Dear reader,

Ecora Resources PLC full year results to 31/12/24 gave a few surprises. But judging by the share price reaction, it’s in the Dog House.

We knew about its pivot and growth, we knew of the challenging 2024 commodity market prices. Its strategic shift toward “Energy Transition” metals like copper and cobalt delivered a 9% increase in portfolio contribution, reaching $63.2 million, driven by record production at key assets despite some gloomier 2024 prices.

Financial Highlights

Ecora’s royalty and metal stream-related revenue for 2024 totaled $59.6 million, a slight 3.7% dip from $61.9 million in 2023, and Operating Profit dipped to $39.5m.

In fact operating cash flow grew from $47.5m to $51.8m (pre tax) but then it all went horribly wrong “below the line”…..

Bear in mind that -$24.9m of the -$28.3m loss was a paper loss revaluing the Cobalt of Voisey Bay based on the 50 year low price of Cobalt at the end of 2024, even while demand for Cobalt actually grew 7% in 2024! Supply grew much more! But good news. The dominant producer the DRC has halted exports for 4 months in 2025 to support the price, which promptly nearly doubled. That is a theoretical paper gain - so hidden value - or a loss which hides the value of Voisey’s Bay, CANADA.

· World class operation: Voisey's Bay is a world-class nickel-cobalt-copper mine, positioned in the 2nd lowest quartile of the industry cost curve and provides exposure to one of the largest sources of cobalt outside of the Democratic Republic of the Congo ("DRC")

· Environmental credentials: Within the industry, Voisey's Bay ranks amongst the lowest global emitters of CO2, supported by a leading sustainability and safety track record;

More so when you consider Conflict exists in the very areas where Cobalt is mined (the East of the DRC). Voisey Bay in Canada, Ecora (and Vale who operate the mine) would go stratospheric if DRC conflict ever escalated. If the tinderbox exploded to quote Reuters.

But with 7,000 dead and 600,000 displaced this year isn’t this already exploding?

ECOR adjusted earnings per share of 11.43 cents slightly down from 11.82 cents in 2023 equates to 8.9p a share so an adj. P/E of 6.6X.

Net debt edged up to $82.4 million by year-end from $74.6 million, yielding a leverage ratio of 1.4x, which management views as manageable given growth prospects in the portfolio. The company also executed a $10 million share buyback program in 2024 and reduced its total dividend to 2.81 cents per share (from 8.50 cents in 2023), aligning payouts with a 25-35% free cash flow policy. Free cash flow itself dropped to $22.1 million from $29.7 million, reflecting higher debt servicing and investment outlays.

Operational Wins

Ecora’s portfolio, now 80% weighted toward base metals, saw standout performances:

Voisey’s Bay (Cobalt): The underground mine expansion in Canada hit record production, delivering 15 cobalt deliveries (20 tonnes each, 70% attributable to Ecora) in 2024, up from 11 in 2023. This met the high end of guidance despite cobalt prices hitting 50-year lows. A 60-70% price rebound since December 2024 has bolstered optimism.

Mantos Blancos (Copper): This Chilean copper mine achieved a record quarterly contribution of $1.7 million in Q4, up 31% from Q3’s $1.3 million, driven by steady output increases. Copper accounted for ~50% of Ecora’s estimated NAV at the end of 2024 and this ratio increased to ~60% with Mimbula’s addition in 2025.

Kestrel (Metallurgical Coal): Despite Q4 production largely outside Ecora’s royalty area, full-year coal royalties rose 13% over 2023, buoyed by strong 1H24 volumes. Metallurgical coal prices, averaging $223/t in 2024, supported this growth, while prices are forecast at $205/t in 2025 with further production growth forecast (the last hoorah before declines in 2026).

Post-year-end, Ecora acquired a $50 million copper stream on Zambia’s Mimbula mine in February 2025, expected to yield 15-20 thousand tonnes of copper annually starting this year. This move reinforces its copper-centric strategy as coal’s share of income—65% in 2024—is projected to shrink to 10% within three years.

Strategic Shift and Market Context

CEO Marc Bishop Lafleche emphasised Ecora’s evolution from a coal-heavy royalty firm to a leader in battery metals. “Since year-end, it’s amazing how quickly things can change,” pointing to cobalt’s price surge and copper’s enduring demand. With 2023 likely marking an earnings trough, Ecora forecasts portfolio contribution climbing toward $100 million by 2027-2028, fueled by ramp-ups at Voisey’s Bay (24-28 cobalt deliveries in 2025), Mantos Blancos (20% copper growth), and Rare Earth Mining coming on stream.

Outlook

For 2025, Ecora anticipates double-digit volume growth across its core assets, with Mimbula adding immediate copper cash flow. Analysts project 14.58% annual earnings growth and deleveraging, with the stock trading at a steep discount to NAV. Ecora’s focus on low-cost, high-quality operations mitigates volatility.

Ecora’s 2024 results show a company at an inflection point, balancing legacy coal income with a bold bet on base metals. Where any kind of run on Copper will be lucrative for ECOR. REEs, Vanadium and Uranium might all surprise too.

Of course the 2-5 year picture is rosier than the 0-2 year picture, but the market will begin forward pricing that 2-5 rosiness in the next year or so.

OB Estimates

This is based on current and conservative pricing on Vanadium, Uranium, Copper, Met Coal and Cobalt. 2025 is a lesson that any of those might become un-conservative.

I’ve used the lower forecast volumes in my estimates.

Very roughly $50m-$60m portfolio contribution delivers something like £20m of free cash flow and profit putting this on a P/E of 7X.

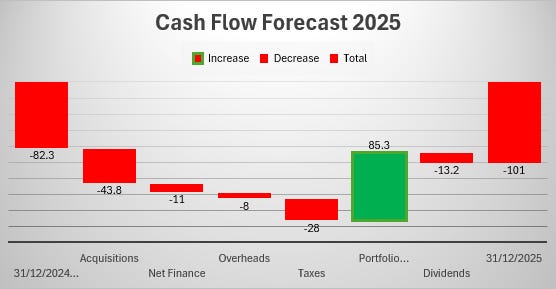

2025 includes -$50m spent buying the Royalty at Mimbula less the $6.2m settlement for Newhaven Coal. This chart shows current and forecast debt based on consensus forecasts by analysts following ECOR.

Of course there are a number of moving parts. Not least the potential for commodity prices to move favourably in 2025.

ECOR Balance sheet puts this at 55% discount including the Cobalt write off.

Or if you go by what “the analysts” then the valuation is 30% higher still. £1.72 per share based on the prospective value of assets is £434m or $560m vs $434.6m per the 2024 balance sheet.

NB: today ECOR is 59.7p not 66p per the chart below.

Ecora it’s just for me and my dog, said the child in that advert many years ago. Yes, priced as a howler, but the potential to go woof.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"