Dear reader

$50m invested for a further copper royalty.

This is a deal done with unlisted Moxico Resources plc for its Mimbula mine in Zambia producing since Phase 1 went live late 2022 and in 2024 produced 14Kt with operating costs in the 50% lowest half of global copper mines. A neighbour to Jubilee Metals in Chingola.

$50m funds a brownfield Phase II expansion which is currently in construction and will increase total copper cathode production capacity to achieve 56,000 Ktpa in mid-2026.

The deal looks like this:

So it’s worth assuming today’s Copper $9,400 per tonne $12.6m in the first year of 56kt and then $5.26m after. Assuming the first 56kt actually takes 18 months due to ramp up it’s safer to assume $7.34m and then $5.26m year 2+.

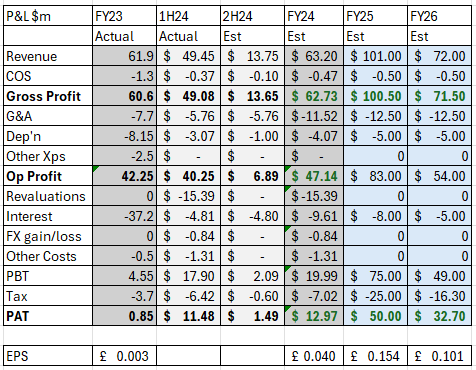

Deleveraging will reduce debt by the end of 2025 to these levels:

With net debt at $135m this means $26m-$40m of deleveraging in 2025. And $21m-$37m in 2026. According to consensus.

So those forecasts equate to implied free cash flow per share of 7.8p-12p in 2025 (estimated) on a share you can buy for 63p (a P/FCF of 5.2X - 8.1X). And 5.7X-10X in 2026.

P/E would roughly FCF minus the depletion. So 6X-10X in 20205 and 6.6X-13.1X in 2026.

Of course we don’t have any specific info on future costs although if we approximately extrapolate the past (and assume no positive or negative revaluations) then we can see a highly-profitable future generating 29.5p per 59p share of net returns post tax by the end of next year! (so nearly 10p a year). That’s equal to a P/E of 6X.

For a share supposedly crashing down due to its Coal Royalty ending.

By the end of 2026, Kestrel, ECOR’s coal assets will be toast and we are into a brave new future of “Transition Metals”. Goodbye to the strong history of metallurgical coal of Anglo Pacific, now renamed Ecora.

Along with a focus on growth, ECOR has a focus on deleveraging, dividends and buybacks. It’s a popular four-prong strategy.

Copper has been creeping up again recently and is at $9,400/tonne. Not at record levels, but certainly hasn’t fallen far from the YTD highs in May and is moving up again. Some speak to $12,500/tonne copper although I’ve not modelled for that in this article. Obviously 10p a year is much, much higher if prices spike to those levels.

Vanadium, Cobalt and Nickel all remain at extreme lows as I write and Uranium is deciding whether to rise again. Iron ore is doing ok but no record prices there. DRC has halted exports to help support the Cobalt price and Indonesia have moderated their breakneck nickel expansion which has great the glut and price plummet.

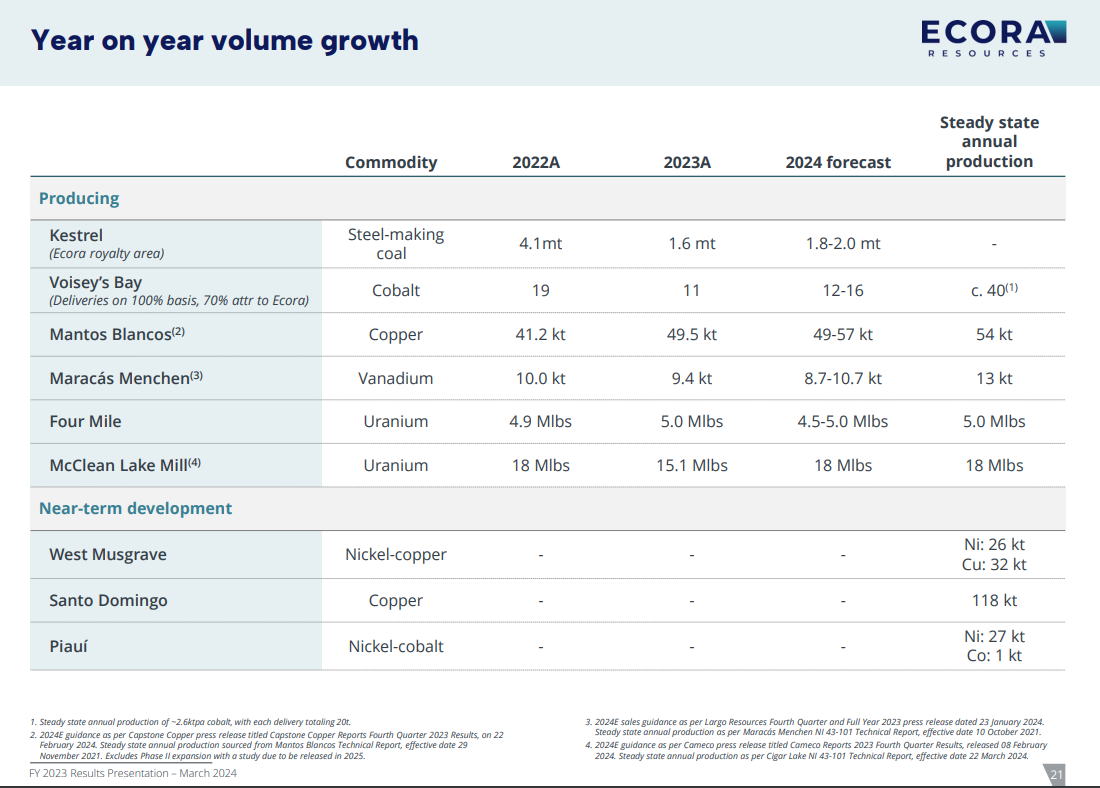

The above diagram is pre-Moxico so Copper rises to about 42% of income with Cobalt about 20%, Nickel 14%, REE 10%, Vanadium 4%, Uranium 3% , Iron 3%, and others 4%.

Ecora has a range of geographies, commodity exposure, operators, and cost curve positioning. 84% are either 1st or 2nd quartile assets (which while mining costs are not of interest/relevance to Ecora directly it does mean a greater chance of expansion and investment by the operator).

Mantos Blancos, a copper mine, saw expansion in 2024 with a potential to grow production further now in 2025. The same operator’s Santo Domingo mine FS announced robust results of +11% reserves and +23% contained copper to its feasibility study and now proceeds with a 2027 go live.

McClean’s Uranium project also sees expansion, as does Maracas Menchen’s Vanadium mine (brave of them given Vanadium’s current pricing)

2024 was a year when Voisey Bay ramped up, and Mantos Blancos expanded. This is despite Cobalt and Vanadium being at far lower prices compared to recent highs, and Copper and Uranium being at decent but not record prices. Both offer the potential to boost returns in 2025 and beyond.

If Copper, Uranium, Cobalt or Vanadium make any kind of price increase in 2025, then Ecora stand to benefit. Meanwhile Metallurgical coal remains at $300/tonne and while volumes will tail off in 2025 and cease in 2026 other holdings come on stream in 2026/2027, and expansion continues at Voisey’s Bay and Mantos Blancos. It’s fair to say that there’s a likely period of lower returns in 2027 where the reduction at Kestrel won’t be seamlessly replaced by new projects - ECOR doesn’t control the build of a mine after all. This extends to dividends, and that there may be a period of patience required. But for patient investors, you are buying ECOR at an extraordinary discount since the loss of dividend has led to harrumphing and the uncertainty of its continuance or consistency in the next few years means this has massively depressed the price.

Meanwhile it is noticeable to me that comparing Ecora vs three ETFs which track (more or less) the same battery metals (minus the metallurgical coal) seen as red and yellow lines the fall in Ecora is noticeable - and overdone in my opinion (based on the comparable value of the commodity ETFs). Particularly as the ETFs merely hold metal (at a cost) hoping for higher prices.

There is no actual production in an ETF unlike Ecora with its royalty share on real production as well as upside on price.

WisdomTree’s Battery Metals ETF

As an aside, what a weird ETF!!! Aluminium-ion batteries are experimental so 27.5% exposure to aluminium for a Battery Metals ETF is quite weird! 12.87% lead too. What are we supporting the production of Milk Floats with these Lead Acid Batteries is it?

Over 3 years ECORA is well below ETFs that track the same commodities. The green one is 100% copper. An explanation back in 2022 could have been the imminent demise of Kestrel combined with high interest rates and ECOR’s debt. But in 2025 under falling interest rates, deleveraging and the NPV of assets held, the difference is a mismatch.

-

This value is reinforced when you consider this chart (based on FY23 results) which puts Ecora well behind almost every other royalty company, and particularly those in blue (which cover non-precious metals).

NB: ECOR is not $234m market cap (as it was when ECOR produced this chart) either - today its market cap is just $185m!! The others are up I include that below also so the valuation differences are much more STARK than when this chart was produced 12 months ago.

Everyone else is up; ECOR is down (Gold prices are part of that to be sure)

Valuation

Overall, Ecora offers a low risk way to “back” the energy build out of electricity without the mining risk. No milk float metals, no experimental aluminium batteries. No gold to be fair.

Instead a royalty company risks the inaction or misfortune of its operators, as well as borrowing costs, but not mining costs directly. Once a mine becomes exhausted then the royalties dry up - as will happen with Kestrel. But if a mine owner goes bust the royalty remains over the mine, so ECOR don’t lose their asset and can wait for a future owner continuing from the bankrupt predecessor.

It is true that there is a gap in 2026 as Kestrel ends and before new holdings ramp up in 2028 and beyond. A 2027 hiatus exists. But not necesarily that large a hiatus. Perhaps none if metal prices are higher than today.

The other point here is that new holdings ramping up longer term are truly exciting. Berenberg for example have Eroca on a target price of 150p. (which is 2.5X today’s share price).

This is based on an updated feasibility study on the Santo Domingo project in Chile. Berenberg said the feasibility study demonstrated "a robust project", with an after-tax NPV of $1.7bn and an after-tax internal rate of return of 24.1%. Moreover, given that Santo Domingo was fully permitted and first in the development pipeline for Capstone Copper, Berenberg remains confident that the project will be built.

They say: "We update our model for the updated FS on the Santo Domingo project, which increases our project NPV to $86.0m from $78.0m. Once fully online, we estimate a portfolio contribution of circa $22.0m over the initial six years of production (c20% of portfolio contribution), driving a step change in Ecora’s royalty revenues. We also make a positive adjustment to our 2025 royalty estimates from the Kestrel metallurgical coal mine in Australia to bring our estimates in line with guidance, and adjust our Mantos Blancos (Chile) volume forecasts following Capstone's Q2 report," said Berenberg, which has a 'buy' rating on the stock.

"Following a negative reaction from the delay to West Musgrave (Australia), we think that the Santo Domingo FS is positive for sentiment and hopefully marks the bottom of the weakness in the shares. The stock is trading on 0.38x NAV and 4.6x 2025E EBITDA."

Even based on the prior FY23 balance sheet (i.e. before any rise in shareholder’s equity in FY2024) we are at a 61.5% discount to NAV.

So Ecora could be an interesting way to profit from the more important energy transition metals (particularly copper) as metal prices move to what the forecasts say they “should” be, with some comfort - and plenty of discount to intrinsic value too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".