DGI9-eridoo

What to make of the FY23 year end update?

Dear reader

The DGI9 FY23 annual report gave me a further opportunity to review my forecast models.

Oak Bloke Accuracy

a/ EBITDA: I estimated at £182.5m; actual was £180.6m (excluding Verne). Accurate to 1%

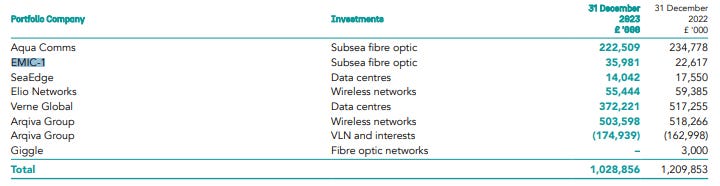

b/ Valuations: I estimated the portfolio to be £799.4m (exc. Verne) actual £831.6m. A 3.9% error. The parts which blindsided me were a change to the Aqua Comms discount rate which was increased to reflect the nascent nature of the business’ expansion into the Asia region. This more conservative approach has resulted in a reduction of the Aqua Comm valuation of 7%. A £12.3m reduction.

Then for Arqiva an eyewatering discount rate of 13.62% was partly used for its valuation. To be precise, 62% of its NAV from investment companies is valued using the FCFE (free cash flow to equity) discounted cash flows approach, 35% of total NAV is valued using evidence of post year end disposal value either agreed or indicative offer and the remaining 3% of investments being valued at cost. This led to a £6.8m reduction.

c/ The Arqiva VLN. I also realised that I’d slightly underestimated the accruing interest on the VLN too.

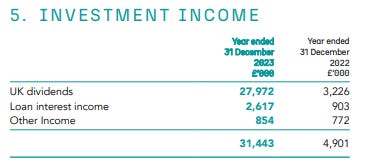

d/ Income I estimated £2m distributions; but the actual income was 15X more than this. More on that later.

Reduction in NAV

The combination of slightly higher debt, the higher 13.62% discount in the DCF element of valuations, and of course the losses and costs of Verne (which were post period but recognised in 2023) led to a reduced 79.33p/share as at 31/12/23.

Optimism

But there are grounds for thinking the reduction is overdone:

For a start we learn that the earn out was reduced by 75% due to prudence and not due to any kind of impossible target or known adverse event. In fact, we know profits grew 89% at Verne in the last reporting period so if that performance continues the £80m reduction will be unwound during 2024 and 2025. DGI9 tell us this:

Going forward, the fair value of the Earn-Out will be updated each reporting period to reflect the actual progress made by Verne Global in achieving the runrate EBITDA target.

If fully unwould that would add back 9.25p per share.

Furthermore, we also know the only reason for the £12.3m reduction at Aqua Comms was the increase of discount for the “nascent nature of the business’ expansion into the Asia region”. I find this reason to increase the discount quite unorthodox, and once again the additional discount seems unwarranted in my opinion and will unwind in time. There were some backhaul costs around the launch of the 3rd transatlantic cable AEC-3 which won’t repeat in 2024 and revenue grew modestly by 4% in 2023, but that was 0% in H1 and 9% growth in H2. Yet the 28/02/24 trading update speaks to “capacity demand continues to grow at very high rates”. This optimistic view becomes strangely tempered in the annual report. Winding back the additional discount would add back 1.4p per share.

Similarly Arqiva is discounted more heavily leading to a £14.6m reduction, 1.7p per share. The reduction in performance appears to be solely due to the one-off nature of the inflation-linked swaps which of course now inflation is lower is much reduced by about 2/3rds (and is “collared” to 6% in the future):

High RPI in March 2023 (13.5%) had a direct short-term cash flow impact on Arqiva due to its inflation-linked swaps, with Arqiva paying £147 million in accretion payments (c.£76 million prorated for D9's 51.76% economic interest in Arqiva).

For the avoidance of doubt, accretion is paid by Arqiva, not D9. The long-term net impact of inflation on Arqiva is positive, increasing EBITDA due to the compounding effect of Arqiva’s long-term inflation-linked contracts. RPI has fallen substantially from the Q1 2023 peak, dropping to 4.3% in March 2024, which will result in an accretion payment of c.£53 million in June 2024 (equating to c.£28 million prorated for D9's 51.76% economic interest in Arqiva).

Elio was reduced by £4m, 0.5p per share. Elio spent the year expanding into the Cork city and the SW of Ireland, so we should see the benefits of that investment in 2024.

Next Steps for DGI9

As Verne updates on progress there is potential for an unwind on the 75% discount on the earn in.

As income grows (did you spot reader that DGI9’s FY2023 income increased by more than 6X in 2023 compared to 2022?). It’s not at all clear where these £28m of UK dividends came from? Probably Aqua, certainly SeaLife, possibly Elio, possibly Verne UK (not Iceland or Finland because these are UK dividends) but surely Arqiva must have paid dividends? £28m is too high to not include Arqiva?

Income is forecast to increase in 2024 and 2025 as the assets grow in attractiveness. It is impressive when you consider that this income number allegedly does not include any income or distribution from Arqiva. Macquarie and DGI9 (the main owners of Arqiva) have been content to allow Arqiva to deleverage its debt pile, although it is interesting that DGI9 would only need to pay £7.6m (as at 31/3/24) to clear the accrued VLN interest to receive distributions between now and October 2026.

Accrued interest must be repaid in full before distributions can be made to the Group. After the fourth anniversary of the VLN (18 October 2026), the Group can only receive distributions if the entirety of the VLN principal and any rolled up interest have been repaid in full. The Company expects Arqiva’s future cashflows to cover D9’s VLN interest payments.

Arqiva’s £129.8m of “Finance Costs” for FY2023 (excluding shareholder loan notes) suggests a cost of capital of around 7.4% (on gross debts of £1,757m as at 30/06/23), so paying this down frees up more operating profit for distributions (around £15m of interest cost per year)

As EMIC-1 nears completion the restricted cash is released and the discount due to “nascent Asian trading” unwinds for Aqua Comms. Once EMIC-1 begins operations it will be earnings accretive. We learn a “major pre-sale” occurred in Q4 2023.

Aqua Comms is expecting substantial growth in earnings and improvement in its EBITDA in 2024 (one-off costs have been sunk) and AEC-3 is now online, boosting capacity by 70%.

Aqua Comms, EMIC-1, SeaEdge and Elio are now being marketed for sale.

Arqiva is cash generative and deleveraging its £1.4bn debt pile by about £200m a year (which is about a £100m reduction relating to DGI9’s share of debt). Arqiva has reduced the cost of the inflation-linked swaps from £147m in accretion payments to just £53m, and introduced a collar to limit accretion to a 6% maximum if (God forbid) inflation surges again. Effectively the swaps introduced a £94m exception in 2023 which we will not see repeating in 2024. Meanwhile Arqiva enjoys long-term and inflation-linked contracts. It reports further progress on the Smart Meter side of the business with 300,000 additional meters to install by 2025.

It is also interesting to note the bulk of restricted cash relates to the RCF. This restricted cash is £24.4m and the RCF is £53m so a shortfall to fully repay the RCF is just £28.6m.

Conclusion:

I believe there is a reduced NAV post period. Sorry to leave a negative until the end.

My estimates based on the revised valuations and accrual of debt interest is that the NAV per share is actually below the year end 79.33p per share.

I estimate it to be now be 74.75p per share.

But at today’s ask price of 21.2p DGI9 remains a 71.6% discount to NAV.

That NAV includes a harsh 13.64% discount rate of discounted cash flows to value 2/3 of each asset’s valuation. When data volumes are doubling every 12-15 months, we are not talking about a “high risk” market. We are talking a slam dunk meteoric demand growth. Growth of AI accelerates data growth too.

A discount for Investment Manager incompetence would be fair, but the 13.64% discount is ridiculous.

The discount to NAV includes other discounts like 75% discount on the earn in, but also have netted off the exceptional costs relating to Verne’s sale (which won’t repeat in 2024).

If we see some or all of the unwinds and income growth I’ve described I can see how 74.75p returns to 85p-95p a share NAV, let alone capital growth or if the discount rate itself reduces (e.g. following interest rate falls later this year).

Moreover on an income basis it’s conceivable to see £30m gross income in 2023 grow to above £100m in 2024 and beyond. Net of costs I believe you could see a net profit of £40m or more once Arqiva begin distributions and as Aqua grows. On a conservative 15X PE a valuation of £600m would see this at a 3.3X increase of share price to reach fair value.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".