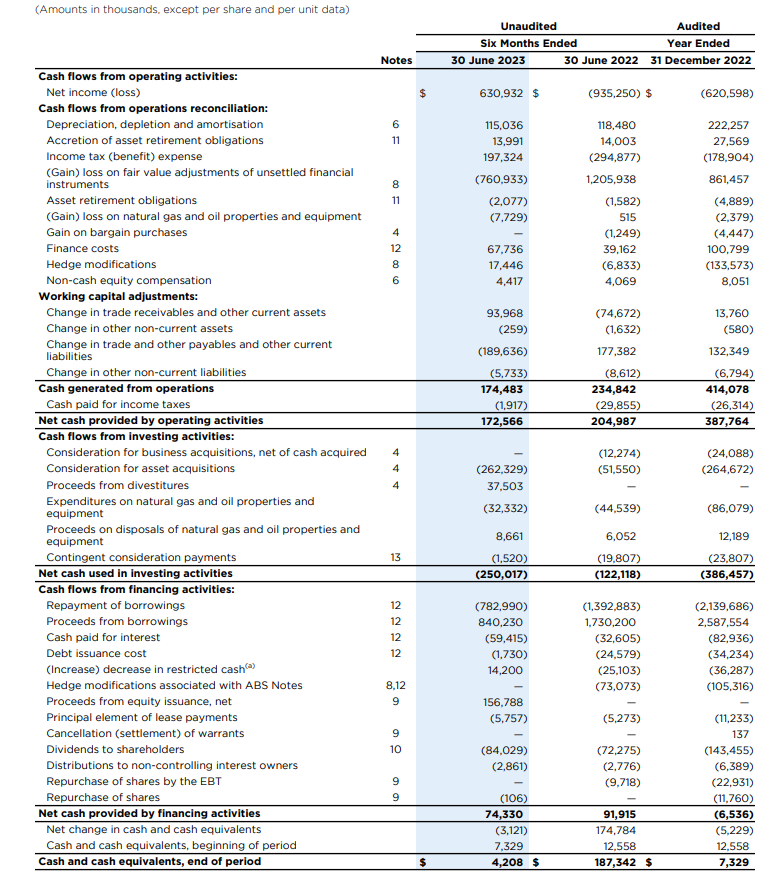

Particularly at “Cash Generated from Operations” excluding working capital “noise”. There’s always positive cash. It’s important to deduct depreciation and and asset retirement (because those are “real” costs) but that arrives at ($174,483+$189,636+$5,733+$259-$93,968-$13,991-$115,036) = $147.1m (for June 2023). That’s like the “Cash in my pocket”.

(Also I've seen people get confused and say DEC is “running out of production” and they “constantly need to go into debt to replace it” the depreciation/depletion/amortisation (D,D&A) value included above of $115m says that simply isn’t true)

If you look at page 7 of the accounts you can see what I mean too.

This page EXCLUDES unsettled hedges and only includes settled hedges. Only the 5p hedge cost for the current year or any hedges that finalise or I cancel (known as “Hedge Modifications” in the accounts.

Again the “Total Revenue including settled” at the bottom shows a positive outcome for the past year. Deduct out the same depreciation and retirement obligations, and operating costs and you arrive at a number close to the cash flow. Money in the pocket.

That is what I believe people just don’t get. I read bulletin boards where this crops up again, again and again. Some people think they’ve “discovered a fraud” but then can’t explain why, other than of course the numbers show a terrible loss. How can this be profitable when the “bottom line” shows a terrible, terrible loss?

The answer is (think again about my subscription) I’m including losses that haven’t happened and may never happen. Also IFRS 9 forces me to bring forward possible future losses BUT IT DOESN’T LET ME BRING FORWARD FUTURE PROFITS.

If you estimate that in the next 9 years DEC is estimated to make something like $4.5billion adjusted EBITDA profit. The fact “the numbers” say there’s a -$700m loss (for the next 9 years), really mean there’s a future net $3.8bn profit.

IFRS 9 is contrary to the MATCHING PRINCIPLE in Accounting that I should match my costs and revenues in the same time period. But there we go. I don’t set the rules I just try to explain them.

As an accountant it look me quite a while to get my head around DEC. For non-accountants until someone comes along with a simple model to explain it (and assuming they want to believe me) then they’ve got no chance.

So this is my opinion. This is not advice. But I hope it helps explain why I believe this to be one of the best opportunities in the market. I wish you well in making your own investment decisions.

Oak.

PS: Henry Hub is now at $3.19 an MMBTU which is up 27% on 1M and 3M prices

PPS Q3/23 production for DEC is expected to be in the range of 134kboepd-138kboepd, in-line with expectations and reflects the sale of its non-operated assets completed during Q2/23.

Thanks for explaining this so clearly. My own hunch is there is someone in the market facing a huge unwind as it’s not just DEC in the O&G space facing some large losses.

Great article - complex topic explained clearly.