Dear reader,

Let’s consider a 1/100th bagger (dropped over 99%) ECR Minerals (ticker ECR). A £5.3m market cap and described as a “sucker” by Stocko.

There are 2,242,655,302 shares in issue and someone is hoovering up more shares each quarter. More on that in a bit.

In the latest media coverage bing bong bing bong presenter Dan Flynn argues there is a “decent argument for a re-rate” which is “fully funded for 2025” based on a recent chat with ECR’s CEO. Here is a link to the video where he makes those remarks:

Claim #1. ECR has a “Strong Cash Balance”

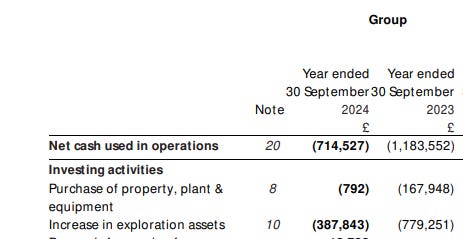

Based on an approximate -£0.7m per annum in 2024 cost “to keep the lights on” and approx -£0.4m exploration expenditure in the year to 30/09/24 then I’d question this statement.

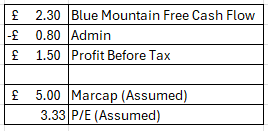

My estimate of cash flow:

If ECR have committed up to £0.6m of exploration expenditure in FY25 then I estimate the money runs out by the end of September 2025. If exploration costs are £0.4m then the money runs out by around the end of Dec. 2025. The CEO said they are “Fully funded for 2025” which isn’t clarified to be FY25 or CY25 so we can only assume FY25 therefore until September 2025. On the basis that you don’t want to reach zero and get funding before then then a further raise needs to happen soon.

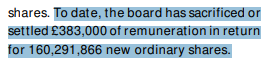

As ECR acknowledge, it remains a very difficult market to access fresh capital. I do recognise they have taken measures to minimise costs and particularly that they partly pay themselves in shares and not in cash which deserves respect and recognition.

Last week that number of sacrificed salary/settled grew to 180m shares and £433k of share-based remuneration; that’s probably more skin in the game than all of Buffalo Bill’s murder victims stitched together. In 2024 £90k of a £102k salary to the Chairman (Tulloch) and CEO (Whitlow) were paid this way. However tucked away in small print is the news that from 1st Jan they took a 47% pay rise and now £90k of a £150k salary is paid this way.

You could argue these issued shares dilute existing shareholders by 1% per quarter but it also shows great commitment and belief. You could also argue 47% is a tasty pay rise but living on £12k a year for any length of time would stretch most folks to breaking point.

However those wage rises also accelerate my cash burn projections by well over £100k per annum making the claim of a “strong cash balance” even less credible, unfortunately.

“The work program will deliver a lot of material value” it is stated by Flynn. I agree. Potentially so. But it’s less likely that the work programs can deliver cash or cash flow. More on that later.

Claim #2 - Sale of Mercatur Gold (MGA)

MGA has A$75m accrued tax losses. Based on a 25%-30% tax rate then that means a profitable business (and there are obviously some of those around and about with gold prices at current levels) would gain A$18m-A22m of benefit. Being conservative and assuming the lower number and that you can sell for 50% of its face value (go halves!) then you are looking at £4.35m. That sum would keep the lights on for ECR until September 2031 at current overhead levels. A prior offer which fell through was for half of the half at A$4.35m or £2.2m so 25% of its lower face value, but the offer also included its 3 prospects.

The weird complication that caused the deal to fall through is that three of its best prospects are contained in that MGA company: Creswick, Bailieston and Tambo.

#2-1 Victoria’s Creswick

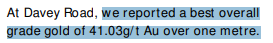

There are two sub-tenements and its Davey Road one has “shoots” of high grade gold across narrow veins which its other Kuboid Hill has a broader halo of mineralisation.

There is potential here but no specified work program, so could be a candidate for divestment.

#2-2 Victoria’s Bailieston

Stream sampling is a technique to try to detect “the mother lode”. Gold flows down stream so if you find growing samples as you sample up stream it is the equivalent of “warmer, warmer…”. To find 0.7g-0.8g/t suggests there’s piping hot gold somewhere nearby since background levels are 1-5 ppb i.e. what’s been found is up to 300X normal.

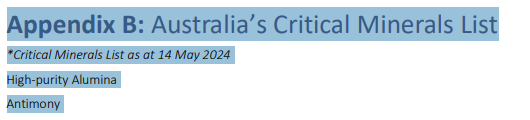

It gets better. Much better. Consider its strongest sample containing 32% antimony (Sb) which is priced at 17X the price of gold. A quarter of the 44 samples returned more than 0.1% Sb. In gold equivalent terms that’s finding out that 25% of your samples are 17 grams per tonne or higher. That’s got the potential to be *highly* profitable.

Those results should raise an eyebrow or a series of non-angry sounding bleeps from Tony Bleeps if this were a Gold-themed reality TV show.

A drill programme is imminent or underway and a “Bulge Zone” is particularly referred to. The results from this could be worth many times today’s share price.

#2-3 Victoria’s Tambo

A recent drilling campaign of 5 holes/428metres revealed 0.4 metres at 8.51 g/ t Au from Drill Hole DOCD002 and 0.15 metres at 10.6 g/ t Au from Drill Hole DOC004.

The campaign potential for deeper finds, so in 2025 ECR intends a follow-up drilling campaign focusing on deeper exploration beneath the high-grade zones identified in DOCD002 and DOCD004 as well as incorporating the structural and geochemical insights gained to explore central portions of the Lode, which remain prospective for gold mineralisation.

Results will be due later in 2025 and if those results are that mineralisation continues past ~90 metres then this asset with 8g-10g gold would be a valuable asset too.

Claim #2 Continued - Sale of Mercatur Gold (MGA)

Clearly the three attached assets have potential, strong potential perhaps. ECR (wisely) terminated the A$4.5m offer and have widened the conversation. Several parties have signed NDAs and entered the data room. ECR particularly allude to “a drilling campaign at Bailieston” which suggests a JV at Bailieston is also under consideration. This could be either where MGA is an asset put into the JV alongside a cash investment from a third party, or that it’s decoupled from MGA (alongside Creswick and Tambo perhaps) to finalise the sale of MGA to a third party. That aspect is not made clear and presumably there are various conversations behind closed doors. Could there also be shadowy military folks behind those closed doors? See my Scenario 3 later on.

What’s also less clear is whether this deal can proceed in time to keep the lights on. There’s a chance, but there’s also a chance that restructuring those assets takes longer to complete.

Sitting on the sidelines waiting for clarity on timing could have its merits; although once newsflow arrives could this move quickly upwards.

Claim #3 - “Potential for Near-term gold” Blue Mountain in Queensland

We are told “A recovery rate of 91.7%” was achieved on samples in a pilot production and “its goal is to reach production of A$475k per month”. A bit of maths tells me that is equivalent to 250 tonnes per day plant at 0.38g/t creates £10k/day revenue that gets to A$470k per month.

91.7% is actually towards the top end of what a BCC-based circuit can achieve (70%-94%). Also there is a historic (non-JORC) report within this region for the South Kariboe Creek and Denny's Gully prepared by Normin Consultants Pty Ltd estimates a potential 1,426,800 bank cubic metre (b.c.m) at 0.60 grammes per b.c.m. implying 27,526 oz Au. Assuming 1600Kg per tonne gravels then we are talking 0.38g/t at 91.7% recoverability.

The Capex for a 250 TPD plant would be circa A$0.7m so “low capex” is not no capex. Leaving aside for a moment quite how this might be afforded let’s consider the economics based on typical operating costs. Processing costs of $64 per tonne wouldn’t be unreasonable but you can see this would not be economic on a cash cost basis, let alone an AISC basis at 0.38g/t.

If we are generous and assume opex of $32/tonne then the profit is okay but only modest. However all hope is not lost.

The pilot production also suggests that the Normin study of 0.38g/t is on the low side. The actual results were a higher 1.55 per BCM.

That would be a game changer and drive a handsome profit of £4.5m per year assuming 250tpd and 91.7% recoverability.

The problem is we don’t know if these results ARE repeatable and in any case ECR only tell us a production plant “could potentially” be established.

After using suitable words of uncertainty “could” and “potentially” Dan Flynn slips up and says “a key point is ECR is funded for the work needed to take an asset into significant monthly gold production!” (at timestamp 23:05 in the video)

That is not in keeping with what ECR themselves say (at least in their Annual Report) and also what the numbers say. To fund my estimate of Blue Mountain capex would leave just £0.2m for all the other 2025 exploration programs so far described.

Highly unlikely!

I wish the numbers and the position were different because I can certainly see the potential. Besides ECR tell us they are bulk sampling as a next step to work out whether the alluvial gold is 0.38g/t or 0.97g/t…. which would make the difference between hardly profitable and highly profitable. Flynn continues “it can begin to generate cash itself reducing its reliance on the market” - again that’s not accurate either - or at least not certain.

Claim #4 Lulworth

Flynn claims “A further drill programme is planned at Lulworth for 5 promising gold prospects”. I could not corroborate this with anything planned either in the ECR annual report or latest presentation.

Instead the focus appears to be on collaborating with some bodies who are interested in studying the land and sampling (at no cost to ECR), James Cook Uni and the Geological Survey of Queensland. I think it’s unlikely that Flynn’s claims are accurate that ECR would expend money when a third party is prepared to progress the tenement for free. And to be clear I would not expect geologists or University folks to come armed with a drill rig….. I mean, come on! They’ll have those little tap tap rock hammers and perhaps buckets and spades.

It is important to note past stream sampling has also shown the presence of Niobium- Tantalum, Neodymium and Rare Earth Element (REE) mineralisation with the best indicators at Oak Creek, so this tenement appears to be about far more than just gold.

Claim #5 Proposed acquisition of a number of Canadian base metal projects.

Flynn does not go into detail beyond mentioning they are projects owned by Maximus Minerals. Surely not I say to myself. But there it is in a March 2025 RNS. This is the bit where I put my head in my hands. Why on earth would you take on another set of projects in a different country (with associated costs) when you have so many other moving parts already? …..And facing a cash call.

Is ECR just Empire Building like some mad Roman Emperor without any concept of cash flow… and the lack there of?

But it’s not as bad as all that. It’s a non-cash deal but operating costs are going to increase. Thankfully only by a small amount per year, assuming the below £12k per annum past costs reflect the future too.

It still means shareholders will be diluted by around 15% too.

Chairman Tulloch justifies it based on “ambition to expand” and meeting “strict criteria”. Time will tell on that.

Claim #6 “They are not taking salary”.

It’s then claimed in the presentation that “they are not taking salary”. That’s inaccurate. The Chairman and the CEO are taking £150k salary each as discussed earlier and 60% is being paid in shares, and 40% in cash, as described earlier.

Scenario #1

It would be great to see ECR succeed. They have interesting assets and potential. But I’m really struggling with the reality of the cash flow. So, it seems, are they.

It seems to me nearly certain that a further raise will be required and soon.

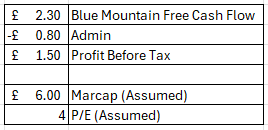

If and assuming a further £1m were raised at an assumed 20% discount and a further 20% dilution occurred what would that look like? It would afford the capex to get Blue Mountain into operation and let’s say it’s halfway between the 0.38g/t and 0.97g/t. That would generate a mid way assumed £2.3m op profit per year and deducting overhead costs gets you to a PBT of £1.5m where accrued tax losses mean there’s no tax to pay for a good while so a P/E of 4X assuming 20% dilution and a marcap of £6m (0.2p per share and 3bn shares)

In case you’re wondering 1,426,800 bank cubic metre (b.c.m) is a lot of ground. At 250tpd it would take 25 years to process it according to my maths.

So £1.5m a year of cash flow (at current prices) for project development has a high likelihood to build other value. In that scenario you’ve got an excellent chance of positive newsflow with a business that is cash generative. That’s a reasonable outcome and a believable one, although not a certain one.

Would £1m of further funding at 0.2p be do-able? I’d like to think so. 10%-20% discount to the current share price.

Scenario #2

If MGA can be sold before the cash crunch i.e. that the Baileston project etc is hived off and separated then assuming A$4.5m as before then you pretty much get to the above scenario but without the 20% dilution.

In either scenario the other risk is that bulk sampling needs to prove the viability and I need to be reasonably close to my estimates of the capex in order for these options to play out.

Scenario #3 The Australian Government funds ECR to develop Baileston

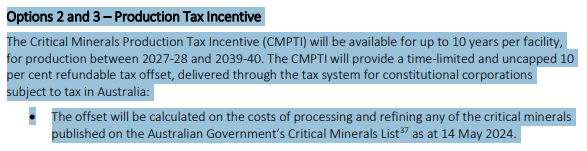

The 2025 Critical Minerals Production Tax Incentive is part of a package aimed at altering the investment decision economics and help projects exceed the hurdle rate. For those familiar with the NPV calculation this diagrams summarises their packages and how the Australian government can.

Antimony is on the list of 31 critical minerals and could some sort of fast track be employed? It’s not impossible and other companies like Guardian Metals in the USA are similarly confident of such support.

Are there shadowy military and government folks in that ECR data room? I would say with near certainty the answer is yes. And maybe not just Australia. US, UK, EU might all be in there, and probably are.

Just to be clear, this is pure Oak Bloke conjecture and not something covered by other commentators nor mentioned by ECR themselves in any presentation.

Doesn’t mean it isn’t quietly happening. The restrictions by China are extremely well telegraphed and ECR’s management would have to be spectacularly and inconceivably misinformed to not be well aware of the strategic importance of Antimony and the moves being made by Western governments scrabbling to respond to China sticking two fingers up at the West and cutting off vital supplies.

So on the basis (and I write this as a 90 day pause on tariffs has literally just been announced between China and US) that China’s restrictions on element like antimony remain in place, or at the very least the future threat will drive the West to secure its own supply as soon as possible.

On that basis I believe ECR is a buy despite needing further cash. The only sucker, in time, will be the West in believing that free trade meant ignoring the securing of strategic resources. So in the current scrabbling to rectify that there is opportunity.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Very balanced analysis. We all love a bargain but this one seems very binary.